The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

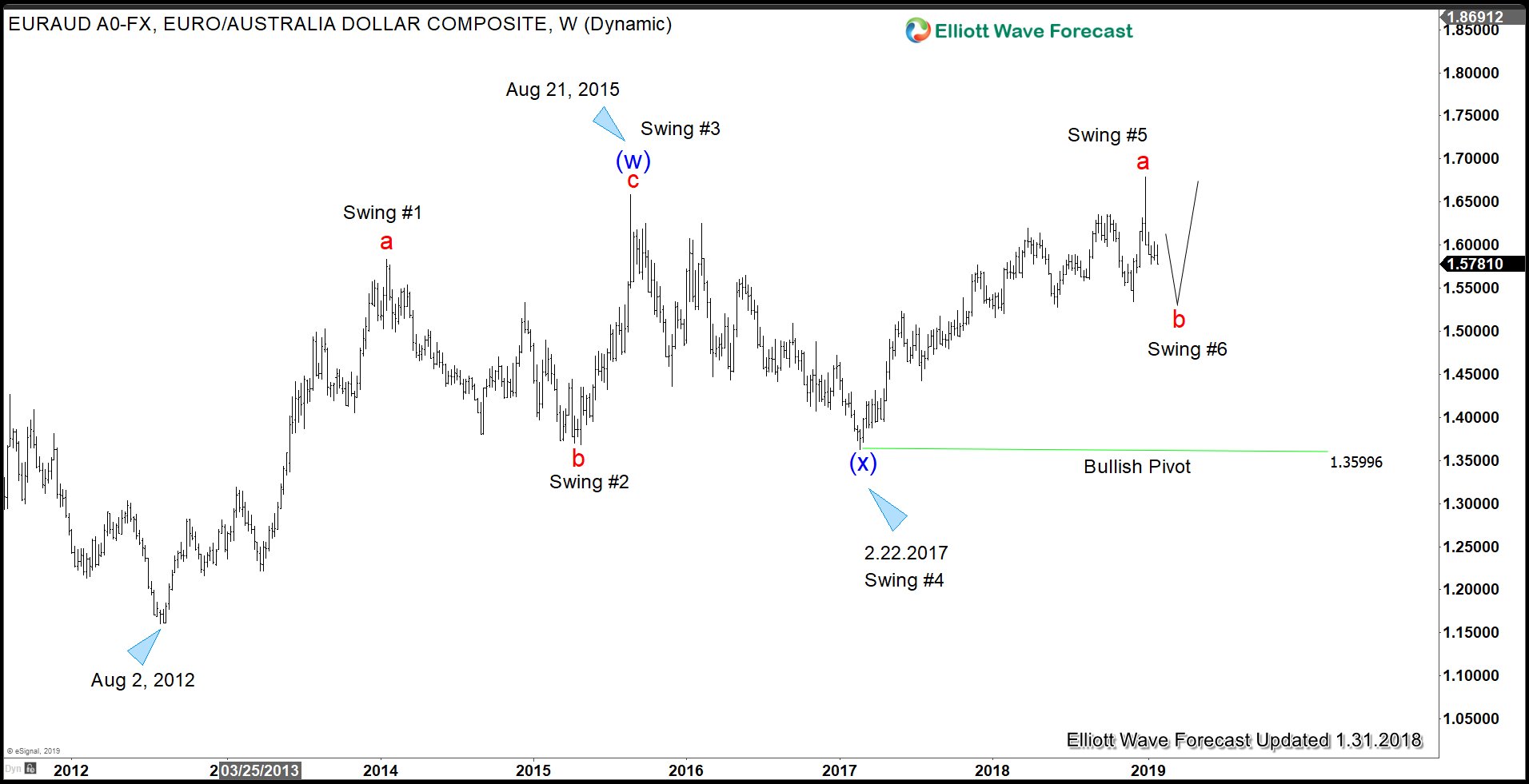

Bullish Outlook in Euro Cross

Read MoreSix years ago in 2012, Euro zone was in the midst of crisis, with bailouts of Greece pushing the Euro to the verge of a collapse. Peripheral European countries like Greece, Portugal, Italy were unable to sell government bonds without offering significant yield. In order to convince international investor, ECB President Mario Draghi back in […]

