-

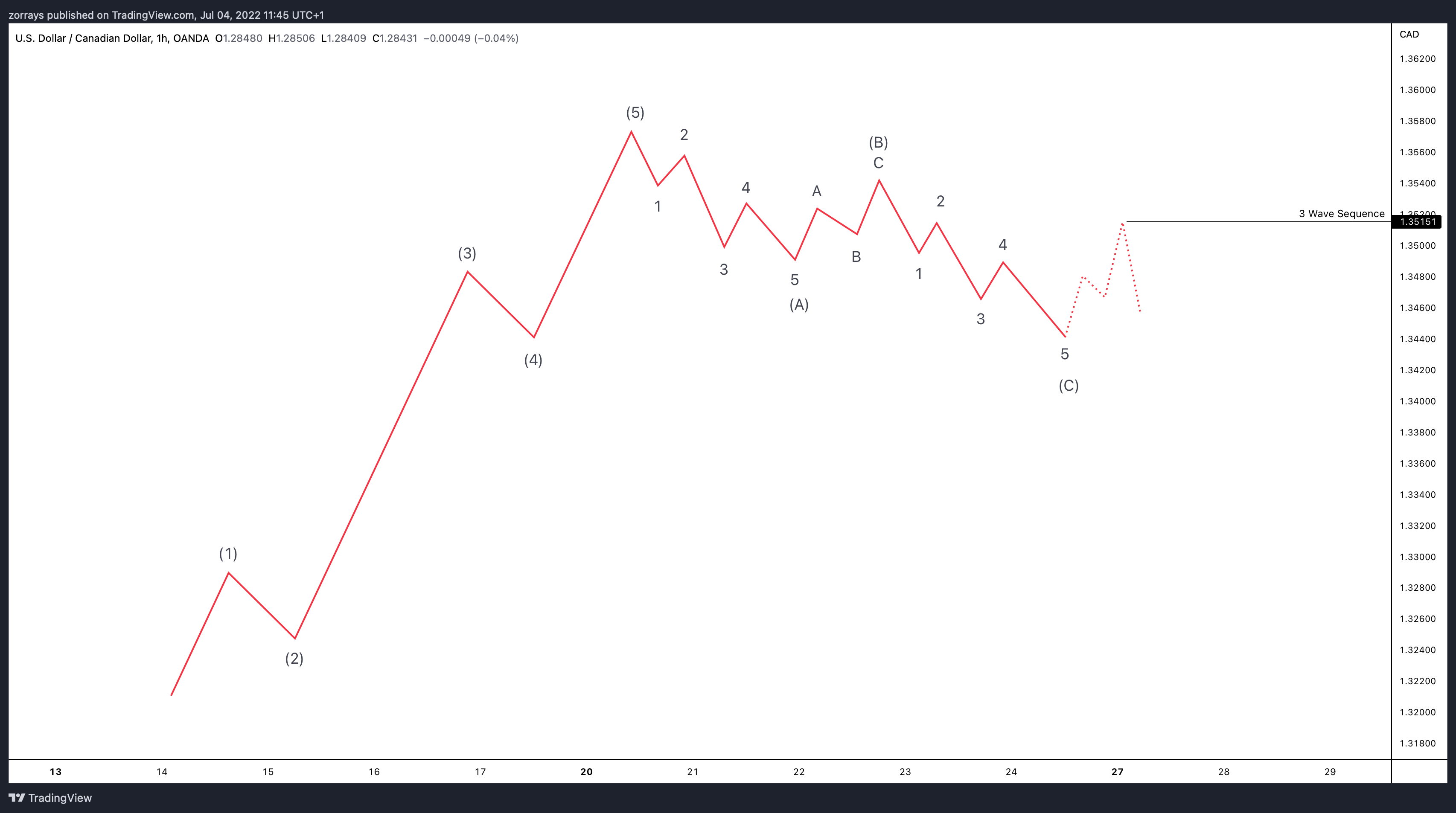

How to spot when a Zig Zag fails and the corrective wave needs more time?

