The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

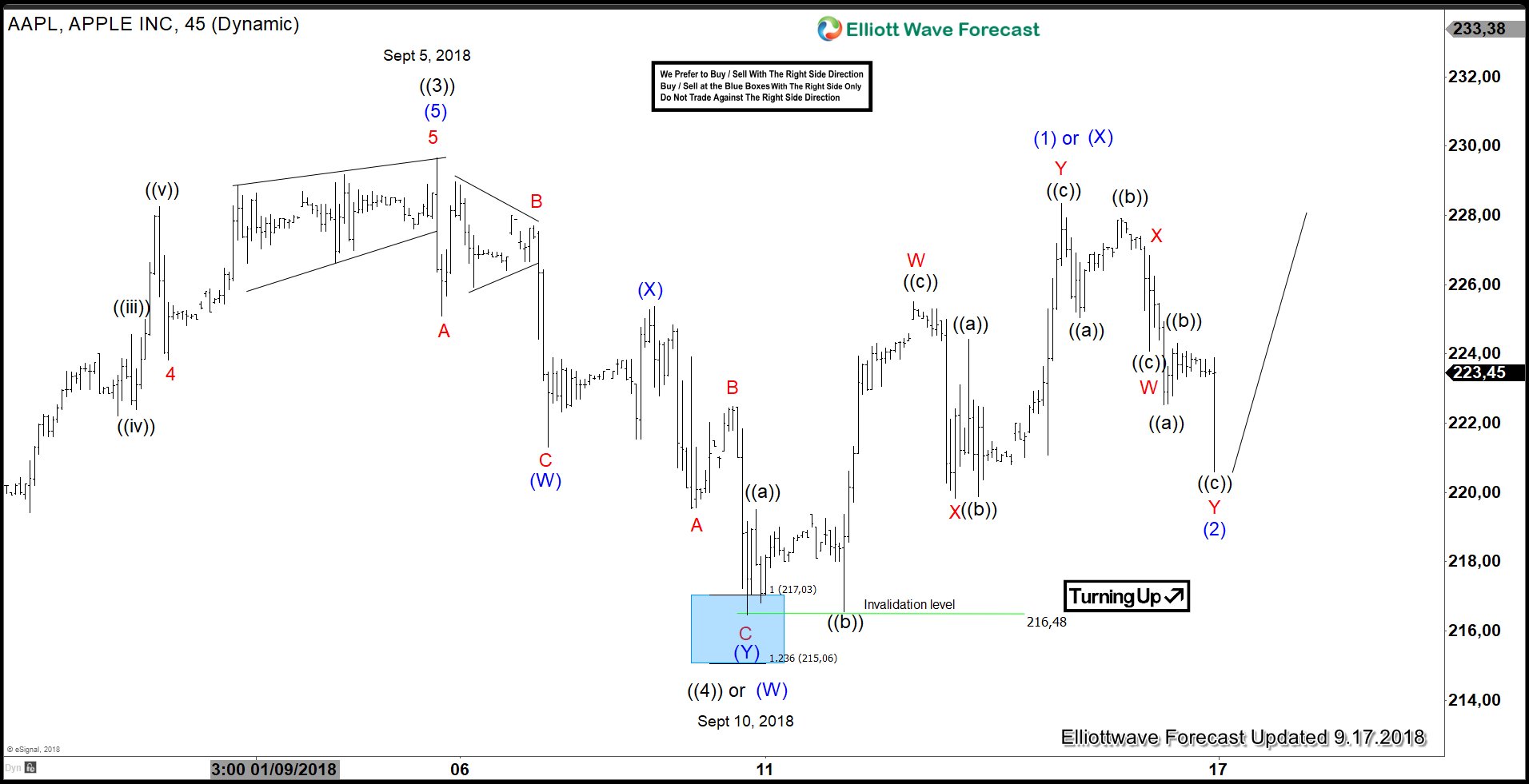

Apple (AAPL): Is the Next Trade War Decline Still a Buy?

