The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

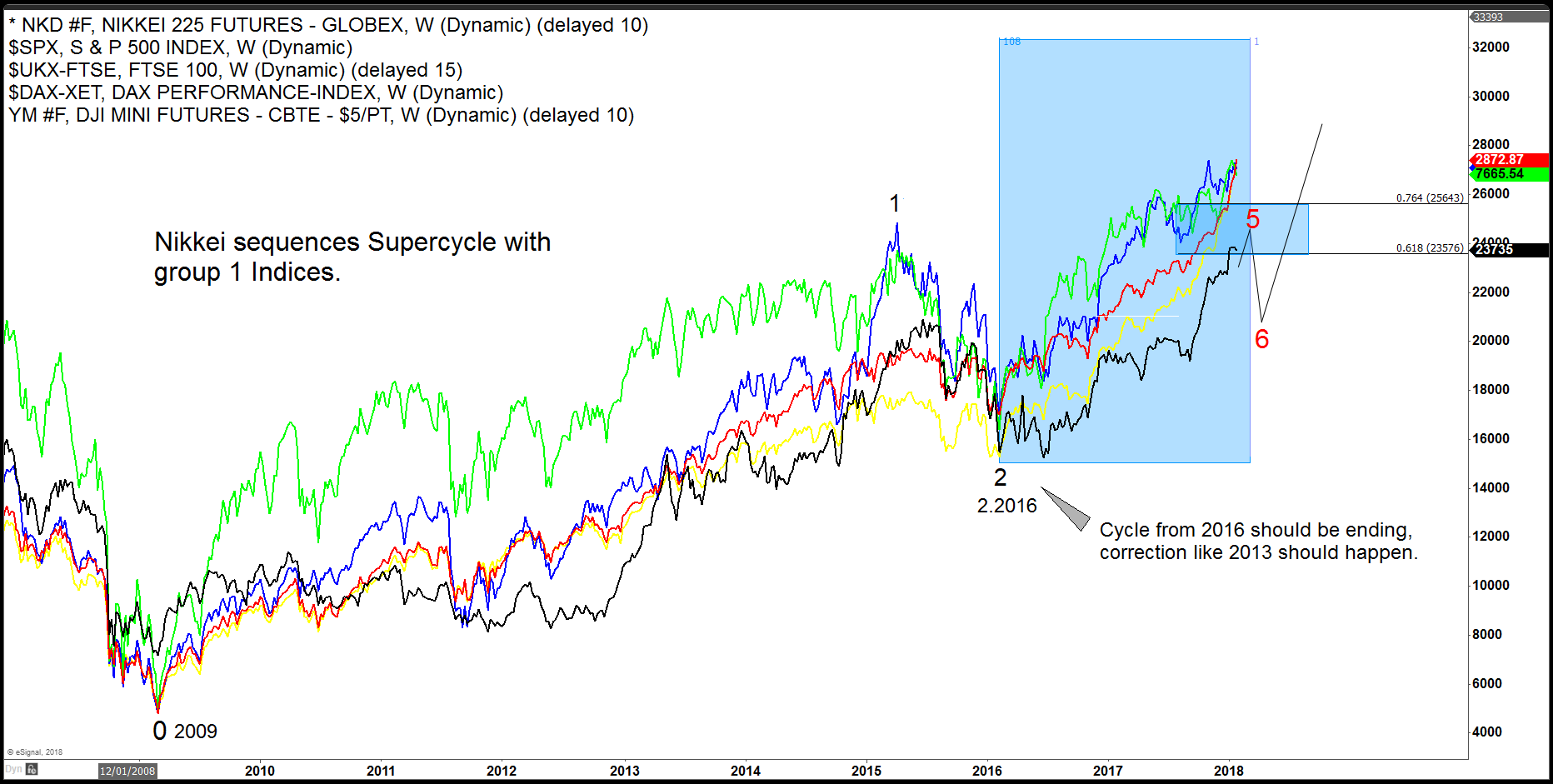

World Indices: When to Start Buying Them Again

Read MoreThe World Indices have shown a sideways to lower year in 2018. The last Quarter alone World Indices lost their gains, for example, the SPX or the Dow Jones. Other World indices peaked earlier than others this year and some of them did not produce new highs again. There is a lot of speculation going around […]