-

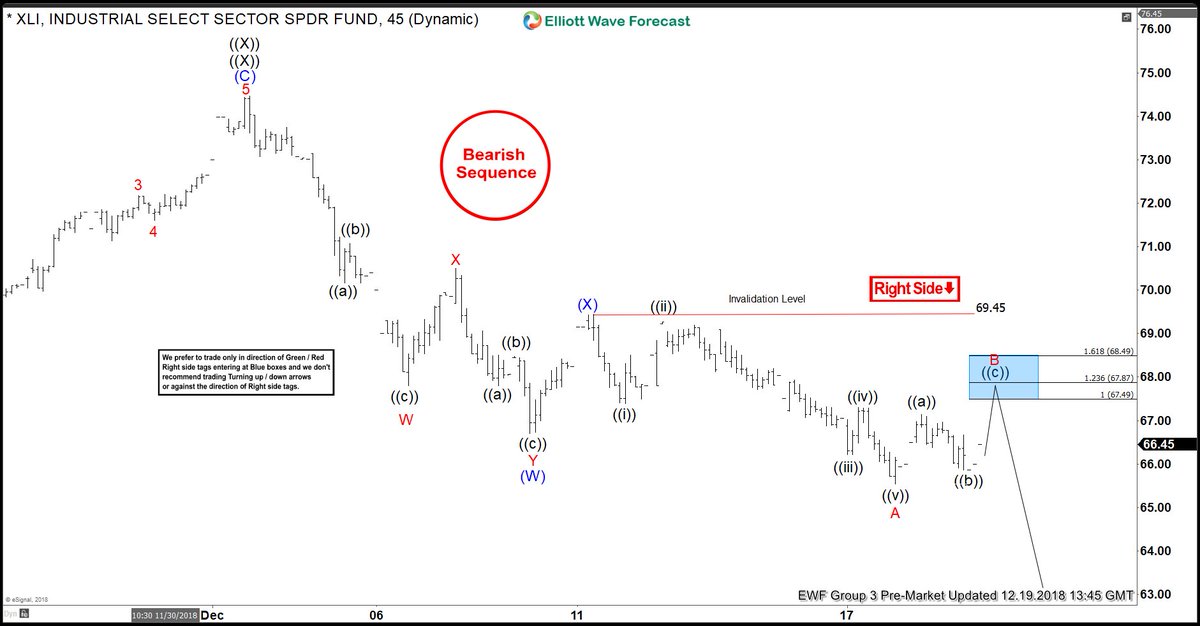

Elliott Wave View: High Frequency Box Suggested XLI Selloff

Read MoreToday, we will have a look at Elliott Wave charts of XLI which we presented to our members in the past. You see the 1-hour updated chart presented to our clients on the 12/19/18. XLI had a Bearish sequence suggesting more downside. XLI ended the cycle from 12/11/18 peak in red wave A at 12/17/18 low (65.51). Above […]

