-

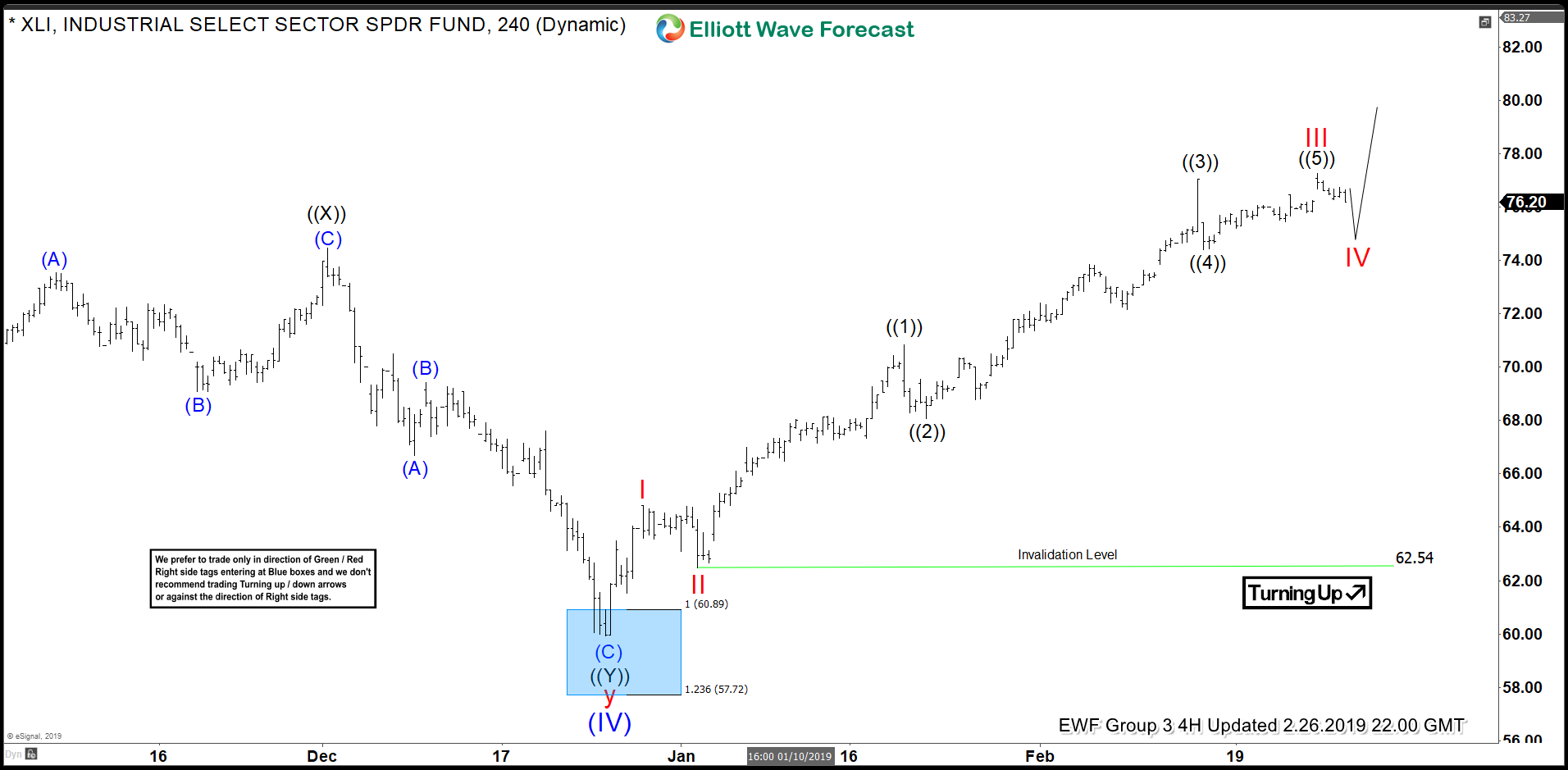

Industrial ETF XLI Set to Make New All-Time Highs

Read MoreXLI Set to Make New Highs The Industrial Sector ETF, XLI, is set to make new all-time highs above the January 2018 high at 80.96. From 80.96 Elliott wave analysis suggests XLI corrected lower on the daily chart in 7 swings to the 12/26/2018 low of 59.92. Within the final 3 waves of y (red […]

