-

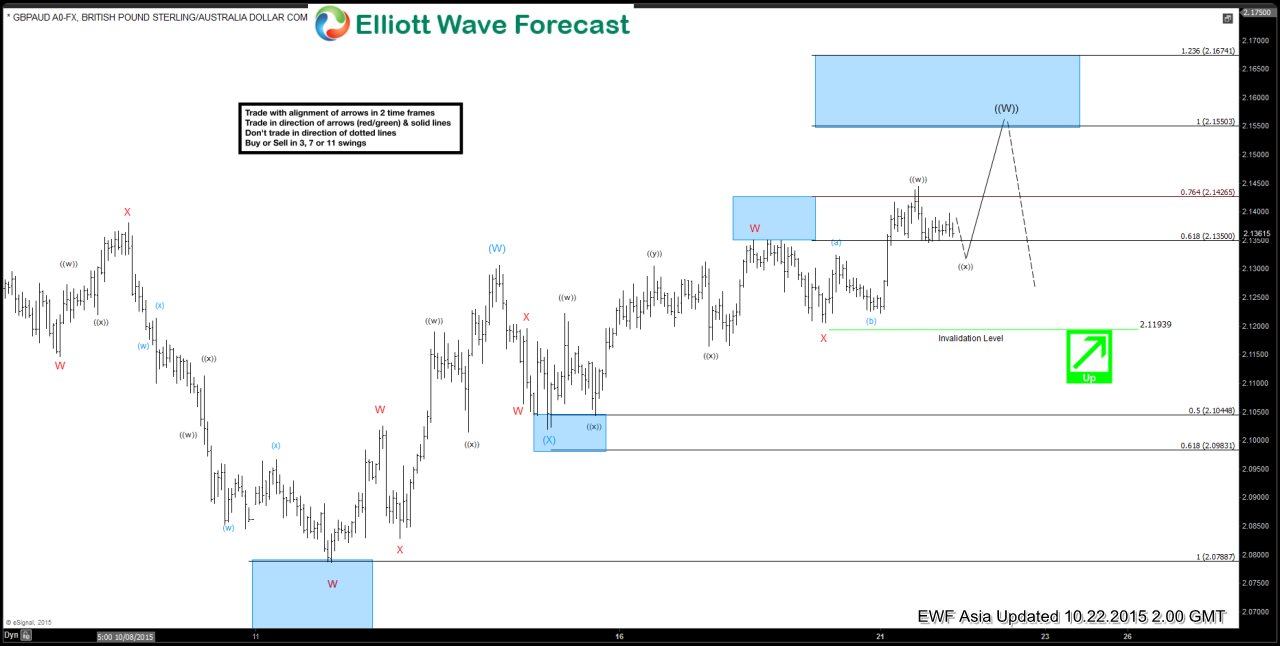

GBPAUD Short Term Elliott Wave Update 10.22.2015

Read MoreShort term Elliott wave view suggests decline to 2.078 ended wave W. From this level, pair is rallying higher in wave ((W)) in double three structure where wave (W) ended at 2.13, wave (X) ended at 2.102, and wave (Y) of ((W)) is in progress towards 2.155 – 2.167 equal leg area before turning lower. Near […]