-

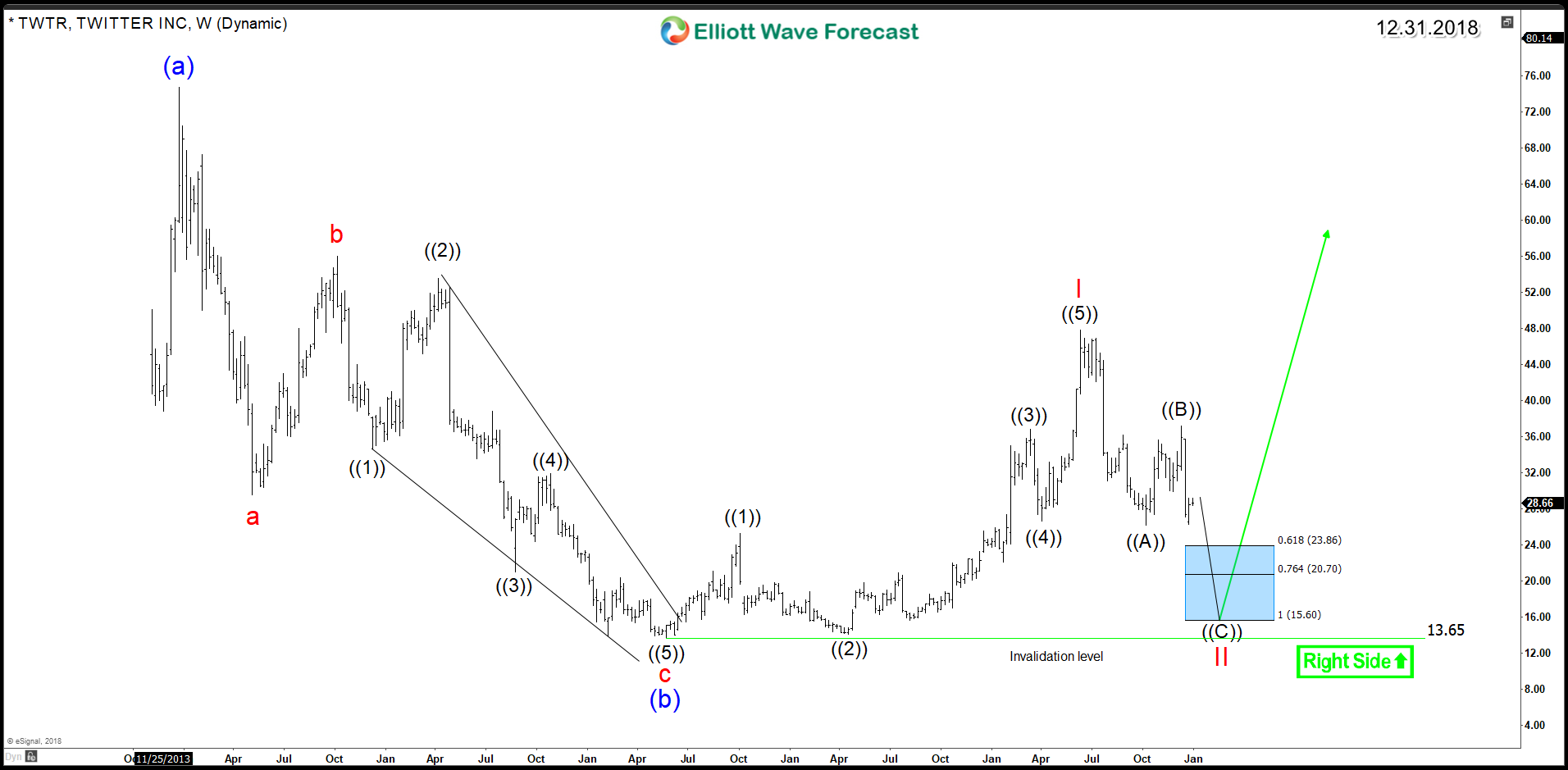

Can Twitter (NYSE:TWTR) Aim for New All Time Highs ?

Read MoreThe social networking service Twitter (NYSE:TWTR), is one of the fewest technology companies that went public and its stock under-performed among the sector against the giants of the game. After its IPO in 2013, TWTR rallied to $74 and since then it started a correction lower with a 3 waves decline as a zigzag structure that […]