-

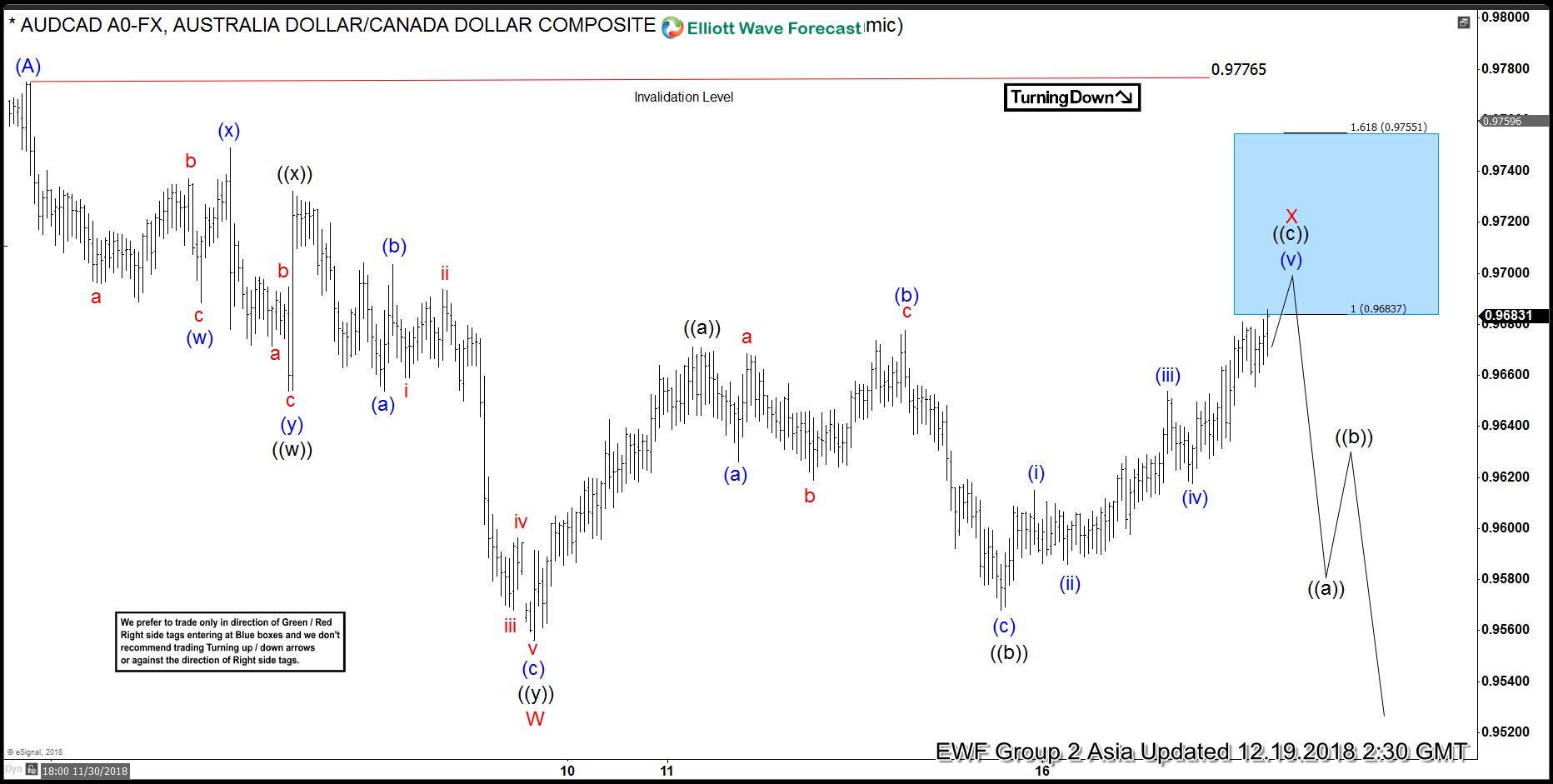

AUDCAD Elliott Wave Analysis: Calling The Reaction From Inflection Area

Read MoreIn this blog, I want to share some short-term Elliott Wave charts of AUDCAD which we presented to our members in the past. Below, you see the 1-hour updated chart presented to our clients on the 12/19/18. Showing that AUDCAD ended the cycle from 12/03/18 peak in red wave W at 12/09/18 low (0.95680). As AUDCAD ended the cycle […]

