The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Bitcoin Elliott Wave View: Reacting lower From Blue Box

Read MoreIn this blog, I want to share some short-term Elliott Wave charts of Bitcoin which we presented to our members in the past. Below, you see the 1-hour updated chart presented to our clients on the 11/06/18 showing Bitcoin in an Elliott wave Tringle structure in red wave B pullback. Bitcoin ended the cycle from 10/15/18 peak in […]

-

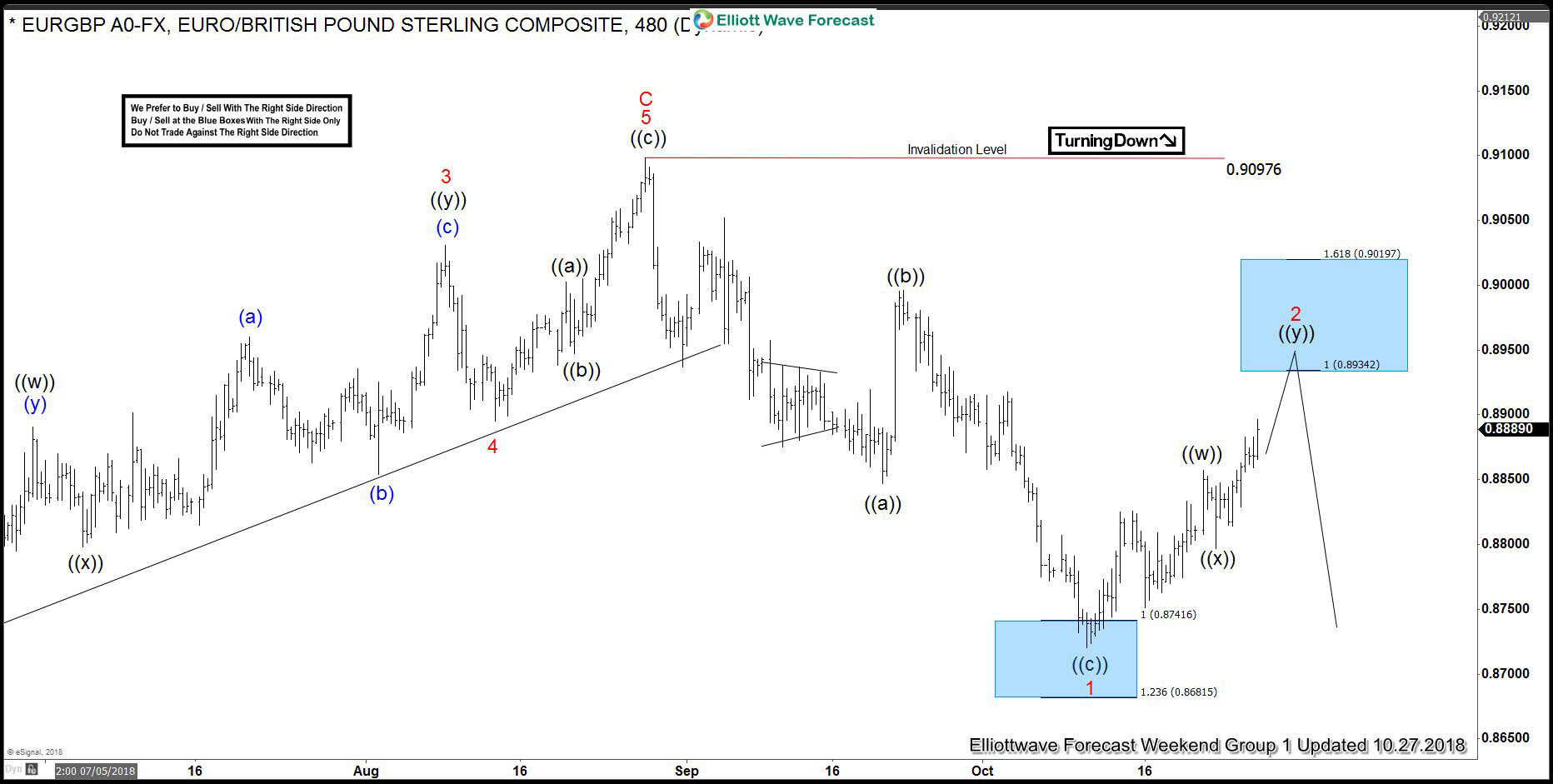

EURGBP Found Sellers After Double Three Pattern

Read MoreIn this technical blog we’re going to take a quick look at the past Elliott Wave charts of EURGBP published in members area of the website. We’ll explain the Forecast and the Price Structure. As our members know EURGBP has ended April 2018 cycle at the 0.90976 peak. We were calling for pottential turn lower […]

