-

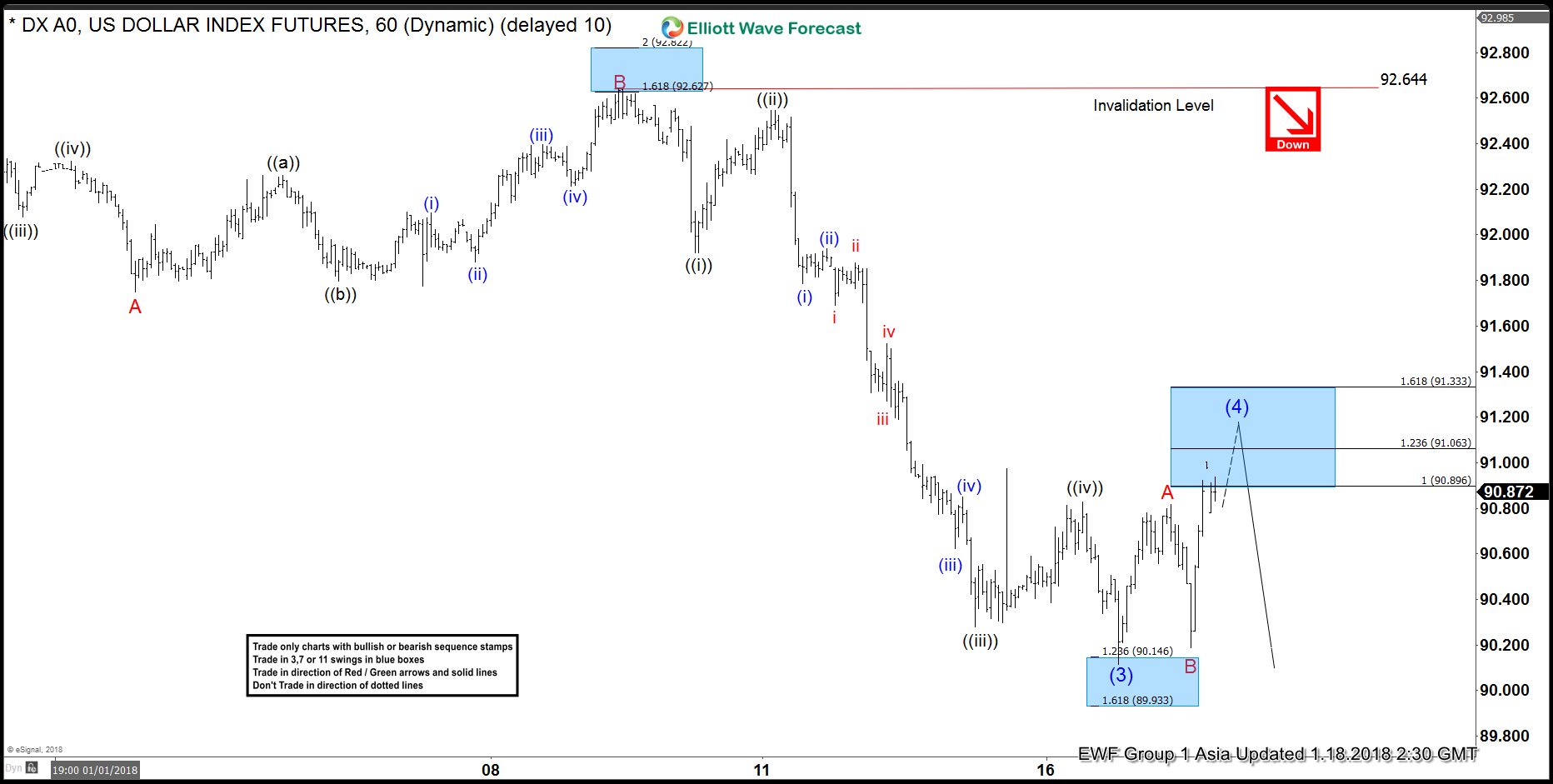

USDX Forecasting Decline & Selling rallies

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the past Elliott Wave charts of Dollar Index USDX published in members area of www.elliottwave-forecast.com. As our members know, USDX have had incomplete bearish sequences in the cycle from the January peak, suggesting further decline. Consequently , we advised our members […]

