-

Allied Healthcare Products Inc. ($AHPI) Leaning Bullish

Read MoreThe Corona Virus has provided some tremendous rallies in the healthcare and bio science sectors. Allied Healthcare Products Inc. is one of those names that has gone parabolic with the COVID-19 spreading worldwide. It still remains very technical, and I think there could be one more leg up before the rally is complete. Lets take […]

-

Intel ($INTC): Strength before more weakness

Read MoreIntel is a very important component for the Semiconductor industry. It is the #2 holding in in both the SOXX ETF, and the SMH ETF. With such a strong weighting in the overall sector, it has much influence over the direction of the industry as a whole. Most recently, Intel has declined with the broad […]

-

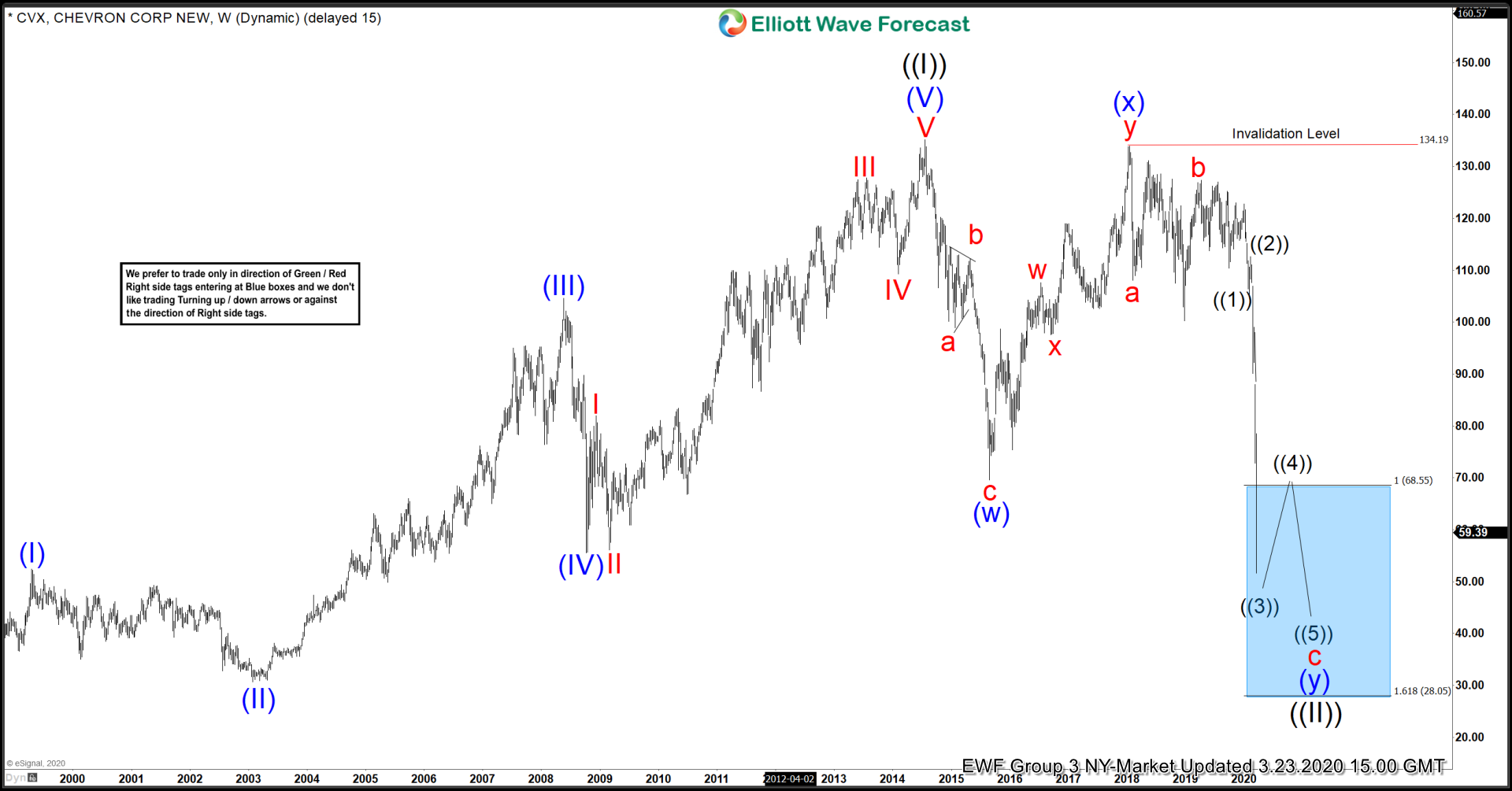

Elliott Wave View: Chevron ($CVX) A Bottom Is Close

Read MoreThe Energy Industry has had a some rough waters for the past few years with Chevron also participating in the rout. However, the current technicals on the chart suggest a major low is possible in 2020. Recently, a lot has happened in the oil industry, OPEC+ (which included Russia) has been all but abandoned. A […]

-

Elliott Wave View: Gilead Sciences ($GILD) Bullish Cycle Heating Up

Read MoreGilead Sciences ($GILD) showing signs that it may be in the beginning stages of new bullish cycle. The Long term chart shows a completed bullish sequence in 5 waves for Blue (I) which topped on June 22/2015 at 123.37. From there a corrective sequence took place for Blue (II) which bottomed on Dec 26/2018 at […]

-

Elliott Wave View: Peloton ($PTON) The Next Leg Up

Read MorePeloton ($PTON) had a very nice run before topping December 2019, and may be ready for the next leg up. The caveat with analyzing companies that have recently gone public is there is not much history to analyze. However, the structure that Peloton has since hitting the all time lows suggests the next bull run […]

-

Elliott Wave View: Virgin Galactic ($SPCE) Extending The Impulse

Read MoreVirgin Galactic ($SPCE) has had an impressive rally after setting all time lows after its IPO in the fall of 2019 and continues to impress as it extends the rally in a wave ((3)) impulse. Up from the 11/25/19 lows at 6.90, $SPCE ended a 5 waves cycle on 1/3/20 at 11.90 in wave ((1)) […]