-

Bitcoin (BTCUSD) Elliott Wave: Incomplete Sequence Calling the Path Ahead

Read MoreHello traders. As our members know, we’ve been favoring the long side in BTCUSD and have made profitable long setups. However, the structure recently has shown clear incomplete sequences from the peak, suggesting more downside in the near term. In this technical article, we are going to present short term Elliott Wave forecast of Bitcoin, including target […]

-

IBEX Elliott Wave Analysis – Perfect Reaction from Equal Legs Area

Read MoreHello fellow traders. In this technical article, we are going to present Elliott Wave charts of IBEX index . As our members know, IBEX has been showing impulsive bullish sequences in the cycle from the August 13739.3 low, pointing to further strength ahead. We have been calling for a rally in IBEX. Recently we got an intraday […]

-

AUDJPY Elliott Wave Update: Zigzag Formation in Progress

Read MoreHello fellow traders, In this technical article, we are going to present Elliott Wave charts of AUDJPY Forex pair . As our members know, the pair is showing a 3-wave pullback against the 96.23 low, taking the form of an Elliott Wave Zigzag structure.In the following sections, we will explain the Elliott Wave pattern and […]

-

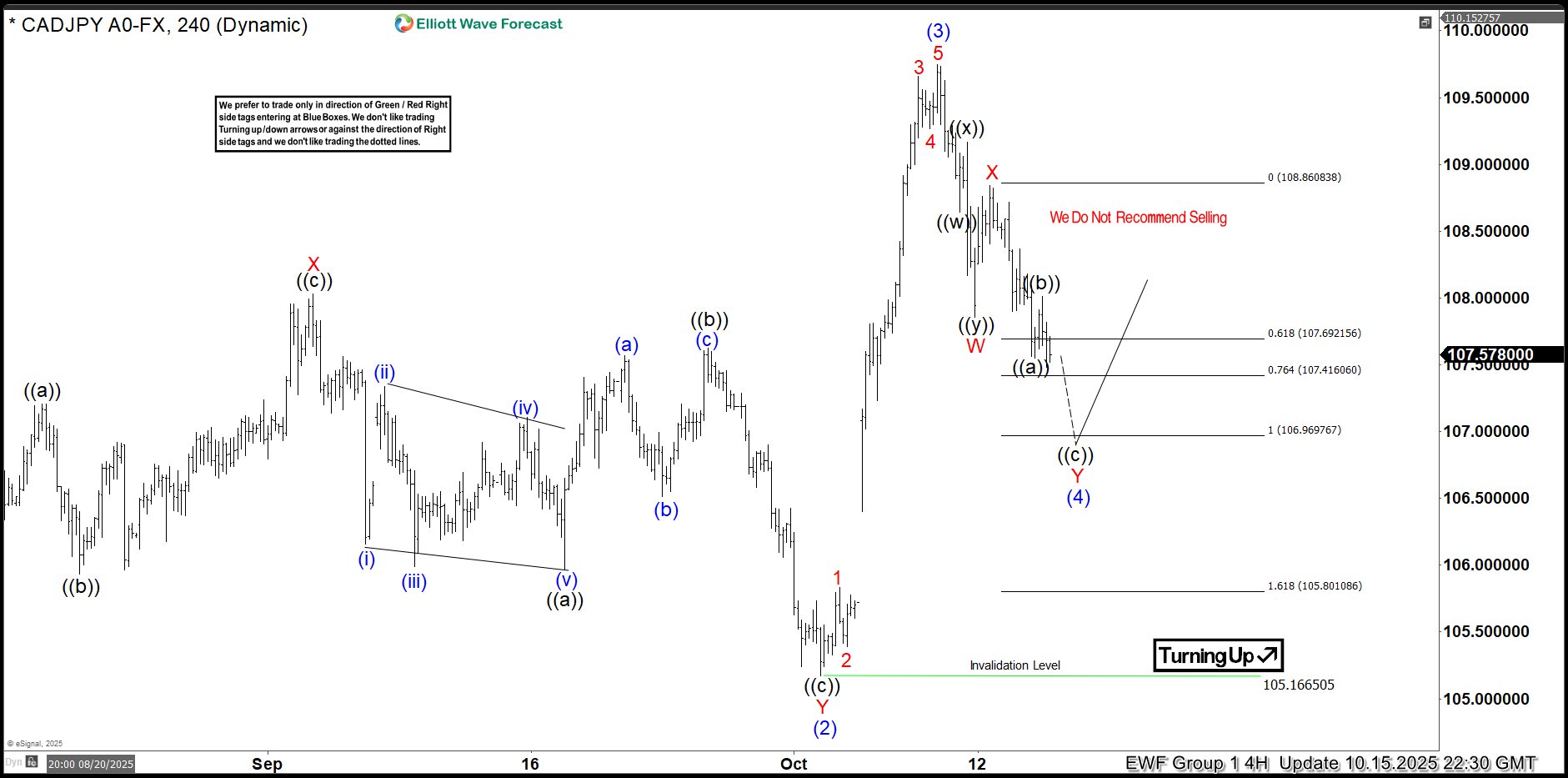

CADJPY Elliott Wave : Calling the Rally From the Extreme Zone

Read MoreHello fellow traders. In this technical article we’re going to take a look at the Elliott Wave charts charts of CADJPY Forex pair published in members area of the website. As our members know CADJPY is bullish against the 105.166 pivot and we prefer the long side. Recently the pair made a clear three-wave correction. […]

-

GOLD (XAUUSD) Elliott Wave: Incomplete Sequences Suggest the Path

Read MoreHello fellow traders. In this technical article, we are going to present Elliott Wave charts of GOLD (XAUUSD). In the following sections, we’ll break down the Elliott Wave structure in detail and explain the forecast and present the target levels. GOLD Elliott Wave 1 Hour Chart 10.28.2025 GOLD has broken the previous low at 4012.3, marked […]

-

Apple (AAPL) Elliott Wave Buying Setup Explained

Read MoreHello fellow traders. In this technical article, we are going to present Elliott Wave trading setup of Apple (AAPL) . The stock completed its corrective decline precisely at the Equal Legs area, also known as the Blue Box. In the following sections, we’ll break down the Elliott Wave structure in detail and explain the setup. AAPL […]