The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

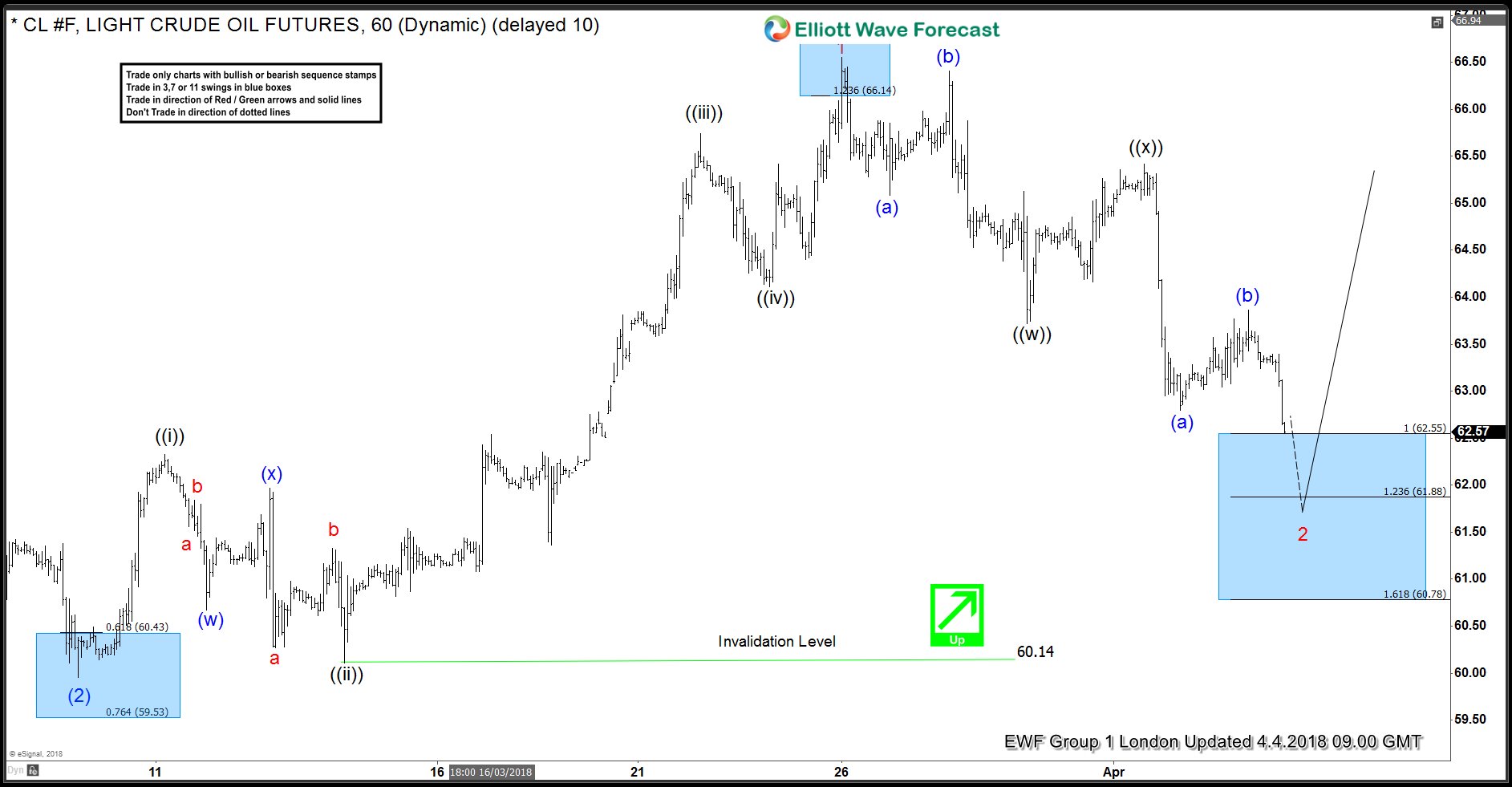

OIL ( CL_F ) Forecasting the Rally After Double Three Pattern

Read MoreIn this technical blog we’re going to take a quick look at the Elliott Wave charts of OIL published in members area of the website. As our members know, we have been favouring the long side, suggesting everyone to avoid selling. Finally on April 11th , we got break of March 26th peak and commodity […]

-

EURUSD: Is History Repeating Itself?