Read MoreMost exciting as an Elliott Wave trader is when you see a nice clean impulse wave and then develops a clean Zig Zag Pattern. A Zig Zag is one of Elliott Wave Theory’s corrective pattern, also known as when the market takes a bit of a breather. So, a Zig Zag consists of a 5 […]

-

CHFJPY – Taking Advantage of Weakening Yen

Read MoreWe saw a surge in the market in CHFJPY last week. First time since 2007, SNB have increased their interest rate by 50 basis points. This occurred as soon as the FED raised their interest rates. Therefore, the next step was us to wait for a 3 or a 7 swing correction. A good way […]

-

USDNOK – Dollar Sees a Reaction from Blue Box

Read MoreWe have been pretty bullish on the USDNOK throughout the year and Dollar has more strength to come to support this pair. Recently, we posted a trade idea on USDNOK that the market was correcting in a 3 or 7 swing structure and we took advantage of this. This has been a pretty successful trade […]

-

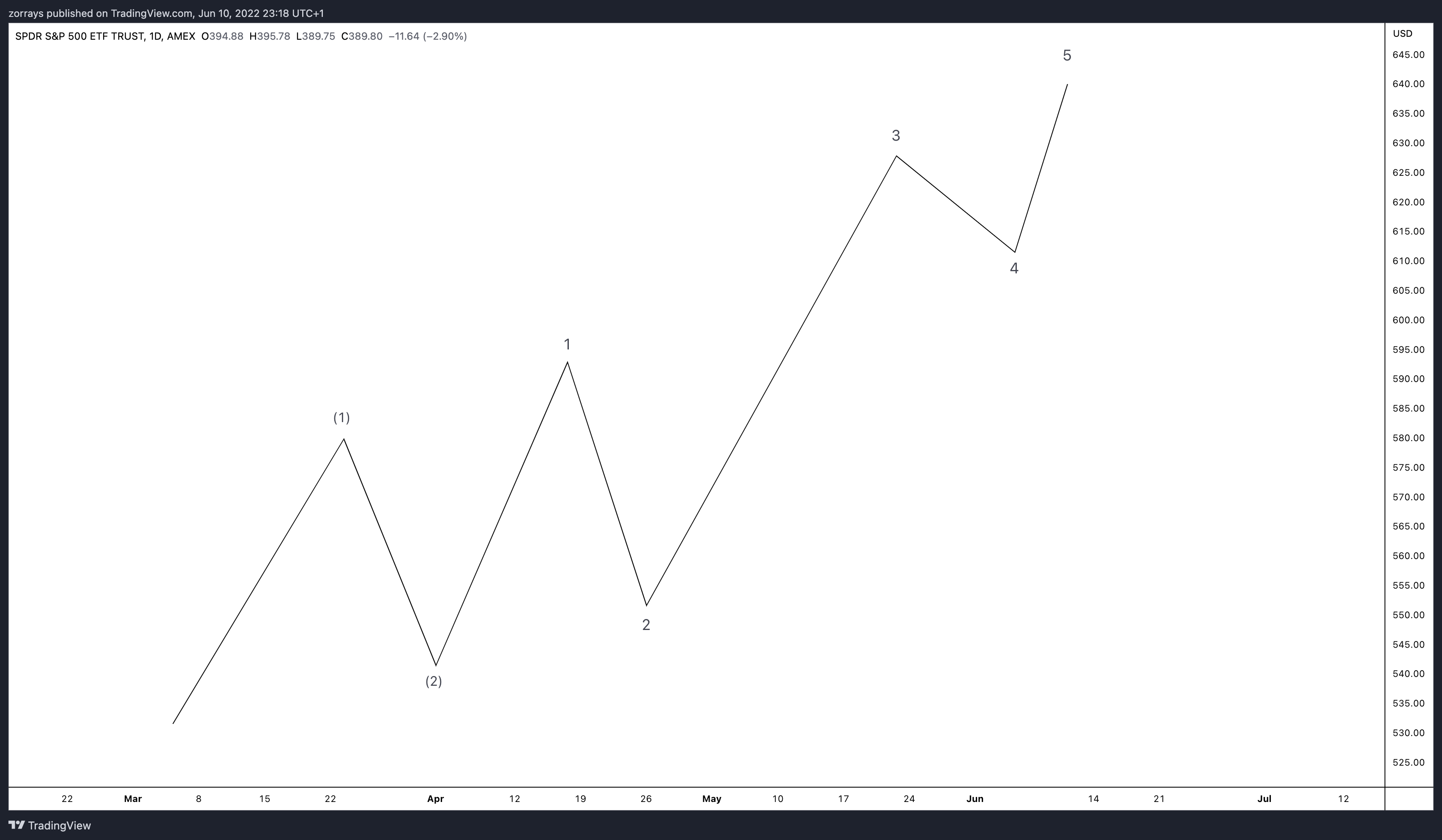

Never break these 3 rules to be a successful Elliott Wave Trader

Read MoreIn today’s blog, I want to take things back to basic when it comes to trading the Elliott Wave Theory – “theory”. There are 3 rules that you must follow to be a good trader. Within the theory, we have rules and guidelines. Guidelines are based on characteristics of the waves, Fibonnaci guidelines in terms […]

