The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

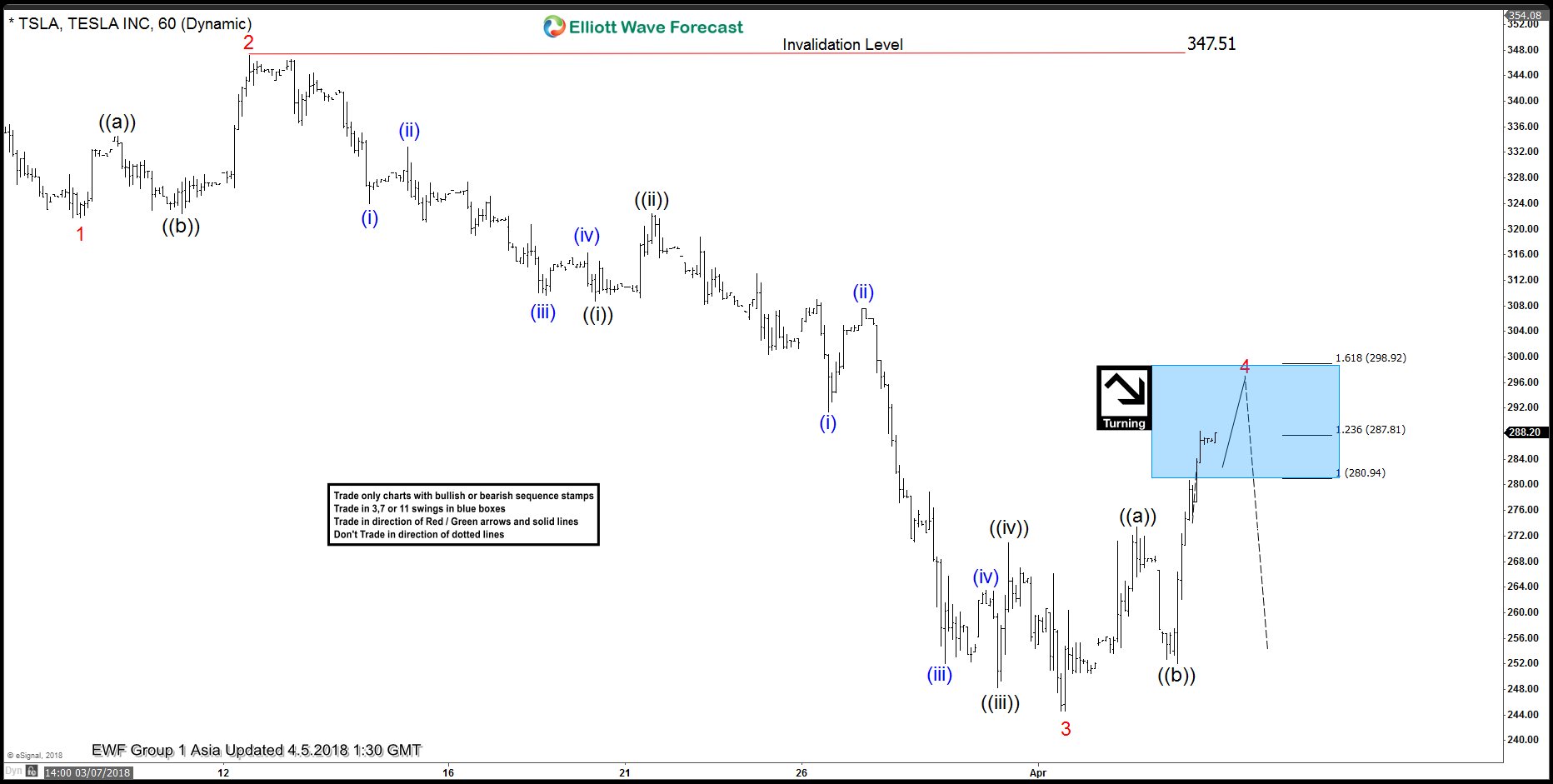

Elliott Wave Analysis: Tesla in a Turning Area

Read MoreLatest Elliott Wave view in Tesla (TSLA) suggests that the decline from 2.27.2018 ($359.99) is unfolding as an impulse Elliott Wave structure. Down from 2.27.2018 high, Minor wave 1 ended at $322.97, Minor wave 2 ended at 347.21, and Minor wave 3 ended at $244.59. Minor wave 3 has an extension and also have 5 waves […]

-

Elliott Wave View: Copper Starts a New Leg Higher

Read MoreShort Term Elliott Wave view in Copper suggests that the decline to 2.938 on 3.26.2018 ended Minor wave IV. The metal started a new leg higher from there in Minor wave V. Subdivision of Minor wave V is unfolding as an impulse Elliott Wave structure. An Impulse Elliott Wave structure is a 5 waves structure where […]

