-

Soybeans Futures ( $ZS_F ) Another Selling Opportunity

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of Soybeans futures $ZS_F. As our members know, Soybeans futures is having incomplete bearish sequences in the cycle from the 1784’0 peak. Current view is calling for further weakness against the 1671’7 pivot. Recently the commodity […]

-

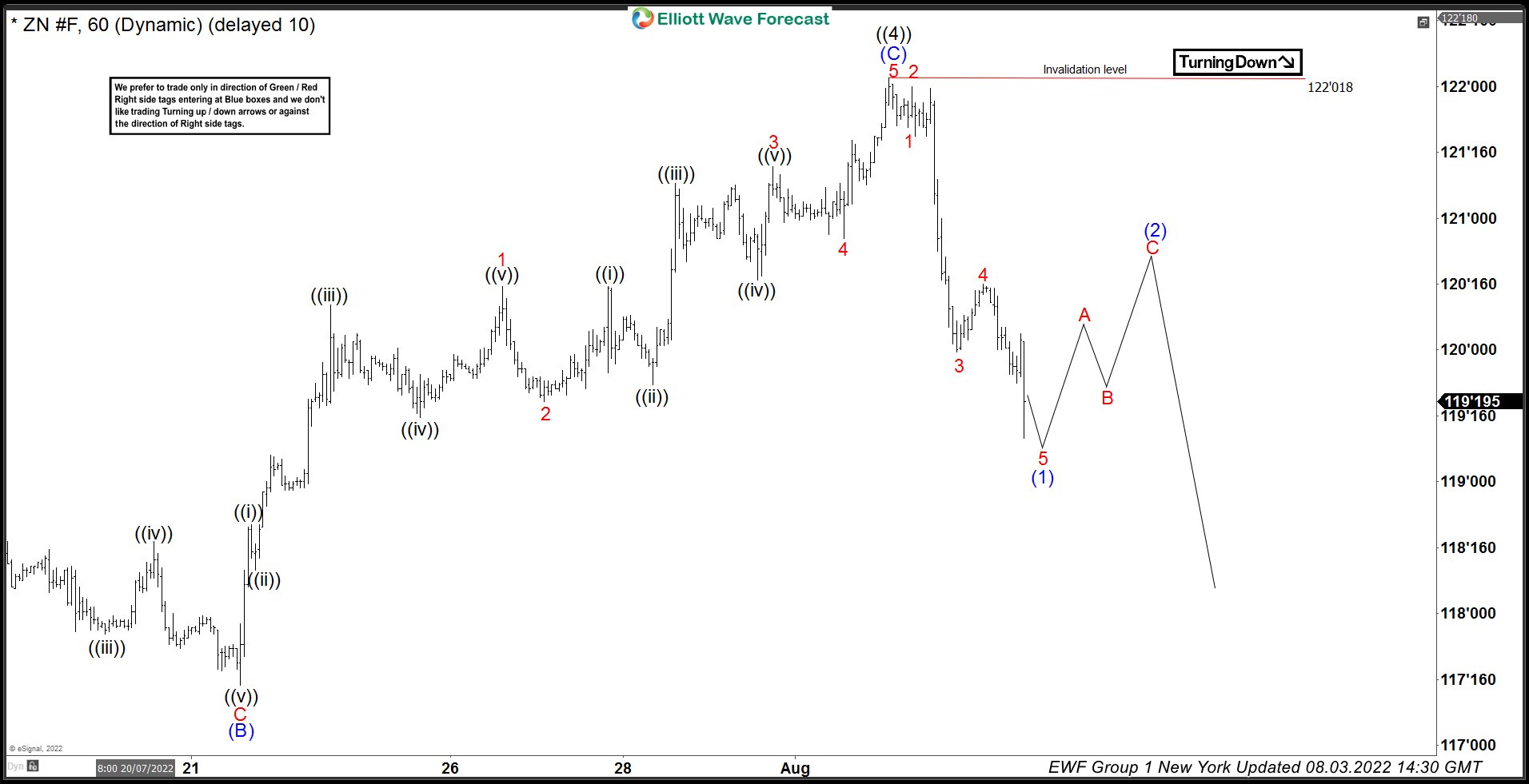

10 Year Notes ( $ZN_F) Elliott Wave: Forecasting The Path

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of 10 Year Notes ( $ZN_F) . As our members know, ZN_F has given us recovery against the 135’17 peak- wave ((4)). Once we got the signs that turn is ready to happen, we label cycle from […]

