-

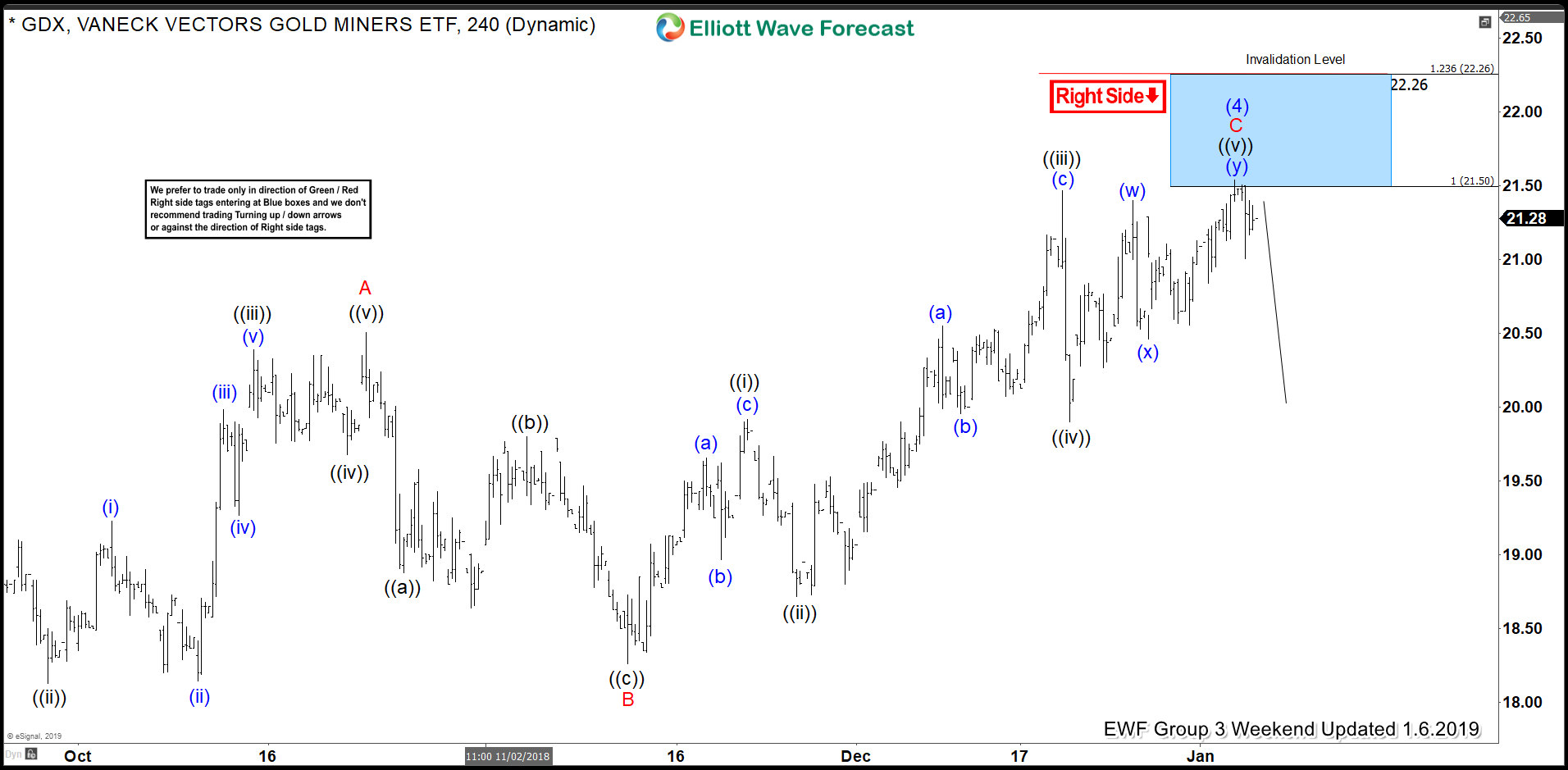

Near Term Projected Top in XAU/USD Confirms Short Setup for GDX

Read MoreNear Term Top XAU/USD Correlated to Short in GDX Subscribers of our Group 3 offerings at EWF know that we are intensively tracking the Elliott wave structure and cycle in GDX anticipating a top in the Vaneck Vectors Gold Miners ETF. Likewise our Group 1 Subscribers are aware we are simultaneously charting for a near […]