Read MoreIn this Blog, we will have a look at the bigger picture of EURUSD pair. One of the reasons why retail traders fail in trading is because they stick to one time frame, analyse that and trade that accordingly. However, traders with this approach will not last long in this business. One of the key elements […]

-

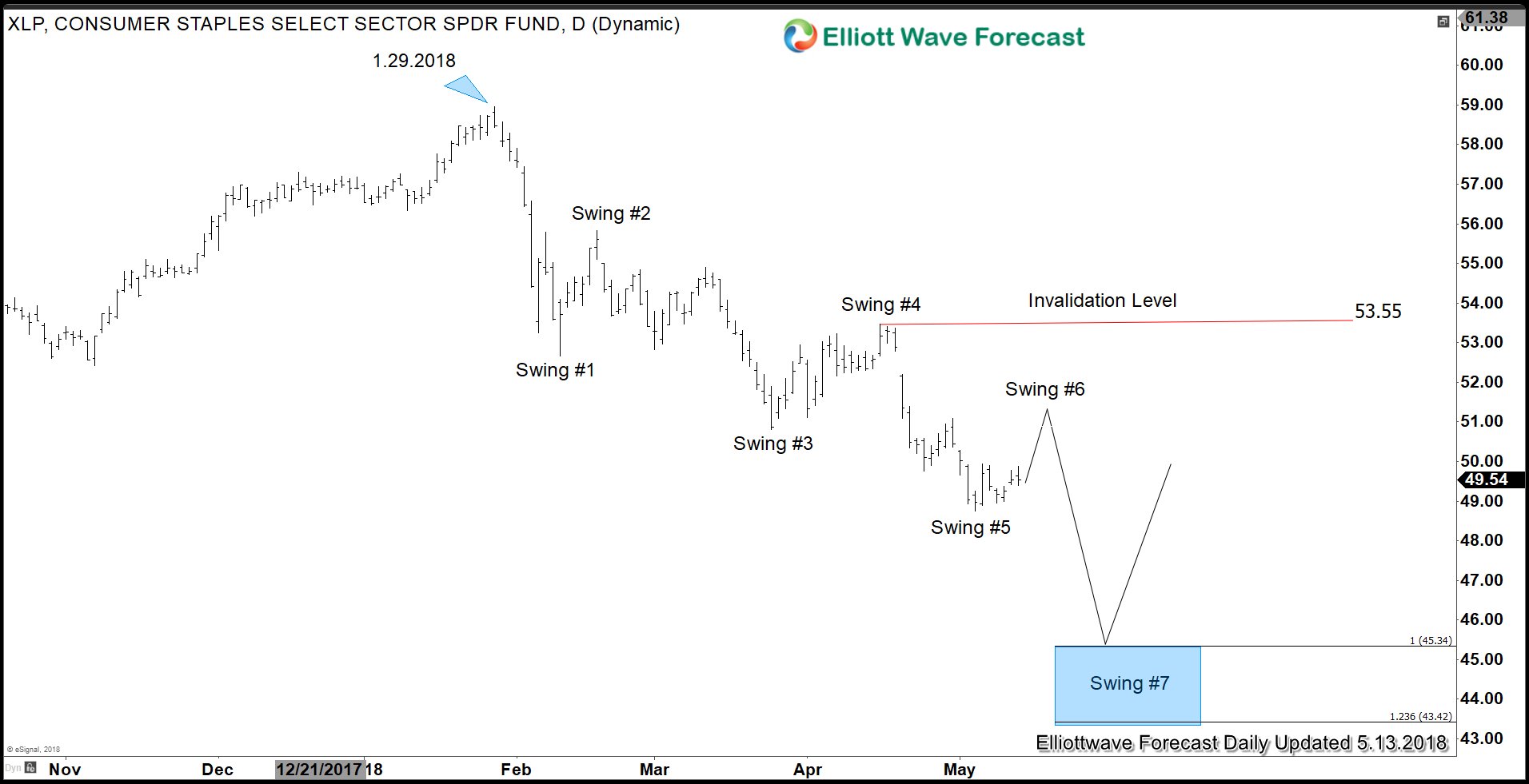

Relative Weakness in Consumer Staple Sector

Read MoreConsumer Staple Sector (XLP) is Underperforming Consumer Staples Select Sector SPDR ETF (XLP) is a basket of 34 companies in the consumer staple sector from the S&P 500. The fund’s holdings are nearly all large-caps. This sector usually shows comparative strength during period of market turmoil. They have also been a popular choice for income […]