-

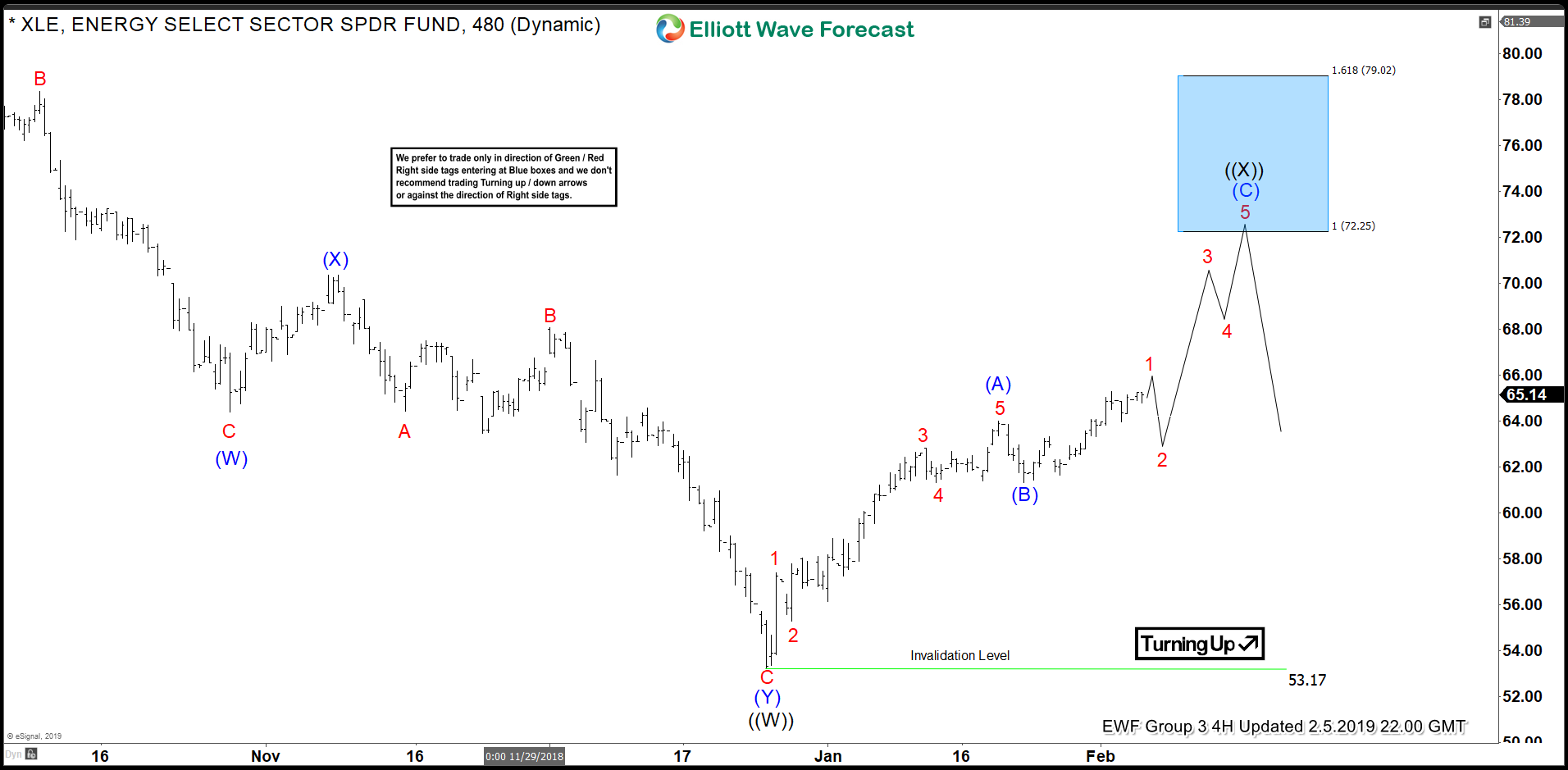

Energy Stocks of XLE Remain Bullish in the Near Term

Read MoreThe Energy Sector ETF, XLE, remains bullish in the near term. From the lows of $53.25 on 12/24/2018 we are charting a zigzag Elliott wave pattern. The target to the upside is $72.25 while the $61.30 low of 1/23/2019 holds. The Model of the Elliott Wave Pattern ZigZag patterns always subdivide into three waves. […]