-

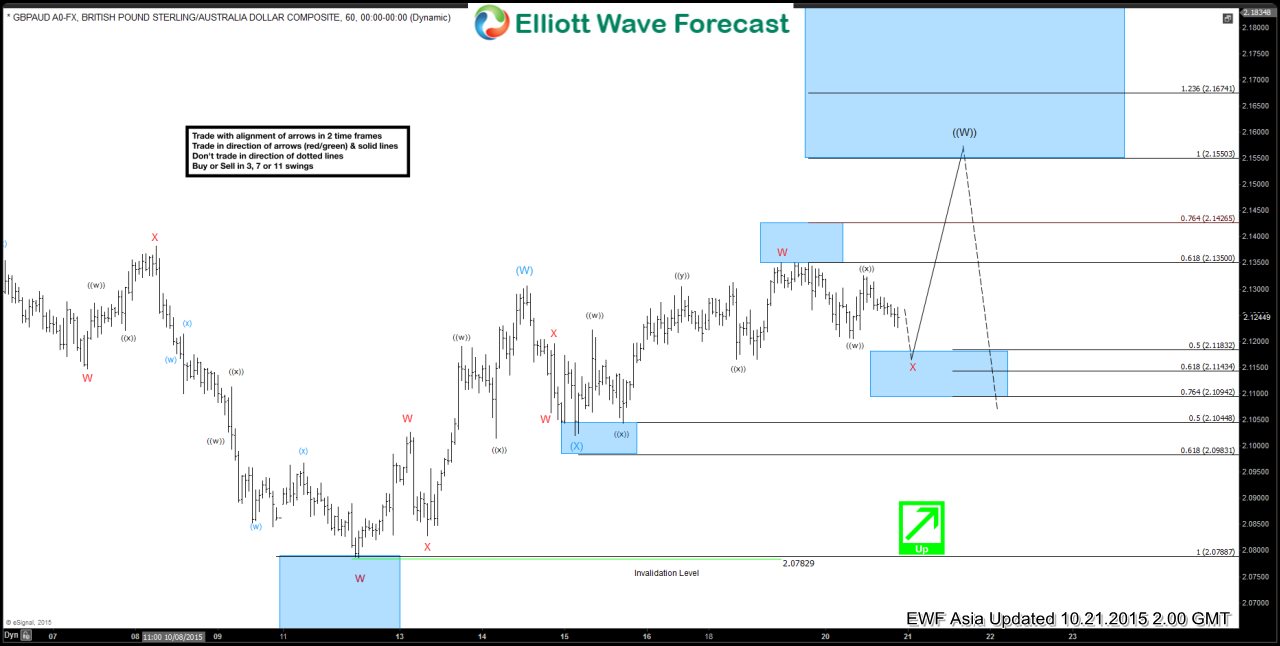

GBPAUD Short Term Elliott Wave Update 10.21.2015

Read MoreShort term Elliott wave view suggests decline to 2.078 ended wave W. From this level, pair is rallying higher in wave ((W)) in double three structure where wave (W) ended at 2.13, wave (X) ended at 2.102, and wave (Y) of ((W)) is in progress towards 2.155 – 2.167 equal leg area before turning lower. Near […]

-

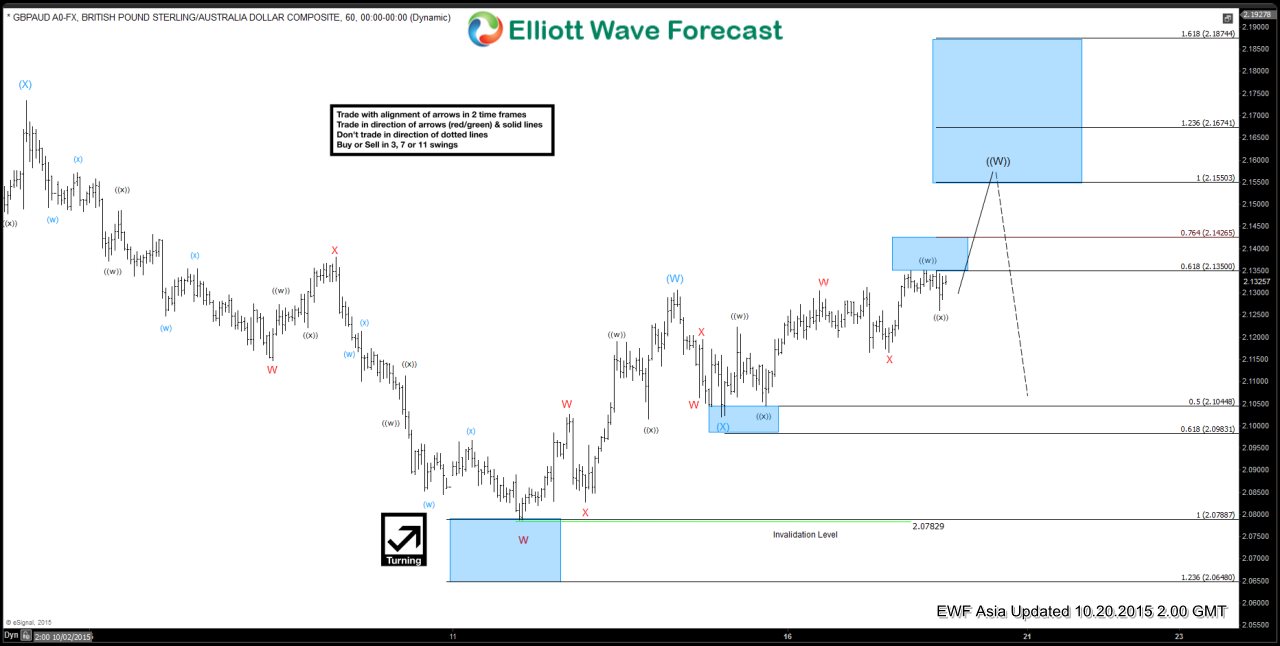

GBPAUD Short Term Elliott Wave Analysis 10.20.2015

Read MoreShort term Elliott wave view suggests decline to 2.078 ended wave W. From this level, pair is rallying higher in wave ((W)) in double three structure where wave (W) ended at 2.13, wave (X) ended at 2.102, and wave (Y) of ((W)) is in progress towards 2.155 – 2.167 equal leg area before turning lower. Near […]

