-

Cisco (CSCO) Elliott Wave Suggests Ideal Entry for Optimal Profit

Read MoreHello traders. Welcome to another blog post on trade setups. In this one, the spotlight is on CISCO under the ticker CSCO. The stock has been in a bullish sequence for many months. Thus, the current pullback could present a good entry opportunity for buyers. Later in the post, I indicated the ideal buying zone […]

-

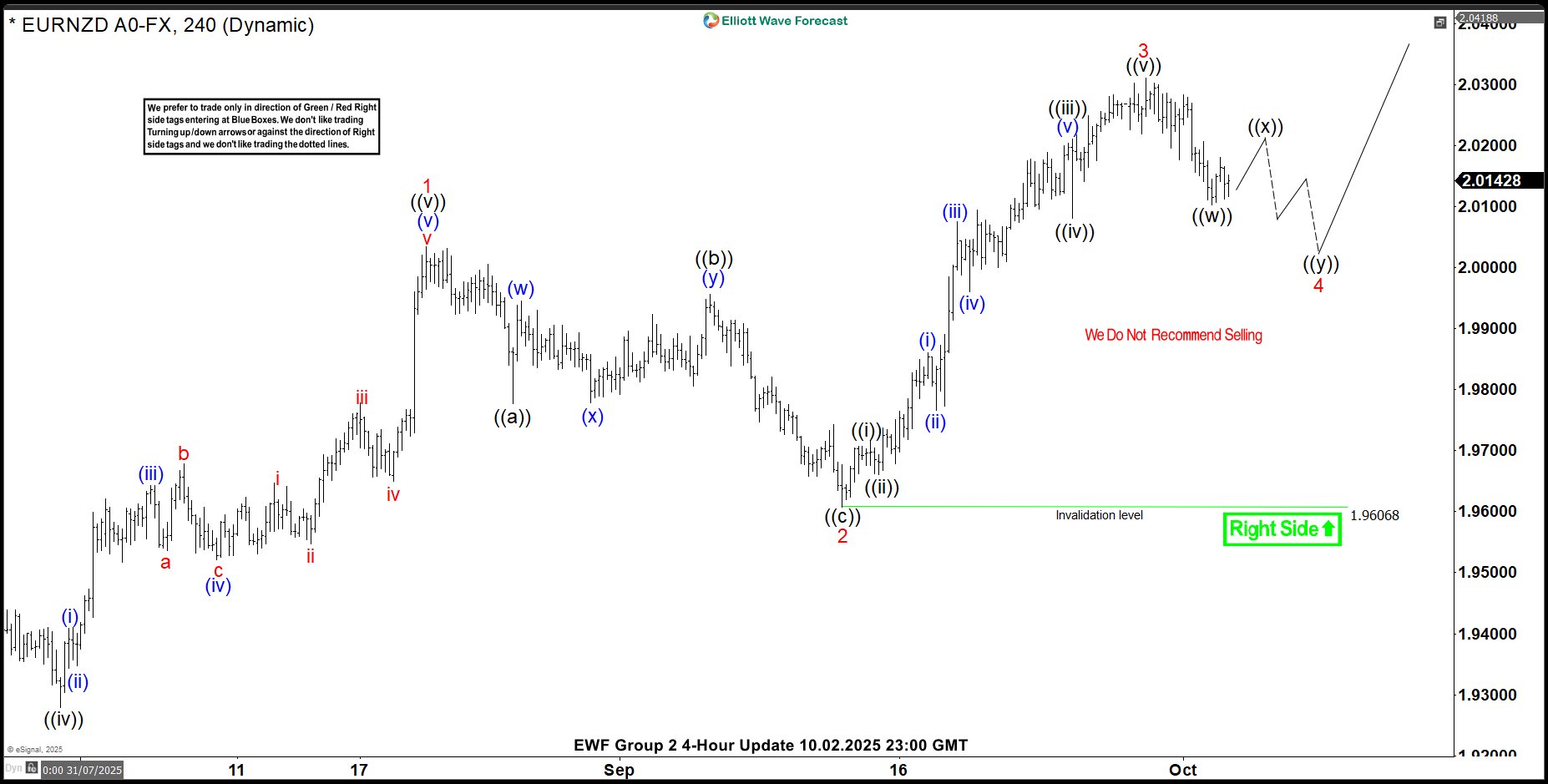

EURNZD Analysis: Bullish Sequence Targets Further Rally From Lows

Read MoreHello traders and welcome to a new blog post. In this one the spotlight will be on the EURNZD currency pair. This pair has been in a long-term bullish sequence since February 2017. Thus, it makes for an interesting instrument to add to the watch list. Is a setup imminent? EURNZD continues to rise in […]