-

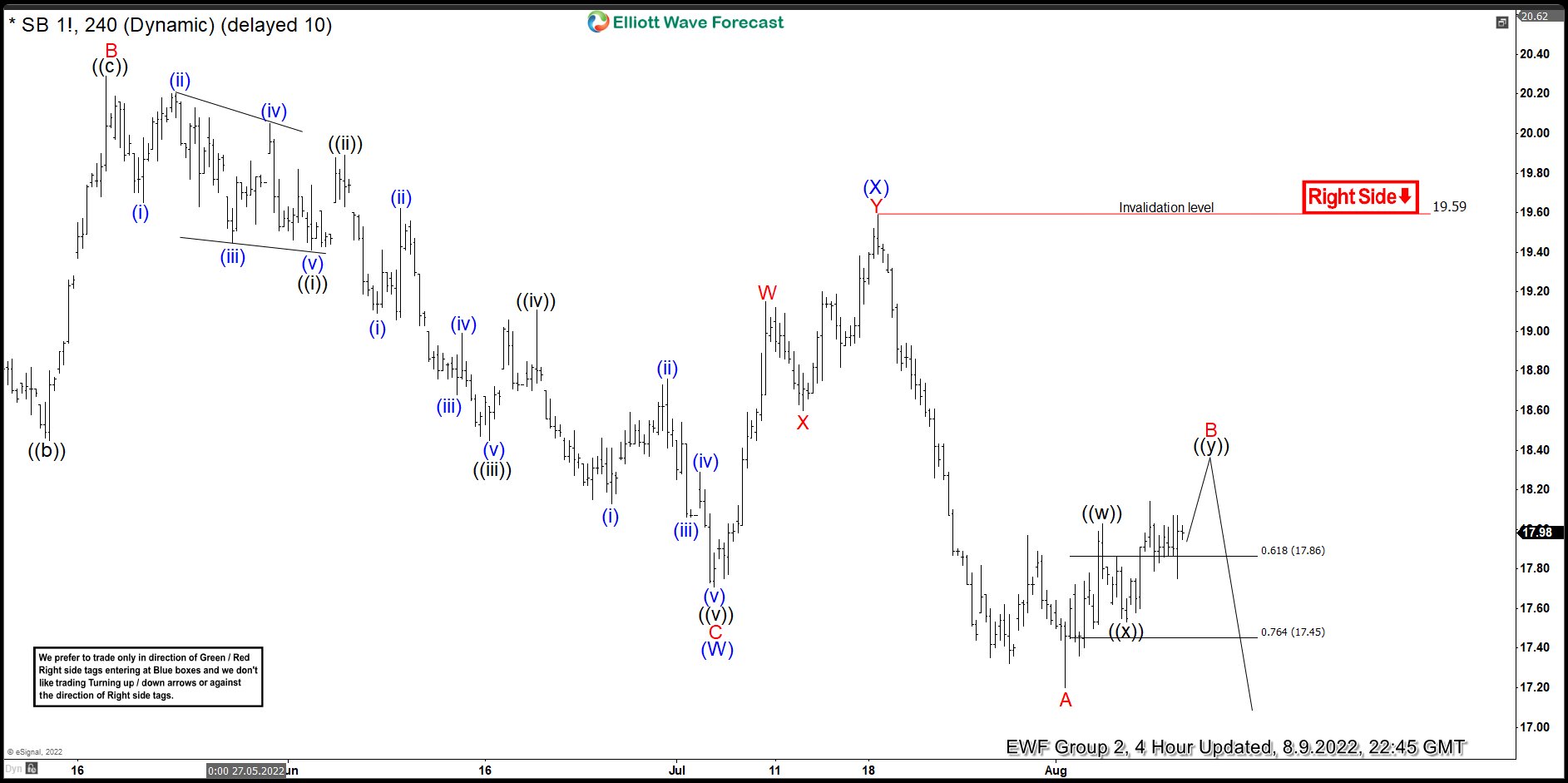

Sugar ($SB_F ) Elliott Wave : Forecasting The path

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of Sugar ($SB_F ). As our members know, Sugar is having bearish sequences in the cycle from the 20.52 peak. Current view is calling for further weakness as far as 19.6 pivot holds. Recently the commodity […]

-

OIL ($CL_F) Elliott Wave : Calling The Decline From Equal Legs Area

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of OIL . As our members know, OIL is having bearish sequences in the cycle from the 123.8 peak. Current view is calling for further weakness against the 101.9 pivot in first degree. Recently the commodity […]

