-

INDU ( $YM_F ) Forecasting The Rally After 3 Waves Correction

Read MoreHello fellow traders. In this article we’re going to take a quick look at the Elliott Wave charts of $YM_F, published in members area of the website. As our members know INDU ended cycle from the 34288 high as 5 waves, and now correcting it. Recovery looks incomplete and we expect to see more short […]

-

Amazon $AMZN Incomplete Sequences Calling The Decline

Read MoreIn this technical blog we’re going to take a quick look at the Elliott Wave charts of Amazon $AMZN. As our members know, Amazon stock has been showing incomplete bearish sequences in the cycle from the August 16th peak. We recommended members to avoid buying the stock and keep favoring the short side due to […]

-

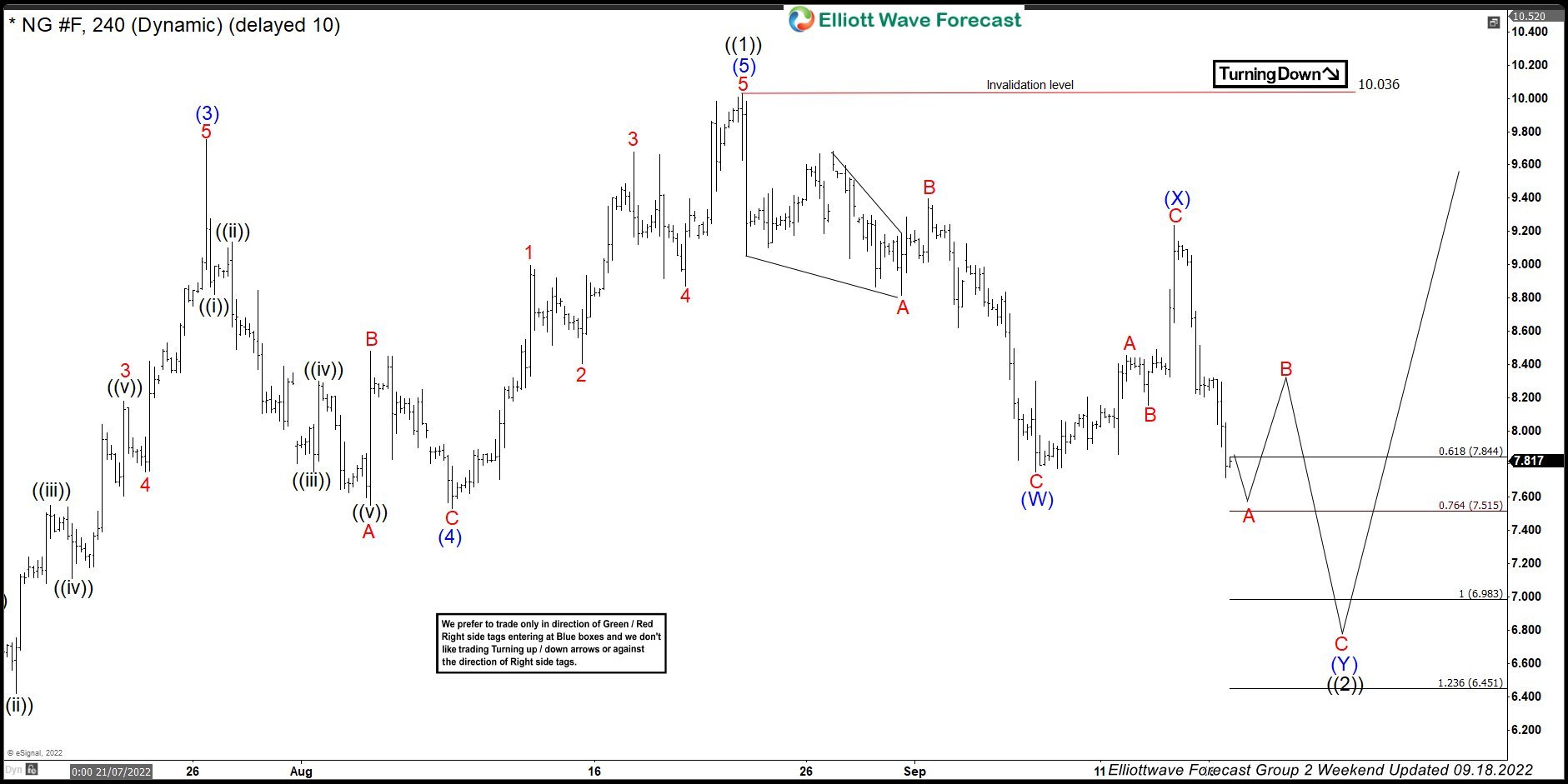

Natural Gas $NG_F Incomplete Bearish Sequences Calling The Decline

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of Natural Gas $NG_F . As our members know, Natural Gas futures has been showing incomplete bearish sequences in the cycle from the August 23rd peak. We recommended members to avoid buying the commodity. Cycle from […]

