-

Vertiv Holdings (VRT) Eyes New High Between $215.3 – $232.75

Read MoreVertiv Holdings Co., (VRT) is an American multinational provider of critical infrastructure & services for data centers, communication networks & commercial & industrial environments. It comes under Industrials sector & trades as “VRT” ticket for NYSE. VRT favors bullish sequence in weekly & expects push higher against 11.21.2025 low. It favors rally between $215.3 – […]

-

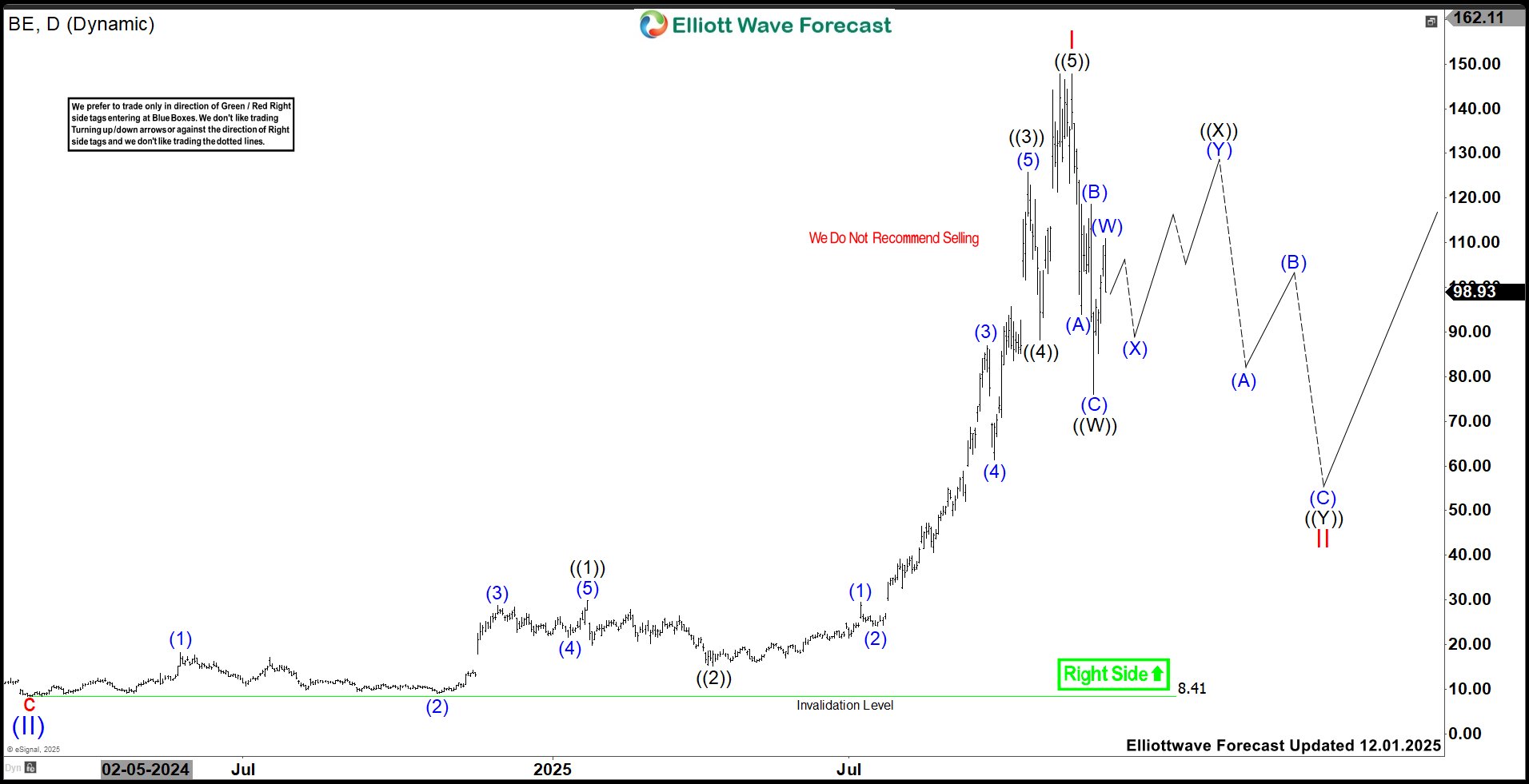

Bloom Energy (BE) Favors Bounce Towards $120.2 Before Lower

Read MoreBloom Energy Corporation., (BE) designs, manufactures, sells & install solid-oxide fuel cell systems for on-site power generation in the United States & globally. It offers Bloom Energy Server, a power generation platform to convert different fuels like Natural gas, Biogas, Hydrogen or blended fuel into electricity through electrochemical process. It comes under Industrials sector & […]

-

Eli Lilly & Company (LLY) Favors Rally Targeting 1188

Read MoreEli Lilly & Company (LLY) discovers, develops & markets human pharmaceuticals worldwide. It comes under Healthcare sector & trades as “LLY” ticket at NYSE. LLY is bullish in weekly & favors rally in (V) against 8.08.2025 low. It should extend rally towards 1054.6 – 1187.8 area within cycle from August low in 9 swings impulse. […]