-

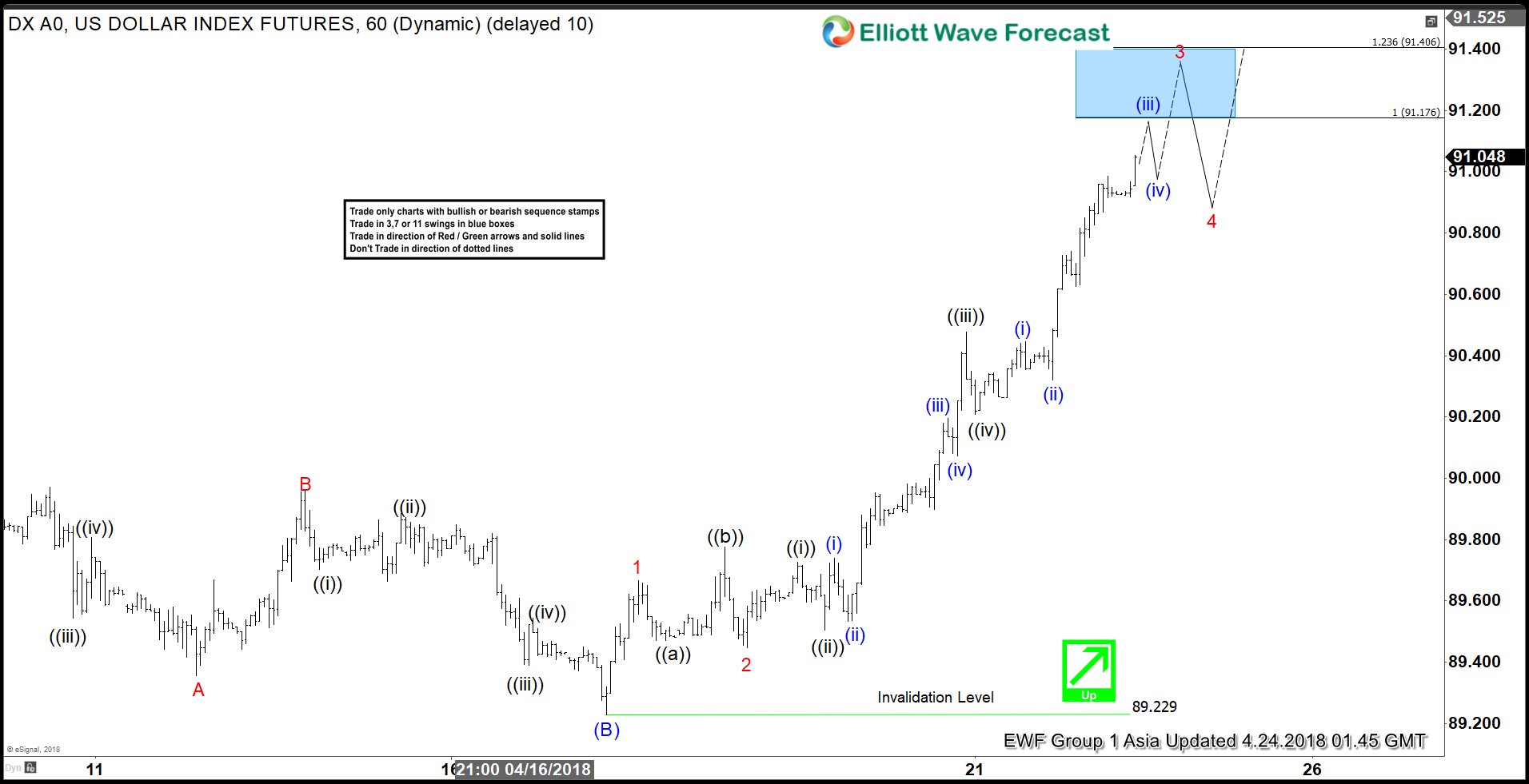

USDX Elliott Wave View: Extending Higher As Impulse

Read MoreUSDX Elliott Wave view in short-term cycle suggests that the decline to 89.22 ended Intermediate wave (B) as Elliott Wave Zigzag correction. Above from there, Intermediate wave (C) remains in progress as Elliott Wave Impulsive sequence with extension looking for further extension higher. The internal distribution of each leg consists of 5 waves structure with […]