The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

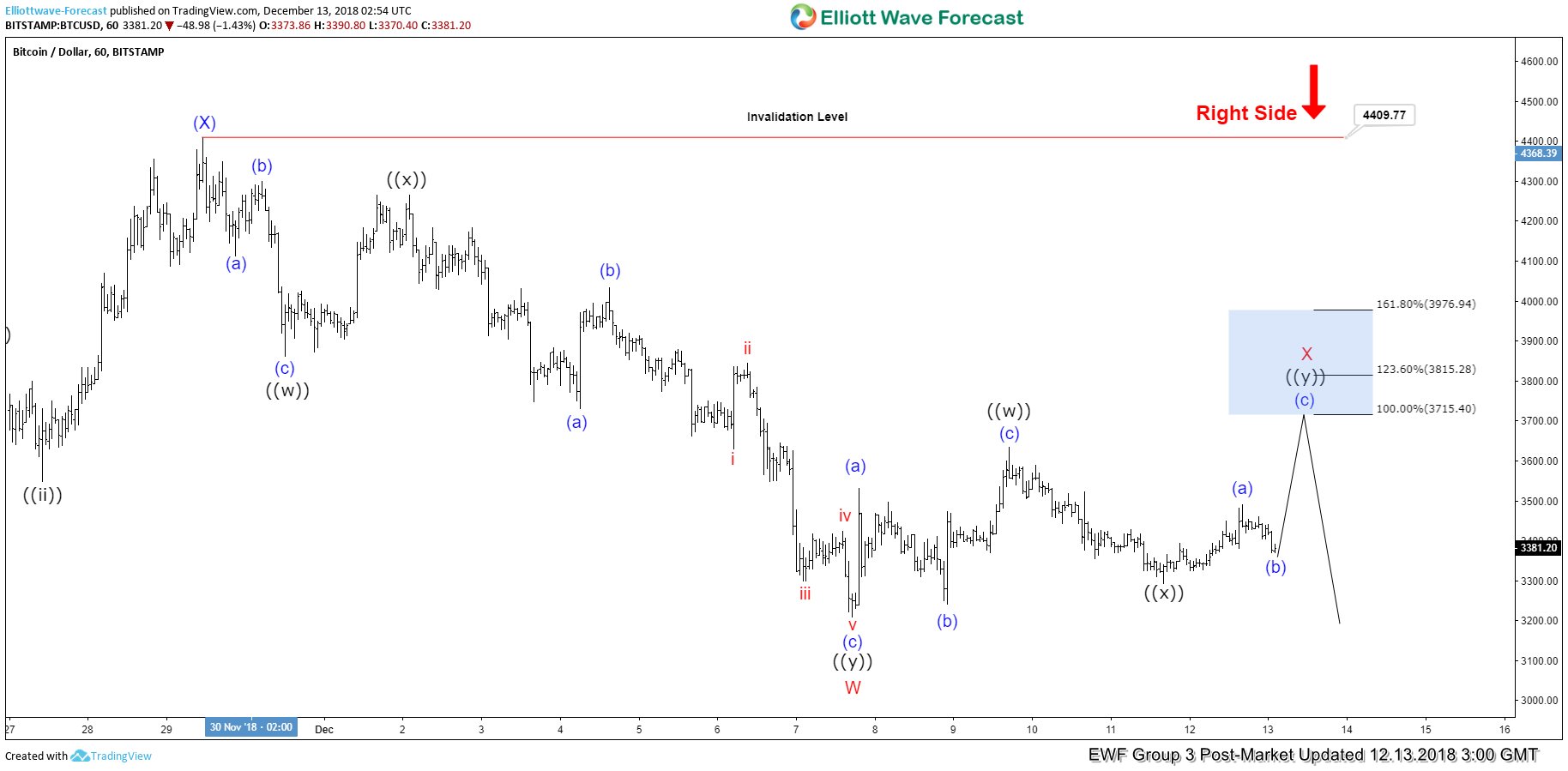

Elliott Wave View Suggests Bitcoin Selloff Not Over

Read MoreShort Term Elliott Wave view suggests that the selloff in Bitcoin is not yet over. Rally to $4409.77 ended Intermediate wave (X). Down from there, the decline is unfolding as a double three Elliott Wave structure where Minor wave W ended at $3210. Internal of Minor wave X unfolded also as a double three Elliott […]