-

Apple ( AAPL ) Calling The Decline After Elliott Wave Flat Pattern

Read MoreIn this technical article we’re going to take a look at the Elliott Wave charts charts of Apple AAPL stock published in members area of the website. As our members know Apple stock has recently given us recovery against the 176.13 high that has unfolded as Irregular flat pattern. Once the stock completed flat correction, […]

-

Microsoft $MSFT Elliott Wave: Calling The Decline After Flat

Read MoreHello Fellow Traders. In this technical article we’re going to take a look at the Elliott Wave charts charts of Microsoft $MSFT stock published in members area of the website. As our members know $MSFT has recently given us Irregular flat pattern against the 294.26 peak. Once the stock completed flat correction, it made decline […]

-

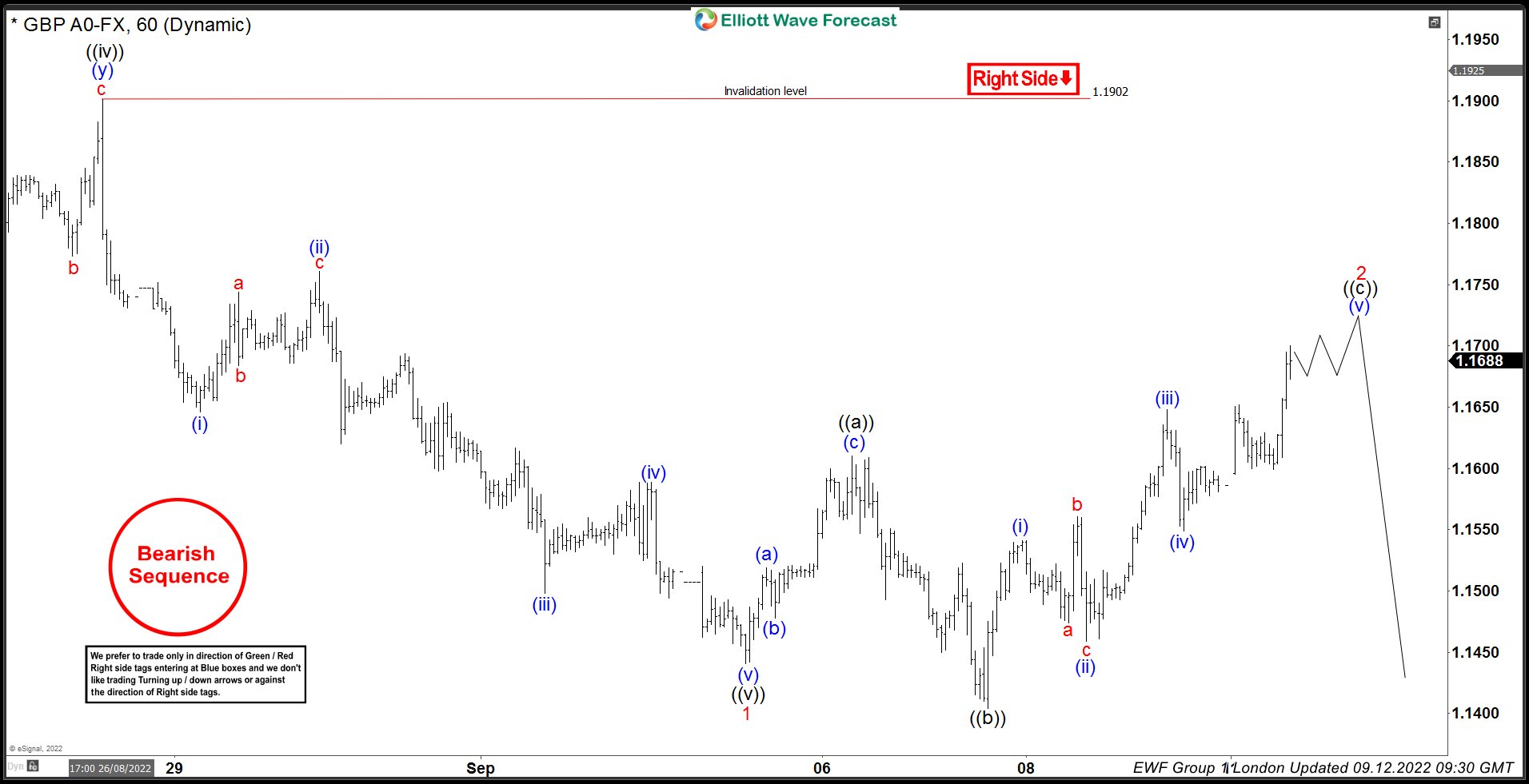

GBPUSD Elliott Wave: Forecasting The Decline After Irregular Flat

Read MoreHello Fellow Traders. In this technical article we’re going to take a look at the Elliott Wave charts charts of GBPUSD forex pair published in members area of the website. As our members know GBPUSD is showing incomplete bearish sequences and we were calling for an extension in weakness. Recently the pair corrected the short […]