-

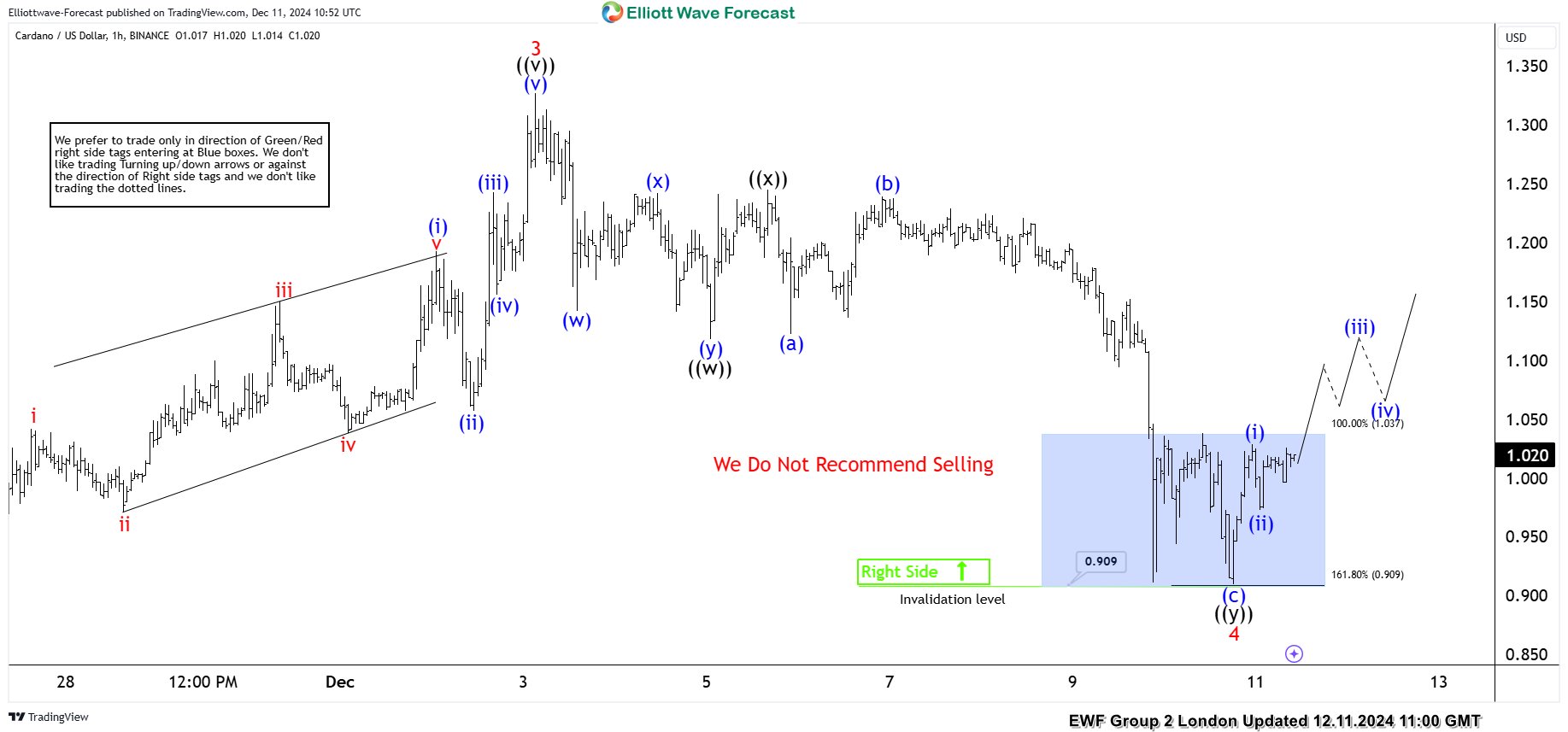

Cardano (ADAUSD) journeys toward $2 from blue box

Read MoreHello traders. Welcome to a new blog post where we discuss trades that Elliottwave-Forecast members took from the blue box. In this post, we will discuss Cardano with symbol ADAUSD ($ADA.X). Cardano is a decentralized blockchain platform and cryptocurrency (ADA) designed to provide a more secure and scalable infrastructure for the development of decentralized applications […]

-

Elliott Wave Analysis: BAC Found Support From Blue Box

Read MoreHello traders. Welcome to another blog post where we share how members of Elliottwave-Forecast trade using the Elliott wave theory. In this post, the spotlight will be on the Bank of America Corporation BAC, which has the ticker $BAC. BAC is one of the stocks still recovering from the 2008 global financial crisis. After plunging […]

