-

Invesco NASDAQ ETF $QQQ Blue Box Area Offering a Buying Opportunity

Read MoreHello everyone! In today’s article, we’ll examine the recent performance of Invesco NASDAQ ETF ($QQQ) through the lens of Elliott Wave Theory. We’ll review how the rally from the April 21, 2025 low unfolded as a 5-wave impulse followed by a 7-swing correction (WXY) and discuss our forecast for the next move. Let’s dive into the structure and expectations for this ETF. […]

-

S&P 500 ETF $SPY Blue Box Area Offers A Buying Opportunity

Read MoreHello everyone! In today’s article, we’ll examine the recent performance of S&P 500 ETF ($SPY) through the lens of Elliott Wave Theory. We’ll review how the rally from the October 2025 low unfolded as a 5-wave impulse followed by a 7-swing correction (WXY) and discuss our forecast for the next move. Let’s dive into the structure and expectations for this ETF. 5 […]

-

Bitfarms Ltd. $BITF Soars 400% from the Blue Box Area. What’s Next?

Read MoreHello Traders! In today’s update, we’ll revisit the Elliott Wave structure of Bitfarms Ltd. ($BITF) and provide insights into the next phase of its price action. You can check the last article here. As anticipated, the 5-wave impulsive cycle from April 2025 has concluded, and a corrective pullback has begun. This pullback presents a potential buying opportunity in the coming weeks. Let’s […]

-

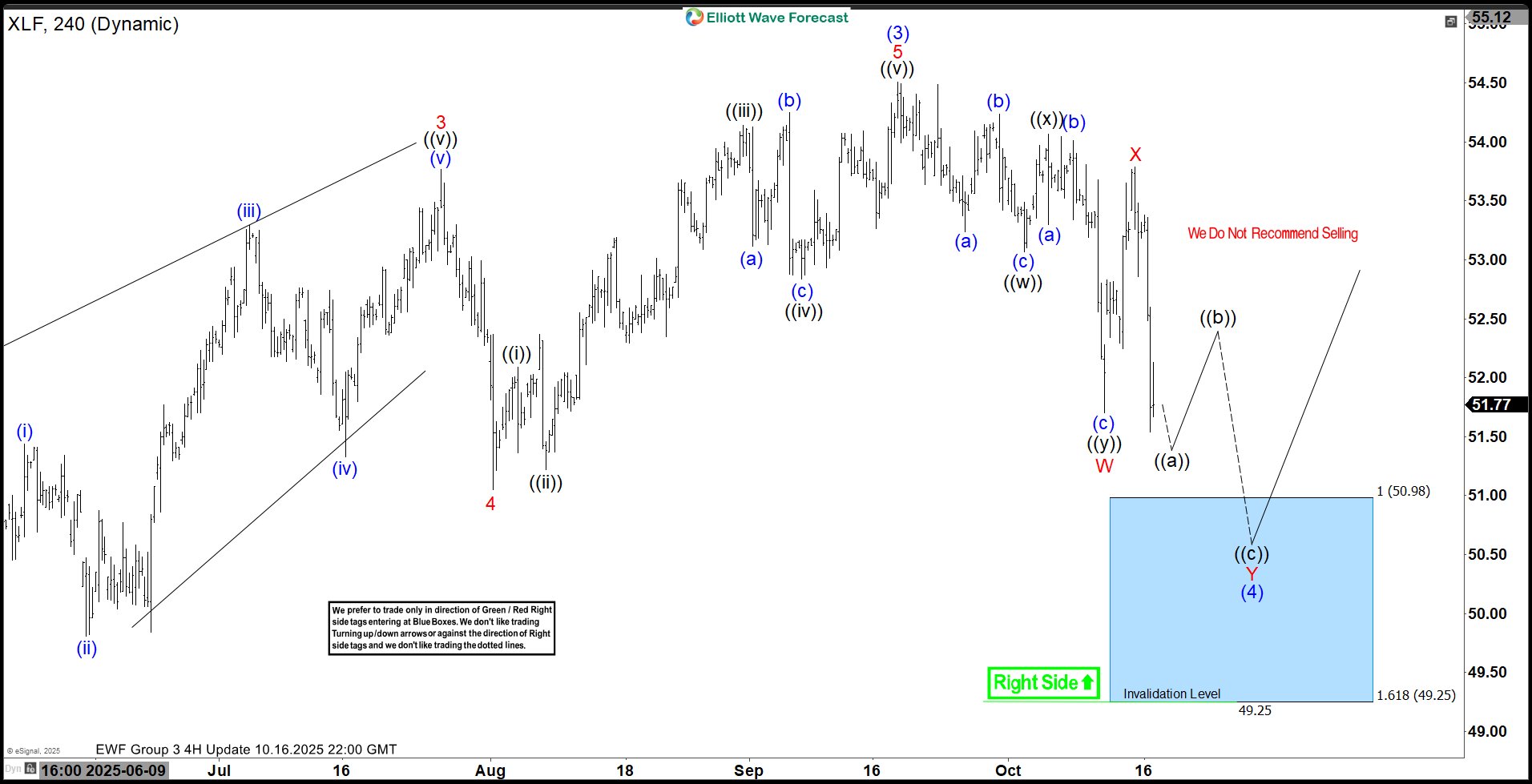

SPDR Financial Sector $XLF Blue Box Area Offers A Buying Opportunity

Read MoreHello everyone! In today’s article, we’ll examine the recent performance of SPDR Financial Sector ($XLF) through the lens of Elliott Wave Theory. We’ll review how the rally from the April 2025 low unfolded as a 5-wave impulse followed by a 7-swing correction (WXY) and discuss our forecast for the next move. Let’s dive into the structure and expectations for this ETF. 5 […]