-

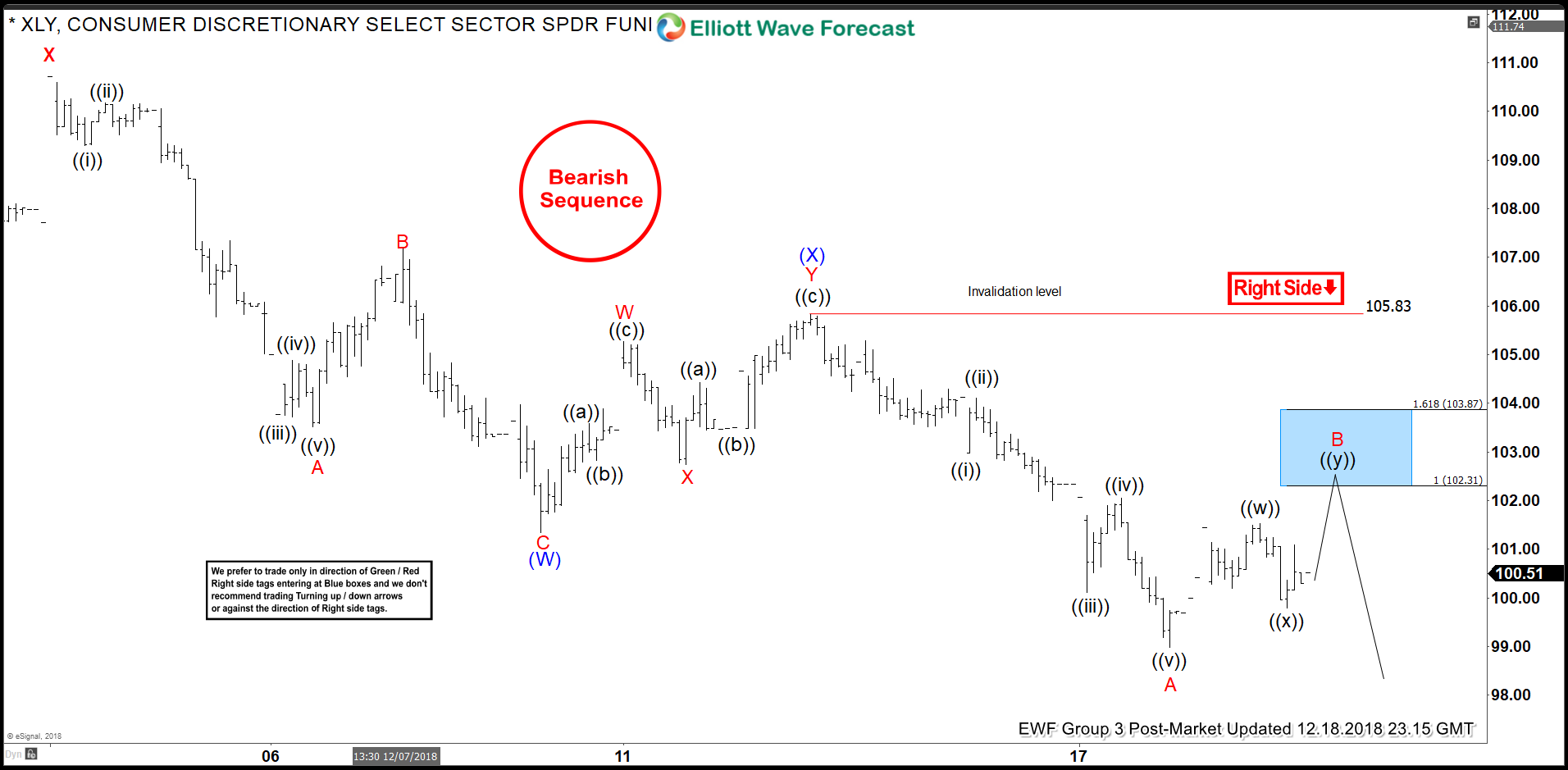

Elliottwave-Forecast.com Analysis Foretold the Reaction of XLY to FOMC Rate Decision

