The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Soybeans (ZS_F) Forecasting The Elliott Wave Pullback

Read MoreIn this technical blog, we are going to take a quick look at the past performance of Soybeans (ZS_F) Charts presented in members area. Last month instrument made a strong reaction lower from March 02. 2018 peak (1083.2) and ended the cycle from June 2017 low cycle. Thus suggested that we should be correcting that cycle […]

-

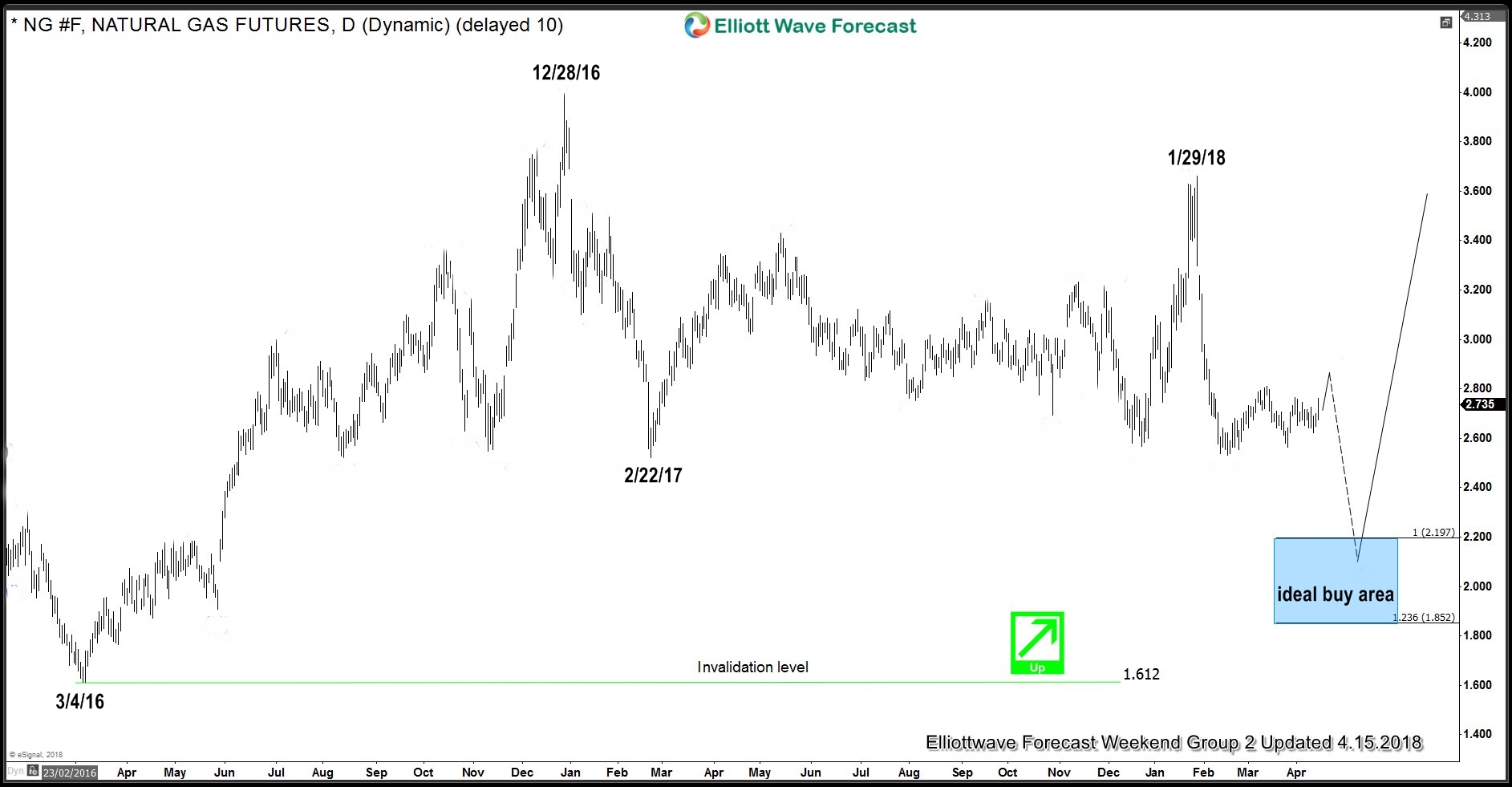

$NG_F Natural Gas Daily Corrective Cycle from 12/28/16

Read MoreAs seen in the daily graphic below you may notice it is absent of an Elliott Wave count. However the important dates with the swing highs and swing lows are highlighted that suggest the target area for buying that can be seen later. Currently Natural Gas is only showing a three swing move lower from […]

-

SPX Elliott Wave View: Calling Reaction Lower Soon

Read MoreSPX Elliott Wave view in short-term cycles suggest that the bounce to 3/13 high (2803.37) ended primary wave ((X)). Down from there, primary wave ((Y)) remains in progress as a double three Elliott Wave structure. The internal distribution of wave ((Y)) shows overlapping structure, thus favored it to be a corrective sequence i.e either W.X.Y […]

-

$SPX: The Index Within Areas Where The Hedging Is Calling a Pullback

Read MoreThe $SPX trend is to the upside but the Index ended the cycle from 2.2016 and like every other Index, it is correcting that cycle. In Elliott Wave Theory, corrections run in the sequences of 3-7-11 swings and consequently trading against the main trend which is to the upside is always risky. We do understand […]