-

Tesla TSLA Providing the Floor in Stock market

Read MoreTESLA (NASDAQ:TSLA) shares spiked 7% higher today before closing the day at $268 same level as late March of last year. What’s hiding behind the move and can investors be relieved ? Shares of the electric-car maker are still down 16.5 percent since the beginning of the year, alongside other automakers like General Motors (NYSE:GM) Down […]

-

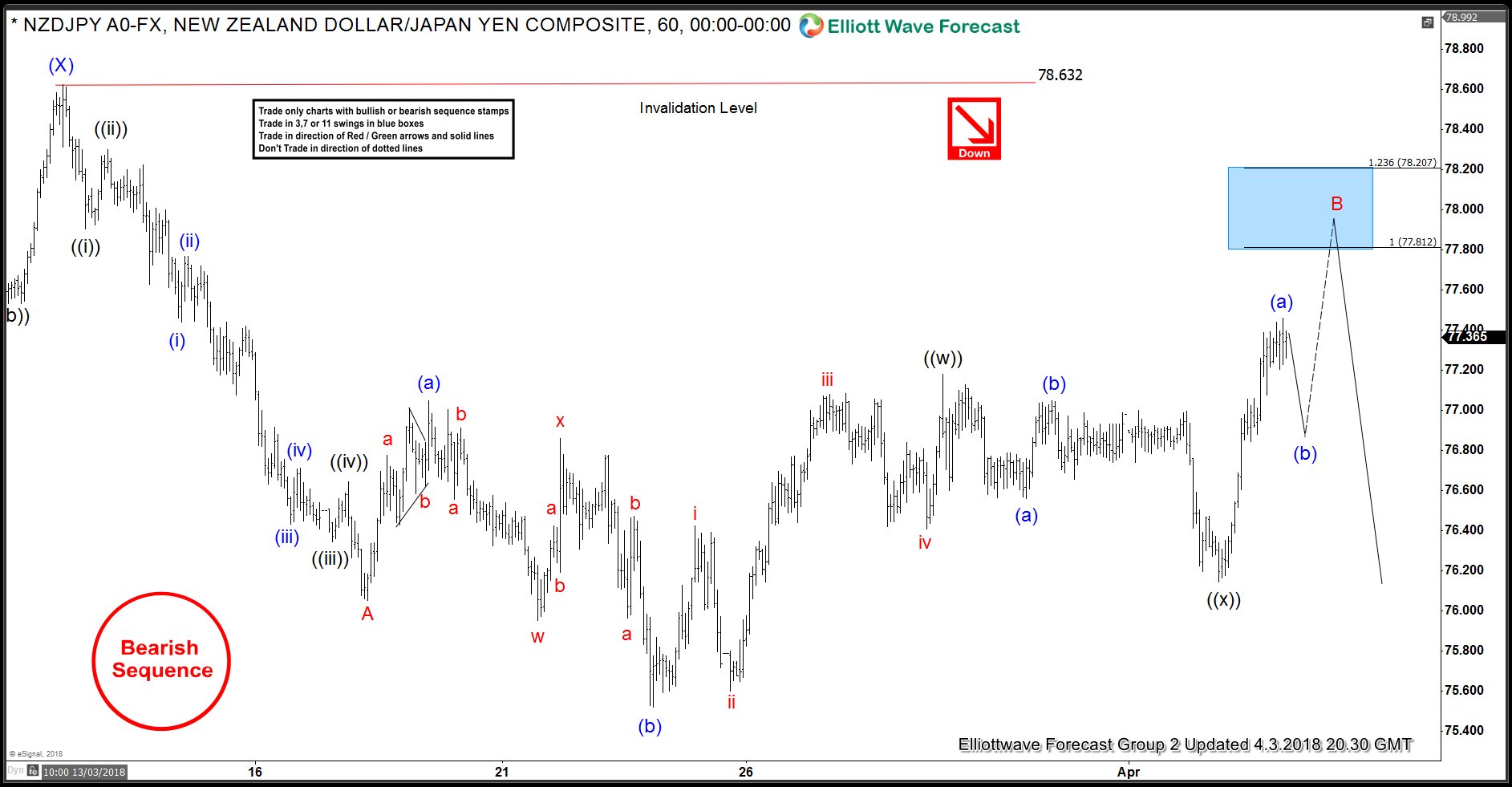

NZD JPY Elliott Wave Analysis: Next Inflection Area

Read MoreNZD JPY has been rallying this week but the question remains if the down move is over and uptrend has resumed or this is just a corrective bounce within an incomplete downward Elliott wave swings sequence. We will take a look at the daily chart of NZD JPY to get an answer to this question […]