The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

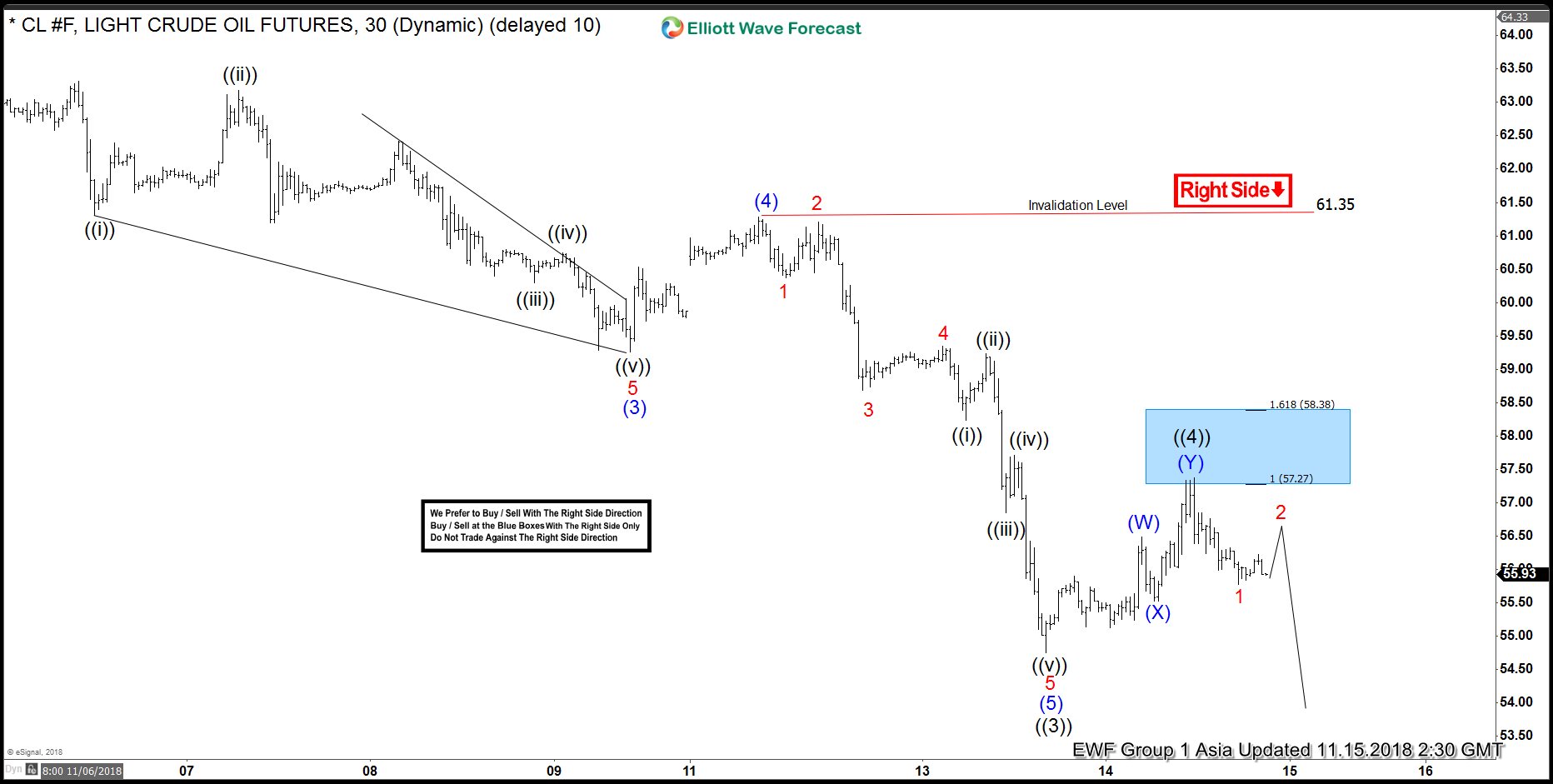

Elliott Wave Analysis: How Much Further Can Oil Drop?

