-

The Golden Rule of 2% – Why you should Risk a little to make a lot.

Read MoreRisking 2% can quite literally save your trading account. By risking too much your trading can be at risk of large drawdowns. But why is this? We searched across the interweb and found several reasons to keep risk low: Surviving losing streaks: Risking 2% per trade allows you to withstand a series of losses without […]

-

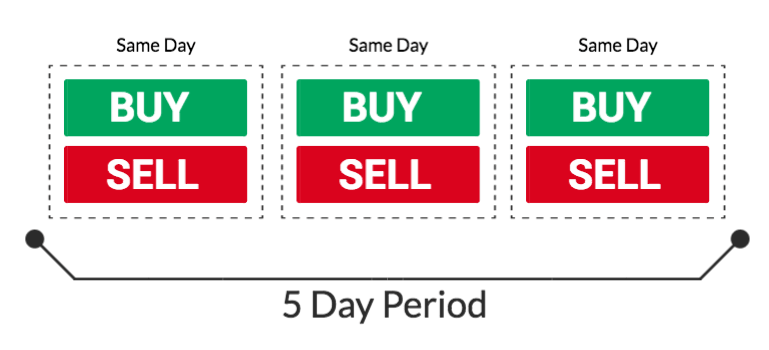

How to Start Trading with a Small Account – Avoid Pattern Day Trader Rule

Read MoreWhen I started out trading back in 2020, there was the allure of starting with a small amount of money and turning it into a large fortune. Since then I have learned several ways of starting with a small amount of money, and growing it exponentially, without having to deal with the Pattern Day Trader […]

-

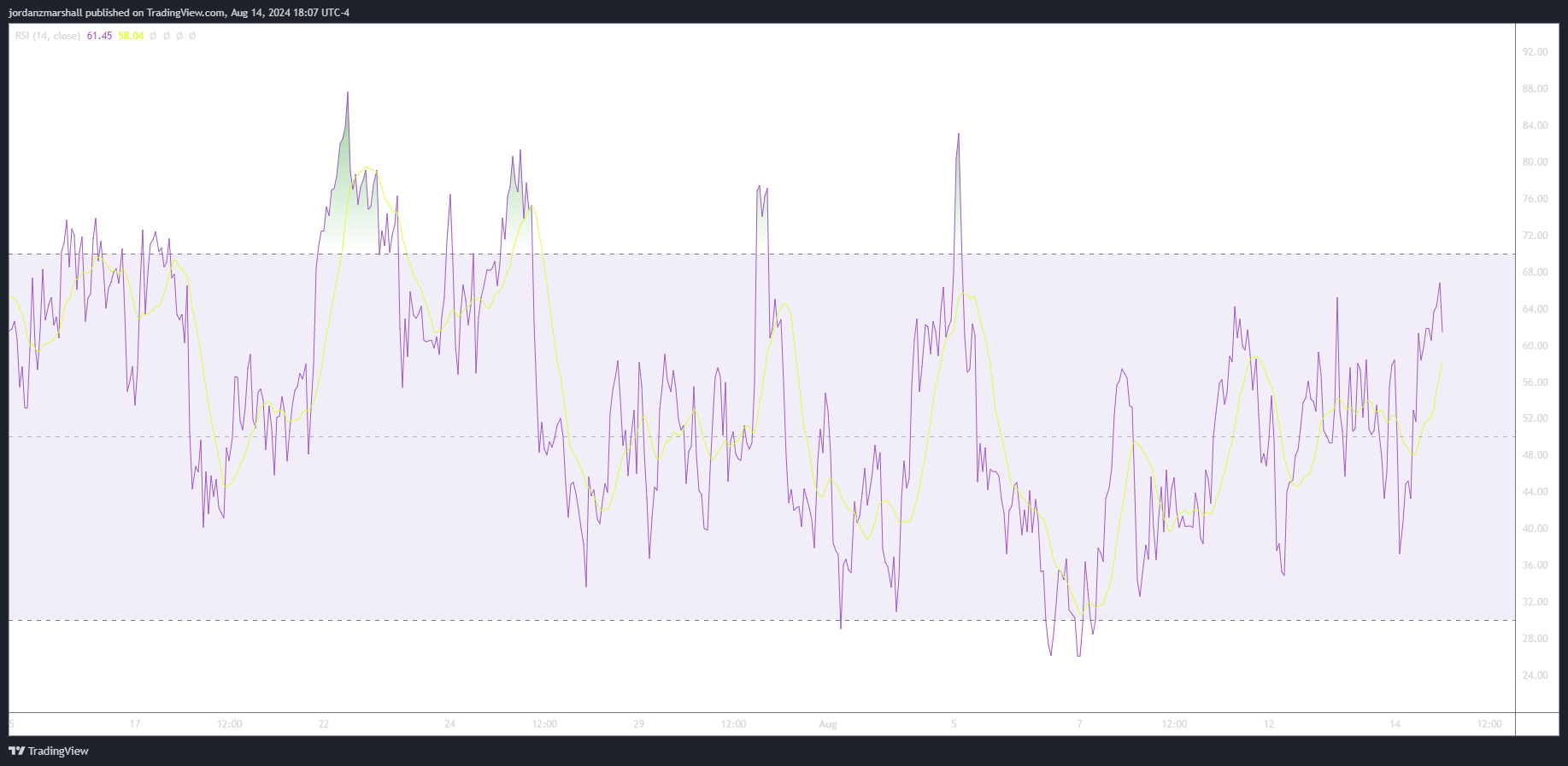

Using RSI to Identify Elliott Waves – Elliott Wave Basics

Read MoreIf you’re new to Elliott Wave, you may be asking: How do I tell if a wave is over when there’s so much price movement? One tool, in addition to trendlines, is to use Relative Strength Index (RSI). Relative Strength Index The relative strength index (RSI) is a momentum indicator used in technical analysis. RSI measures the […]

-

Trendline Basics – A Critical Market Tool

Read MoreWhy trendlines? One thing I’ve found through my past years as a trader and market analyst is the importance of using a trendline. These simple tools can really help make or break your trading, and often signal a larger move to come. I’ve met traders who ONLY use trendlines, and they have made massive profits […]

-

Short term SPY Price Prediction for the Days Ahead.

Read MoreRSI and Trendlines – SPY S&P500 shifted to new highs today, but how long will the trend last? As we can see, with price making new highs, RSI has made lower-highs. A possible sign of a impending short-term top. On this chart as well, I’ve drawn two trend lines to capture the recent upward movement […]

-

The Future of Copper and a Look Back – Trading Review

Read MoreCopper has been a hot commodity, only to fall rapidly. If we look at Copper ‘s price action history on the daily chart, there is a giant spike from the 3.57 to 5.19 area in just a few months. After that, HG (Copper Futures) has crashed back down to just 3.95 today shown here. What […]