-

Riding the Wave: ($XLU)’s Impressive Rally and What’s Coming Next

Read MoreHello everyone! In today’s article, we will follow up on the past performance of the SPDR Utilities Select Sector ETF ($XLU) forecast. We will also review the latest weekly count. First, let’s take a look at how we analyzed it back in October 2023. $XLU Weekly Elliott Wave View – October 2023: In our last article, we […]

-

SPDR Industrial ETF ( $XLI) React From the Blue Box Area as Expected.

Read MoreHello everyone. In today’s article, we will look at the past performance of the 1H Hour Elliott Wave chart of SPDR Industrial ETF ($XLI) . The rally from 5.02.2024 low at $120.56 unfolded as 5 waves impulse. So, we expected the pullback to unfold in 7 swings and find buyers again. We will explain the […]

-

NVIDIA Corp ( $NVDA) Reacted From the Blue Box Area as Expected.

Read MoreHello everyone. In today’s article, we will look at the past performance of the 1H Hour Elliott Wave chart of NVIDIA Corp ($NVDA) . The rally from 5.02.2024 low at $812.70 unfolded as 5 waves impulse. So, we expected the pullback to unfold in 7 swings and find buyers again. We will explain the structure […]

-

SPDR Energy Select Sector ( $XLE) Found Buyers at the Blue Box Area as Expected.

Read MoreHello everyone. In today’s article, we will look at the past performance of the 4H Hour Elliott Wave chart of SPDR Energy Select Sector ($XLE). The rally from 1.18.2024 low at $78.98 unfolded as 5 waves impulse. We expected the pullback to unfold in 3 swings and find buyers again. We will explain the structure […]

-

SPDR Industrial Select ETF ( $XLI) Found Buyers at the Blue Box Area as Expected.

Read MoreHello everyone. In today’s article, we will look at the past performance of the 1H Hour Elliott Wave chart of SPDR Industrial Select ETF ($XLI). The rally from 1.17.2024 low at $109.95 unfolded as 5 waves impulse. So, we expected the pullback to unfold in 7 swings and find buyers again. We will explain the […]

-

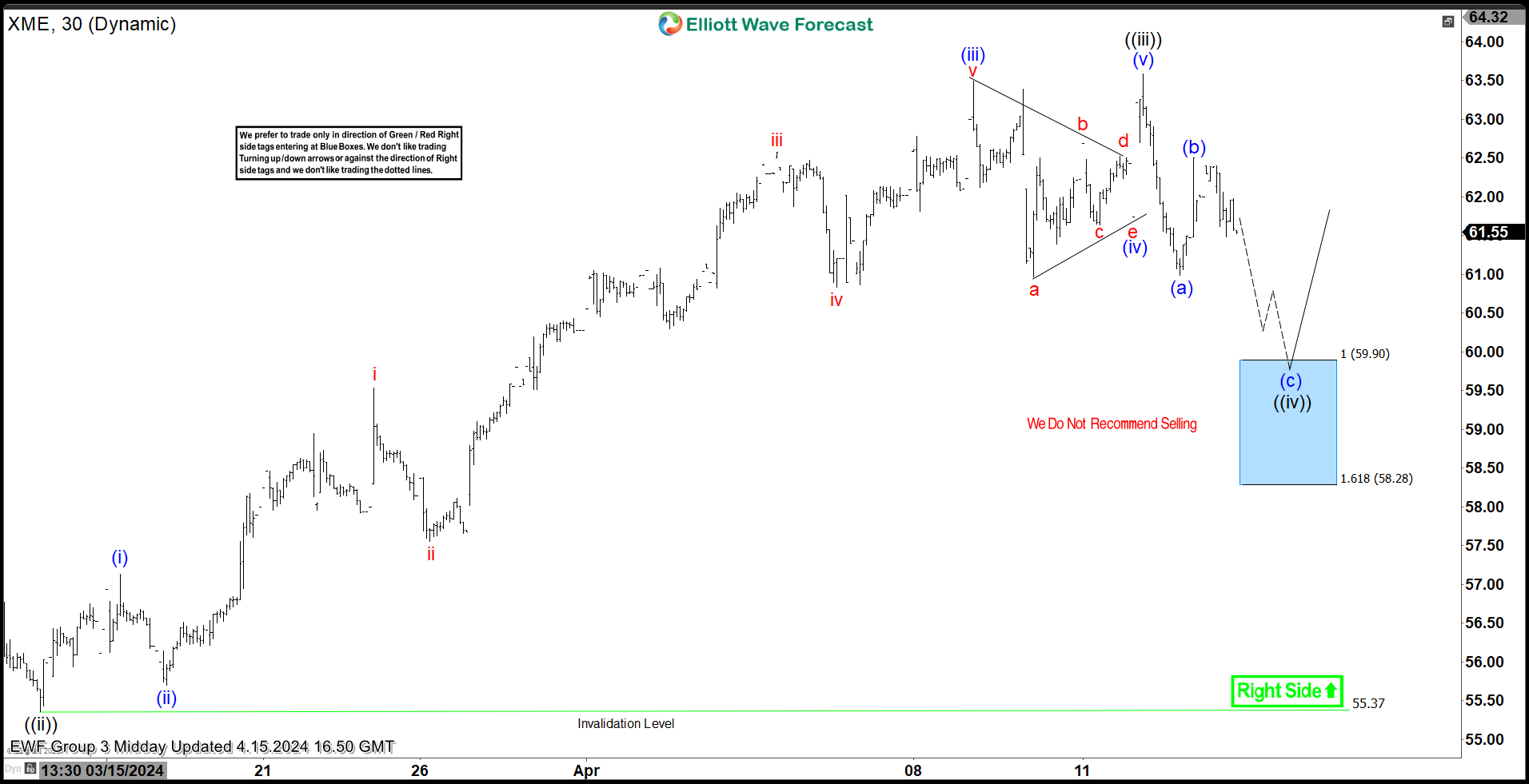

SPDR Metals & Mining ETF ( $XME) Found Buyers at the Blue Box Area as Expected.

Read MoreHello everyone. In today’s article, we will look at the past performance of the 1H Hour Elliott Wave chart of SPDR Metals & Mining ETF ($XME). The rally from 3.14.2024 low at $55.37 unfolded as 5 waves impulse. So, we expected the pullback to unfold in 3 swings and find buyers again. We will explain […]