The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

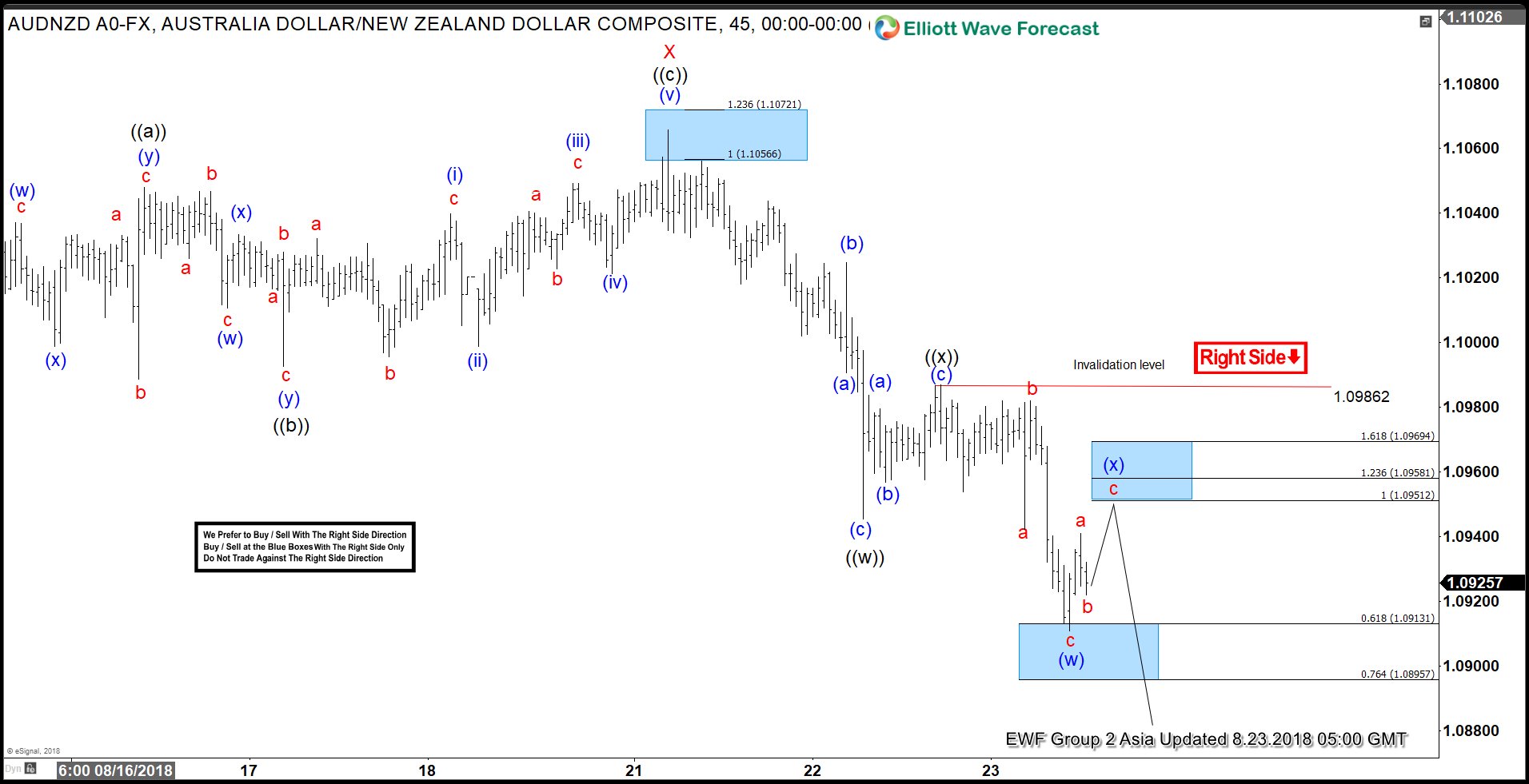

AUDNZD Elliott Wave View: Further Downside Expected

Read MoreAUDNZD Short-term Elliott Wave view suggests that the rally to 1.1066 ended Minor wave X. The internal subdivision of Minor wave X is unfolding as a zigzag Elliott Wave structure where Minute wave ((a)) ended at 1.1048, Minute wave ((b)) ended at 1.0992, and Minute wave ((c)) of X ended at 1.1066. A zigzag is […]

