The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

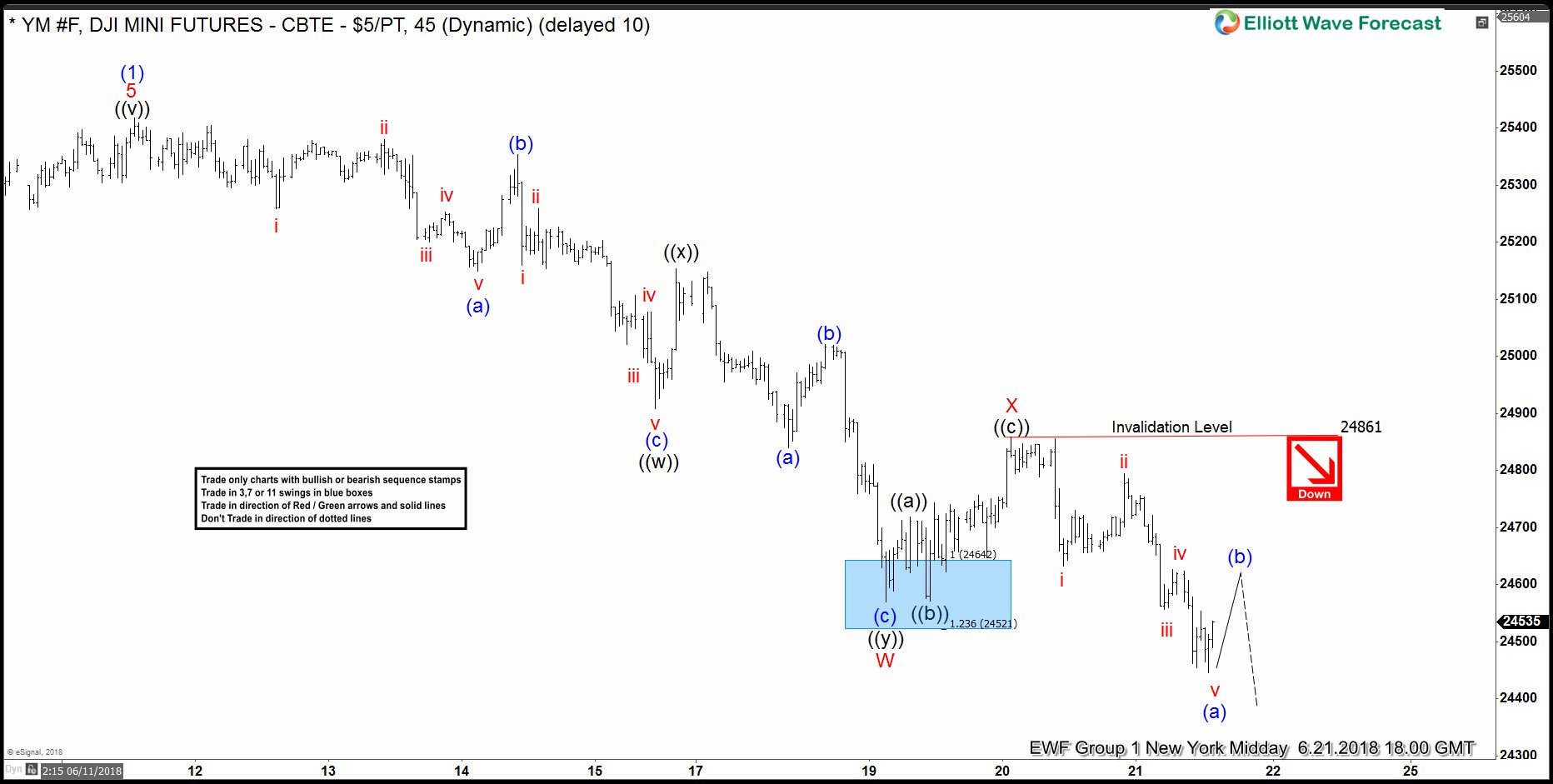

Dow Jones Elliott Wave Analysis: Tracking Recent Price Action

Read MoreToday, we will have a look at some Elliott Wave charts of the Dow Jones Futures which we presented to our members in the past. Below, you can find our 1-hour updated chart presented to our members on the 06/20/18 calling for more downside after a 3 waves correction in black wave ((a))-((b)). Dow Jones Future […]