-

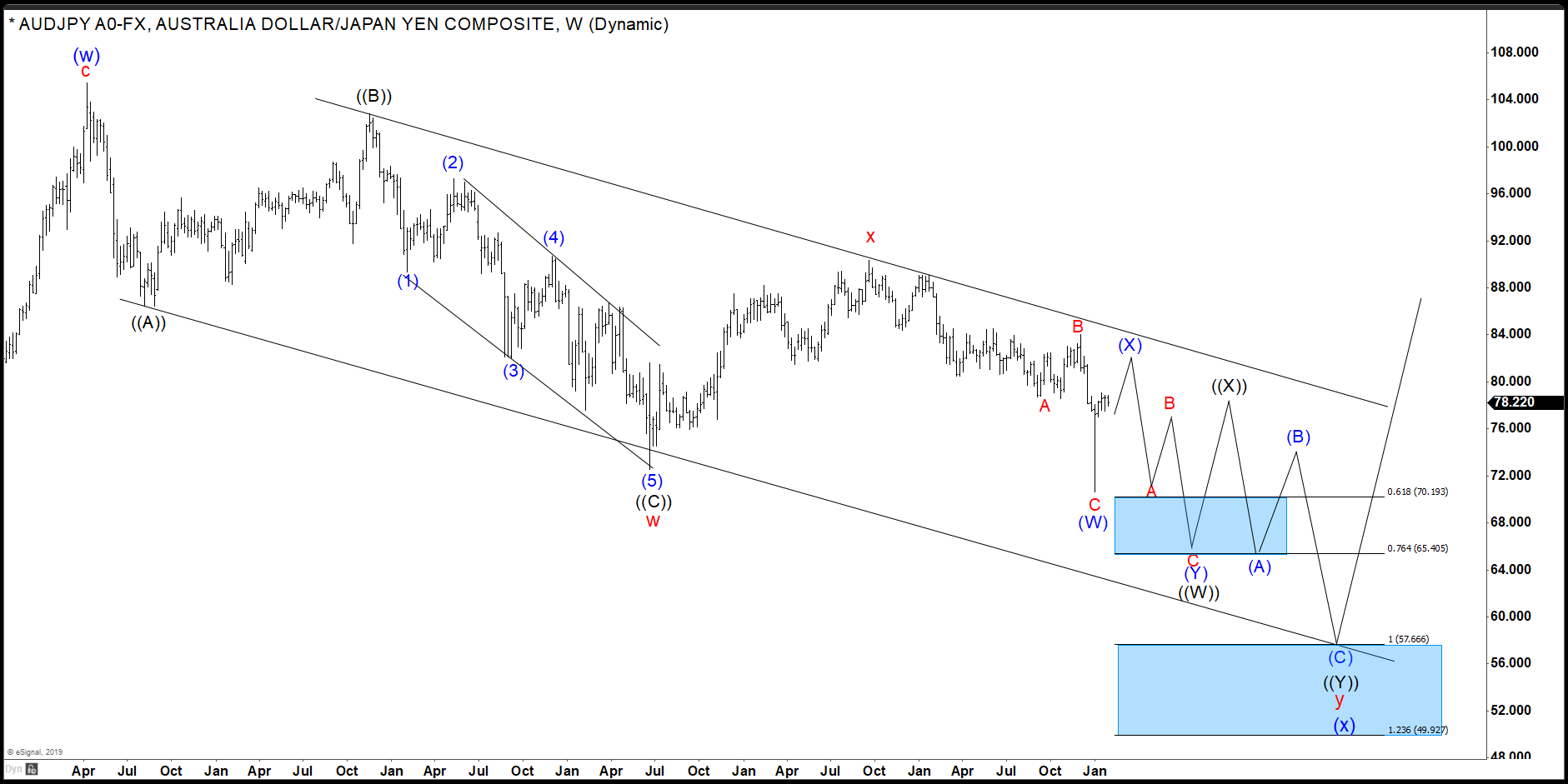

Yen Strength to Channel AUDJPY Lower

Read MoreOver the next few weeks Japanese Yen strength should drive prices of AUDJPY lower within a downward sloping channel. The current incomplete Elliott Wave structure also supports this expectation of further downside. In this article we’ll explore the basics of the current wave structure and its parallel channel. This combined analysis charts a great area […]

-

TSLA Leading Stocks Lower

Read MoreThe current price action and Elliott wave analysis suggest further declines for TSLA shares. Not even a full month into the new year TSLA shares have already seen 2 large declines. The first drop was blamed on a pricing adjustments for U.S. vehicles. The 2nd drop is being blamed over layoffs and unappealing guidance. Bearish […]