-

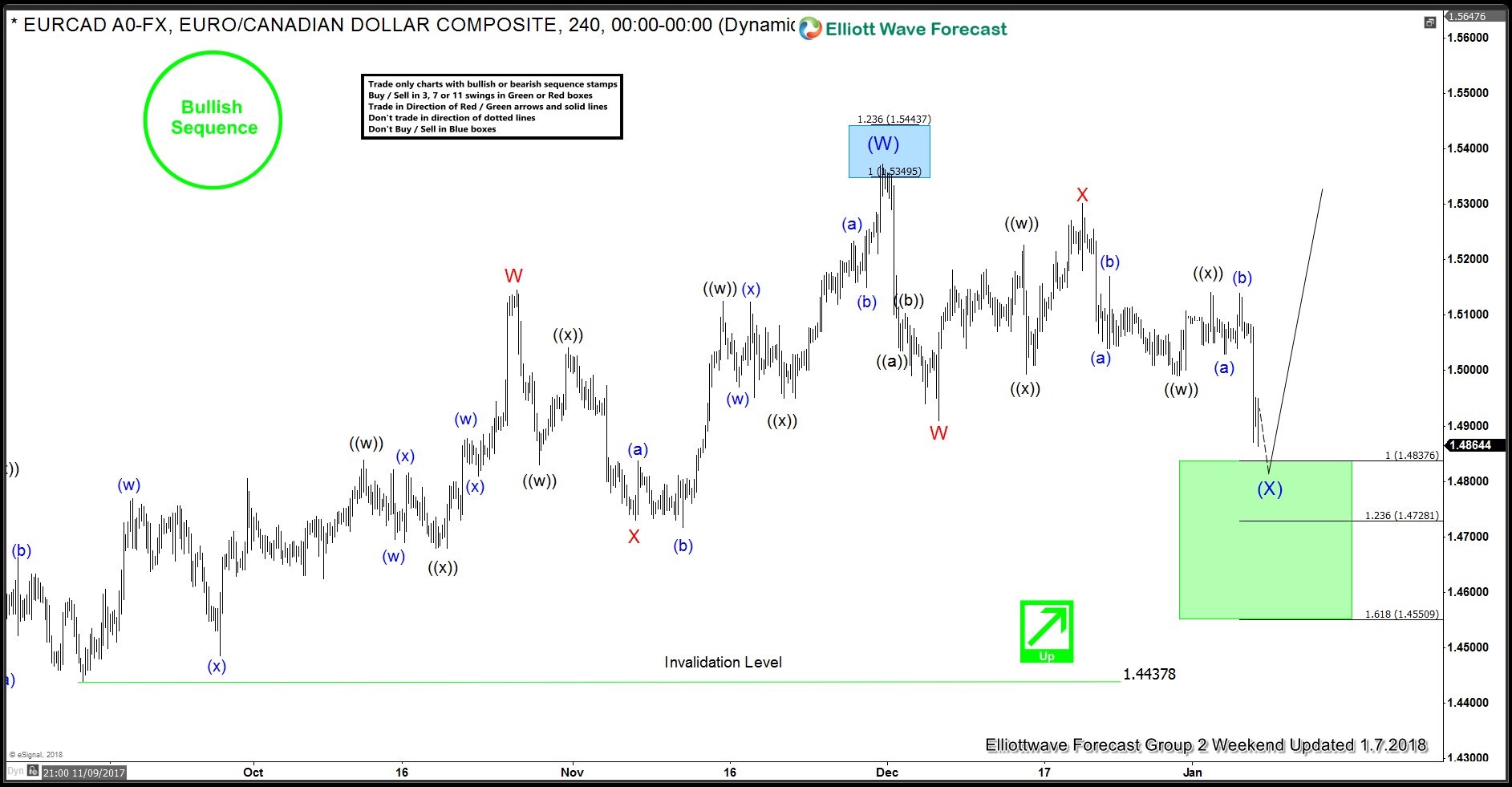

EURCAD Forecasting Rally & Buying Dips

Read MoreIn this technical blog we’re going to take a quick look at the past Elliott Wave charts of EURCAD published in members area of www.elliottwave-forecast.com. As our members know, EURCAD have had incomplete bullish sequences in the 4 Hour cycle, suggesting further strength . Consequently , we advised our members to avoid selling the pair and […]