Read MoreThe latest trade war between U.S. and China may affect U.S. companies with big operations in China, such as Apple. Saturday’s report by The Wall Street Journal suggests that President Trump has given a go ahead to his aides to implement a fresh $200 billion tariffs ahead of scheduled trade talks with China. This can […]

-

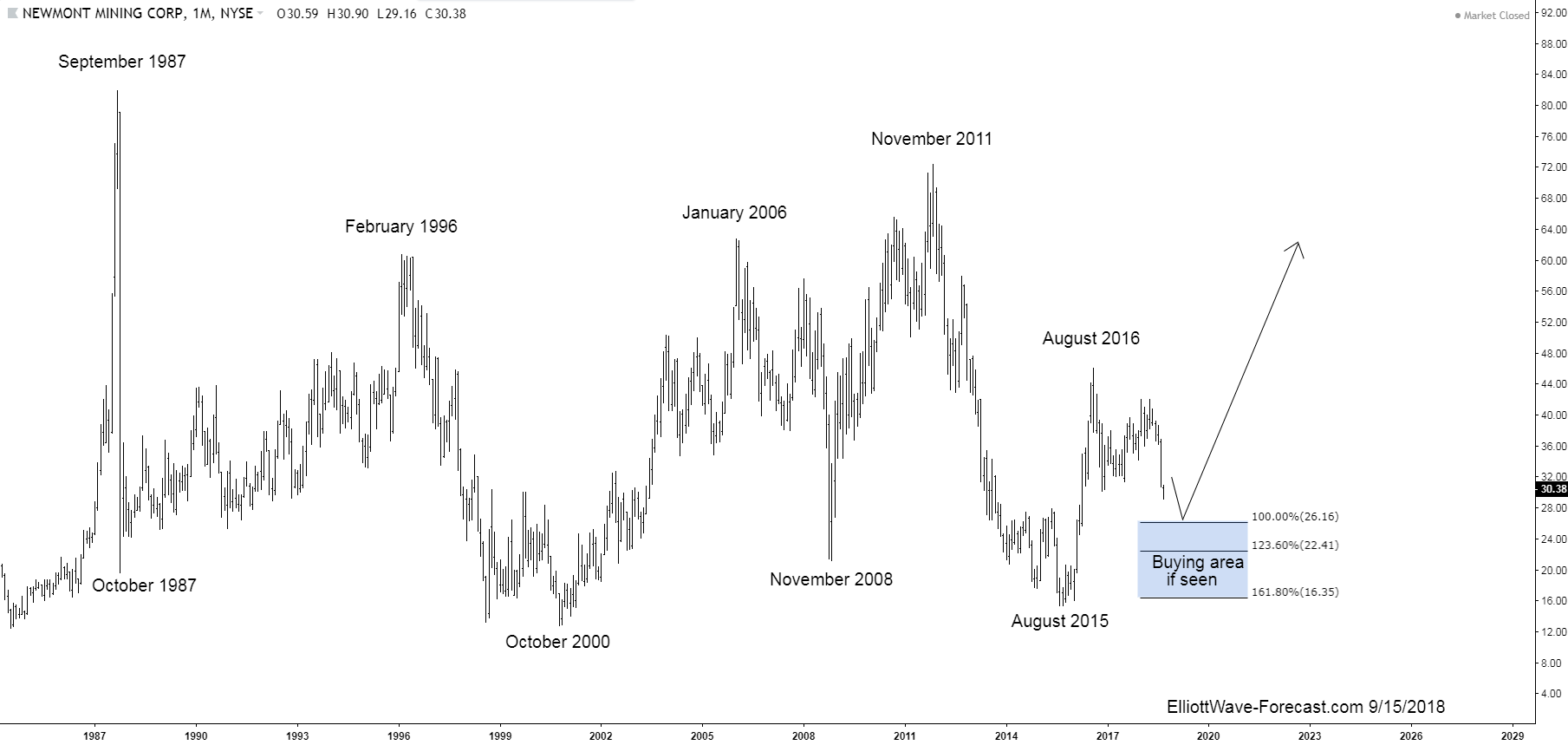

NEM Could Newmont Mining Begin a Larger Bullish Cycle Soon?