-

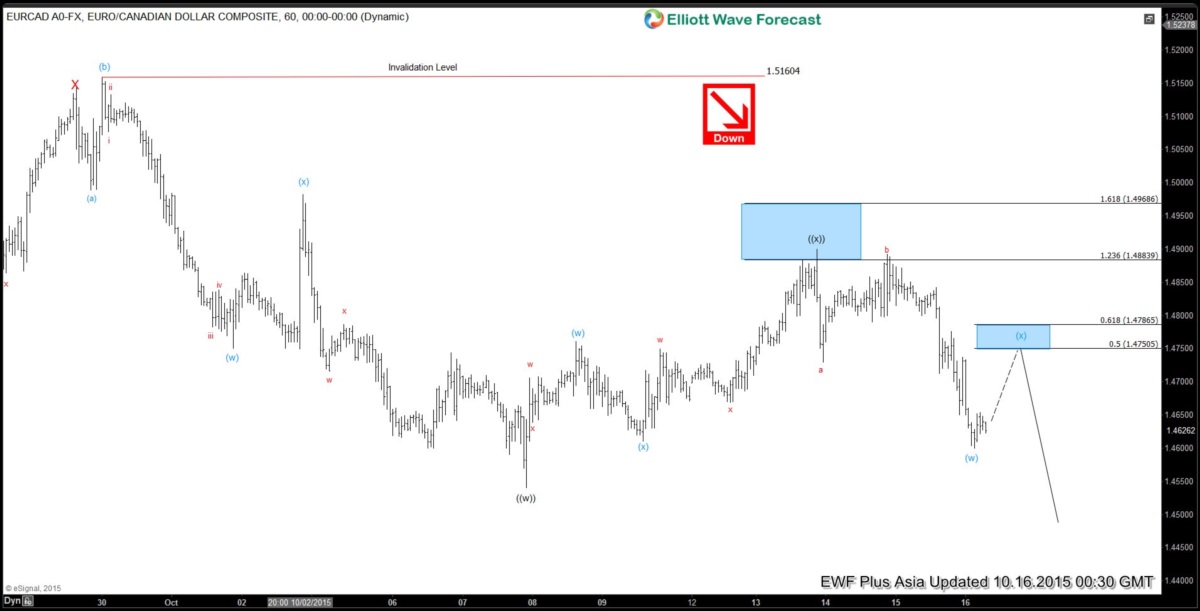

EURCAD Short Term Elliott Wave Update 10.16.2015

Read MoreBest reading of the cycle in the short term suggests decline to 1.454 ended wave ((w)). Wave ((x)) bounce is unfolding as a double three structure where wave (w) ended at 1.476, wave (x) ended at 1.461, and wave (y) of ((x)) is proposed complete at 1.49. Near term, wave (w) low is proposed complete at […]