Read MoreShort term Elliott Wave view on Oil suggests that the decline starting from Oct 3 high ($76.9) remains in progress as a 5 waves impulse Elliott Wave structure. Down from Oct 3 high, Primary wave ((1)) ended at $68.47 and Primary wave ((2)) ended at $69.66. Primary wave ((3)) ended at $54.75 and Primary wave ((4)) […]

-

Elliott Wave View: Nifty looking to resume rally

Read MoreShort term Elliott Wave view on Nifty suggests that the decline to 10004 on Oct 26 low ended Primary wave ((2)). This means that Index has ended the selloff which started from Aug 28 high (11760.20). It is currently either in the process of eventually breaking to new high again or at least rallying in […]

-

EURGBP Opened Further Extension Down in 7th Swing

Read MoreHello fellow traders. Another instrument that we have been trading lately is EURGBP . In this technical blog we’re going to take a quick look at the Elliott Wave charts of EURGBP , published in members area of the website. As our members know, EURGBP has incomplete bearish sequences in the cycle from the 08/28 […]

-

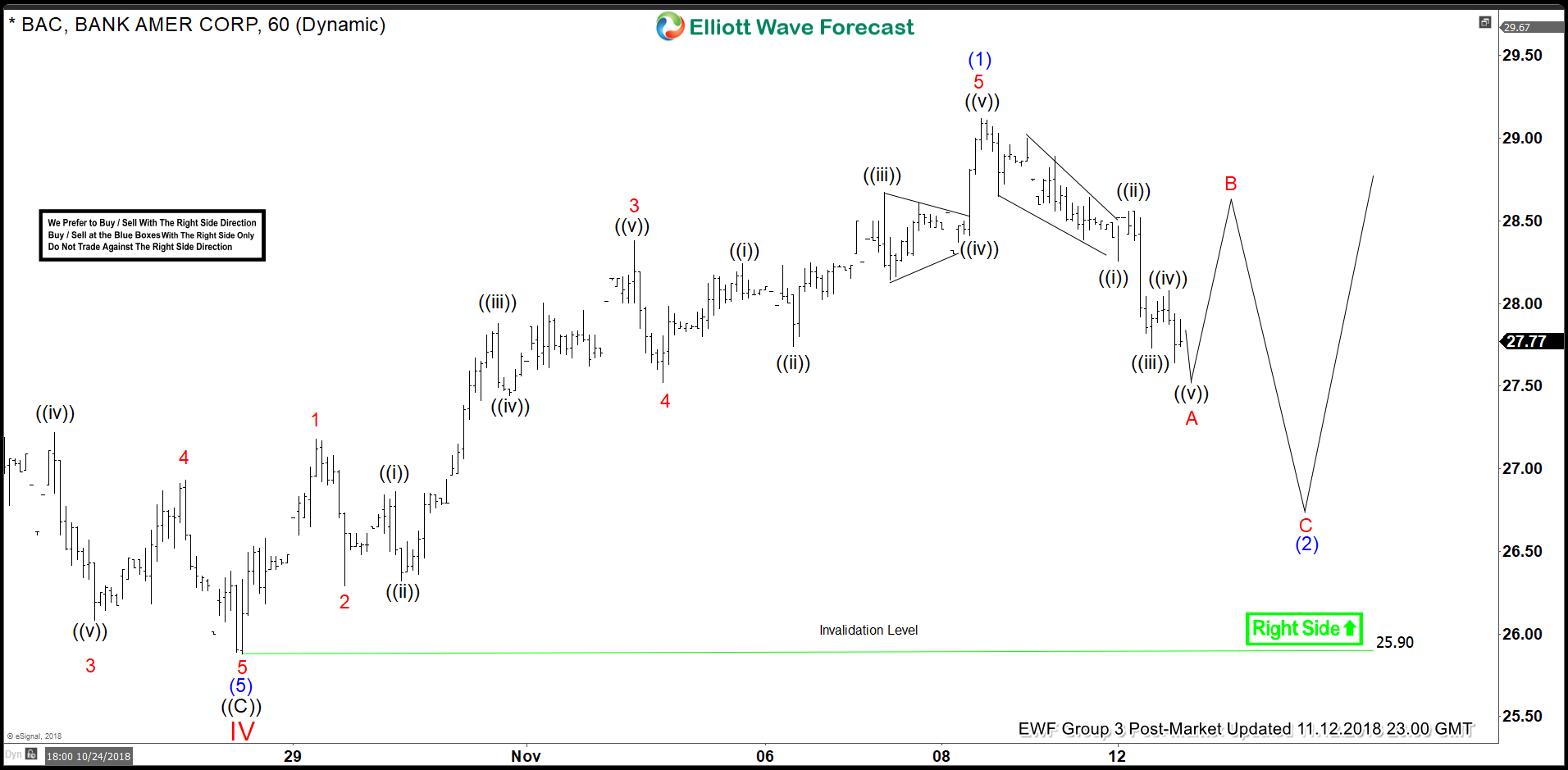

BAC Elliott Wave Dips Are Expected To Remain Supported

Read MoreBAC short-term Elliott wave view suggests that a decline to $25.90 low ended cycle degree wave IV pullback as a Flat correction. Up from there, the stock is expected to resume the next leg higher in cycle degree wave V or should do another extension higher from $25.90 low because the rally higher from that […]