-

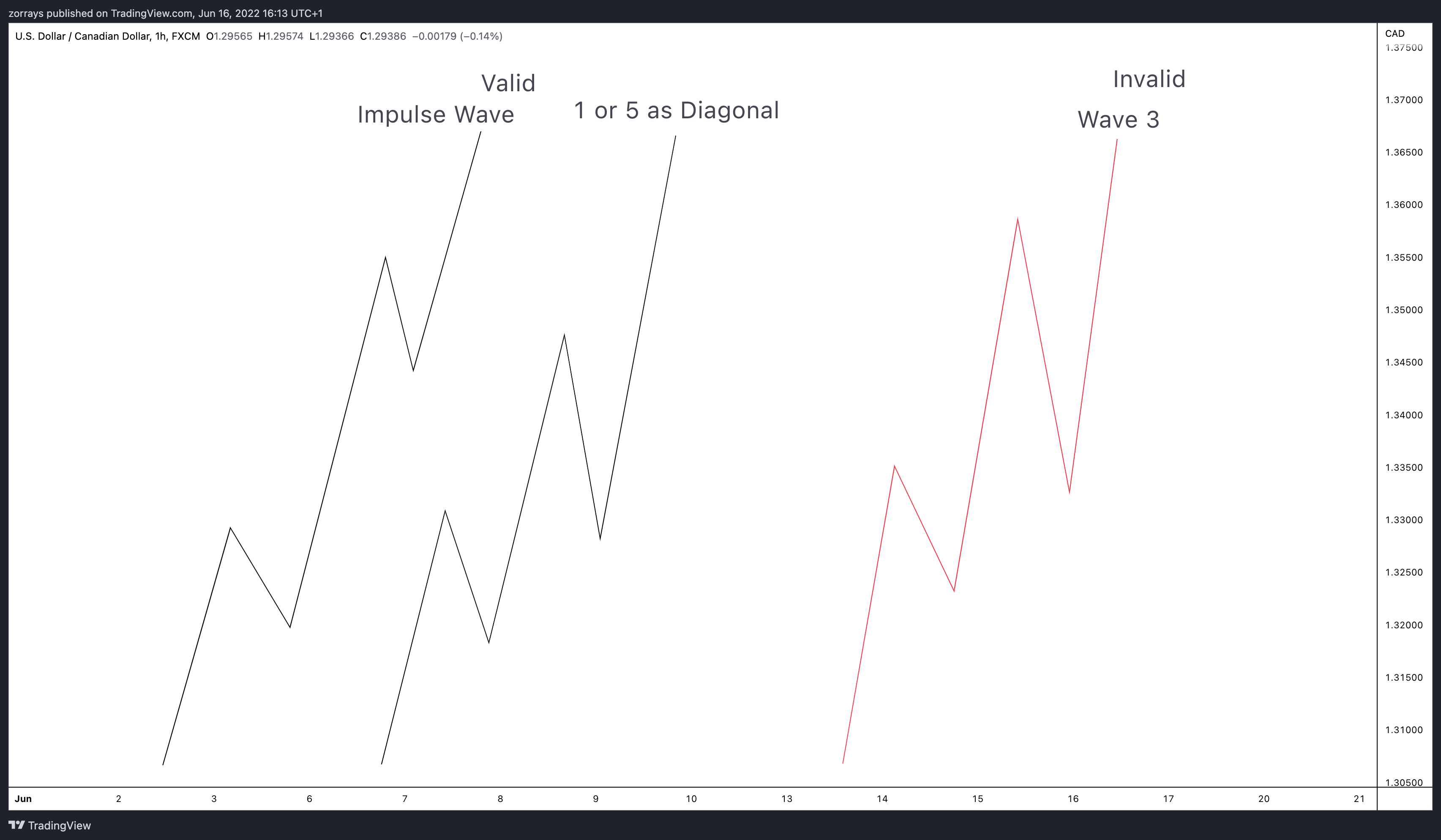

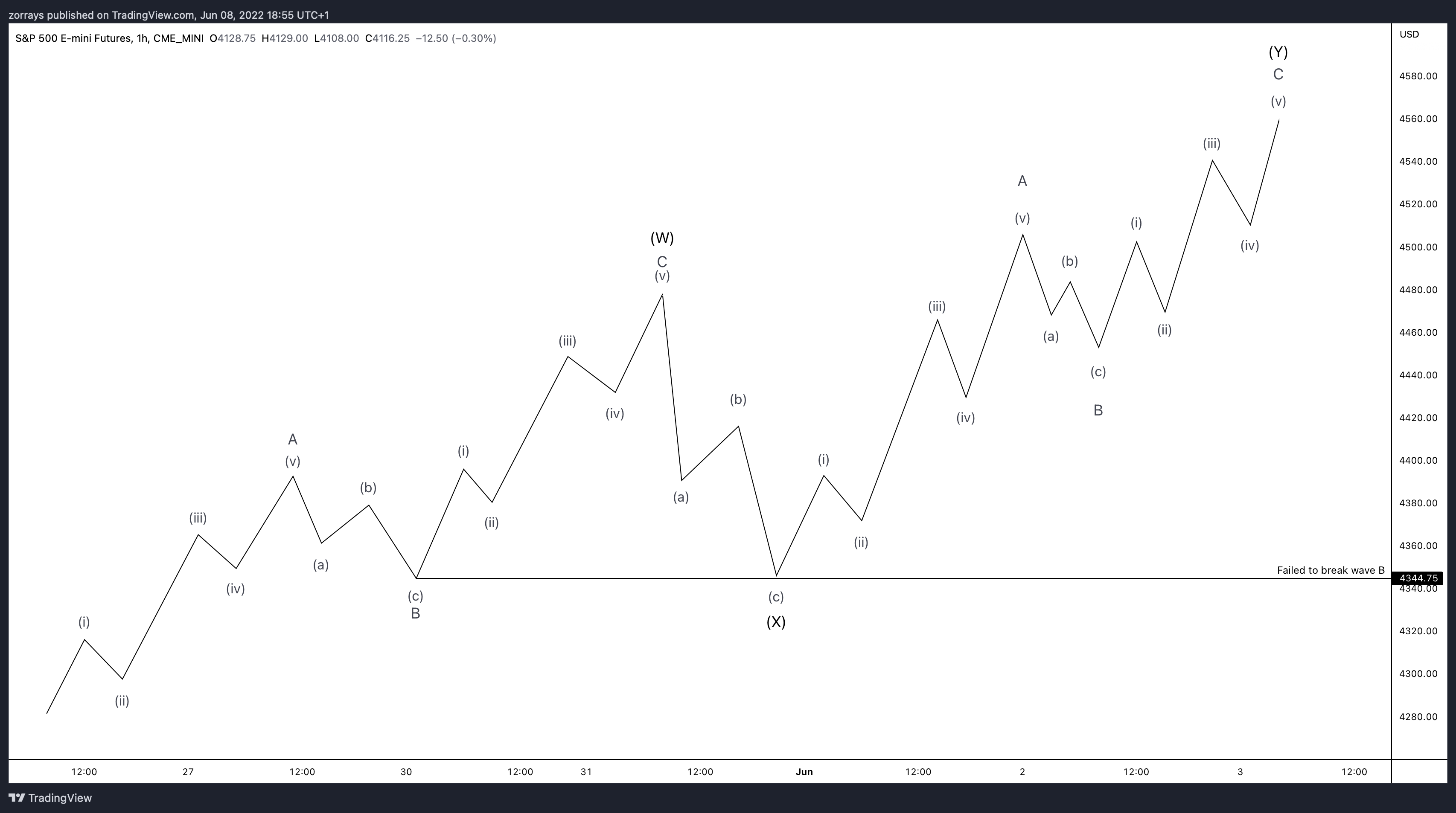

Why do wave counts change? Part 2

Read MoreSo, in my previous blog I mentioned the reasons why wave counts must change and be adjusted. Most of it is to do with the fact that rules are violated. Let’s go into a bit more detail on why else they may change and potentially trick you if you’re on top of the count. When […]

-

Why do wave counts change? Is it a good thing or detrimental to your trading?

Read MoreWe get asked a lot from novice Elliott Wave traders on why our counts change as the market progresses. One day we may have a bullish count, the next day it is bearish. We could be calling a corrective pattern a Zig-Zag, then a Double Correction and then next thing you know it turned into […]