-

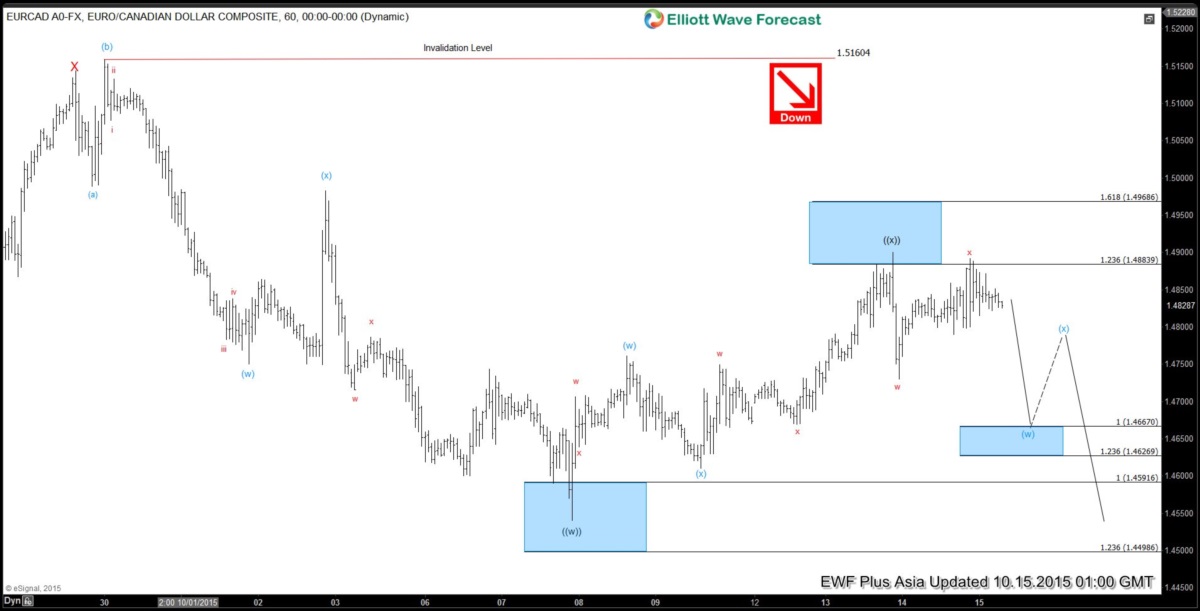

EURCAD Short Term Elliott Wave Update 10.15.2015

Read MoreBest reading of the cycle in the short term suggests decline to 1.454 ended wave ((w)). Wave ((x)) bounce is unfolding as a double three structure where wave (w) ended at 1.476, wave (x) ended at 1.461, and wave (y) of ((x)) is proposed complete at 1.49. While below 1.49, or more importantly as far as […]

-

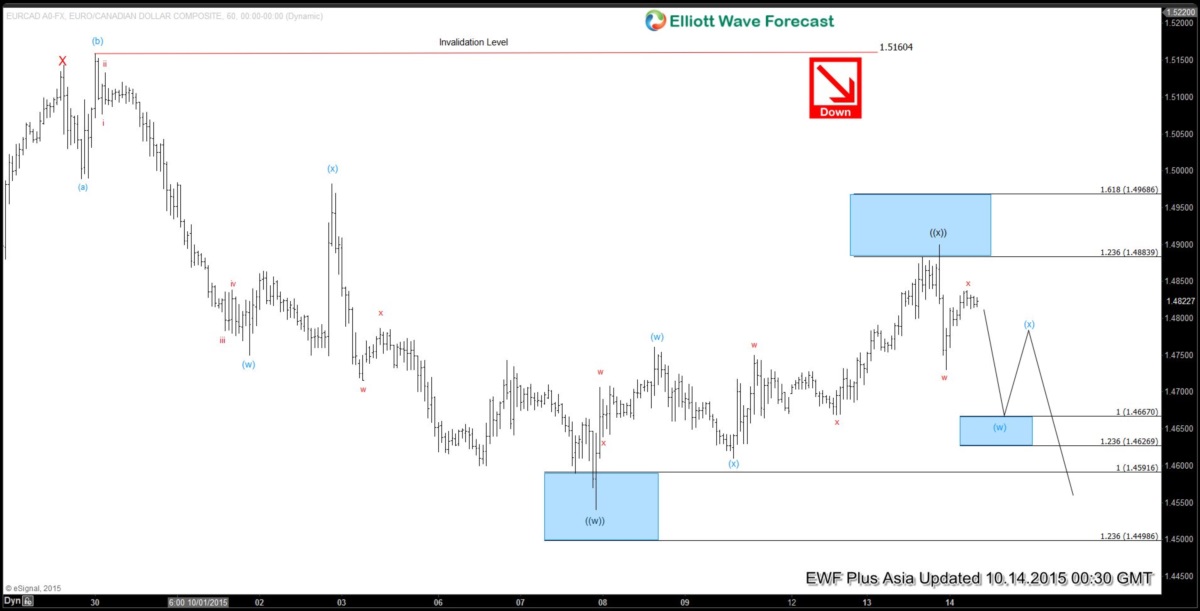

EURCAD Short Term Elliott Wave Update 10.14.2015

Read MoreBest reading of the cycle in the short term suggests decline to 1.454 ended wave ((w)). Wave ((x)) bounce is unfolding as a double three structure where wave (w) ended at 1.476, wave (x) ended at 1.461, and wave (y) of ((x)) is proposed complete at 1.49. While below 1.49, or more importantly as far as […]