-

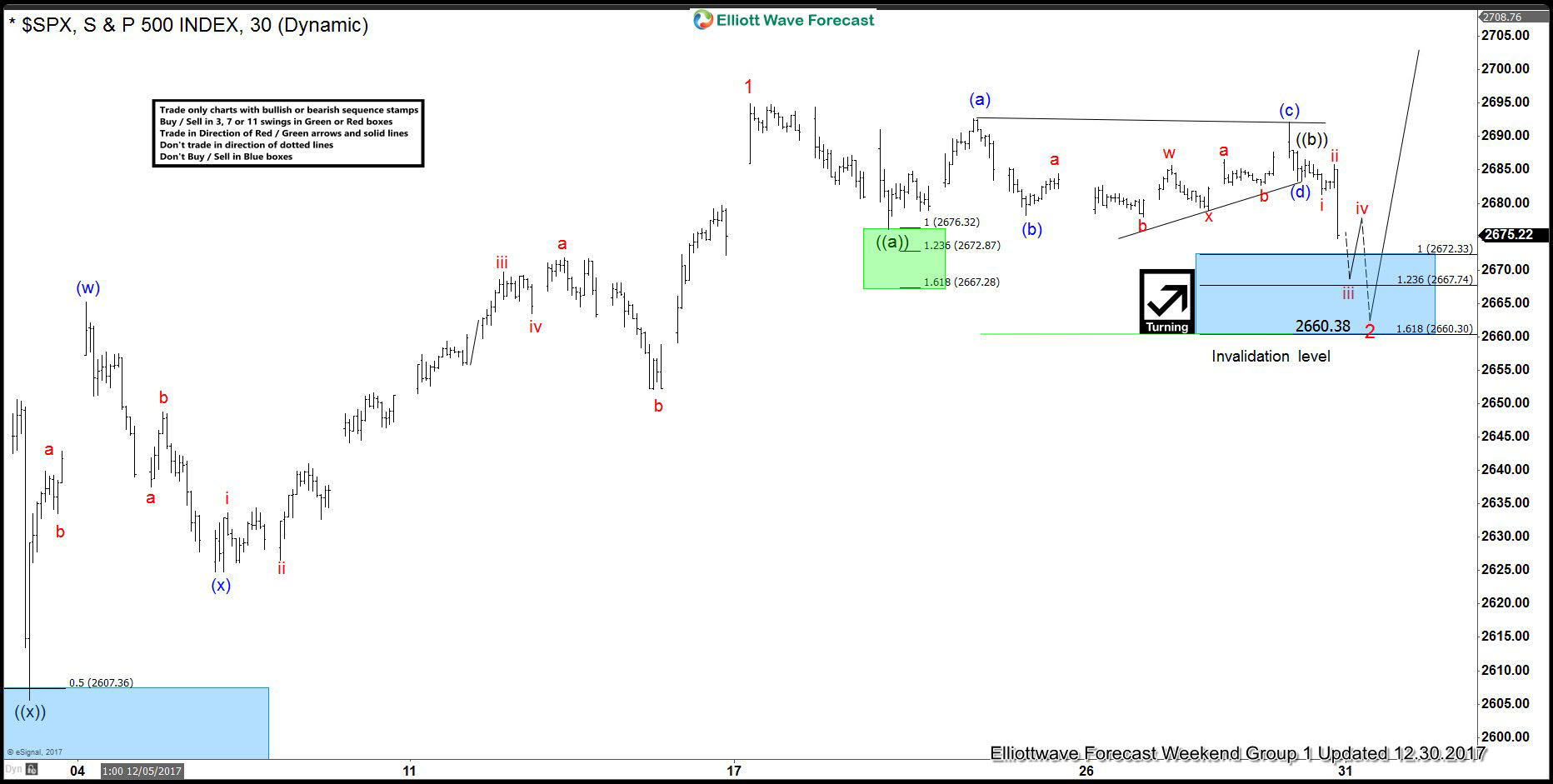

SPX Forecasting rally & Buying Dips

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the past Elliott Wave charts of S&P 500 Index (SPX) published in members area of www.elliottwave-forecast.com. As our members know, we were kept saying that SPX is having incomplete bullish sequences in the 1 Hour cycle as shown in Sequence Report. […]

-

OIL (CL #F) Forecasting The Rally & Buying The Dips

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the past Elliott Wave charts of OIL (CL #F) published in members area of www.elliottwave-forecast.com. We’re going to explain the Elliott Wave forecast and our trading strategy. As our members know , we were keep saying that OIL is trading within […]

