-

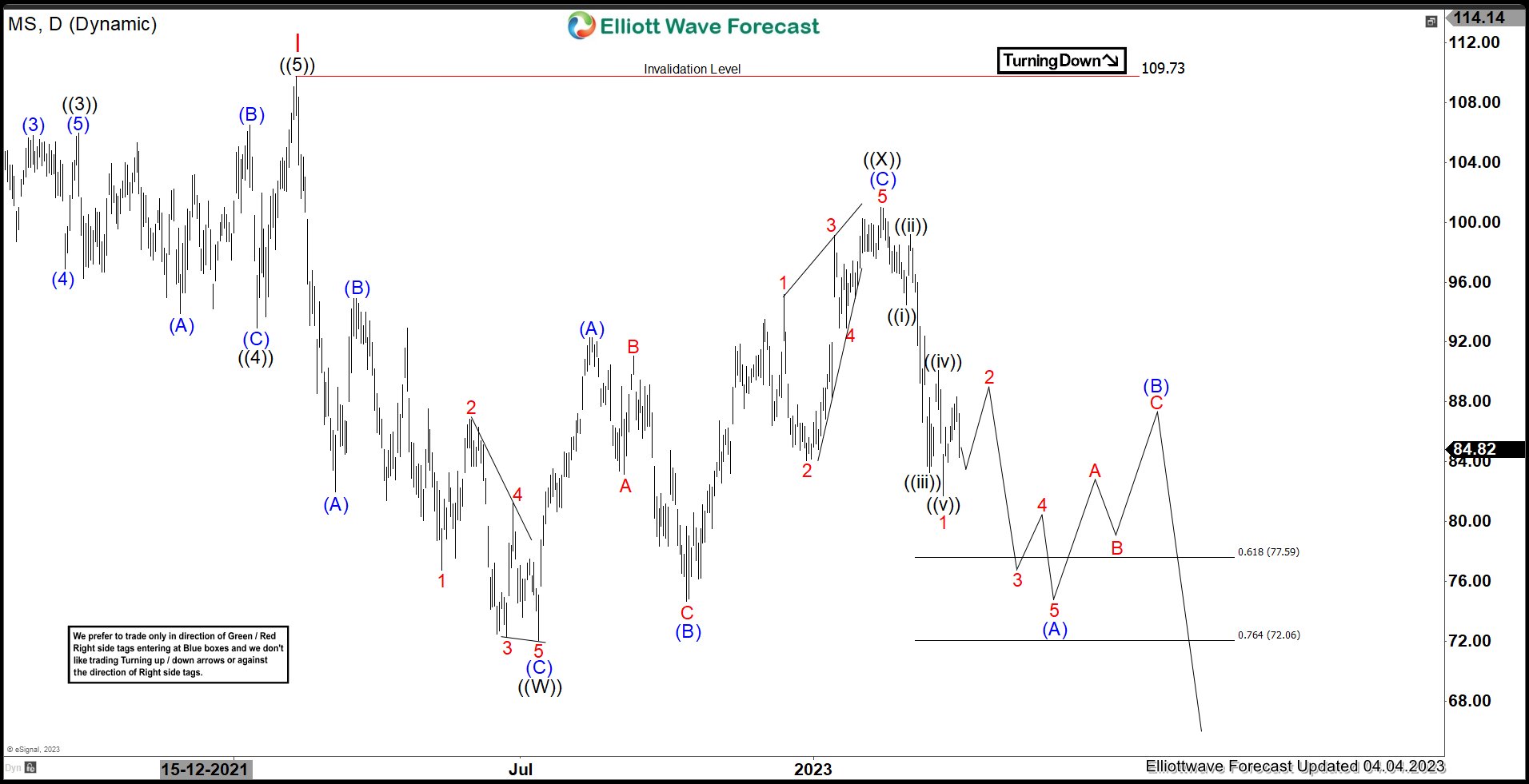

Morgan Stanley (MS) Favors Correcting Lower

Read MoreMorgan Stanley (MS), a financial holding company provides various financial products & services to corporations, governments, financial institutions & Individuals in the Americas, Europe, Middle East, Africa & Asia. It operates through Institutional Securities, Wealth Management & Investment management services. It is based in New York, US, comes under Financial services sector & trades as […]