-

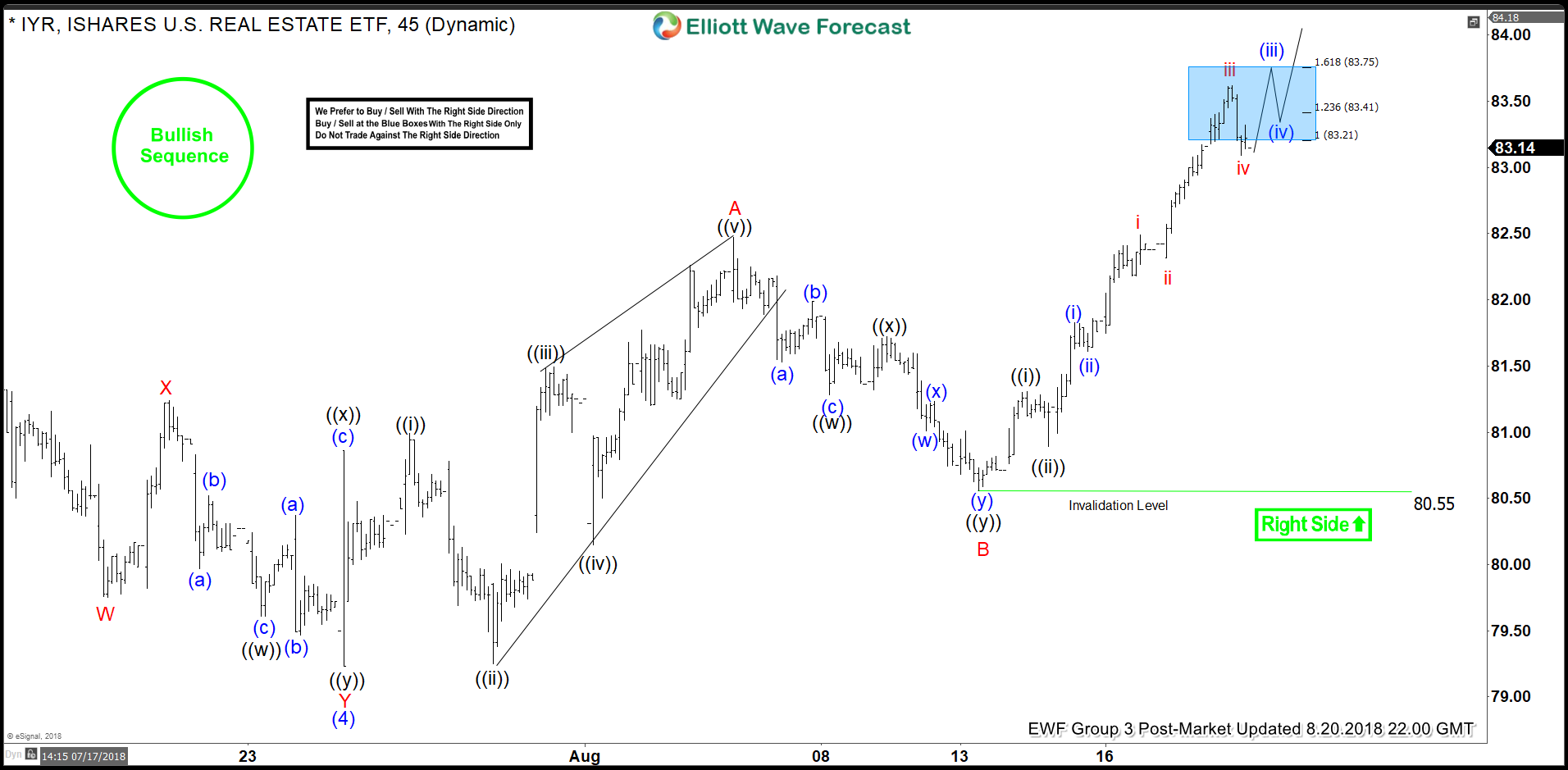

IYR Elliott Wave View: Found Buyers in Blue Box and Rallied

Read MoreHello Traders, In this blog, I want to share with you our recent Elliott Wave charts of the Real Estate ETF called IYR which we presented to our members. Below, you see the 1-hour updated chart presented to our clients on the 08/08/18. IYR ended the cycle from 03/23/18 (72.71) low at the peak of 07/06/18 (82.20) in […]

-

AT&T Elliott Wave View: Rallying as Impulse with Nest

Read MoreAT&T (ticker symbol T) Short-term Elliott Wave view suggests that the pullback to $31.76 ended Minor wave 2. The stock is rallying from there within Minor wave 3 as an impulse Elliott Wave structure with a nest. An impulse structure subdivides in 5 waves and we can see up from $31.76, the rally to $33.58 […]

-

Dow Futures Elliott Wave View: Pullback Should Find Support

Read MoreShort-term Elliott Wave view on YM_F (Dow Futures) suggests that the pullback to 24956 low ended Minor wave 4. Up from there, Index is rallying within Minor wave 5 to end a 5 waves up from 4/2/2018 low. Minute wave ((i)) of 5 is currently in progress with internal subdivision as an impulse Elliott Wave structure. […]