-

TXN Elliott Wave Analysis Update: Calling Resurgence From Pullback

Read MoreAfter it completed a 5-wave resurgence from the April 2025 blue box, TXN is about to correct this bullish cycle to a zone where it could attract fresh bids it would need to launch a new bullish cycle. Texas Instruments (TXN) is a global semiconductor company known for designing and manufacturing analog and embedded processing chips. […]

-

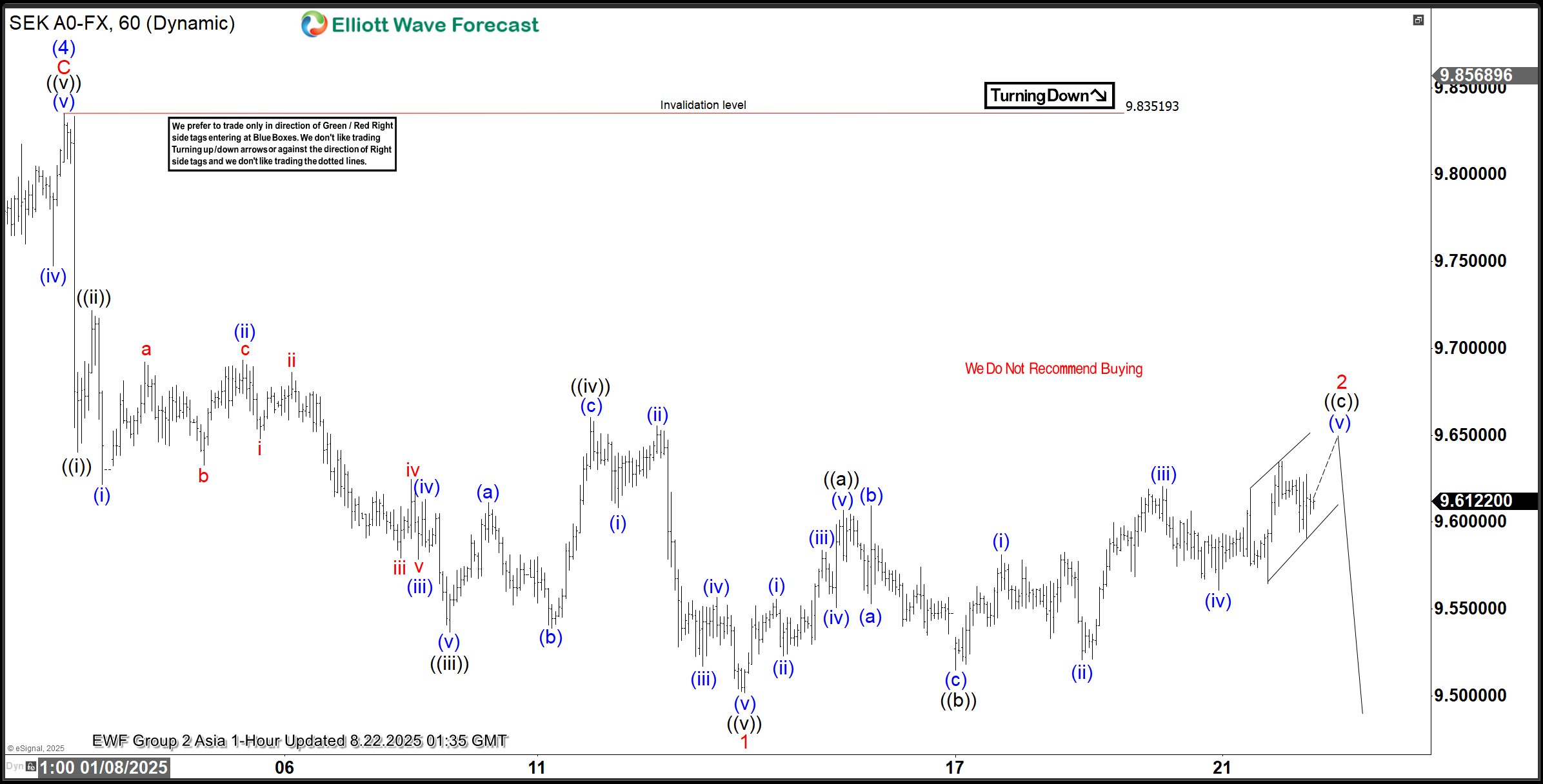

USDSEK Analysis: How We Pinpoint a Perfect Turning Point

Read MoreHello traders. Welcome to a new blog post where we discuss how the Elliott wave theory helps traders to identify perfect turning point in the markets. In this one, the spotlight will be on the USDSEK Forex pair. The USDSEK is one of the Forex pairs we analyze for Elliottwave-Forecast members in Group 2. It […]

-

Dow (YM) Rockets Higher From Extreme Zone—Bull Run Continues

Read MoreDow (YM) Futures bounced from the extreme support zone and broke to new highs, extending April’s bullish cycle. This post shows how our Elliottwave analysis positioned members ahead of the move—spotting the setup before the breakout. Following the end of the February 2025 pullback that corrected the bullish cycle from October 2022, a new bullish […]

-

TMUS Gains 35% off the Bluebox, Buyers Regain Control

Read MoreTMUS resumes the long term bullish sequence after finding the low for the March 2025 pullback in the blue box on 17th June 2025. The upside is now largely favored, going into the new trading week. What should traders expect next? T-Mobile US (NASDAQ: TMUS) is a leading U.S. wireless carrier, known for its aggressive […]

-

USDCHF July Rally Stalls at Blue Box, Sellers Gain Advantage

Read MoreUSDCHF is selling from the blue box following a familiar market structure. Sellers at Elliottwave-forecast sold from the blue box and secured some profits already while looking out for more. This blog post looks at the structure that informed our decision to go short. Since January 2025, the USDCHF forex pair, like the U.S. dollar […]

-

EURCAD Analysis: Bullish Sequence Extends From Blue Box

Read MoreHello traders. Here is another blue box blog post. In a post like this, we review some of the latest blue box trades that Elliottwave-Forecast members took. In this post, the spotlight will be on the EURCAD currency pair. EURCAD is clearly in a bullish sequence from August 22, 2022, in the primary degree wave […]