Read MoreTechnical based traders using EWF’s Blue Box System on 12/19/2018 executed a near perfect entry short in the Consumer Discretionary ETF – XLY before the FOMC rate decision. Prior to the actual trigger of the trade, Elliottwave-Forecast.com analysis showed our Group 3 Membership the ideal entry range. It is in these ranges of symmetrical extremes […]

-

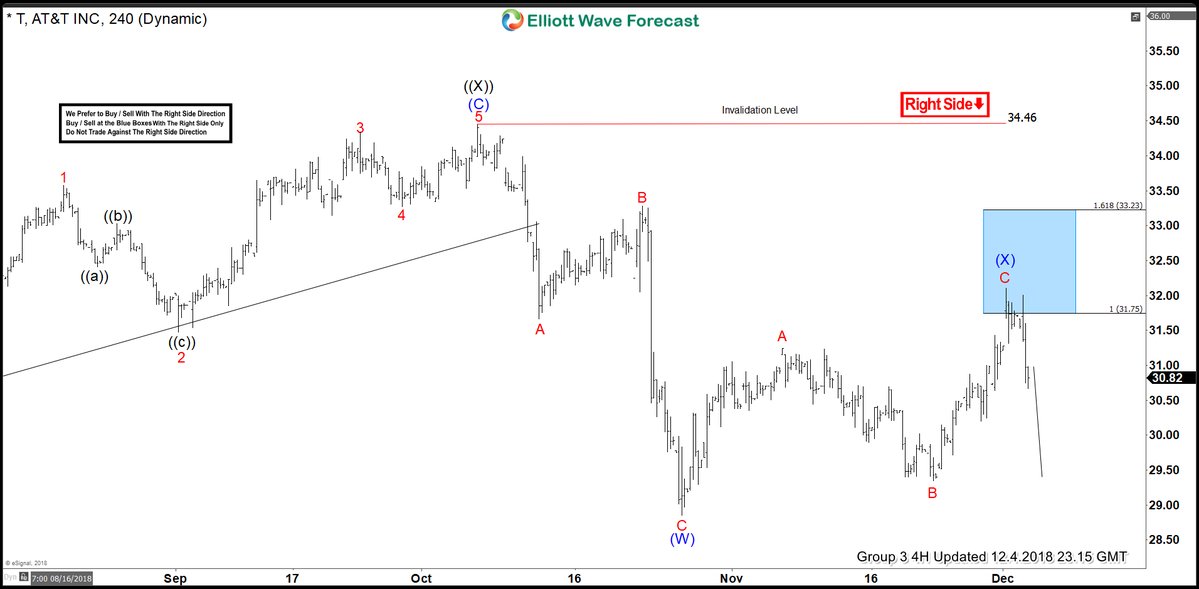

A Low Risk Trade In T Using Our Blue Box System

Read MoreIn this blog I want use the stock of AT&T (NYSE:T) to show you an outstanding example of our typical low risk trade setups using our Blue Box System. In our recent Group 3 Member Area updates we stated T to be Bearish on both the Daily and 4-Hour time frames. This cohesive directional call […]

-

An Industrial to Trade: Is BA a BUY Here?

Read MoreBA and the Trade Tensions Between China and Elliott wave As we all are well aware there are definitely heightened tensions on the global trading playing field these days. The markets have been whipping back in forth in exacerbated moves. Every hint or tweet about anything to do with trade, specifically, trade and China causes […]

-

XLY – Don’t Count the American Consumer Out Yet

Read MoreThe U.S. Consumer Measured Via the XLY “The U.S. economy is the global economic driver. And within the U.S. economy, the U.S. consumer is the global driver.” James P. Gorman We’re Entering In Negative Territory for 2018 The stock market (measured via the S&P 500 and Dow Jones Industrial Average) has officially erased all of […]

