-

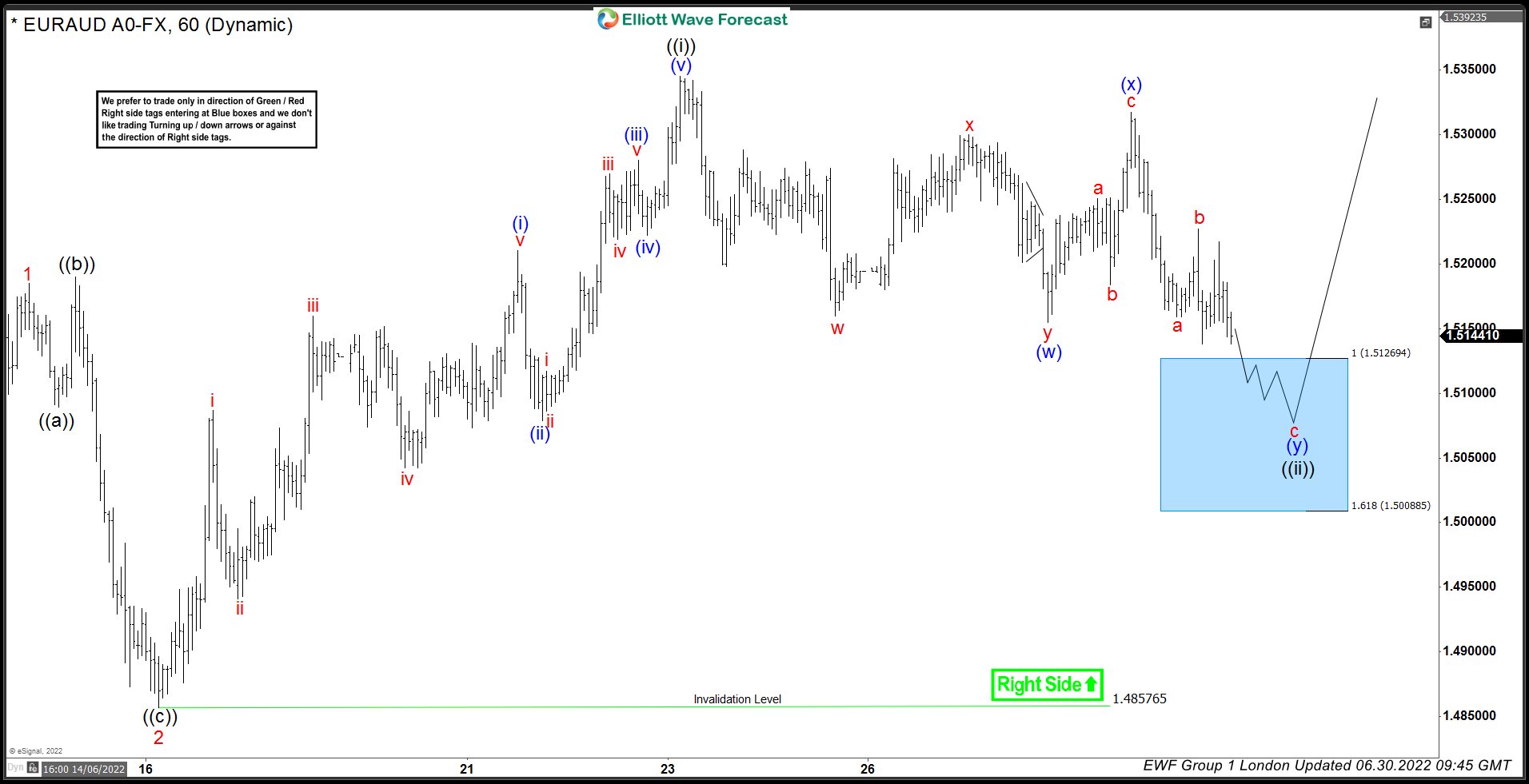

EURAUD Buying The Dips At The Blue Box Area

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of EURAUD, published in members area of the website. As our members know, we’ve been favoring the long side in EURAUD due to incomplete bullish structure the pair is showing in the cycle from the April […]

-

USDCAD Is Showing Reaction From The Blue Box Area

Read MoreHello fellow traders. USDCAD has given us another trading opportunity recently. As our members know, we’ve been favoring the long side in USDCAD and buying the dips in 3,7,11 swings. Reason for expecting further rally is incomplete bullish structure the pair is showing in the weekly cycle from the 05.30. low . In this technical […]

-

Bitcoin ( BTCUSD ) Incomplete Bearish Sequences Calling The Decline

Read MoreHello fellow traders. In this technical article we’re going to take a look at the Elliott Wave charts charts of BTCUSD published in members area of the website. As our members know we have had a lot of buying setups in Bitcoin during the past 2 years. However at this moment buyers should be very […]