-

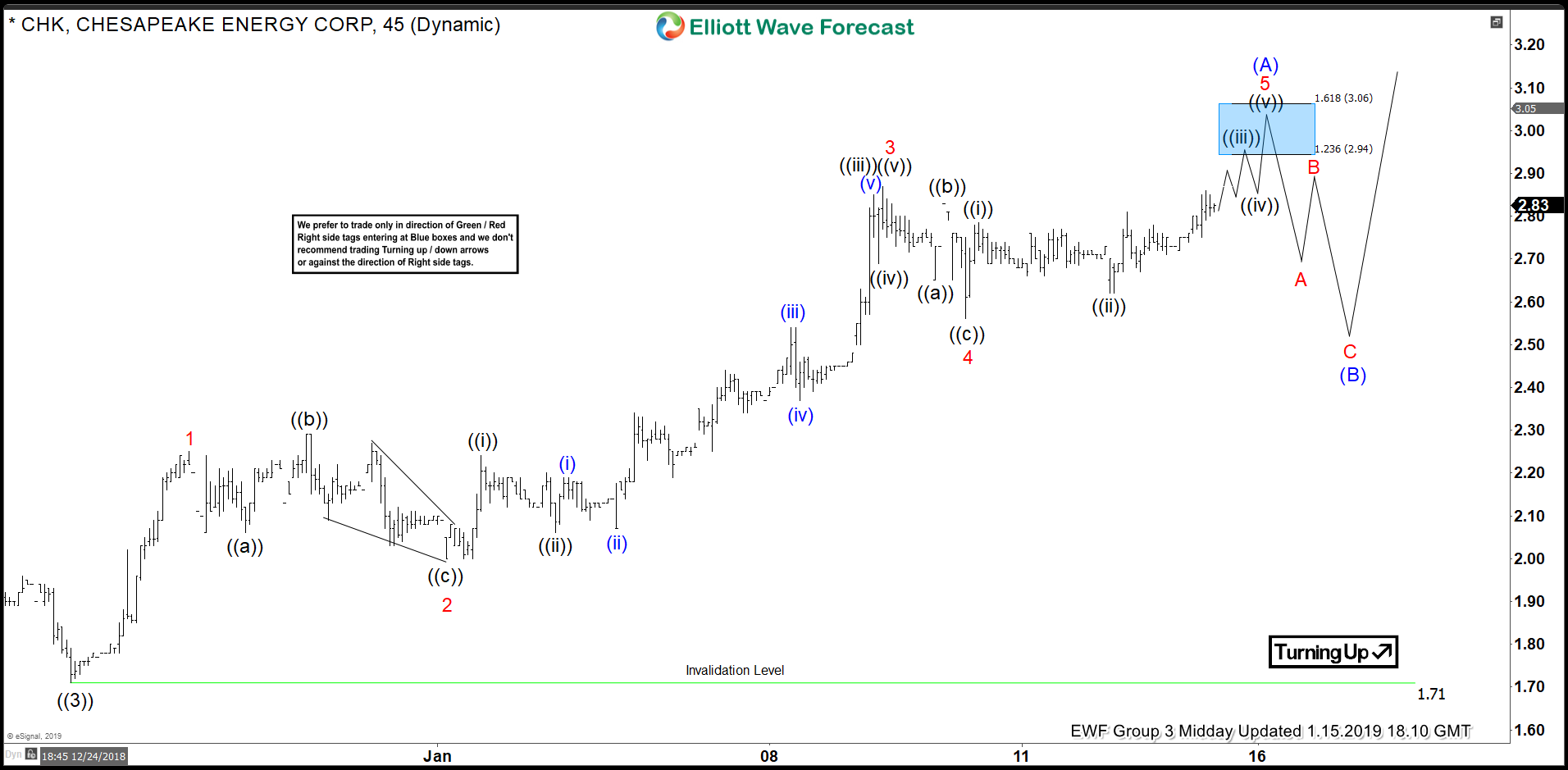

Elliott Wave Hedging Suggests More Upside in CHK

Read MoreChesapeake Energy Corp’s (NYSE: CHK) most recent price action suggests the stock may be poised for a comeback in 2019. Beaten down to prices not seen since 2016 CHK is now tracing out what appears to be an impulsive five swing Elliott wave sequence from $1.71. Elliott wave hedging strategies used by us here at […]