-

Ethereum Holds Blue Box Support Zone and Quickly Reverses Higher

Read MoreHello traders and welcome to a new blog post highlighting how our proprietary blue box support system helps traders found opportunities in the financial markets. In this post, the spotlight will be on Ethereum – a cryptocurrency. Ethereum is a decentralized, open-source blockchain platform that enables smart contracts and decentralized applications (dApps). Launched in 2015, […]

-

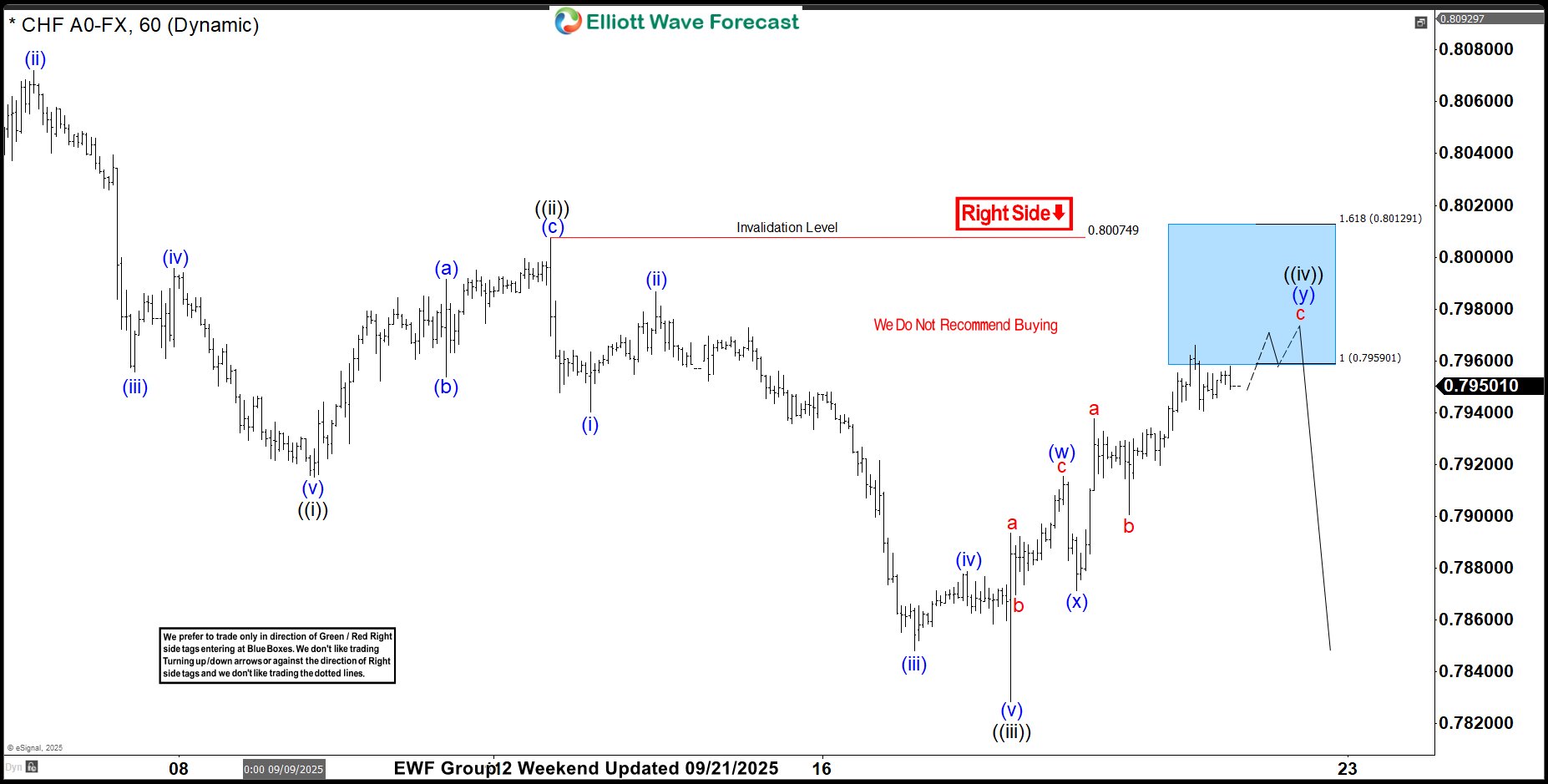

USDCHF Elliott Wave Analysis Shows Fresh Sell-Off From Bluebox

Read MoreHello traders. Welcome to a new blog post where we discuss recent trade setups from the blue box to the Elliottwave-forecast members. In this one, the spotlight will be on the USDCHF currency pair. The USDCHF currency pair remains clearly bearish. This trend is driven by dollar weakness since September 2022 and more recently January […]