-

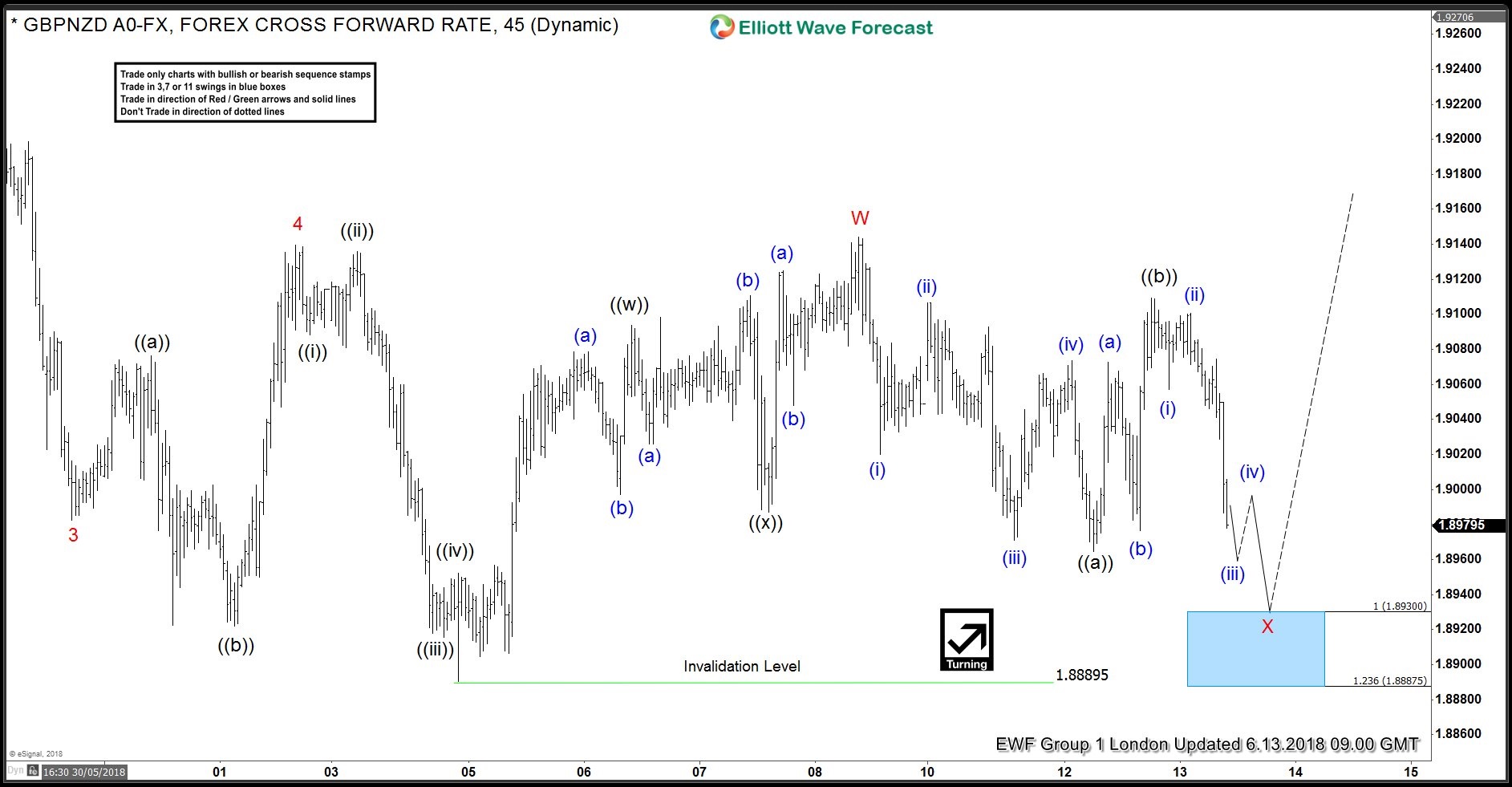

GBPNZD Forecasting the Rally after ZIGZAG

Read MoreIn this technical blog we’re going to take a quick look at the past Elliott Wave charts of GBPNZD published in members area of the website. As our members know, we have been calling for the recovery in the pair since the cycle from the April peak ended at 1.8889 low. In further text we’re […]