-

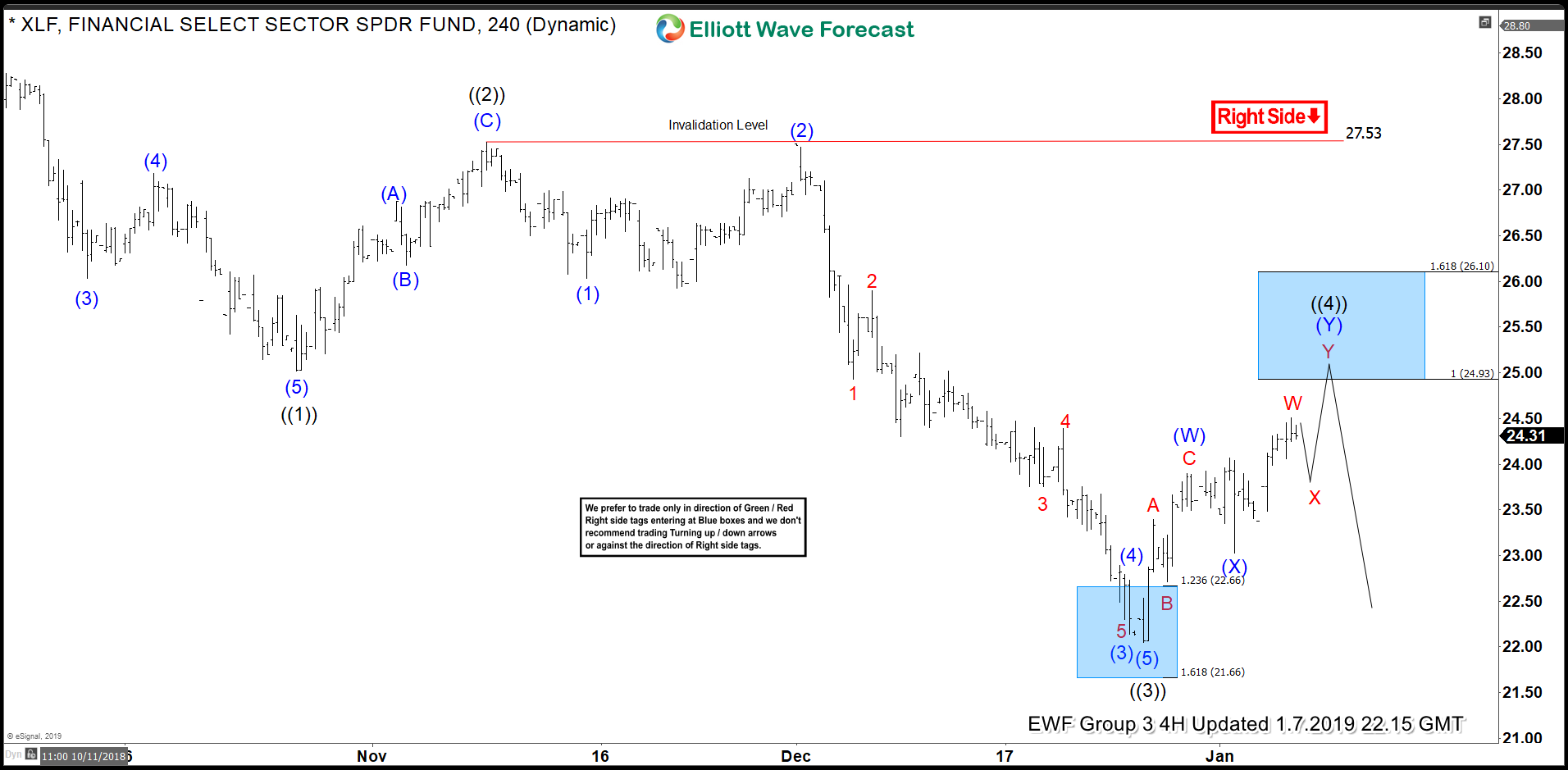

XLF Bearish Into Banking Stocks Earnings Releases

Read MoreThe major component stocks of XLF begin to report earnings for Q4 2018 the week of January 14th. This includes banking stocks such as C (reporting on 1/14/2019) and JPM (reporting on 1/15/2019). January 16th will see more banking stocks such as WFC, BAC, GS, and USB report. This brief explores the near-term price structure […]