-

Is SoFi Technologies (SOFI) Set For Major Breakout?

Read MoreSoFi Technologies, Inc., (SOFI) provides various financial services in the US, Latin America, Canada & Hong Kong. It operates through three segments; Lending, Technology Platform & Financial services. It comes under Financial Services sector & trades as “SOFI” ticker at Nasdaq. SOFI is showing 5 swings higher from December-2022 low as the part of impulse […]

-

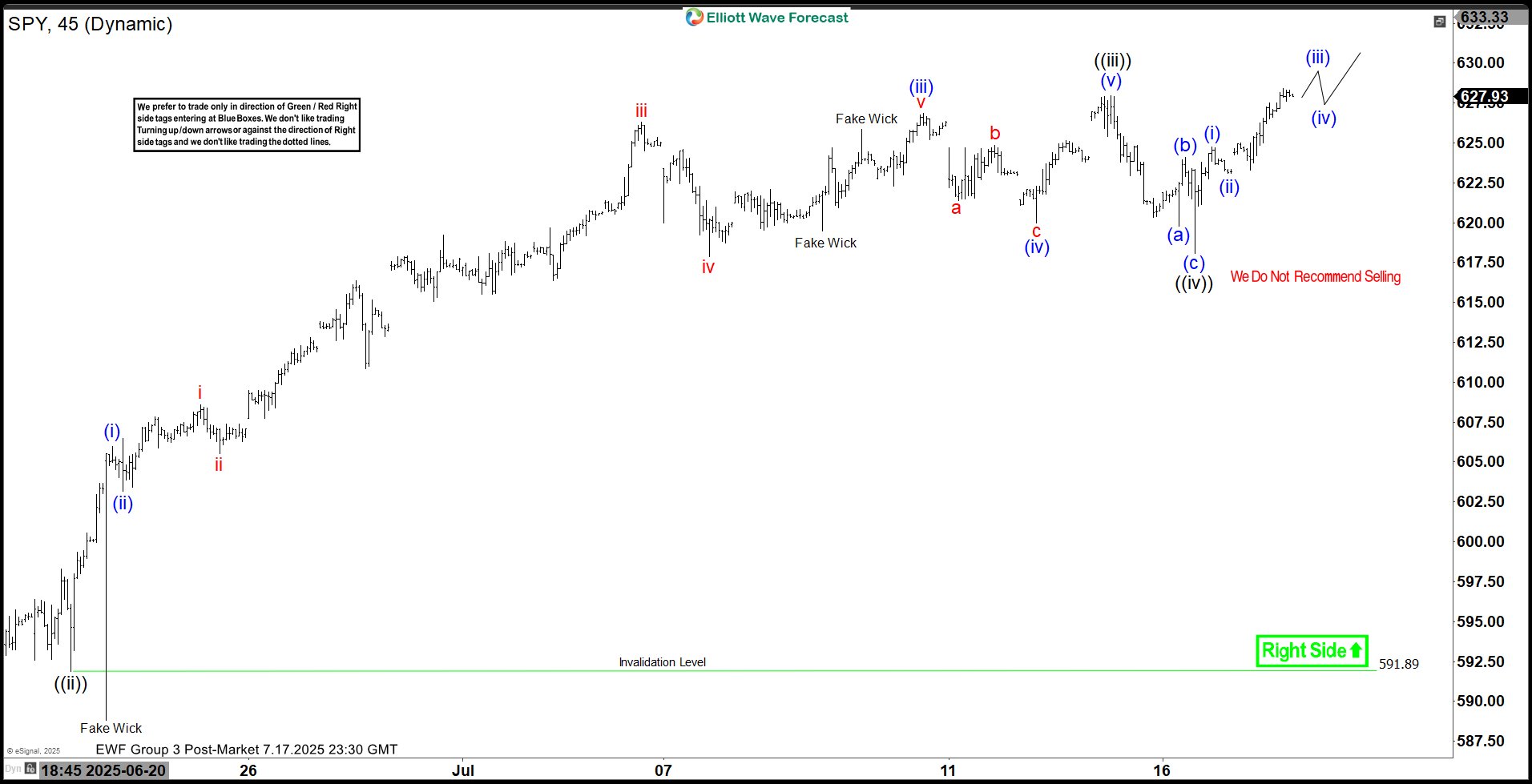

Elliott Wave Analysis: SPY Poised To Extend Higher In Bullish Sequence

Read MoreElliott Wave sequence in SPY (S&P 500 ETF) suggest bullish sequence in progress started from 4.07.2025 low. It expects two or few more highs to extend the impulse sequence from April-2025, while dips remain above 6.23.2025 low. SPY ended the daily corrective pullback in 3 swings at 480 low on 4.07.2025 low from February-2025 peak. […]

-

Elliott Wave View: XAUUSD (Gold) Should Continue Rally

Read MoreElliott Wave sequence in XAUUSD (GOLD) suggest bullish view against September-2022 low in weekly. In daily, it should remain supported in 3, 7 or 11 swings to continue rally to extend higher. In daily, it ended ((4)) correction in 7 swings sequence at 3120.20 low in 5.15.2025 low against April-2025 peak. Above May-2025 low, it […]

-

Elliott Wave Sequence Supports Rally In Dow Jones Futures (YM_F) From Extreme Area

Read MoreThe Dow Jones E-mini Futures (YM_F) favors impulsive rally from 4.07.2025 low of 36708. It is trading close to the previous high of 1.31.2025 of 45227. A break above that level will confirm the bullish sequence. Other US indices like Nasdaq & S & P 500 futures already confirmed the new high in daily, calling […]

-

Alnylam (ALNY) Eyes for ((3)) Rally Toward $368–$469 Zone

Read MoreAlnylam Pharmaceuticals Inc., (ALNY) discovers, develops & commercializes therapeutics based on ribonucleic acid interference. It comes under Healthcare – Biotech sector & trades as “ALNY” ticker at Nasdaq. ALNY favors rally in bullish weekly sequence & expect continuation against April-2025 low. It favors rally in ((3)) of III against 4.07.2025 low & pullback in 3, […]

-

Gorilla Technology (GRRR): Bulls In Control Above Key Support

Read MoreGorilla Technology Group Inc., (GRRR) provides solutions in security, network, business intelligence & internet of Things technology in Taiwan & United Kingdom. It operates through three segments: Video IoT, Security Convergence & Other Segments. It comes under Technology sector & trades as “GRRR” ticker at Nasdaq. GRRR favors upside against May-2025 low & current pullback […]