-

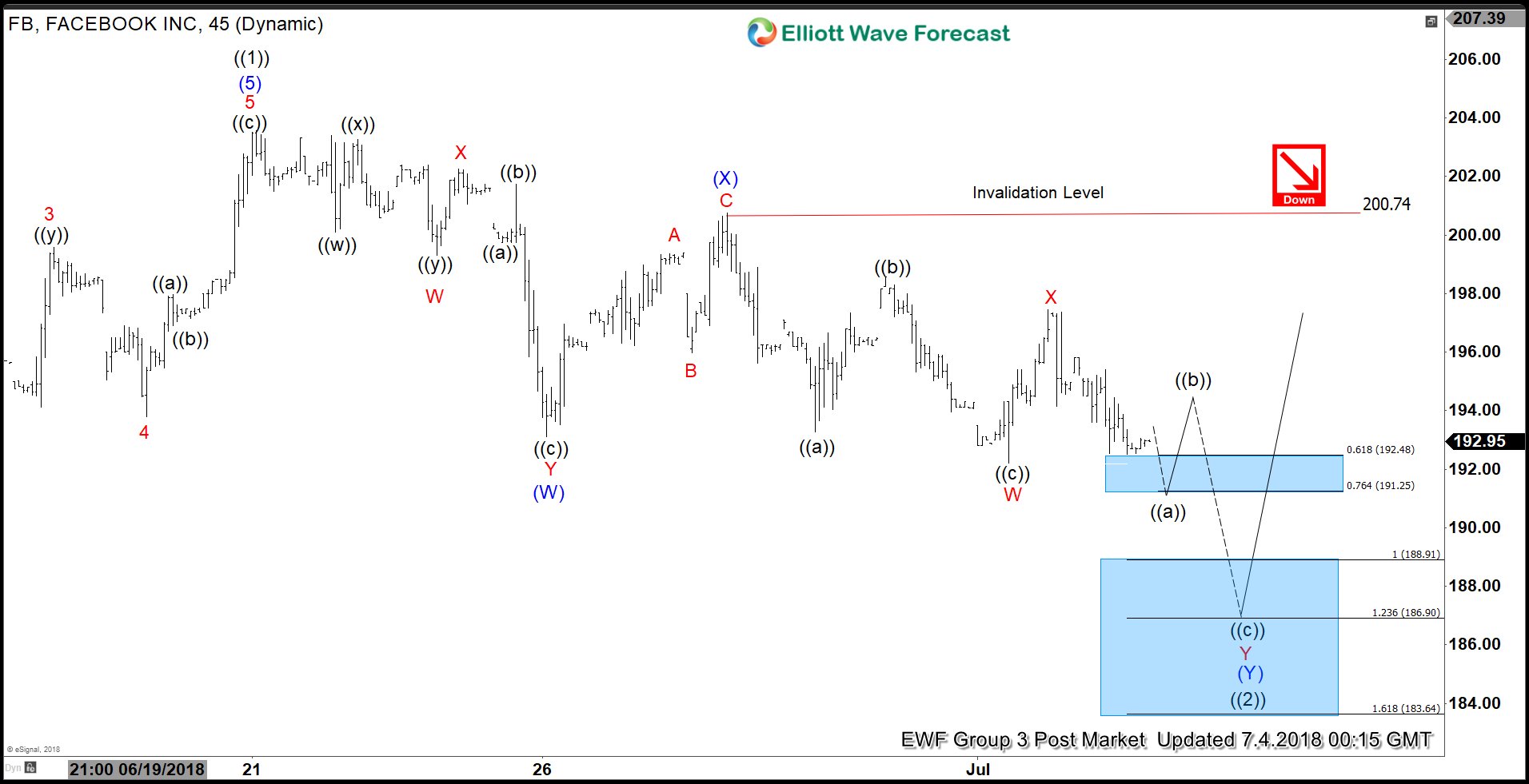

Facebook ($FB) Elliott Wave Analysis: Pullback Remains In-progress

Read MoreFacebook ticker symbol: $FB short-term Elliott wave analysis suggests that the rally to $203.55 ended primary wave ((1)). Down from there, the pullback in primary wave ((2)) remains in progress in 3, 7 or 11 swings to correct cycle from 3/26/2018 low. The internals of that pullback shows an overlapping structure thus suggesting that the […]