-

Elliott Wave Analysis: SPX Bounce Expected to Fail

Read MoreSPX has broken below Oct 30 low (2603.54), i.e. Primary wave ((W)), opening further downside with incomplete bearish sequence from Sept 21 high (2940.91). Near term Elliott Wave view suggests the decline to 2603.54 on Oct 30 low ended Primary wave ((W)). Bounce to 2815.6 ended Primary wave ((X)) as a zigzag Elliott Wave structure. Up […]

-

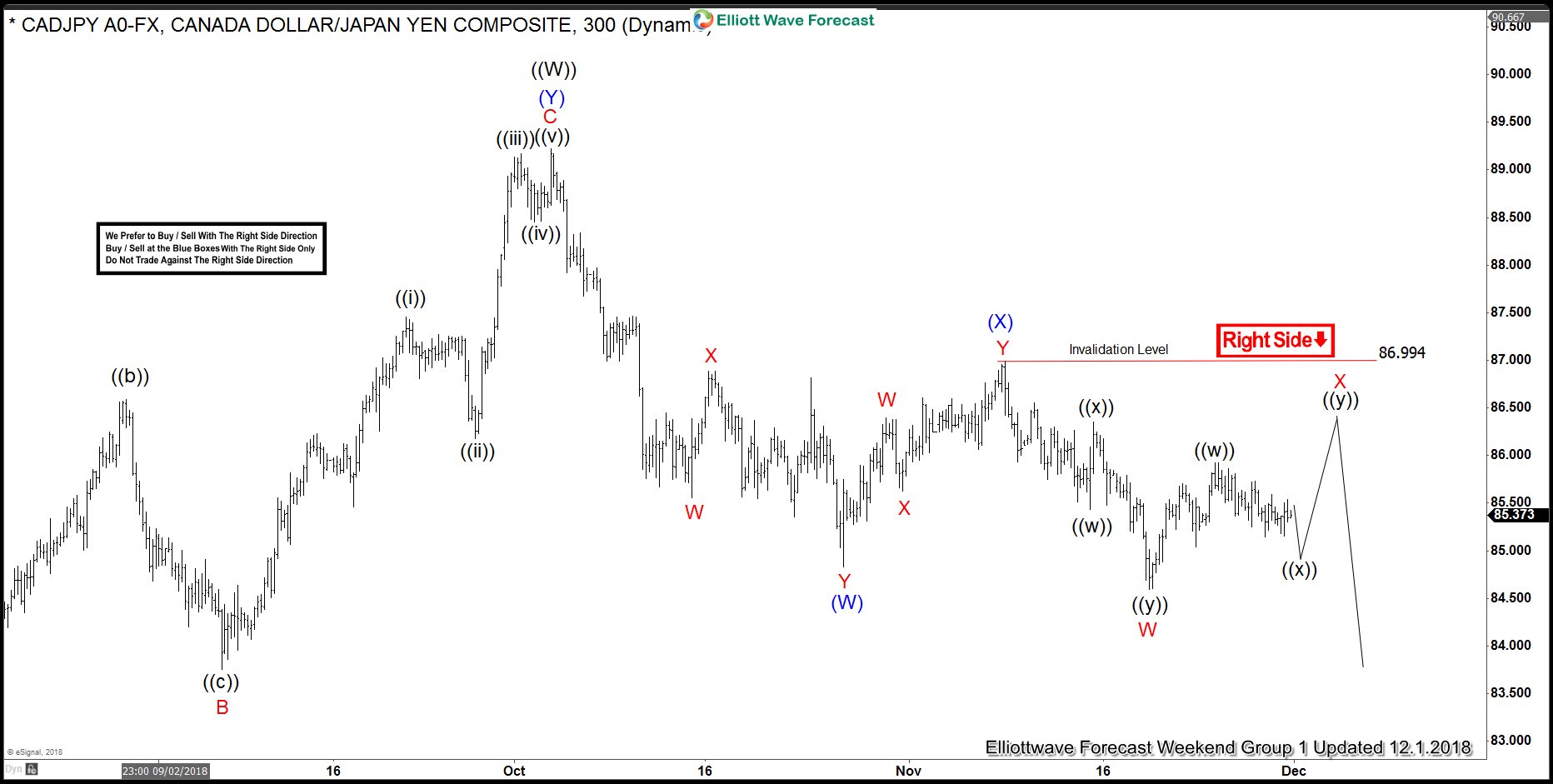

CADJPY Incomplete Bearish Sequence Called The Decline

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the past Elliott Wave charts of CADJPY