-

Russell 2000 incomplete bullish sequences calling the rally

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the past Elliott Wave charts of Russell 2000 ( $RUT). We’re going to explain the structure and see how we guided our members through this instrument. The chart below is $RUT daily update from 10.23.2016. Price structure is showing incomplete […]

-

Dow Jones (INDU) forecasting the rally & buying the dips

Read MoreHello fellow traders. Here’s a short capture from the Strategy of the Week video 10/16 2016 held by EWF Senior Analyst Daud Bhatti. Daud presented Elliott Wave count of Dow Jones Industrial Average and explained the swings structure. The Index was having incomplete bullish swings structure in the cycle from the January 21st low. Our […]

-

ES #F Elliott Wave Forecasting the Rally from 2080-2023

Read MoreThe Video below is a short capture from the Plus Daily Technical Video held on October 26th by Hendra Lau. Hendra counted the short term swings and explained our Elliott Wave forecast of ES #F We expected wave (X) blue to make double three against the 1981.58 low. At that time the price of ES #F […]

-

One of the most common Traps in Elliott Wave Trading

Read MoreIn this technical blog we’re going to give you some tips on how to avoid one of the most common trading traps when using Elliott Wave theory. We will try to close you to our strategy, emphasizing importance of trading with the trend. Many beginner traders believe that spotting formation of a good pattern or clear Elliott […]

-

NZDJPY Elliott Waves forecasting the rally & buying the dips

Read MoreHello fellow traders, in this technical blog we’re going to take a quick look at the past Elliott Wave charts of NZDJPY to see how we guided our members through this instrument. The chart below is $NZDJPY daily update from 11.07.2016 It’s suggesting we’re in the potential pull back X red from the 76.90-78.01 area, […]

-

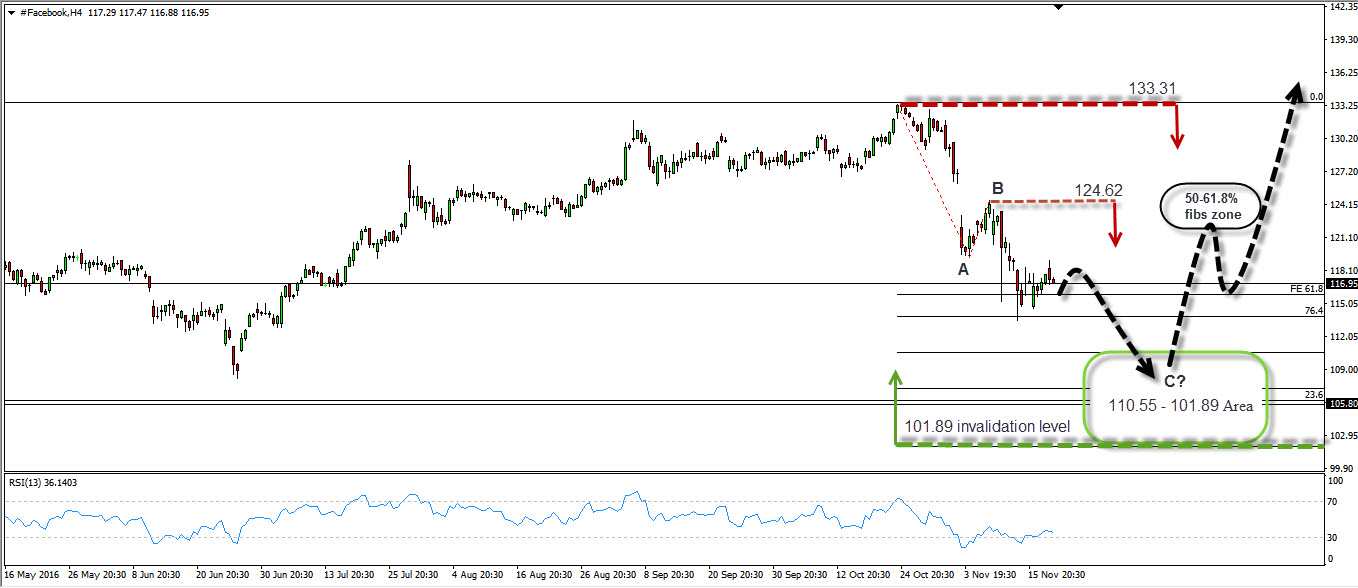

Facebook Inc potential short-term Elliott Wave scenario

Read MoreHello fellow traders, in this technical blog we’re going to take a quick look at the short term structure of Facebook’s shares price. Facebook began selling stocks to the public in May 2012, as a part of Nasdaq stock exchange with initial price of $38 per share. Eventyaly, the market developed a strong, 3-year-old bullish […]