-

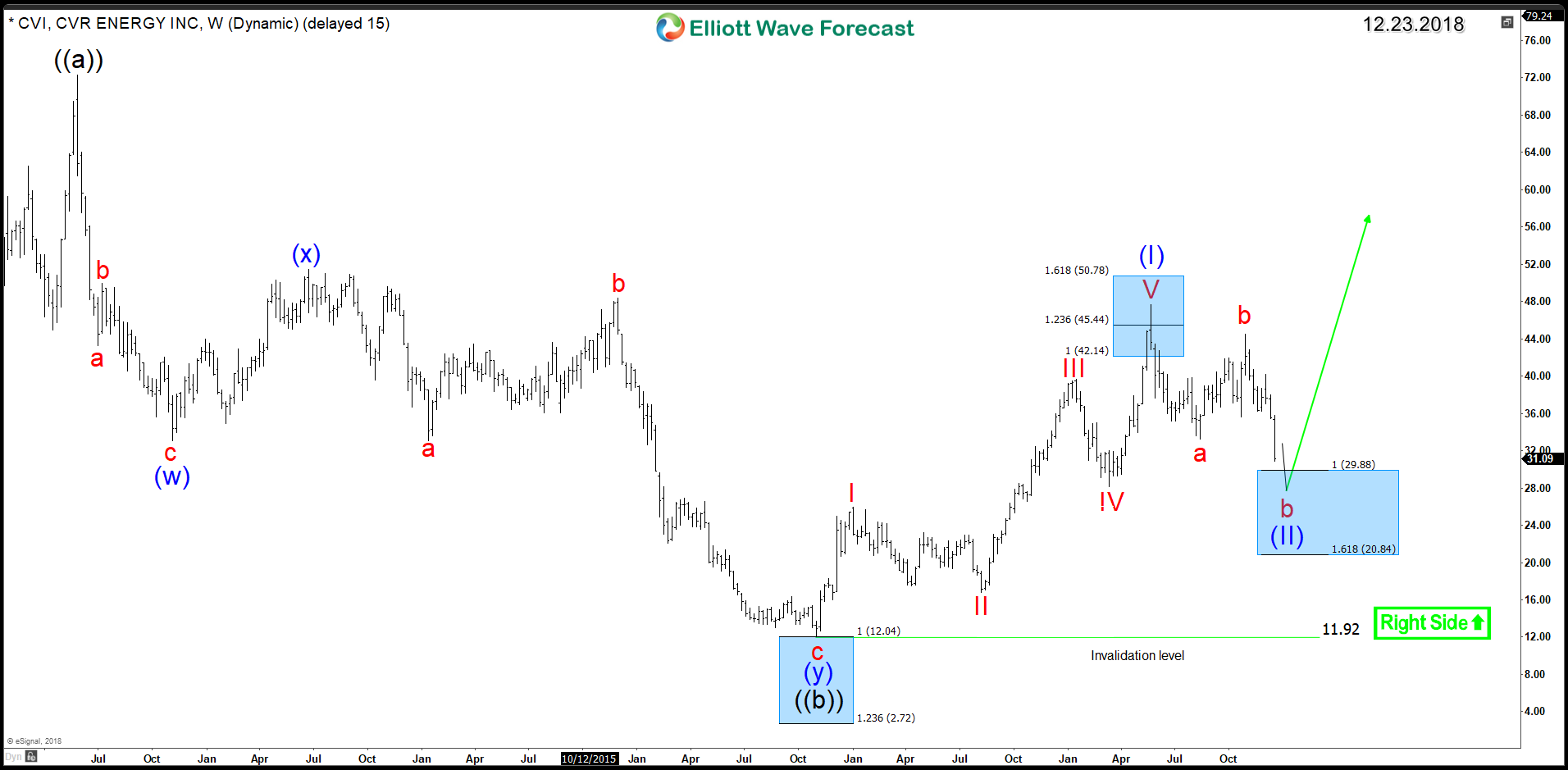

CVR Energy (NYSE:CVI) – Another 5 Waves Rally To Follow

Read MoreCVR Energy (NYSE:CVI) is presenting one of the best technical structure in Energy market despite the recent scary 40% drop in Oil prices. At Elliottwave Forecast, we believe in the One Market Concept therefore we always look for answers around other instruments within the market. Since 2016 low, CVI did advance in a bullish 5 waves impulsive […]

-

Can Aggressive Elliott Wave View In Nikkei Will Play Out?

Read MoreNikkei short-term Elliott wave view suggests that the cycle from 10/01/2018 peak is showing 5 swings bearish sequence. This favor more downside to 19073-16773 100%-123.6% Fibonacci extension area to be reached in 7 swings before support for bigger 3 wave bounce is seen at least. The decline from 10/01 peak is showing overlapping price action […]