-

Dow Jones (YM #F) Buying Dips in Extremes

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the past Elliott Wave charts of Dow Jones (YM #F) Mini Features published in members area of www.elliottwave-forecast.com. As our members know, we were kept saying that Dow Jones is having incomplete bullish sequences in the 1 Hour cycle targeting 24379 area […]

-

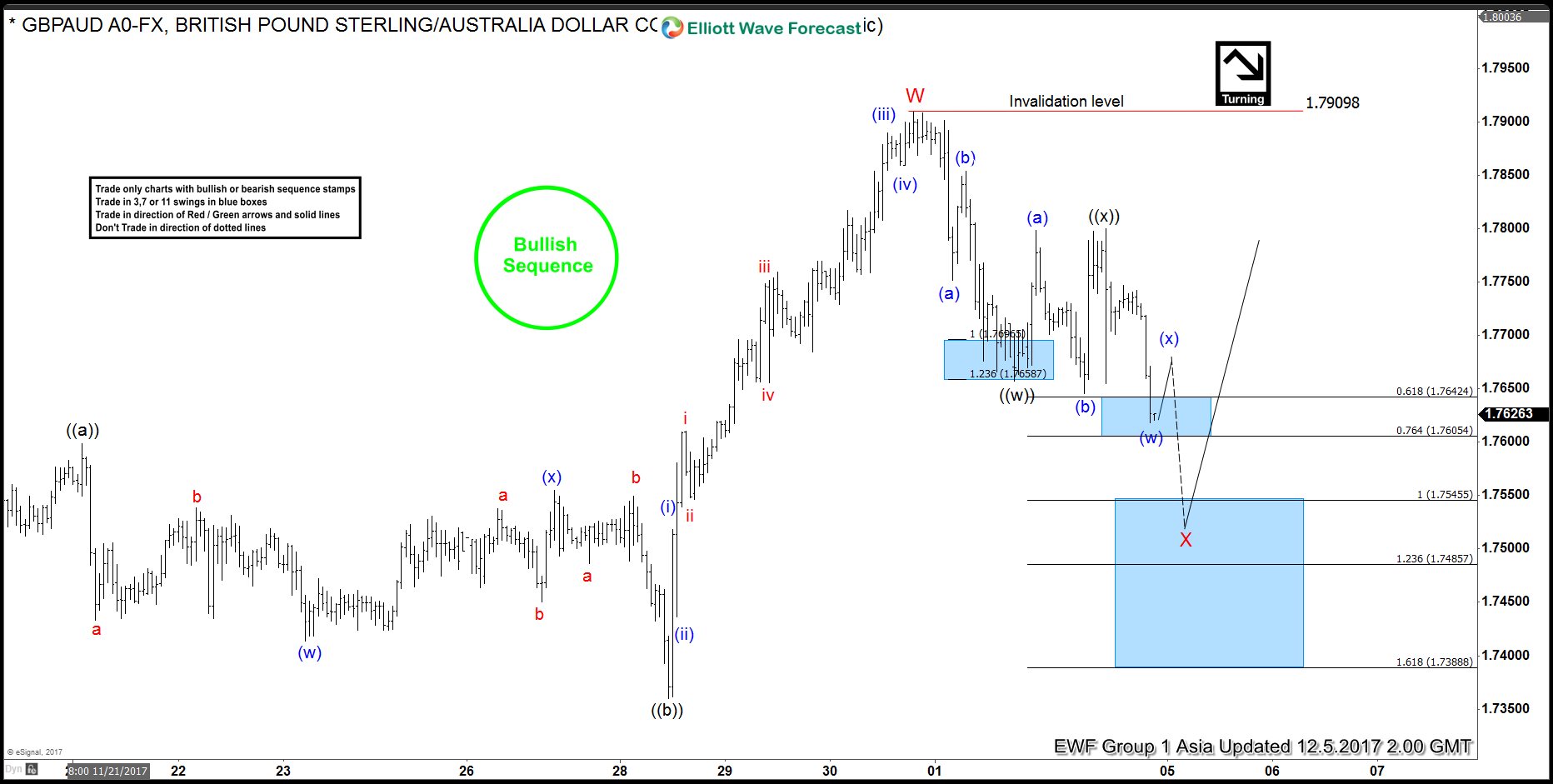

GBPAUD Buying The Dips After Double Three Correction

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the past Elliott Wave charts of GBPAUD published in members area of www.elliottwave-forecast.com. We’re going to explain the Elliott Wave forecast and our trading strategy. As our members know , we were keep saying that GBPAUD is trading within larger bullish […]