-

$EURAUD forecasting the path & selling the rallies

Read MoreOn August 10th $EURAUD broke the previous low from April 21st @1.4425 , making the bearish cycle from the Febrtary peak still alive. Our Elliott Wave analysis suggested for at least another big swing lower below 1.44037 low, so we recommend our members to avoid buying the pair and keep selling the rallies against the […]

-

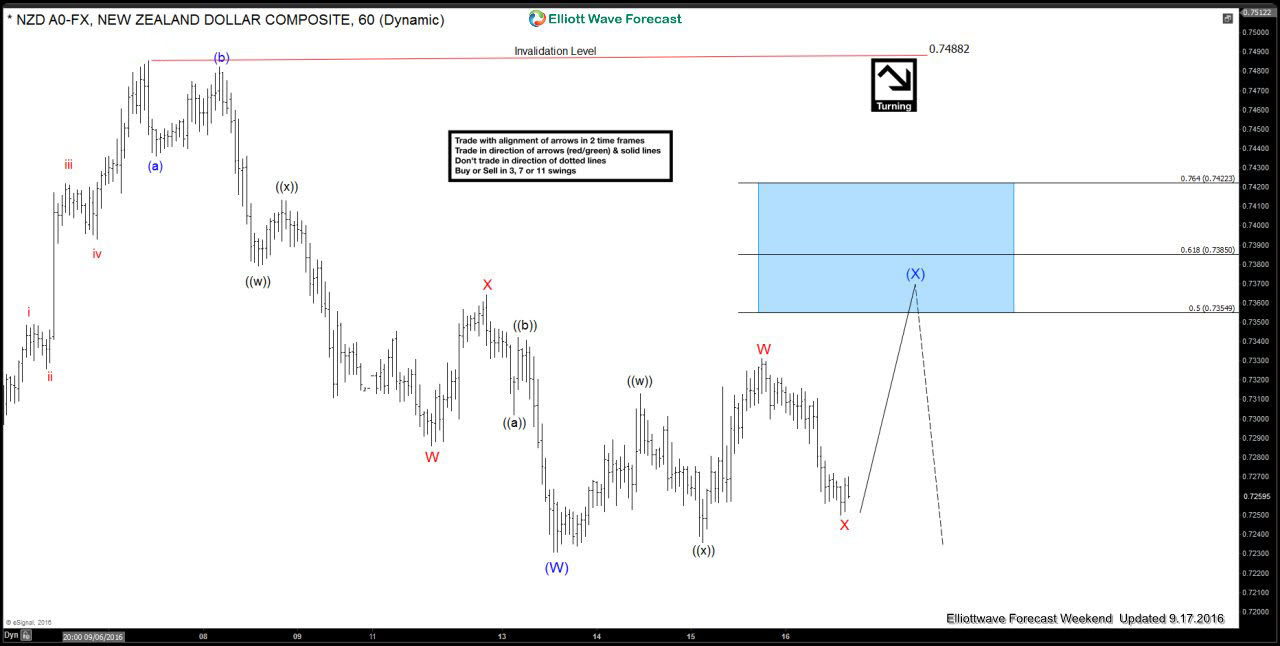

$NZDUSD Elliott Waves forecasting the decline

Read MoreAt the begining of September 2016 $NZDUSD reached daily extreme area at 0.7389-0.7557 and our view was suggesting potential pull back in 3 waves against the January 20th low at least. The pair found sellers at the mentioned technical area and made top on September 7th ( 0.74882 peak) and since then it traded lower. […]

-

$GBPAUD Elliott Waves: Forecasting The Decline

Read MoreHello fellow traders, the video below is short capture from the London Live Analysis session held on 10/04 by EWF Senior Analyst Daud Bhatti. Back then, Daud presented Elliott Wave count of $GPBAUD, suggesting further decline due to a fact the pair was showing incomplete bearish swings sequences in the cycle from the September peak. […]

-

FTSE calling the rally & buying the dips

Read MoreThe video below is a short capture from London Live Analysis session held on 09/30 by EWF Senior Analyst Daud Bhatti. Daud presented Elliott Wave count of FTSE, explaining the swing sequences and calling the short term x red pull back completed at 6769.9 low. The index was showing incomplete bullish Elliott Wave structure in […]

