The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

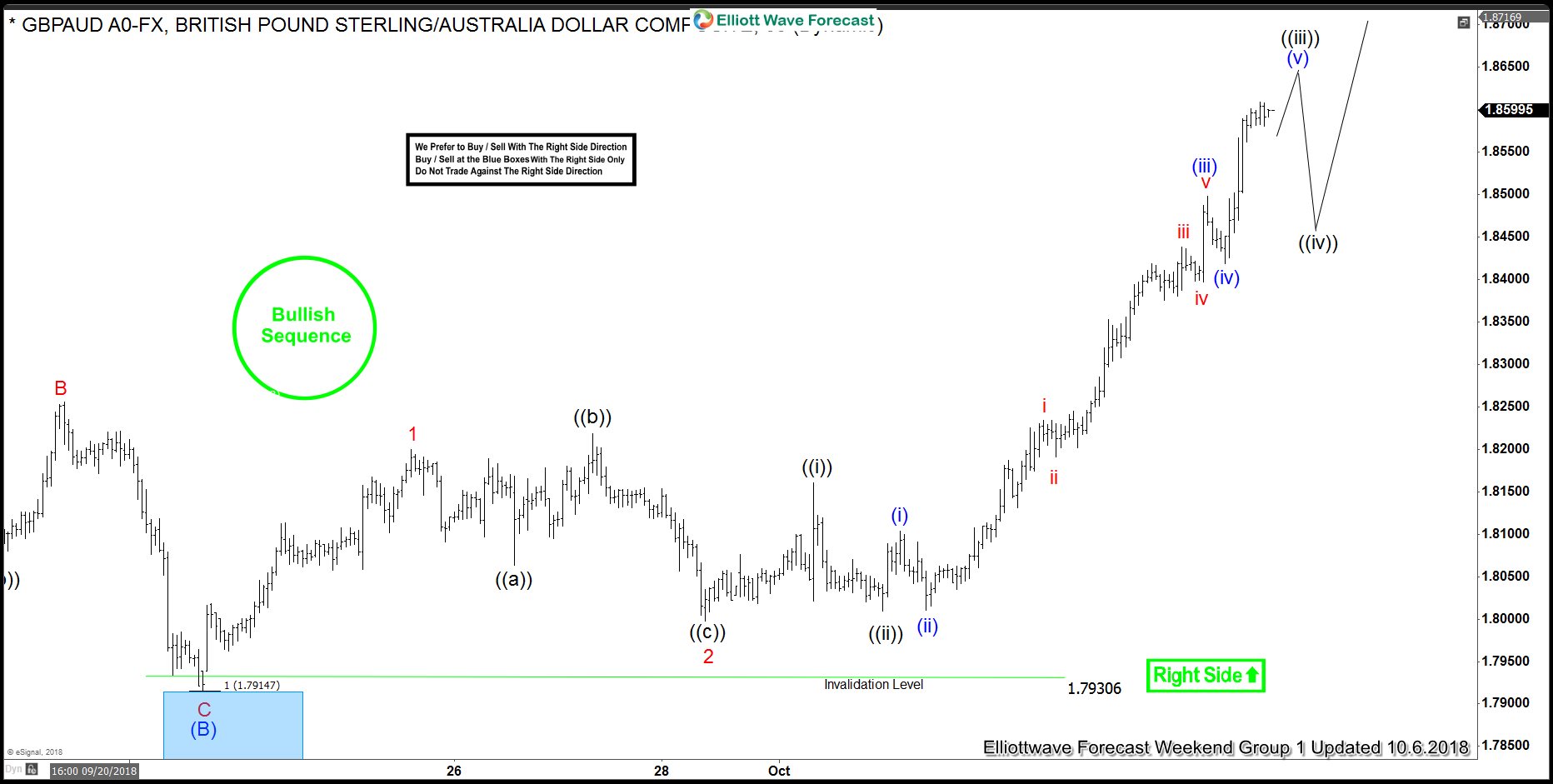

Prospect of Brexit Deal Supports Poundsterling

Read MoreThe UK is going to leave the EU on 29 March 2019. However, currently the EU and UK have not reached agreement on the Irish border issue. In the last few years, the potential for no Brexit deal has given pressure to Poundsterling. But last week, Poundsterling surged higher against other major currencies as EU’s […]