-

USDCAD Elliott Wave : Buying The Dips At The Blue Box Area

Read MoreHello fellow traders. Another instrument we have traded lately is USDCAD. As our members know, we’ve been favoring the long side in USDCAD due to incomplete bullish sequences the pair is showing in the weekly cycle from the 05.30. low . In this technical blog we’re going to take a quick look at the Elliott […]

-

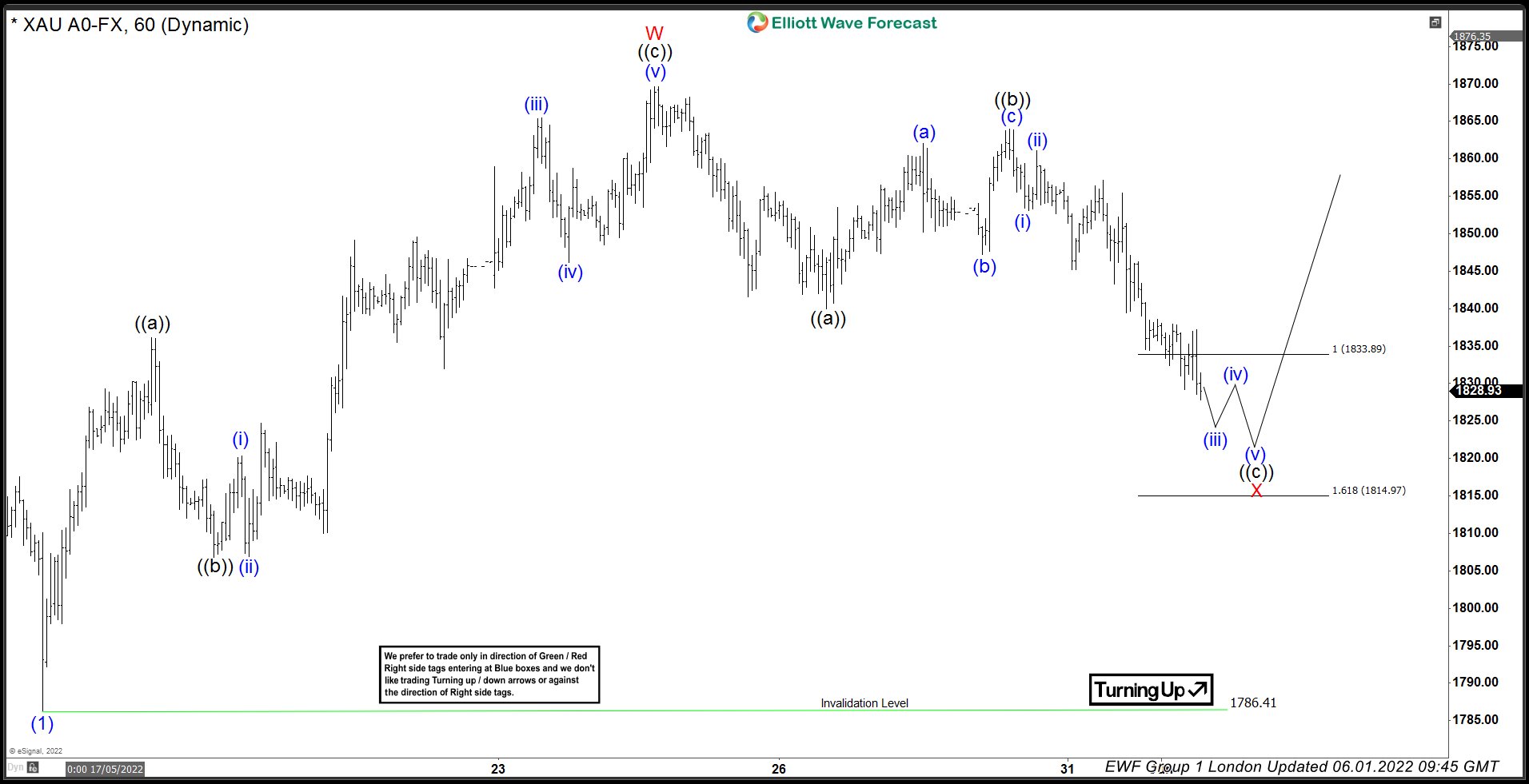

GOLD ( $XAUUSD) Forecasting The Rally After Elliott Wave Zig Zag Pattern

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of GOLD, published in members area of the website. As our members know, GOLD is giving us correction of the cycle from the 2069 high. Recently GOLD ( $XAUUSD ) made a pull back that has […]

-

AUDJPY Buying The Dips At The Blue Box Area

Read MoreIn this technical blog we’re going to take a quick look at the Elliott Wave charts of AUDJPY, published in members area of the website. As our members know, we’ve been favoring the long side in AUDJPY due to incomplete bullish sequences the pair is showing in the weekly cycle from the March 2020 low. […]