-

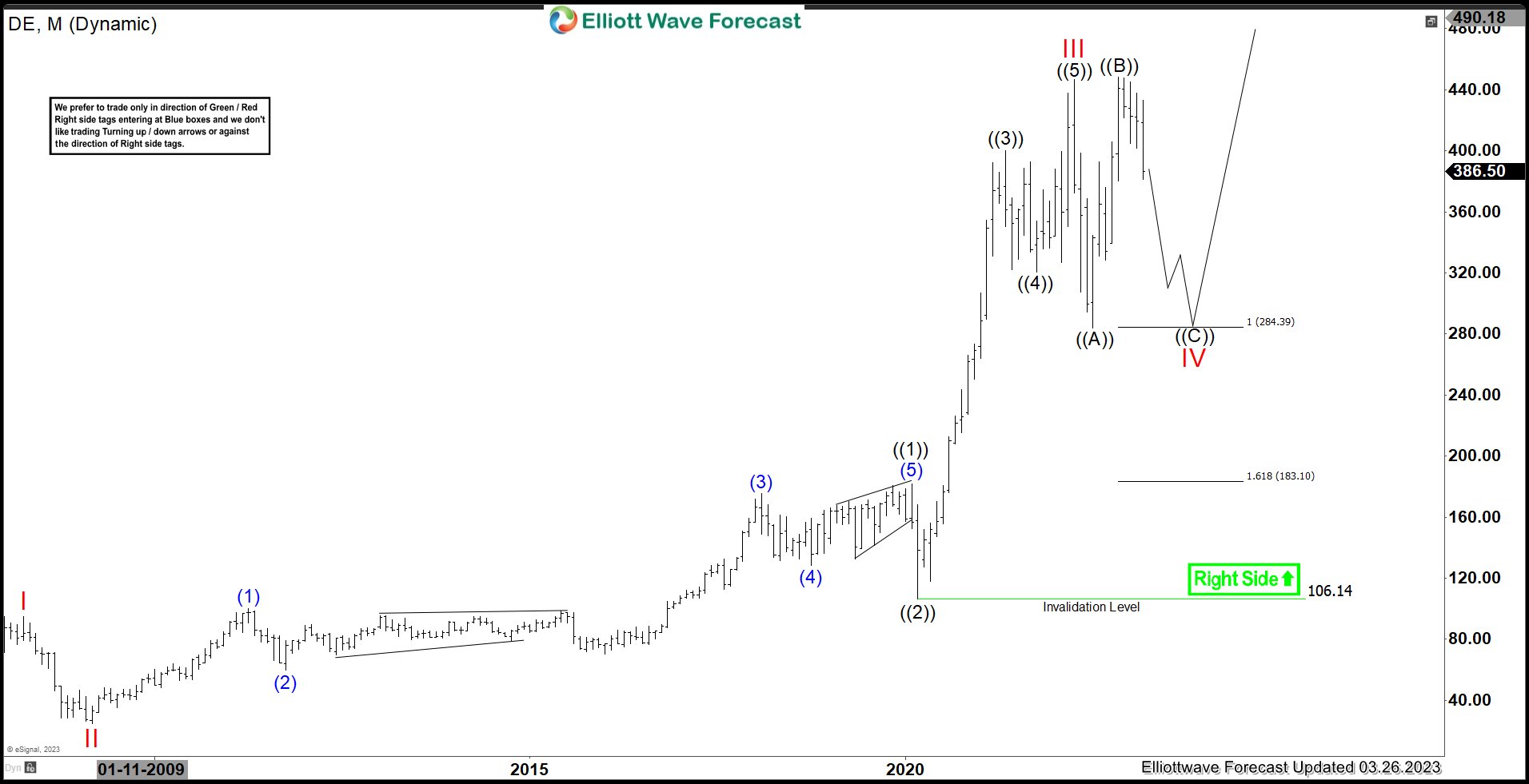

Deere & Company (DE): Favors Sideways To Lower In Correction

Read MoreDeere & Company (DE) manufactures & distributes various equipment worldwide. The company operates through four segments: Production & Precision Agriculture, small Agriculture & Turf, Construction & Forestry, & Financial services. The company is based in Illinois, US, comes under Industrials sector & trades as “DE” ticker at NYSE. DE showing bullish sequence on monthly chart […]

-

Toronto-Dominion Bank (TD): Favors Weakness To Continue

Read MoreThe Toronto-Dominion Bank (TD), together with its subsidiaries, provides various financial products & services in Canada, US & internationally. It operates through three segments: Canadian retail, US retail & Wholesale banking. It is based in Toronto, Canada, comes under Financial services sector & trades as “TD” ticker at NYSE. TD ended wave I as impulse […]

-

Morgan Stanley (MS) Favors Short Term Weakness

Read MoreMorgan Stanley (MS), a financial holding company provides various financial products & services to corporations, governments, financial institutions & Individuals in the Americas, Europe, Middle East, Africa & Asia. It operates through Institutional Securities, Wealth Management & Investment management services. It is based in New York, US, comes under Financial services sector & trades as […]

-

FCX : Favors Upside & Should Remain Supported

Read MoreFreeport-McMoRan Inc., (FCX) engages in the mining of minerals in North America, South America & Indonesia. It primarily explores for Copper, Gold, Molybdenum, Silver & other metals, as well as Oil & gas. It is based in Phoenix, Arizona, US, comes under Basic Materials sector & trades as “FCX” ticker at NYSE. FCX shown impulse […]

-

JCI : Impulse Sequence Favors Further Upside

Read MoreJohnson Controls International plc, (JCI) engages in engineering, manufacturing, commissioning & retrofitting building products & systems in United States, Europe, Asia -Pacific and internationally. It operates in four segments like Building Solutions in North America, Building Solutions EMEA/LA, Building Solutions Asia-Pacific & Global products. It is based in Ireland, comes under Industrials sector & trades […]