-

Apple Nesting Higher As Elliott Wave Impulse Structure

Read MoreApple ticker symbol: $AAPL short-term Elliott wave view suggests that the decline to $215.31 low ended intermediate wave (4) pullback. Above from there, the stock is nesting higher within wave intermediate wave (5) looking for more upside extension. The internals of intermediate wave (5) is unfolding as impulse structure with the sub-division of 5 waves […]

-

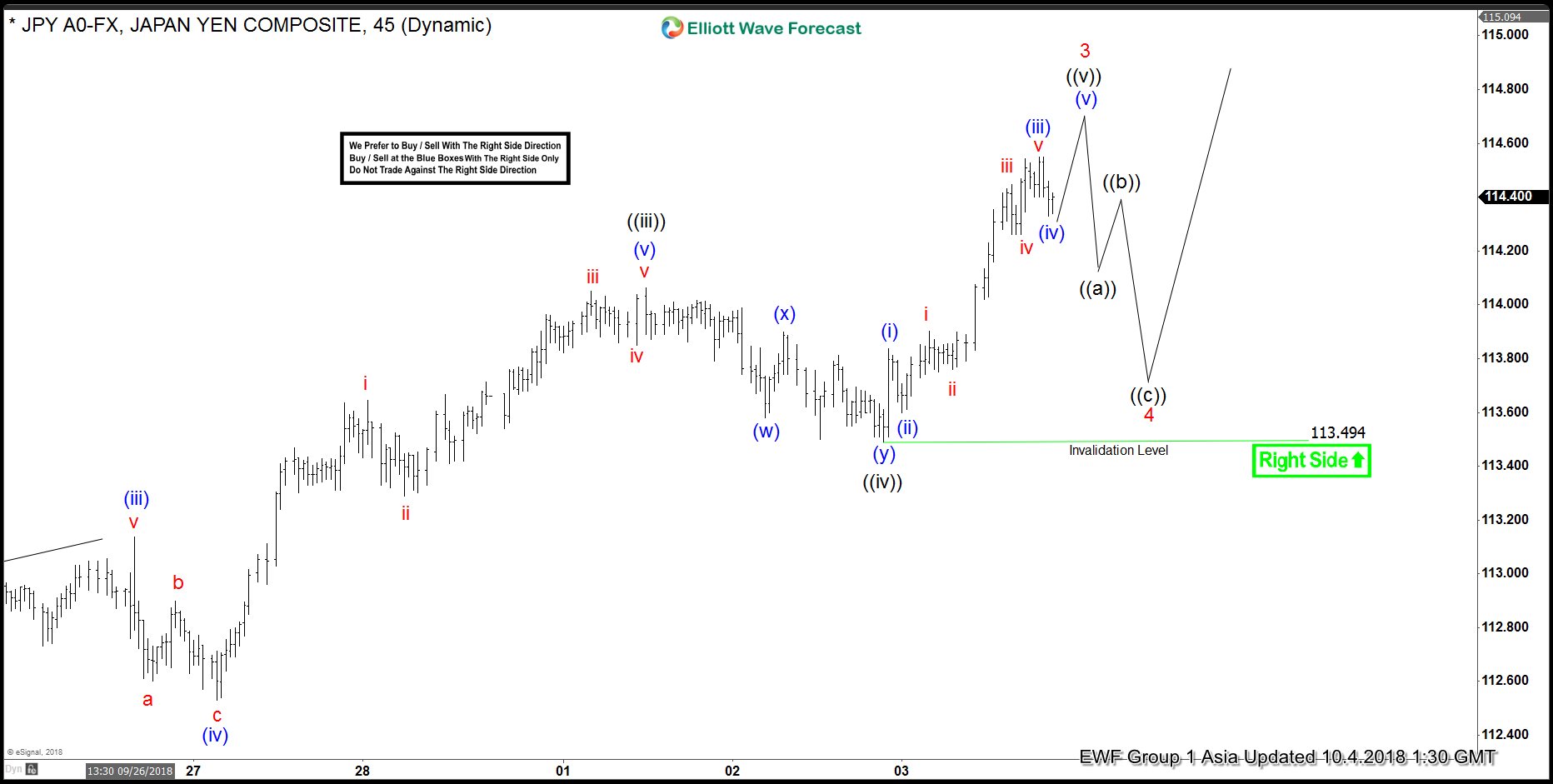

USDJPY Elliott Wave Suggest Extension Towards 118.24-120.30 Next

Read MoreUSDJPY short-term Elliott wave view suggests that the pair is nesting higher as impulse structure. Looking for an extension higher towards 118.24-120.30 100%-123.6% Fibonacci extension area from 3/23/2018 low. And until that area is reached dips are expected to remain supported in 3, 7 or 11 swings looking for upside extension. Currently, Minor wave 3 remain […]