-

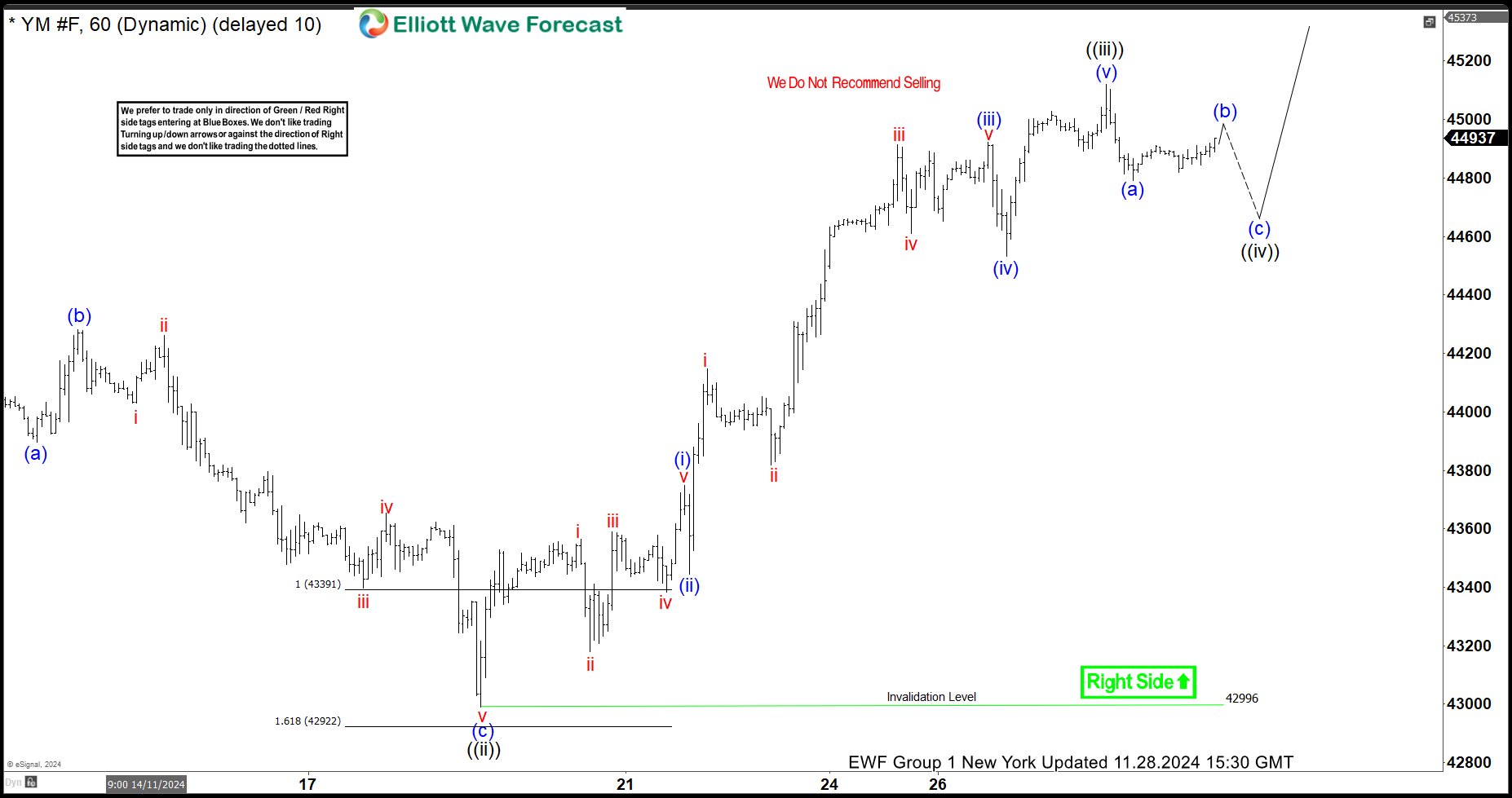

Dow Futures (YM) extends bullish sequence from zigzag pullback

Read MoreHello traders. Welcome to another trading and educational blog post. We will discuss the Zigzag corrective sequence today while using the Dow Futures YM ($YM_F) as a case study. About the Zigzag Structure The zigzag structure is one of the three core corrective patterns explained in the Elliott wave theory. The other two are the […]