-

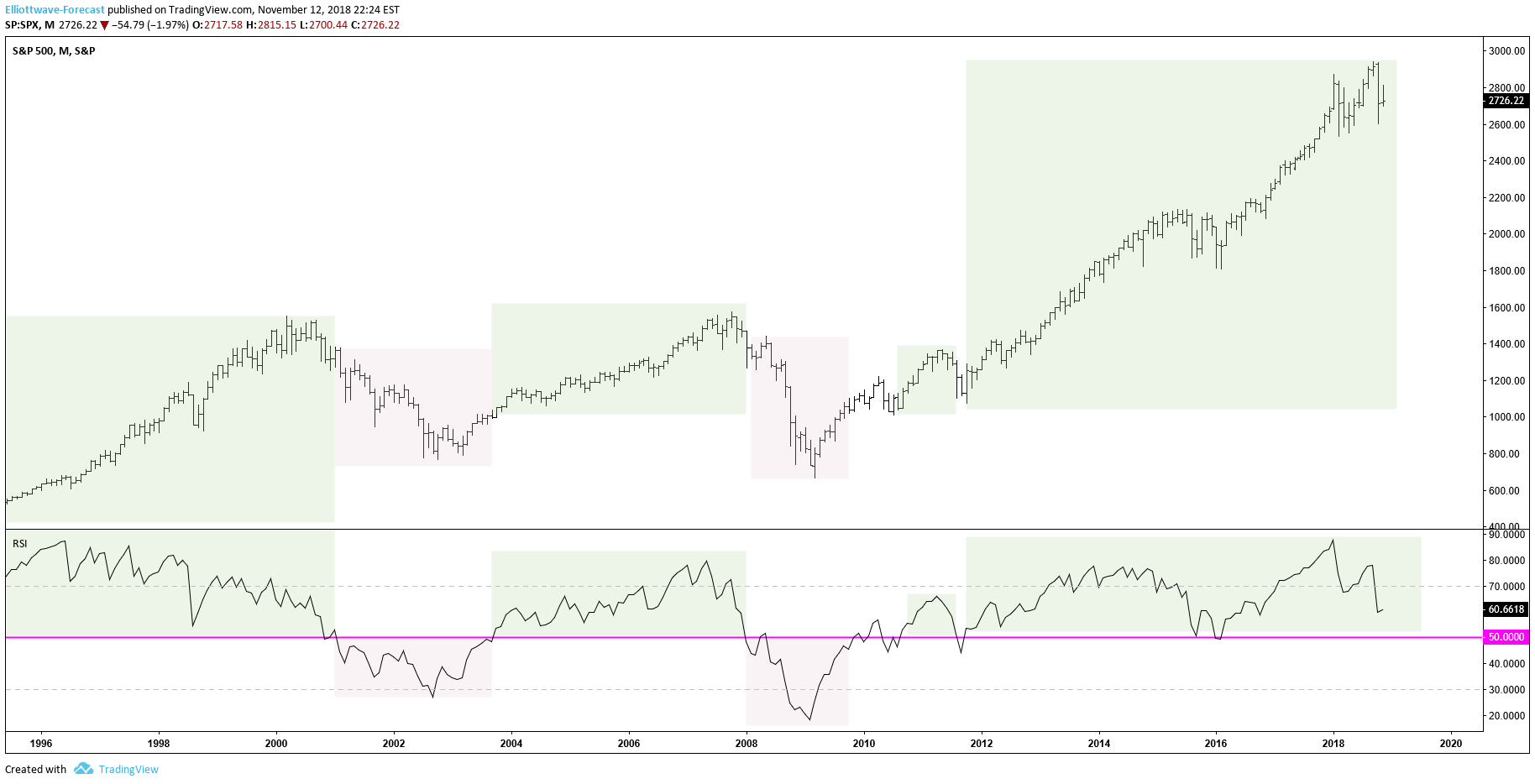

SPX RSI Analysis Suggests the Sky Isn’t Falling – Yet

Read MoreTo be kind, it’s been quite a challenging couple of months for the emotional health of all of us, including traders. There’s been state sponsored attempted cover-up of a murder that could threaten the geo-political environment depending upon what the strong hand of the U.S. considers toward a so called “ally”, world record lottery jackpots […]