published in members area of The Website. As our members know CADJPY has the incomplete bearish sequences in the cycle from the October 3th peak. Break of 10/26 low has made the pair […]

-

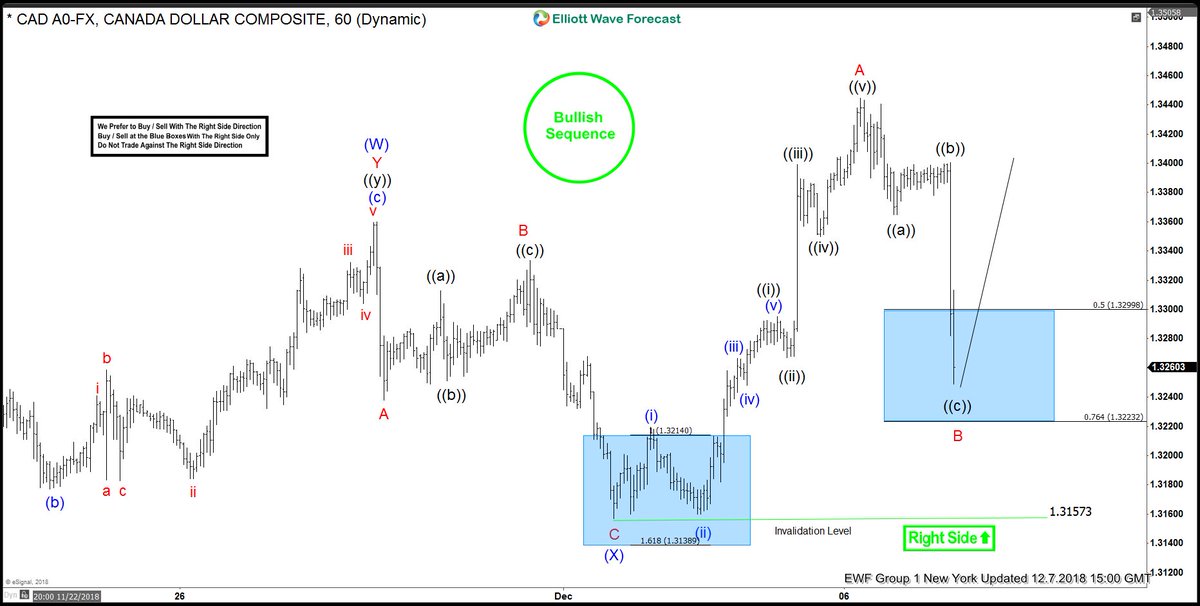

USDCAD Buying The Elliott Wave Dips

Read MoreIn this technical blog, we are going to take a look at the past performance of USDCAD, 1 hour Elliott Wave charts that we presented to our clients. We are going to explain the structure and the forecast below. USDCAD 1 Hour Elliott Wave Chart From 12/06/2018 Above is the 1 hour Chart from 12/06/2018 Asia update, […]