-

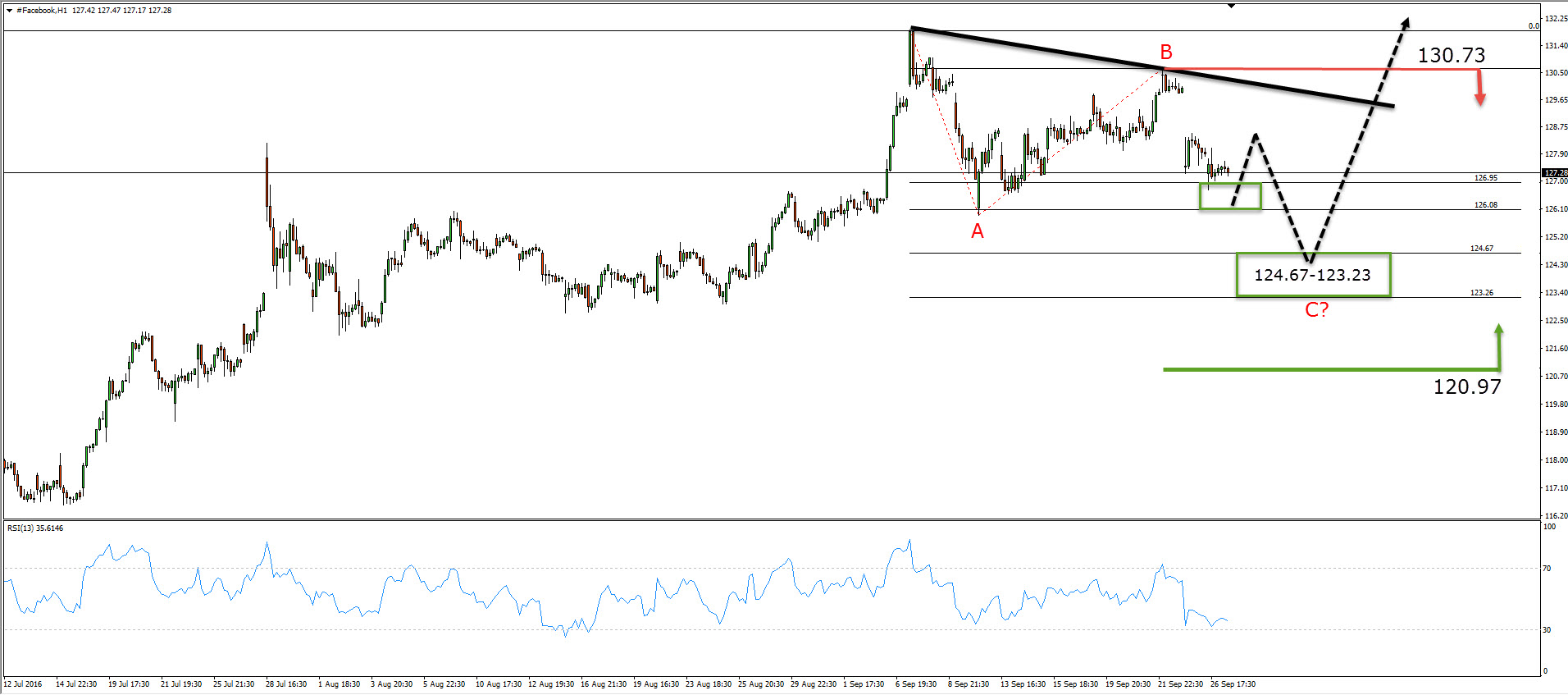

Anyone making money trading Facebook Inc ?

Read MoreFacebook was founded on February 4, 2004, by Mark Zuckerberg, along with his fellow students from the Harvard College. At the beginning it was intended for the site to be used only by Hardvard students, however it gradually allowed anyone of age 13 or above to become a registered user. After holding its initial public […]

-

AAPL (Apple) Elliott Waves showing the path & buying the dips

Read MoreThe Video below is a short capture from the Plus Daily Technical Video from September 8th, where EWF Technical analyst Hendra Lao presented Elliott Wave chart of AAPL (Apple), explaining the view and the swings sequences. AAPL (Apple) was proposed to be in incomplete Elliott Wave 5 wave structure from the May 5th low, suggesting […]