-

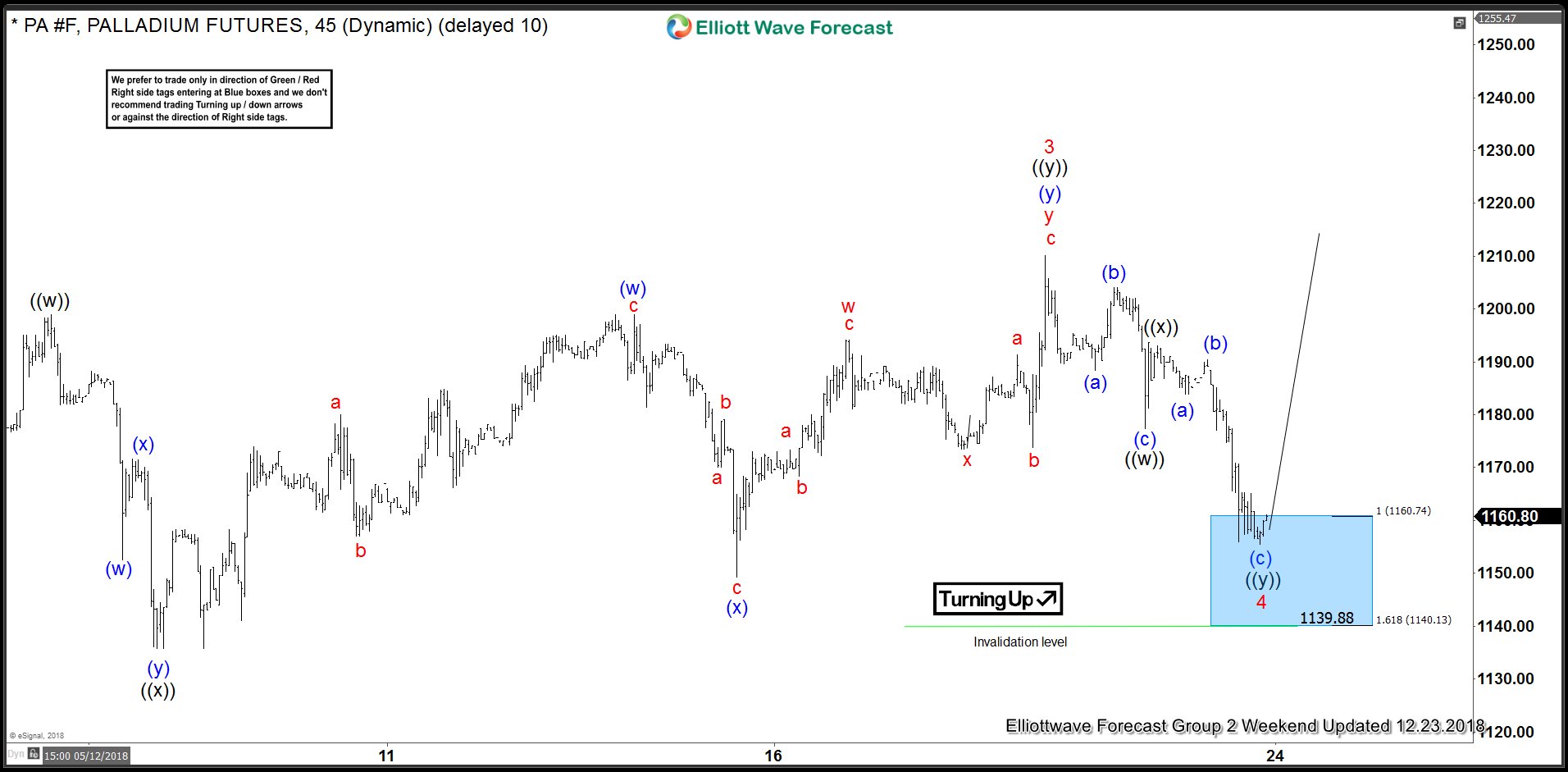

Elliott Wave Analysis: Palladium’s Target Area Reaction

Read MoreWelcome traders, today we will look at a couple of Palladium futures (PA #F) charts. The metal reached one of our blue target areas and react perfectly to our expectations. This will show you how profitable and efficient it can be to trade with our philosophy and basic Elliott Wave analysis. First of all, we start […]