-

American Airlines ( AAL ) Selling The Rallies At The Blue Box Area

Read MoreHello fellow traders. In this technical article we’re going to take a quick look at the Elliott Wave charts of American Airlines Group ( $AAL ) stock. As our members know, the stock is trading within the cycle from the 19.2 high. The stock is showing impulsive bearish sequences. We have been calling for the […]

-

NIKKEI ( NKD_F ) Buying The Dips At The Blue Box Area

Read MoreIn this article we’re going to take a quick look at the Elliott Wave charts of NIKKEI published in members area of the website. As our members know NIKKEI is showing impulsive bullish sequences that are calling for a further strength. Recently we got a 7 swings pull back that has ended at the Blue […]

-

USDJPY Elliott Wave Calling The Rally From The Equal Legs Area

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of USDJPY , published in members area of the website. As our members know the pair is showing impulsive bullish sequences in the cycle from the January low. Consequently, we were calling for the further rally […]

-

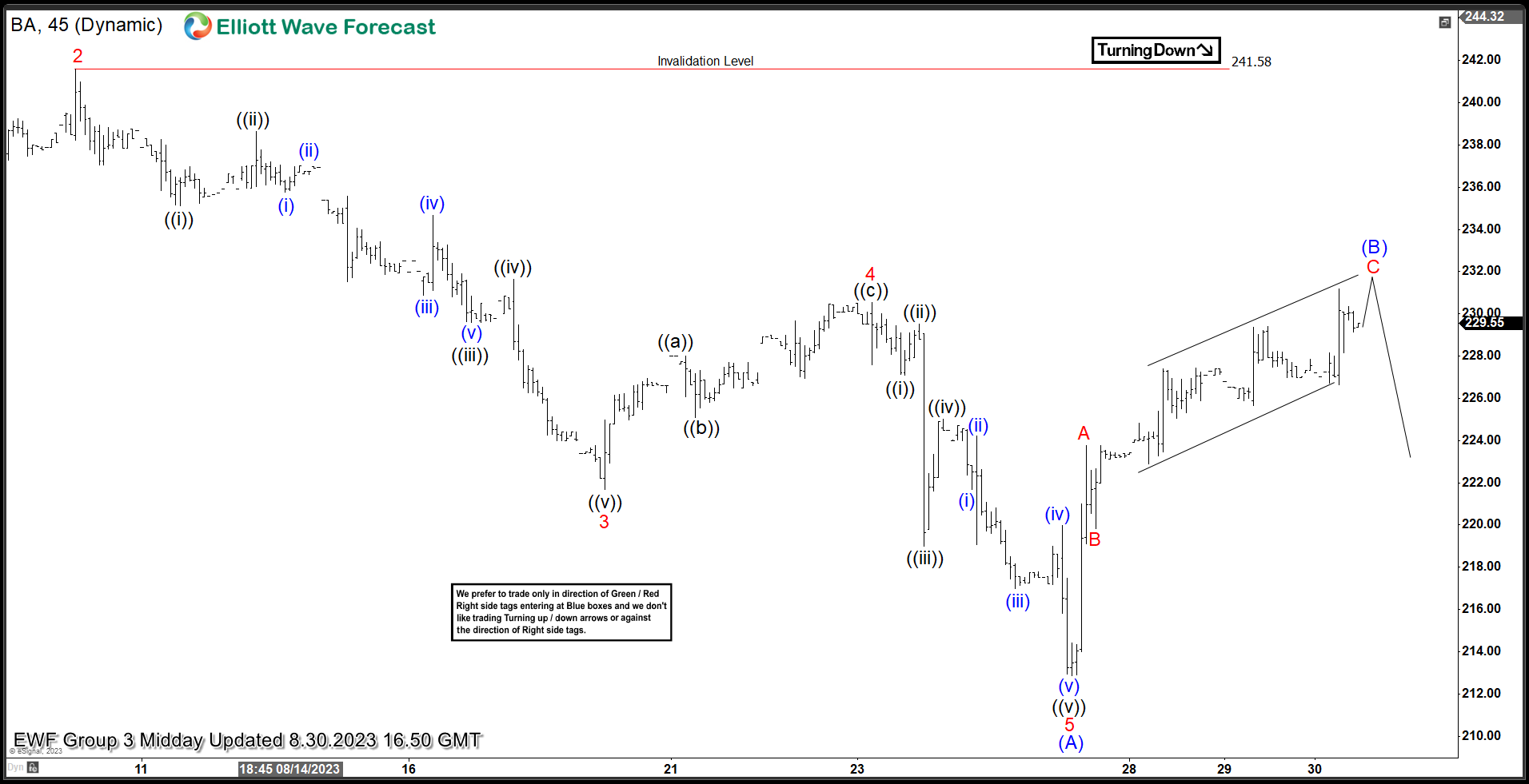

BA ( Boeing Company ) Found Sellers After Elliott Wave Zig Zag Pattern

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of BA , Boeing Stock. As our members know, BA has recently given us correction against the 241.58 peak. Recovery formed Elliott Wave Wave Zig Zag Pattern. In the further text we are going to explain […]

