-

NZDJPY Elliott Waves forecasting the rally & buying the dips

Read MoreHello fellow traders, in this technical blog we’re going to take a quick look at the past Elliott Wave charts of NZDJPY to see how we guided our members through this instrument. The chart below is $NZDJPY daily update from 11.07.2016 It’s suggesting we’re in the potential pull back X red from the 76.90-78.01 area, […]

-

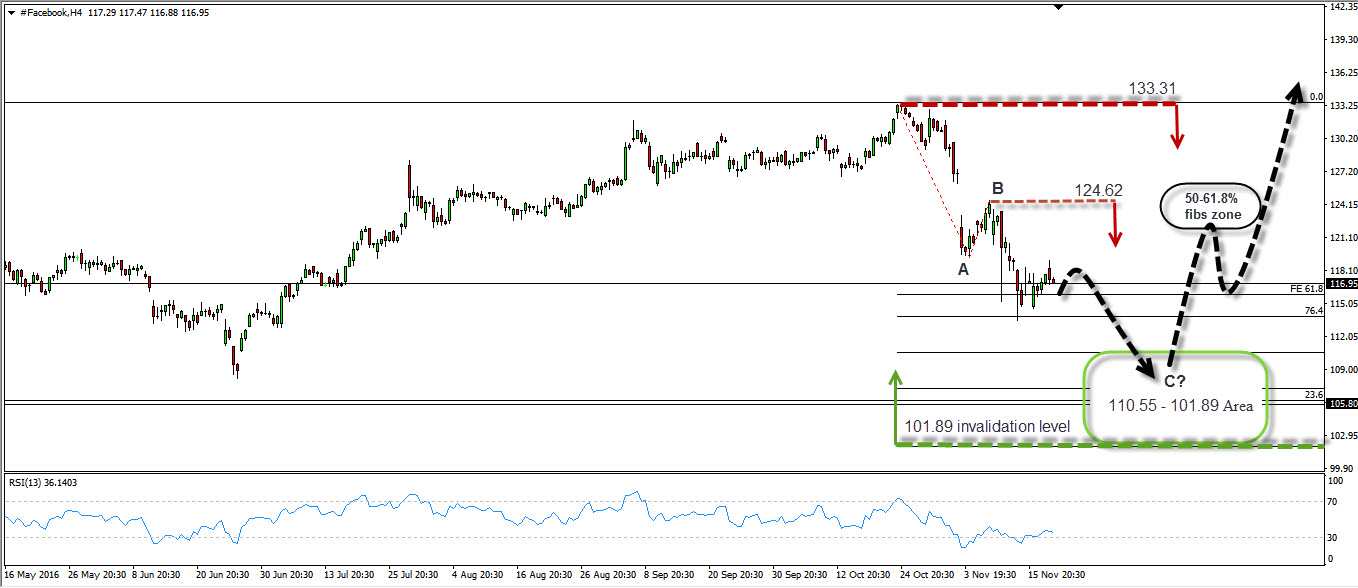

Facebook Inc potential short-term Elliott Wave scenario

Read MoreHello fellow traders, in this technical blog we’re going to take a quick look at the short term structure of Facebook’s shares price. Facebook began selling stocks to the public in May 2012, as a part of Nasdaq stock exchange with initial price of $38 per share. Eventyaly, the market developed a strong, 3-year-old bullish […]

-

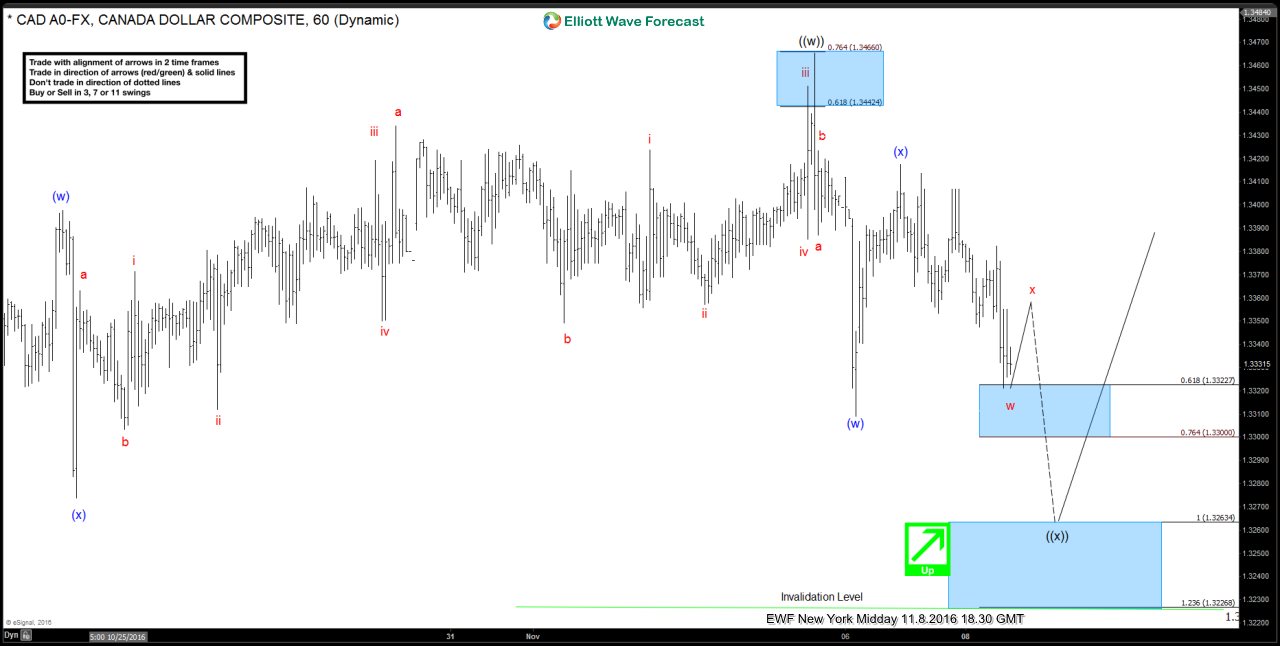

$USDCAD Elliottwaves Forecasting The Rally & Buying The Dips

Read MoreThe video below is a short capture from the NY Live Analysis Session held on November 8th by EWF Founder & Chief Currency Strategist Eric Morera. Eric presented Elliott Wave count of $USDCAD suggesting potential double in wave ((x)) pull back toward 1.2363-1.3226 before further rally takes place. Back then, $USDCAD was showing incomplete swings […]

-

$AUDUSD Elliottwaves forecasting the rally and buying the dips

Read MoreThe Video below is a short capture from the Live Trading Room held on September 13th by EWF Technical analyst Hendra Lau. In the first part, Hendra explained some basic rules of money management that every trader should be aware of, how to avoid overleveraging by spliting the position size within the instruments of the […]

-

$CADJPY Elliott Wave Zig Zag pattern

Read MoreHello fellow traders, in this technical blog we’re going to explain what Elliott Wave Zig Zag pattern looks like on real market example CADJPY price structure. Before we take a look at the $CADJPY chart, lets get through some basic EW theory and explain Zig Zag in a few words. Zig zag is the most […]

-

$TNX Elliott wave forecasting the rally

Read MoreHello fellow traders, in this technical blog we’re going to take a quick look of the price structure of $TNX and explain the swing sequences. The Elliott Wave chart below present EWF’s forecast from October 17th 2016 with added swings labelling . Back then, the instrument was showing incomplete bullish structure in the cycle from […]