-

DexCom Inc (DXCM): Forecasting Trends & Key Levels In Double Correction

Read MoreDexCom Inc., (DXCM) prominent player in the healthcare sector, specializes in continuous glucose monitoring systems, helping improve diabetes management. Listed on Nasdaq under the ticker “DXCM,” the company operates on a global scale. This stock reflects a notable trading pattern, with anticipated market movements providing insights for investors. From a technical perspective, DXCM has been […]

-

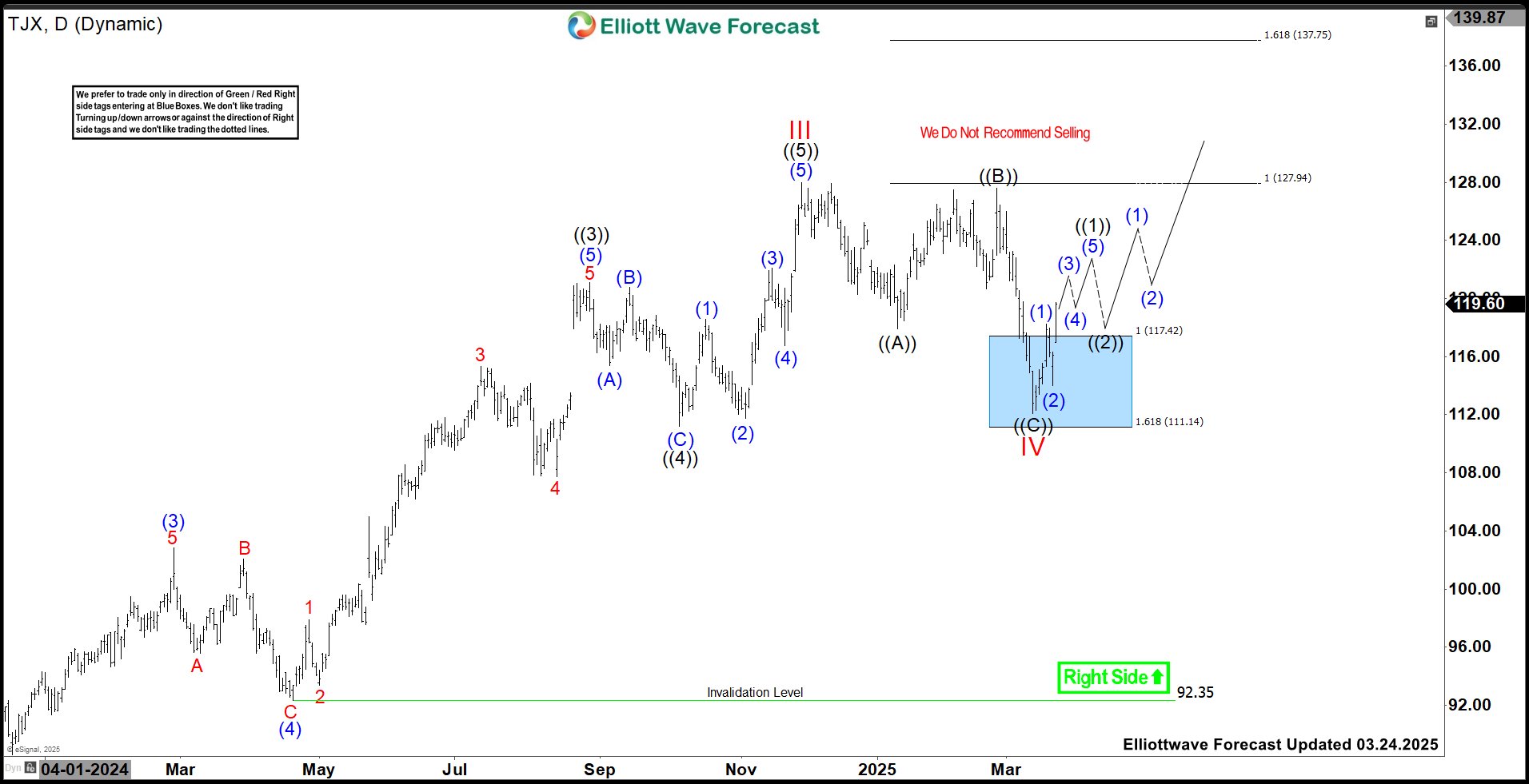

TJX Companies (TJX) Continue Rally Towards $137

Read MoreTJX Companies, Inc., (TJX) operates as an off-price apparel & home fashions retailer in Unites States, Canada, Europe & Australia. It operates through four segments: Marmaxx, HomeGoods, TJX Canada & TJX International. It comes under Consumer Cyclical sector & trades as “TJX” ticker at NYSE. TJX favors bullish weekly sequence & expect rally to extend […]

-

Boston Scientific (BSX) Continues Rally Above $110.6

Read MoreBoston Scientific Corporation (BSX) develops, manufactures & markets medical devices for use in various interventional medical specialties worldwide. It operates through MedSurg & Cardiovascular segments. It offers devices to diagnose & treat different medical conditions & offer remote patient management systems. It comes under Healthcare sector & trades as “BSX” ticker at NYSE. BSX favors […]

-

Vistra (VST) Should Find Buyers In Support Zone

Read MoreVistra Corp., (VST) operates as an integrated retail electricity & power generation company in the United States. It operates through five segments like Retail, Texas, East, West & Asset Closure. It comes under Utilities sector & trades as “VST” ticker at NYSE. VST favors corrective pullback against March-2020 low in weekly. It expects to remain […]

-

Is Nu Holdings (NU) Ready For Next Rally ?

Read MoreNU Holdings Ltd., (NU) provides digital banking platform in Brazil, Mexico, Colombia, Germany, Argentina, United States & Uruguay. It offers spending solutions comprising credit & prepaid cards, mobile payment solutions & integrated mall that enables customers to purchase goods & services from various ecommerce retailers. It is based in Brazil, comes under Financial services sector […]

-

NextEra Energy (NEE) Should Bounce Towards $75.77

Read MoreNextEra Energy, Inc., (NEE) through its subsidiaries generates, transmits, distributes & sells electric power to retail & wholesale customers in North America. The company generates electricity, through wind, solar, nuclear, natural gas & other clean energy. It comes under Utility sector & trades as “NEE” ticker at NYSE. As shown in the last article, NEE […]