The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

$SPX Forecasting The Rally & Buying The Dips

Read MoreHello fellow Traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of $SPXpublished in members area of the website. Another trading opportunity we have had lately is long trade in $SPX. As our members and followers already know, the right side in $SPX is long side. Recently […]

-

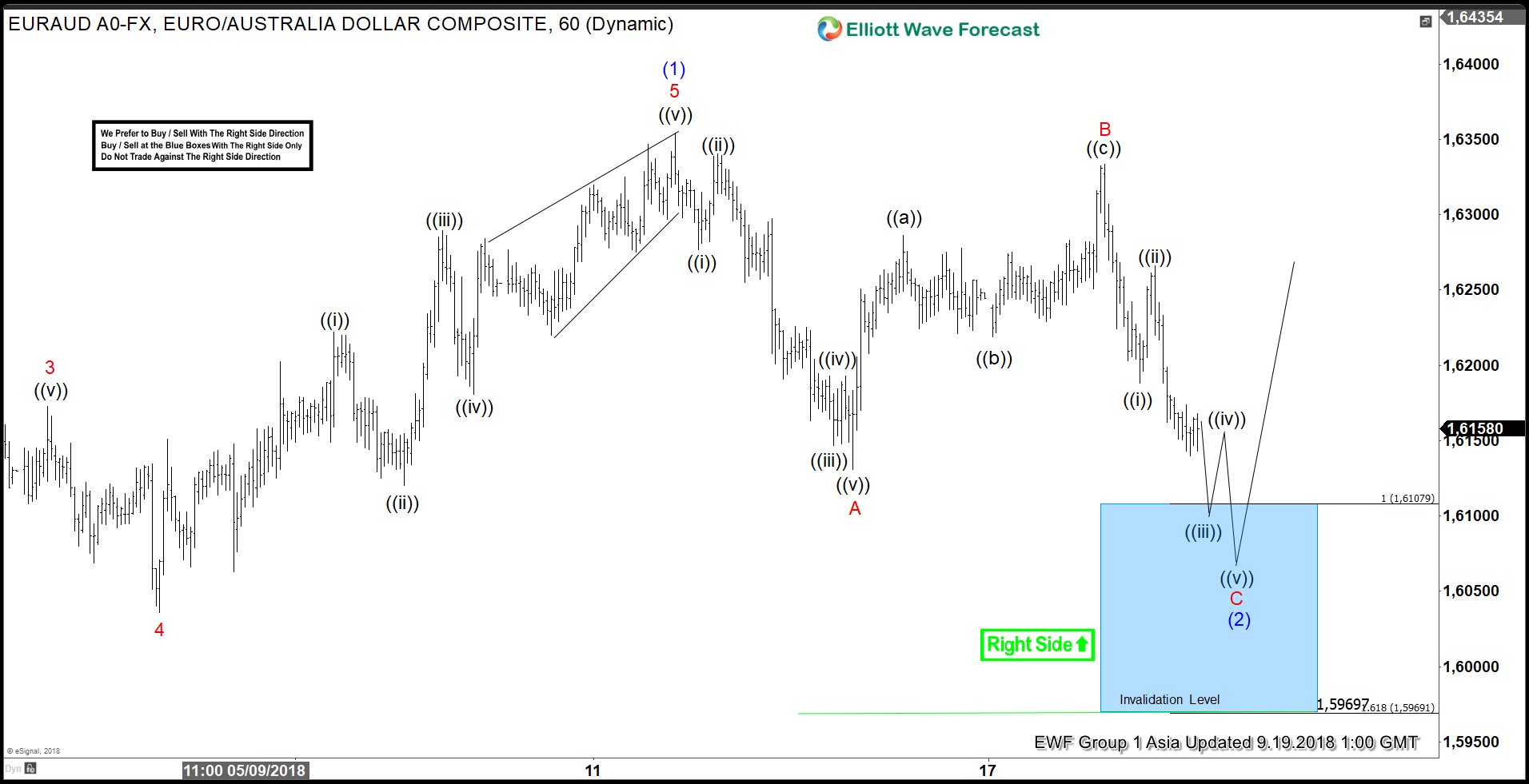

EURAUD Forecasting The Rally & Buying The Dips

Read MoreHello fellow traders. Another trading opportunity we have had lately is EURAUD. In this technical blog we’re going to take a quick look at the Elliott Wave charts of EURAUD published in members area of the website. As our members know, EURAUD has incomplete bullish sequences. Break of March 28th peak has made cycle from […]

-

AUDUSD Bearish Sequence Support More Downside

Read MoreAUDUSD short-term Elliott wave view suggests that the bounce to 0.7316 high ended intermediate wave (X). Down from there, intermediate wave (Y) remain in progress as a zigzag structure. Where initial decline to 0.7049 low ended in 5 waves impulse structure & also completed the Minor wave A lower. Also, it’s important to note that […]

-

Tesla Elliott Wave View: Favoring More Downside To Proceed

Read MoreTesla ticker symbol: $TSLA short-term Elliott wave view suggests that the rally to $317.51 high ended intermediate wave (X) bounce. The internals of that bounce unfolded as zigzag structure where Minor wave A ended in 5 waves at $302.64 high. Down from there, Minor wave B pullback ended as a Flat at $260.56 where lesser […]