-

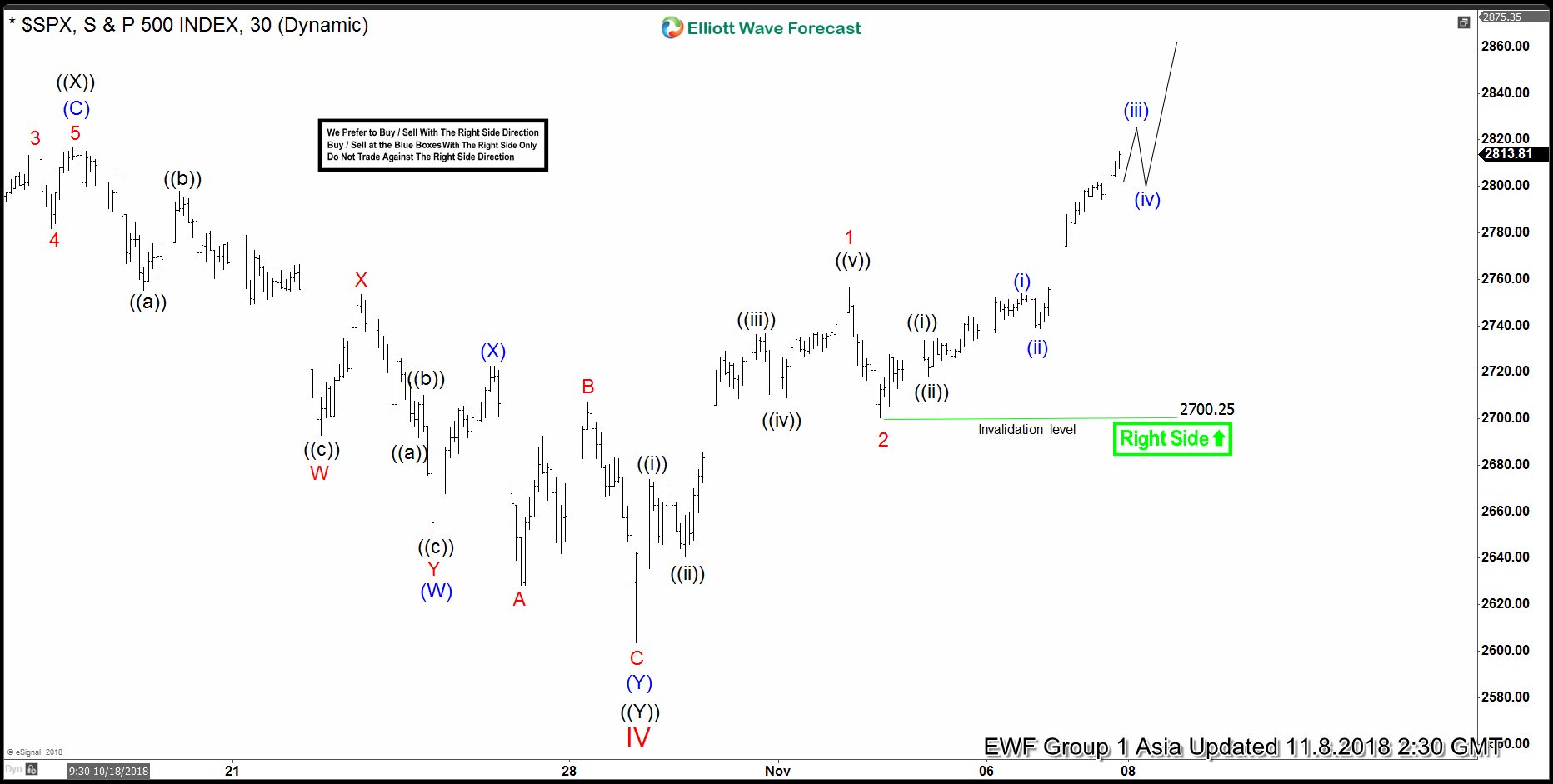

Elliott Wave View: SPX Starts a New Impulsive Rally

Read MoreShort term S&P 500 (SPX) Elliott wave view suggests that the selloff starting from Sept 21 high (2940.9) has ended at Oct 29 low (2603.54). We take the most aggressive view and call the low at 2603.54 as wave IV in Cycle degree. This suggests that SPX is ready to rally in a new bullish […]

