-

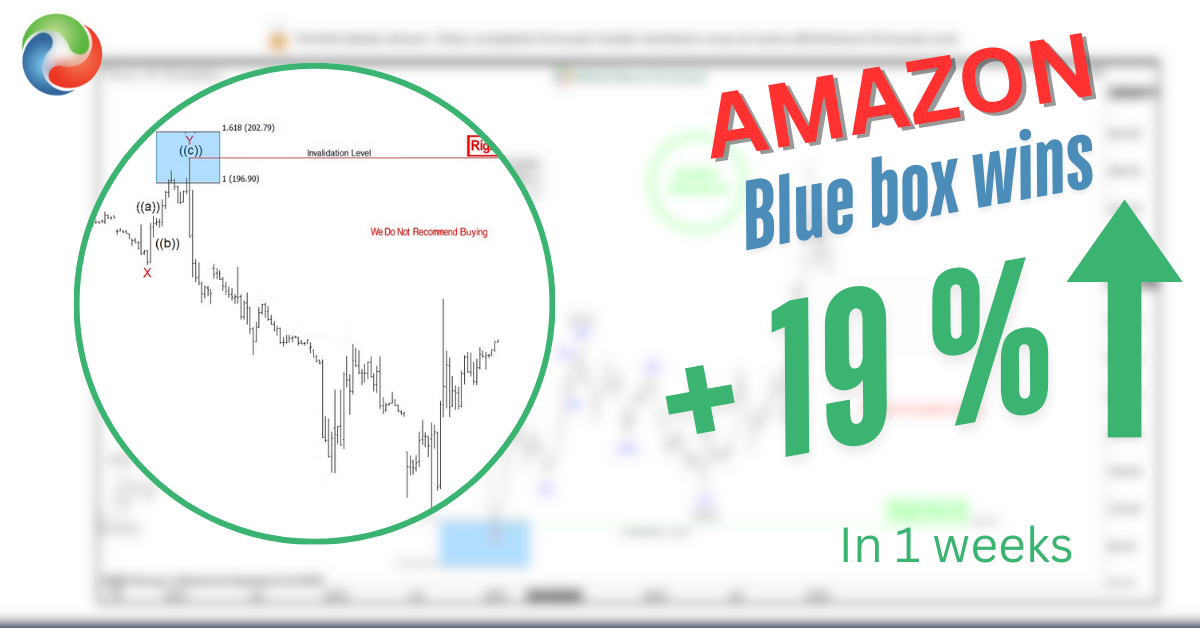

Amazon (AMZN) Falls 19% From Projected Blue Box Zone

Read MoreHello traders and welcome to a a new blog post. This post will discuss how we utilize the Elliott wave theory to spot trading opportunities from our proprietary blue box zone. In this one, the spotlight will be on AMZN stock price. Amazon.com, Inc. is a global tech giant known for its e-commerce platform, cloud […]

