The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

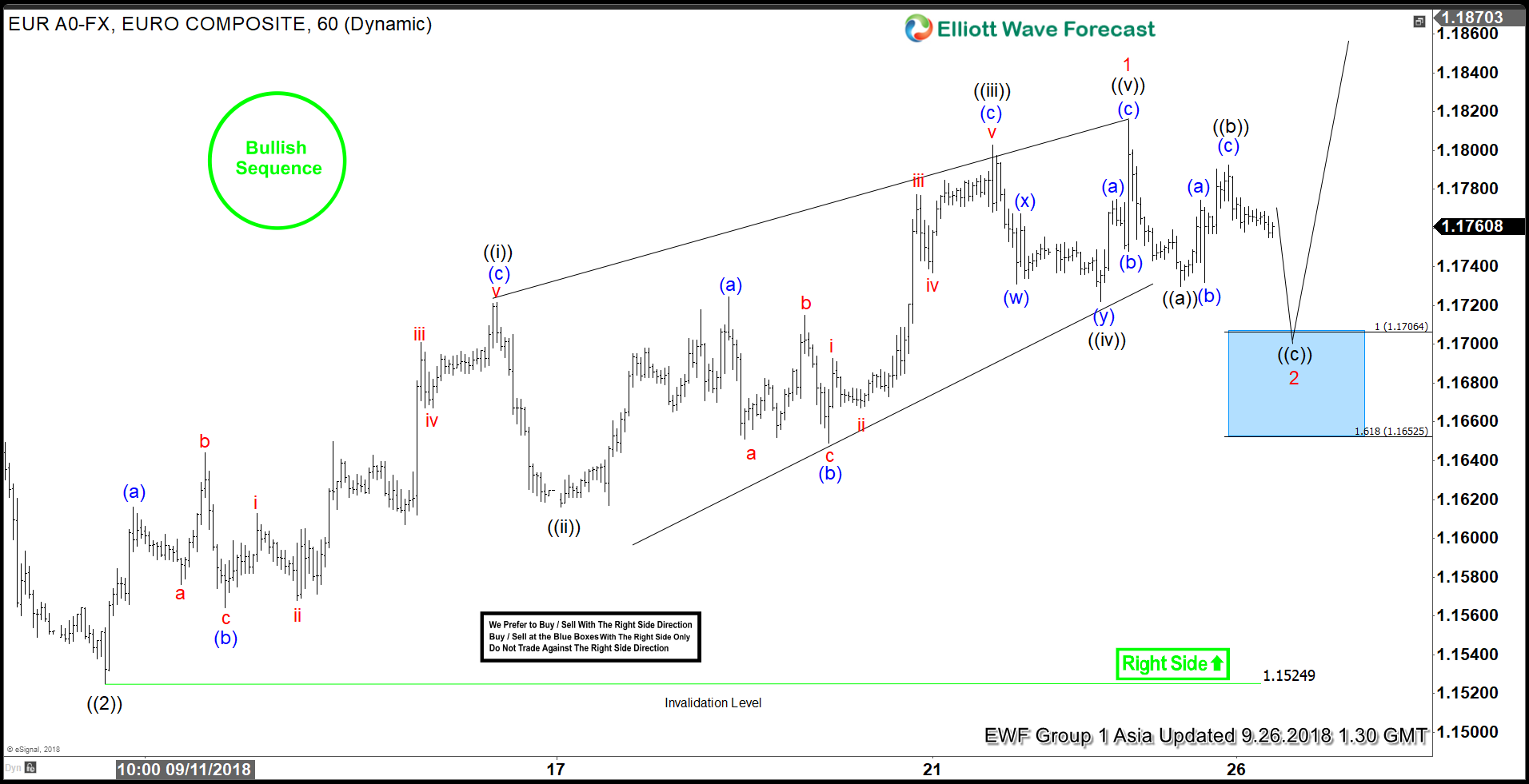

EURUSD Elliott Wave: Why Dips Should Remain Supported?

Read MoreEURUSD short-term Elliott wave view suggests that the decline to 1.1524 low ended Primary wave ((2)) pullback. Above from there, Primary wave ((3)) remain in progress as impulse structure looking for a further extension higher. It’s important to note that the pair is having bullish sequence tag & also the right side tag is calling higher. […]

-

BAC Elliott Wave View: Ready To Resume Higher?

Read MoreBAC short-term Elliott wave view suggests that the rally to $31.49 low ended Minor wave X bounce. Down from there, the decline to $30.08 low ended Minor wave Y & also completed intermediate wave (2) pullback. The internals of Minor wave Y unfolded as double three structure where Minute wave ((w)) ended at $30.62 low […]

-

AT&T: Drop and Rally Was Fundamental or Technical?

Read MoreIn this blog, we will take a look at the drop in AT&T in July and how that presented a buying opportunity in the stock which we highlighted on our chart. We also prove that all markets are technical and even when fundamentals news can create short-term volatility in the market, it doesn’t have the […]

-

PFIZER Long Term Bullish Trend and Elliott Wave Cycles

Read MorePFIZER Long Term Bullish Trend and Elliott Wave Cycles The PFIZER long term bullish trend and Elliott Wave cycles suggest the stock price will be trending higher. The cycles project it should continue toward the April 1999 highs 50.04 while it is above the February 2018 lows. From the beginning of the stock trading it had […]