-

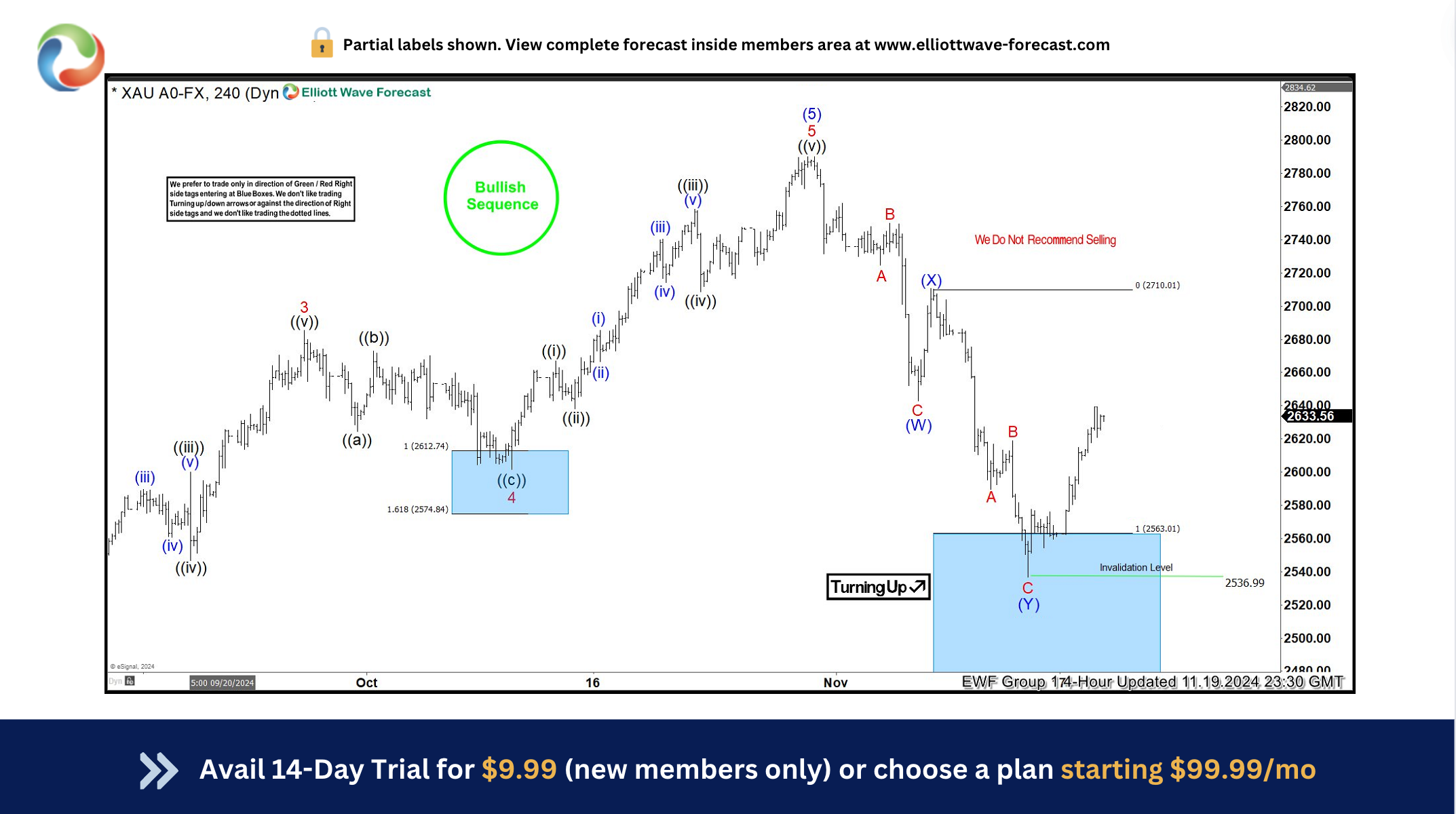

Gold (XAUUSD) puts buyers in profit from the blue box

Read MoreHello traders. Welcome to new blog post where we discuss trade setups across the major asset classes. In this post, we will discuss a recent setup on Gold (XAUUSD) for educational purposes. Gold is in an all-time bullish sequence. The commodity continues to hit fresh record highs. It did that multiple times this year after […]

-

META Approaches Risk-Free Area for Buyers. What Next?