-

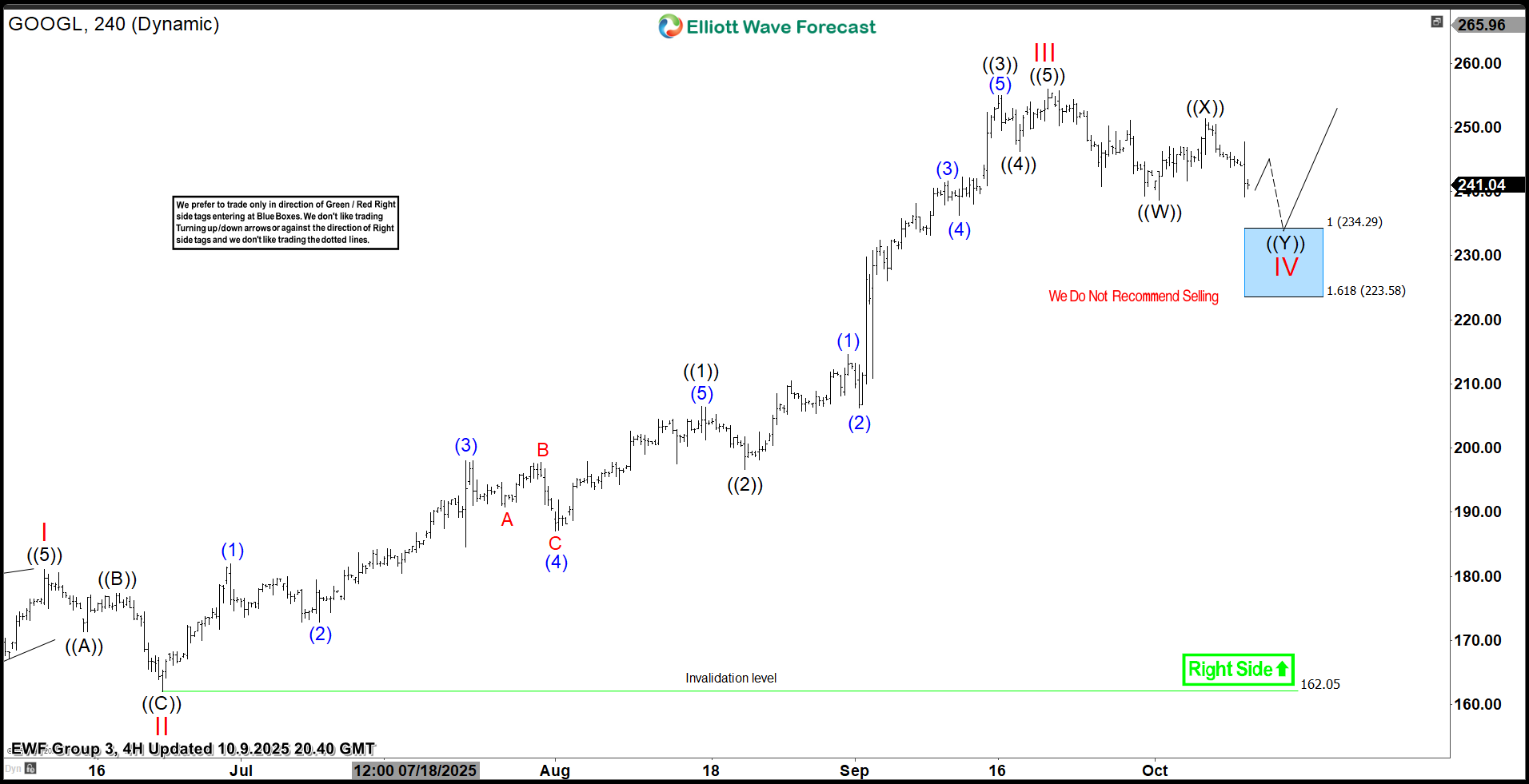

Alphabet Inc. $GOOGL Blue Box Area Offers A Buying Opportunity

Read MoreHello everyone! In today’s article, we’ll examine the recent performance of Alphabet Inc. ($GOOGL) through the lens of Elliott Wave Theory. We’ll review how the rally from the June 2025 low unfolded as a 5-wave impulse followed by a 7-swing correction (WXY) and discuss our forecast for the next move. Let’s dive into the structure and expectations for this stock. 5 Wave […]

-

Advanced Micro Devices $AMD Soars 200% from Blue Box Area, With $260 Target Still Ahead

Read MoreHello everyone! In today’s article, we’ll examine the recent performance of Advanced Micro Devices ( $AMD ) through the lens of Elliott Wave Theory. We’ll review how the reaction from the April 2025 blue box areas unfolded as an impulsive 5 waves and discuss the incomplete bullish sequence towards $260 area. Let’s dive into the structure and expectations for this […]