-

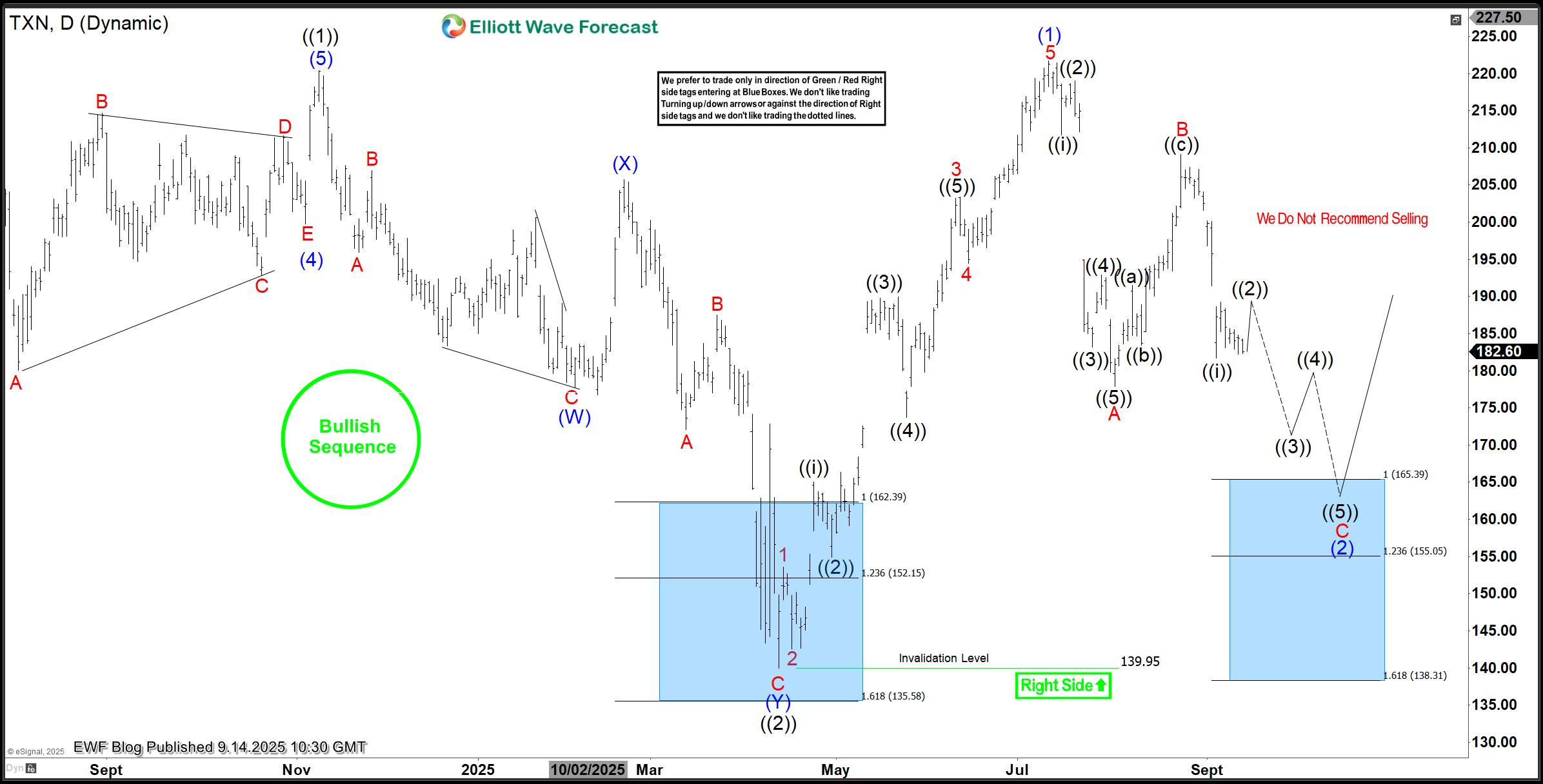

TXN Elliott Wave View: Dip Approaches Blue Box Buying Zone

Read MoreAfter it completed a 55% rally from April 2025 to July 2025, TXN is correcting the impulse rally. At the extreme of the current pullback, buyers can find new entry. What’s the buying zone? Check the rest of the post and be sure to read everything. Texas Instruments (TXN) is a global semiconductor company known for […]