-

DexCom (DXCM) Eyes Deeper Correction Toward $44.11–$20.95 Zone

Read MoreDexCom Inc., (DXCM) is a medical device company, that focuses on the design, development & commercialization of glucose monitoring systems globally. It comes under Healthcare sector & trades as “DXCM” ticker at Nasdaq. The DXCM favors double correction in weekly from November-2021 high discussed in last article few months ago. It favors weakness started from 2.17.2025 […]

-

RY (Royal Bank of Canada) Favors Final Push Before Pullback

Read MoreRoyal Bank of Canada., (RY) operates as diversified financial service company worldwide. It operates through personal finance, commercial banking, wealth management & Insurance segments. It comes under Financial services sector & trades as “RY” ticker at NYSE. RY favors rally within April-2025 sequence as showing in (1) discussed in last article. It expects further upside […]

-

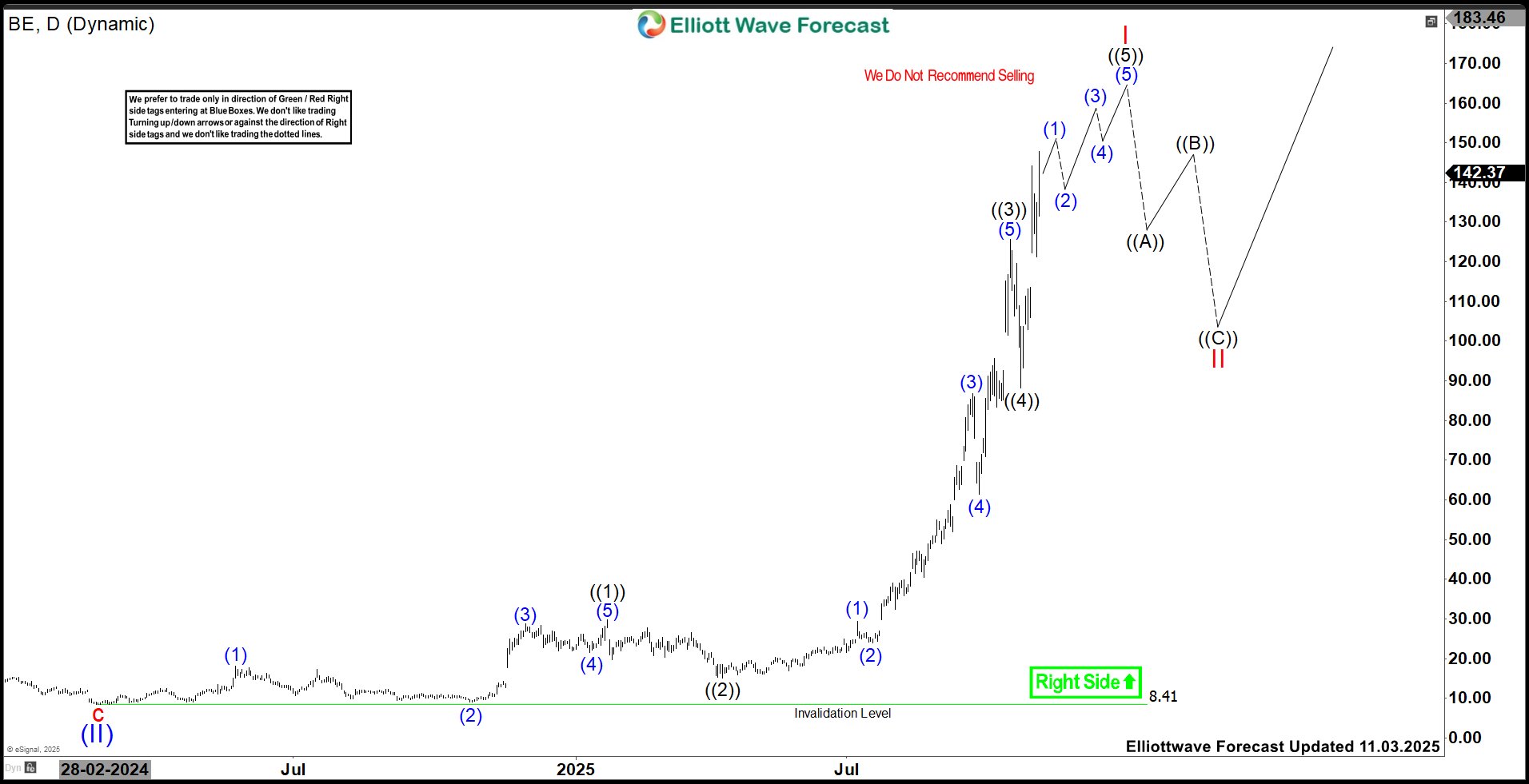

Bloom Energy (BE) Expects Rally Between 160.6 – 205.4

Read MoreBloom Energy Corporation., (BE) designs, manufactures, sells & install solid-oxide fuel cell systems for on-site power generation in the United States & globally. It offers Bloom Energy Server to convert different fuels like Natural gas, Biogas, Hydrogen or blended fuel into electricity. It comes under Industrials sector & trades at “BE” ticker at NYSE. BE […]