-

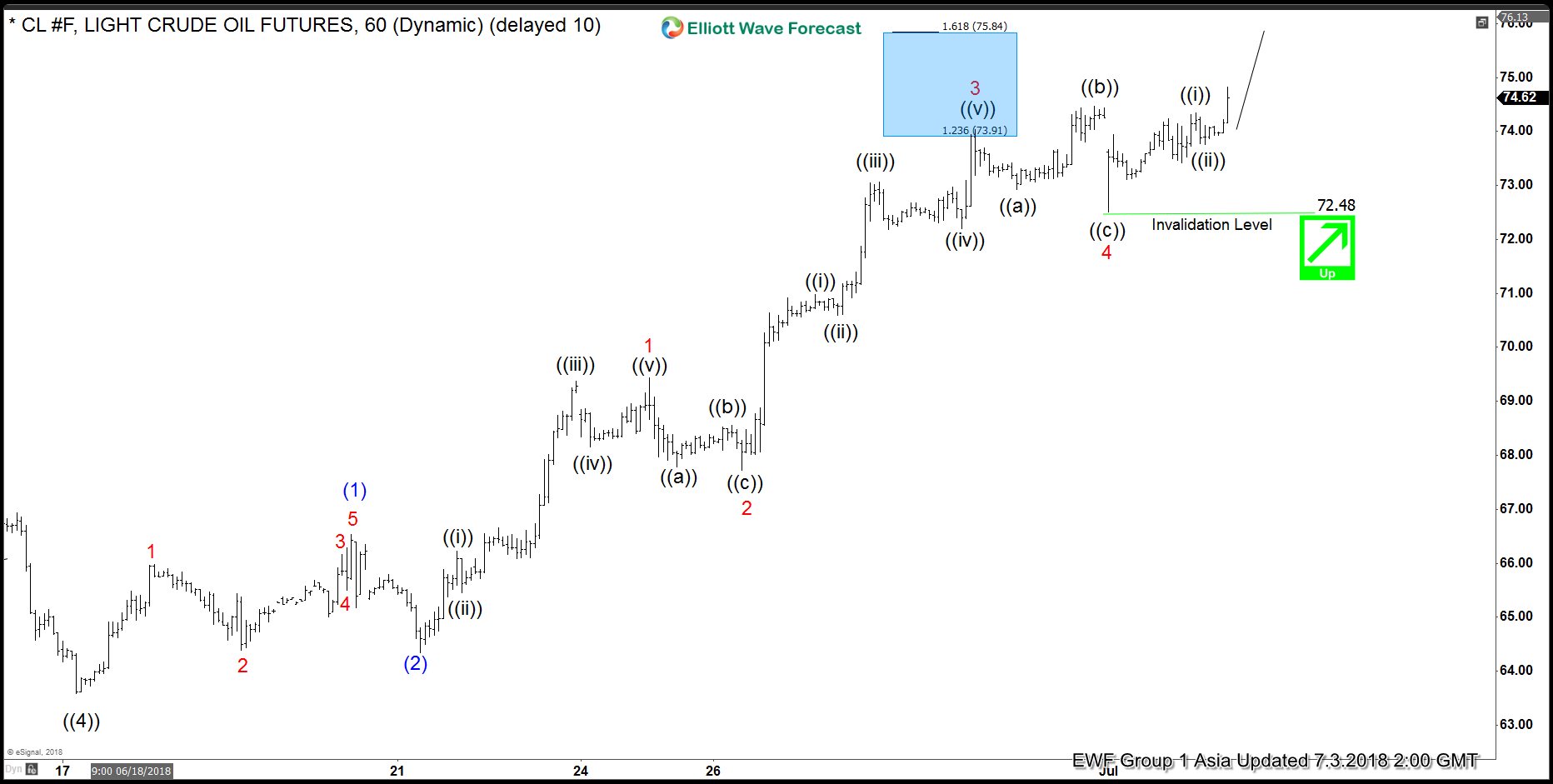

OIL Elliott Wave Analysis: Rallying Higher In An Impulse Structure

Read MoreOIL short-term Elliott Wave view suggests that the pullback to $63.59 on 6/18/2018 low ended primary wave ((4)). Up from there, the instrument reacting strongly to the upside and internals of that rally higher suggests that it’s taking place in an Impulse Elliott wave structure with extension with lesser degree oscillation showing the sub-division of 5 waves […]