The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

World Uranium Index Suggesting Higher price for the metal

Read MoreWorld Uranium Index (URAXPD) and Uranium Futures contract tracking the spot price of the metal which ended the downtrend cycle from 2007 peak and been bouncing higher since 2016 lows. The two instrument may have different dates for the peak or low but they share the same swings and URAXPD is the one leading move at current […]

-

Nikkei Elliott Wave Analysis: Pullback Remains In Progress

Read MoreNikkei short-term Elliott wave view suggests that the rally to 23060 on May 20 high ended Intermediate wave (1) as an impulse. Down from there, the index is pulling back in Intermediate wave (2) pullback to correct cycle from March 23, 2018 low in 3, 7 or 11 swings before the rally resumes. The decline […]

-

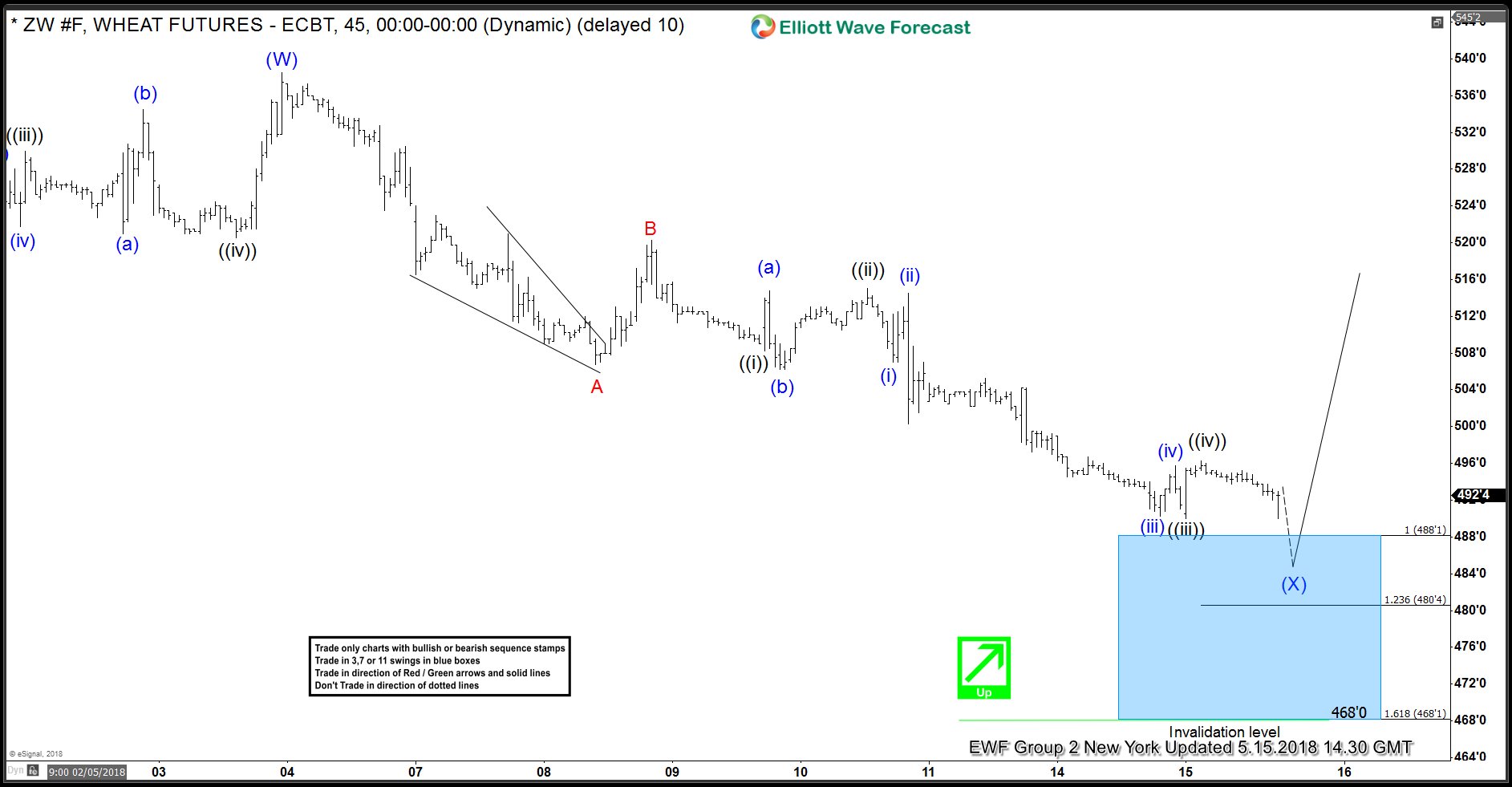

Wheat Elliott Wave Analysis: Forecasting And Buying The Rally

Read MoreIn this blog, I want to share some short-term Elliott Wave charts of Wheat Futures which we presented to our members in the past. Below, you see the 1-hour updated chart presented to our clients on the 05/15/18 showing Wheat reaching a blue box buying area as a Zig-zag Elliott wave structure. Wheat ended the cycle from […]

-

The CAC 40 Index Long Term Bullish Cycles

Read MoreThe CAC 40 Index Long Term Bullish Cycles Firstly the CAC 40 index long term bullish cycles have been trending higher with other world indices. In September 2000 it put in an all time high. From there it followed the rest of the world indices lower into the March 2003 lows which was a larger […]