-

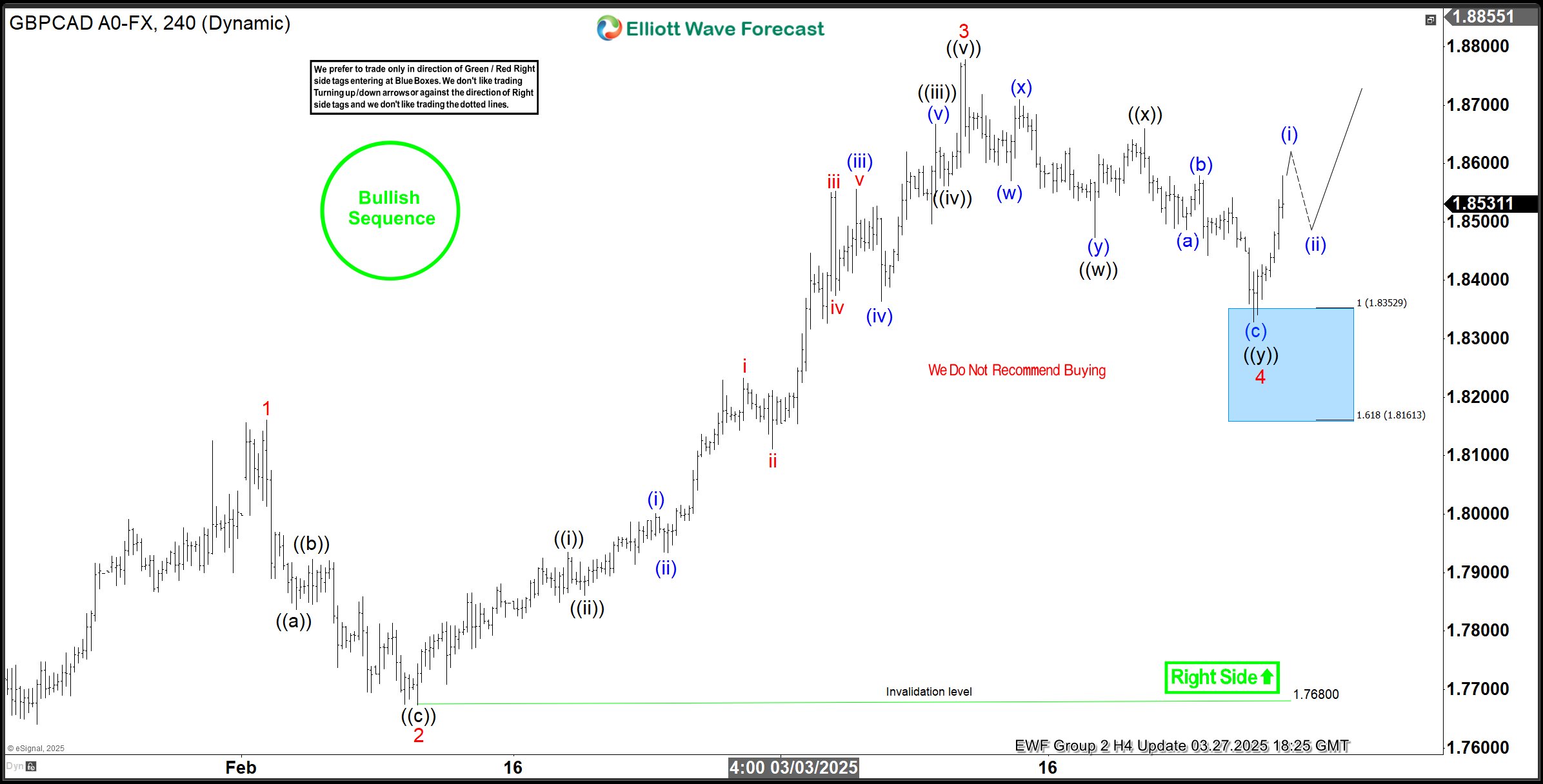

GBPCAD Finds Support in Blue Box, Buyers Achieve First Target

Read MoreHello traders. Welcome to another ‘blue box’ post where we discuss the recent trade setup that Elliottwave-forecast members traded. In this post, the spotlight will be on the GBPCAD currency pair. In the long term, GBPCAD is developing as a bearish market within a proposed diagonal structure. The Supercycle degree wave (I) was completed in […]

-

EuroStoxx-50 Trade Setup: Securing Risk-Free Gains on Long Positions

Read MoreHello traders. Welcome to a new blog post that highlights the latest trade setups shared with the Elliott-wave-forecast members. In this post, the spotlight will be on the Eurostoxx-50. The post will uncover the setup that led to the recent Long position for educational purposes. The EuroStoxx refers to a family of stock market indices […]

-

Home Depot (HD) Elliott Wave Forecast: Key Levels for Buyers

Read MoreThe Home Depot (HD) stock prices are correcting the long term bullish trend. This could provide buyers will an opportunity in the coming days. This blog post will discuss the key price levels that should interest buyers from the Elliott wave perspective. Home Depot Company Overview and Market Position The Home Depot, Inc. leads the […]

-

BAC Rebounds From Blue Box, Buyers Hit Easy Target

Read MoreHello traders. Welcome to another blog post where we discuss recent trade setups from the blue box. In this post, the spotlight will be on the Bank of America, BAC with the ticker $BAC. The stock recently reached the blue box where buyers went long. How did we come about this setup and what should […]

-

NASDAQ Elliott Wave Forecast – Identifying The Next Buying Opportunity

Read MoreThe NASDAQ (NQ_F) remains bullish from the all-time low despite the pullback from December 2024. The pullback could present a perfect opportunity for buyers in the coming days. This blog post will address key price areas for the buyers to anticipate the next opportunity. NASDAQ (NQ) is in an all-time bullish trend. Within this all-time […]