-

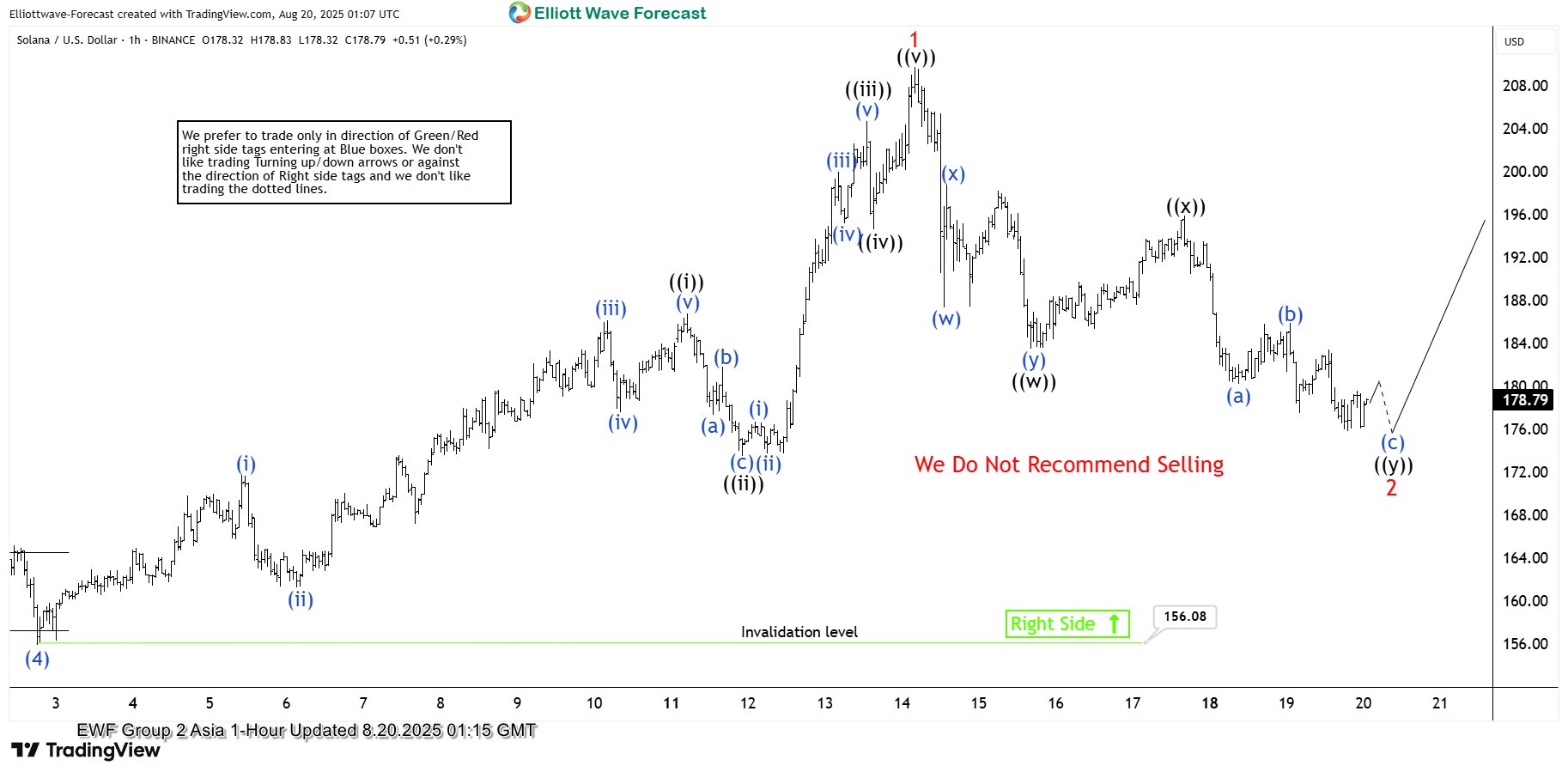

Solana (SOLUSD) Analysis – How We Navigate Using Elliott Wave Analysis

Read MoreHello traders. Welcome to a new blog post where we discuss trade setups in the recent times. In this post, the spotlight will be on Solana – a cryptocurrency. Solana is a high-speed blockchain launched in 2020, combining Proof of Stake and Proof of History to process thousands of low-cost transactions per second. It powers […]