-

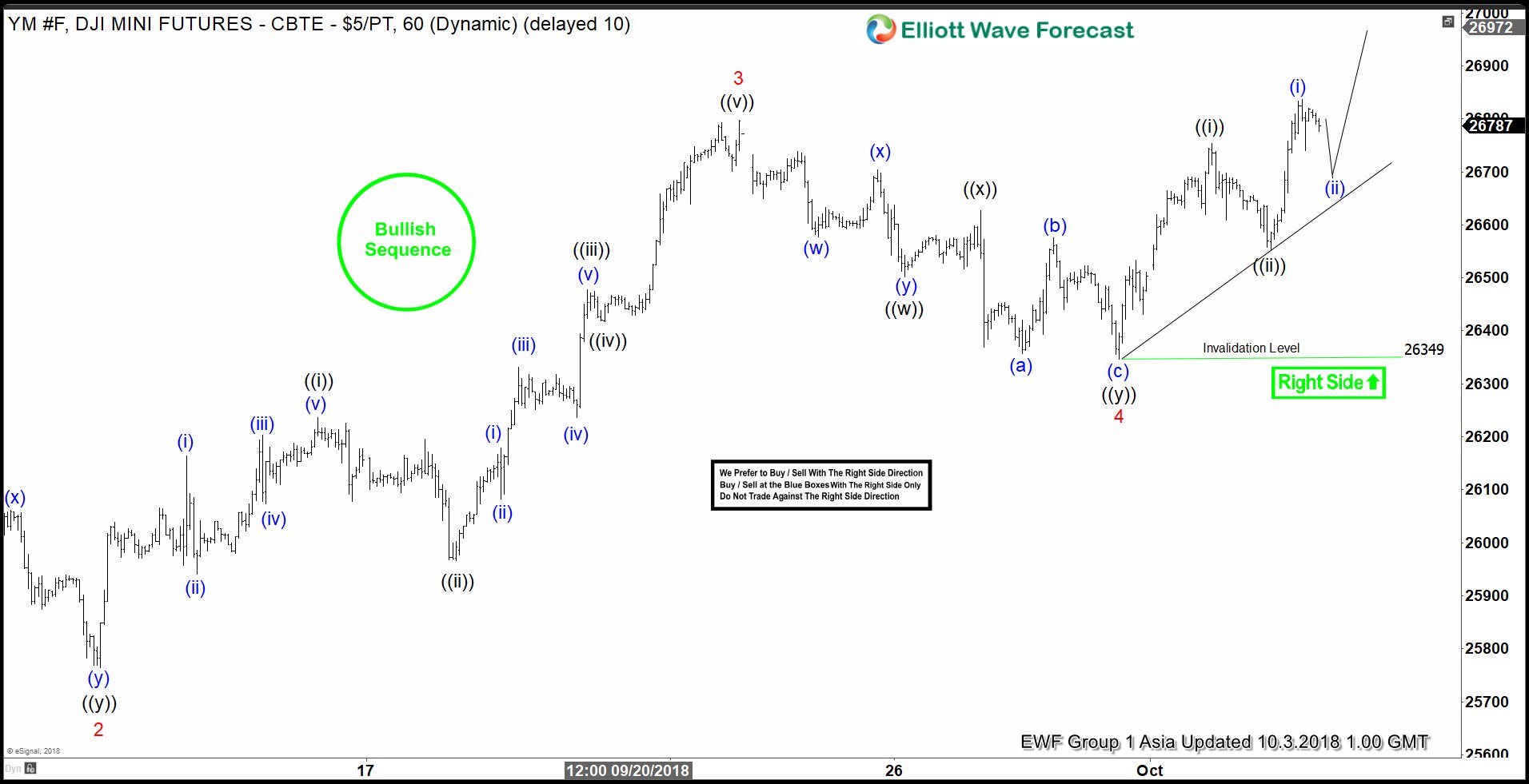

YM_F Elliott Wave: Started Nesting Next Leg Higher

Read MoreDJI Mini Futures ticker symbol: YM_F short-term Elliott wave view suggests that the index is nesting higher as impulse structure looking for more upside. The internals of lesser degree cycles is showing the sub-division of 5 waves advance in each leg higher i.e Minor wave 1, 3 & 5. While Minor wave 2 & 4 […]