Read MoreNEM Could Newmont Mining Begin a Larger Bullish Cycle Soon? Could Newmont Mining Begin a Larger Bullish Cycle Soon? In short answer form is yes. The area from where I think that will happen from is highlighted on the chart below. Before getting to that point again later I would like to talk about some […]

-

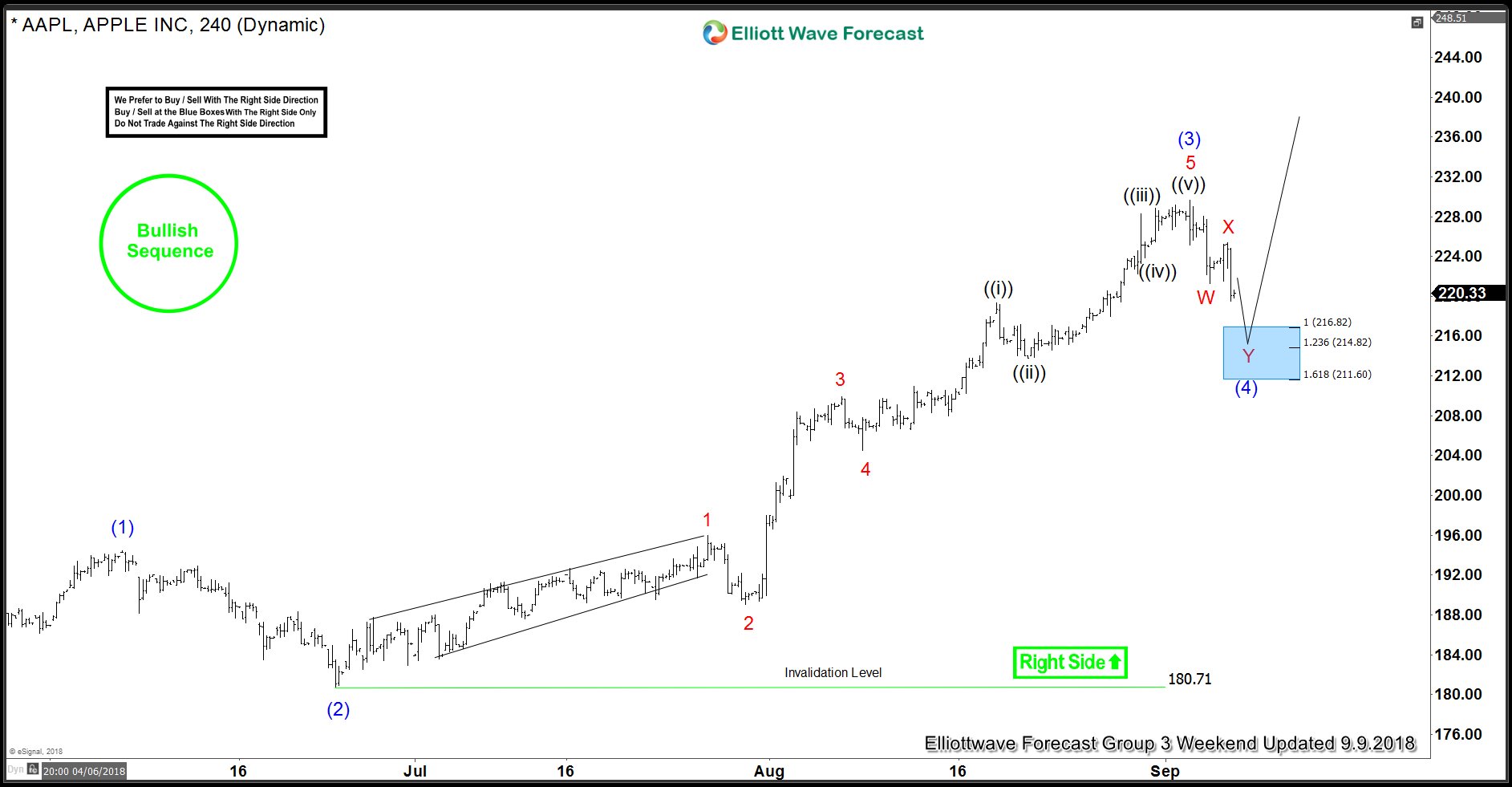

AAPL: Trading The Right Side using Elliott Wave Theory

Read MoreIn this blog, AAPL has been in a strong up trend with right side up in all time frames. We have developed a Right Side system which combines Elliott Wave, Cycles and Sequences and consists of Right side up, Right side down, turning up and turning down arrows. We only trade in direction of the Right […]

-

NKE Ready To Start The Next Leg Higher?

Read MoreNike Ticker symbol: NKE short-term Elliott wave view suggests that the pullback to $75.06 low ended intermediate wave (2). Above from there, the stock has rallied to new all-time highs confirming the next leg higher in intermediate wave (3). The internals of intermediate wave (3) higher is unfolding as Elliott wave impulse structure with the sub-division of […]