Read MoreHello traders. Welcome to another trading blog post where we discuss trade setups that the Elliottwave-Forecast members took in recent days. In this one, we will discuss the META stock. Meta Platforms, formerly Facebook, is a tech company focused on building the “metaverse.” It owns Facebook, Instagram, and WhatsApp, and develops virtual reality (VR) and […]

-

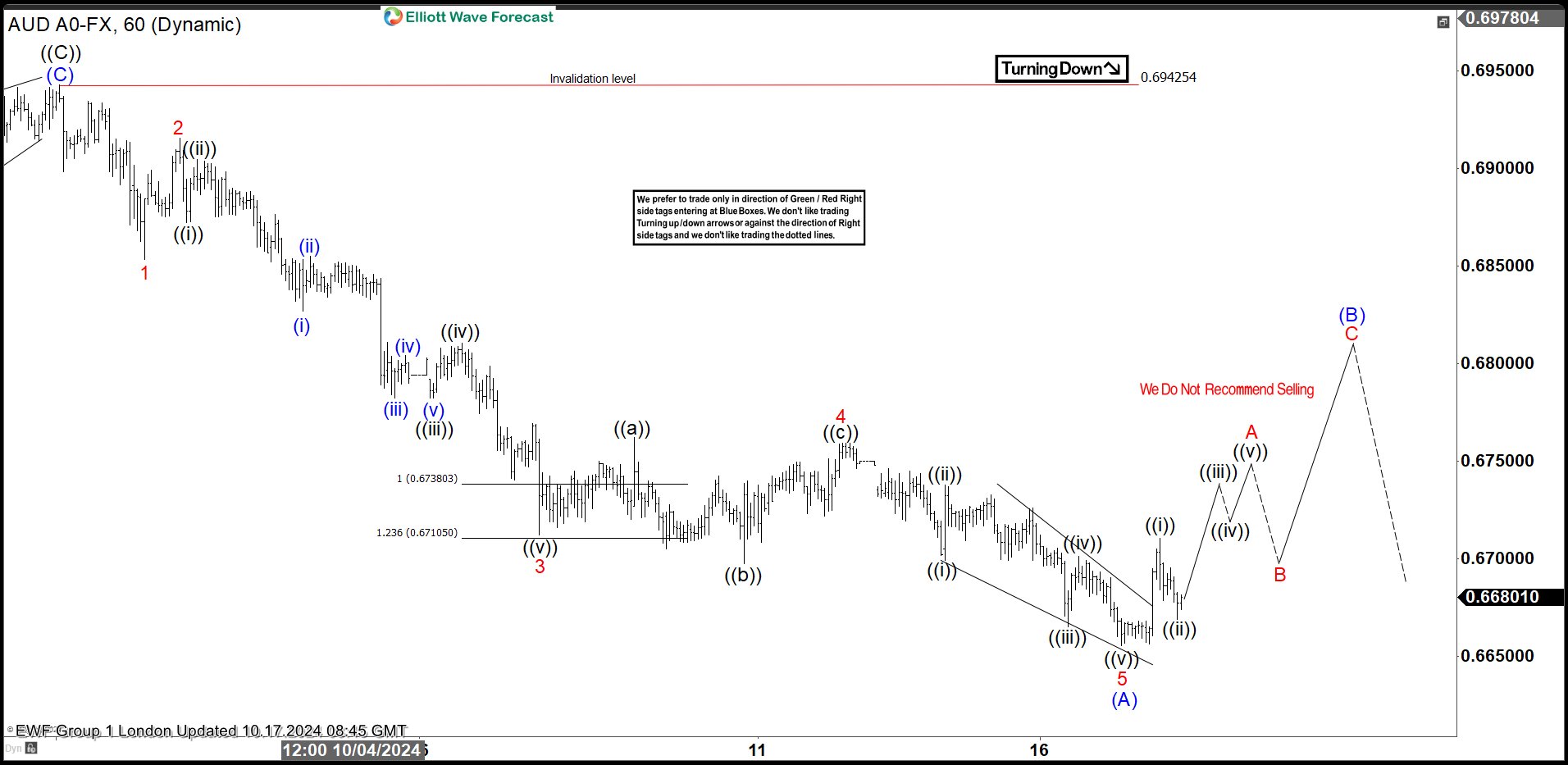

AUDUSD Elliott Wave Analysis: short term favors downside from bounces

Read MoreHello traders, welcome to a new Forex blog post. In this one, we will discuss AUDUSD short-term Elliott wave analysis. We believe the forex pair is still within a bearish corrective cycle from late September 2024. Thus, the current minor bounce should fail at some point, leading to a further intraday sell-off. From the perspective […]