-

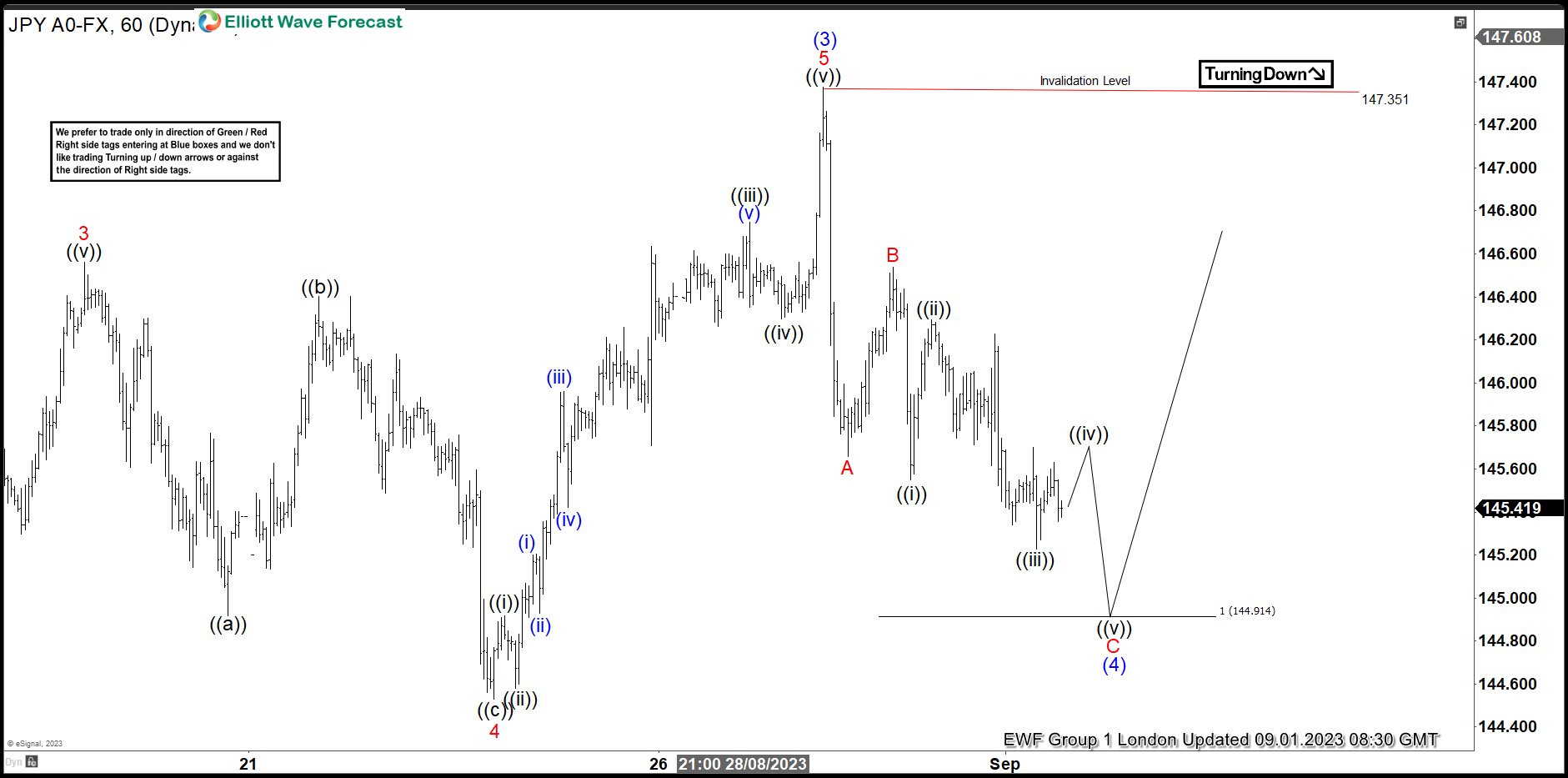

USDJPY Forecasting The Rally After Elliott Wave Zig Zag Pattern

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of USDJPY , published in members area of the website. As our members know the pair is showing impulsive bullish sequences in the cycle from the January low. Consquently, we were calling for the further rally. […]

-

XLF Incomplete Sequences Calling The Drop Toward Blue Box Area

Read MoreHello fellow traders. In this technical article we’re going to take a look at the Elliott Wave charts charts of XLF ETF published in members area of the website. As our members know XLF is giving us pull back against the May 3rd low. Correction made clear 3 waves from the peak and reached the […]