-

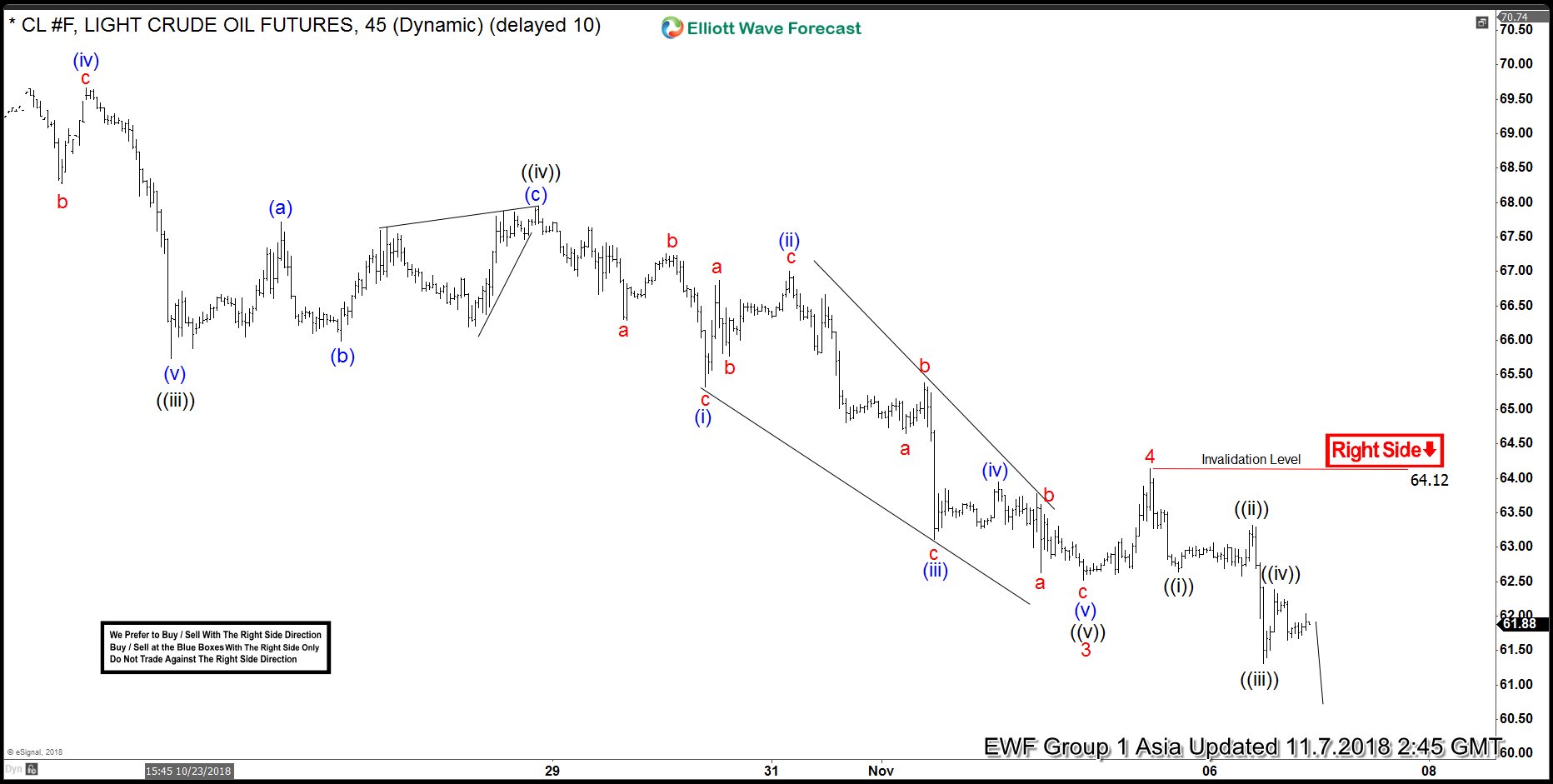

Elliott Wave Analysis: Oil (CL_F) looking to end 5 Waves

Read MoreOil (CL_F) short-term Elliott wave analysis suggests that the decline from Oct 3rd high is unfolding as a 5 waves impulse structure. In an impulse structure, the internals of wave 1, 3, and 5 also subdivide in another 5 waves of lesser degree. We propose Minor wave 3 ended at $62.52 , Minor wave 4 […]