-

GBPUSD Selling The Rallies At The Blue Box Area

Read MoreAnother instrument that we have been trading lately is GBPUSD forex pair. In this technical blog we’re going to take a quick look at the Elliott Wave charts of GBPUSD and explain the trading strategy. As our members know, GBPUSD is bearish against the 1.2670 pivot. Recently the pair has given us good trading opportunity. […]

-

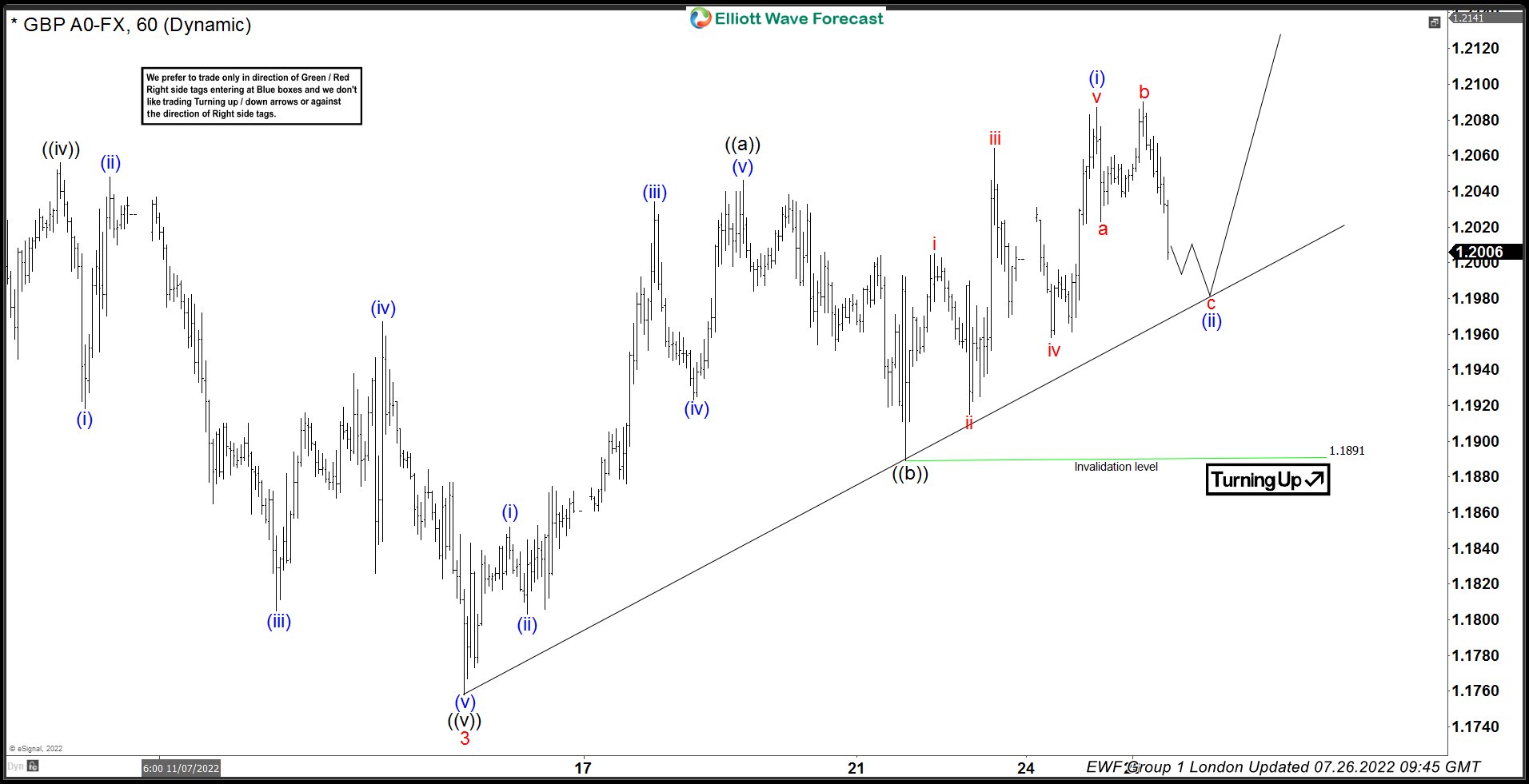

GBPUSD Elliott Wave Zig Zag Pattern Forecasting The Path

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of GBPUSD . As our members know, GBPUSD is in process of forming Elliott Wave Zig Zag Pattern in the cycle from the 07.14 low. In the further text we are going to explain the Elliott […]