-

$USDPLN Elliottwave Analysis 6.15.2016

Read MoreWhile pair stays above wave W at 3.7056, it has scope to extend higher towards 4.068 – 4.134 area to complete wave X and end cycle from 4/1 low. Then pair should resume weekly decline as far as 4.158 pivot stays intact. If pair doesn’t make a new high and pivot at 3.7056 fails, then it has started the […]

-

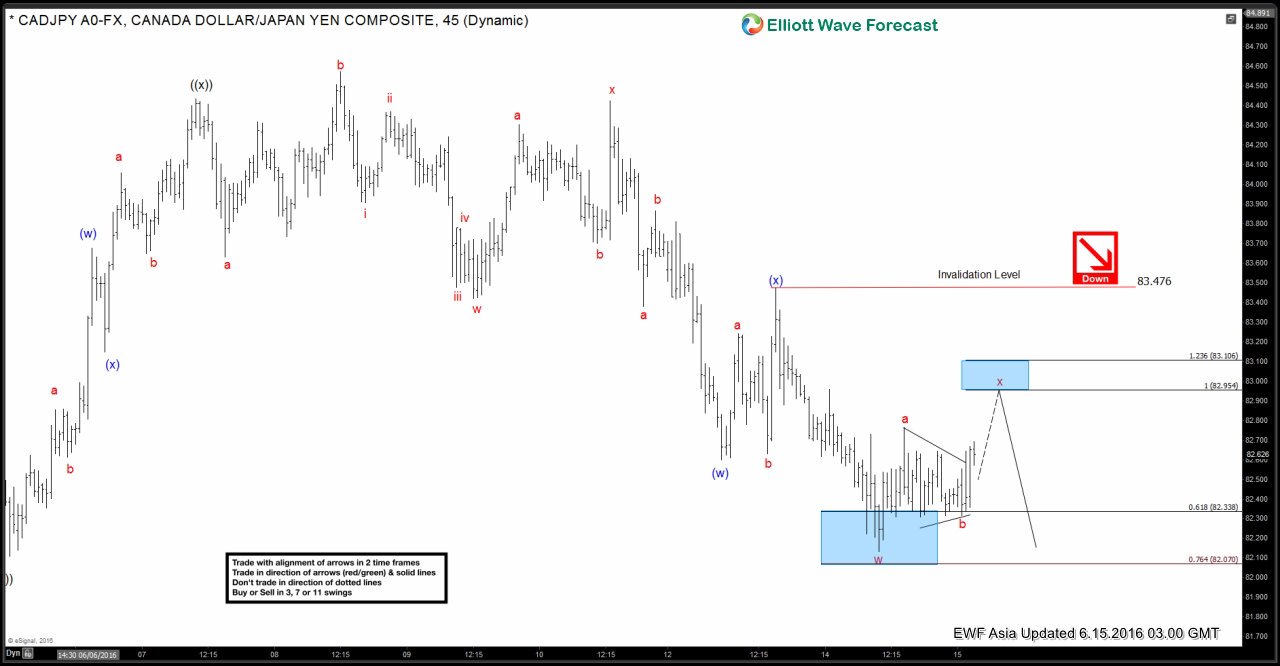

$CADJPY Short-term Elliott Wave Analysis 6.15.2016

Read MoreShort Term Elliottwave structure suggests that rally to 84.43 ended wave ((x)). Decline from there is unfolding as a double three where wave (w) ended at 82.6 and wave (x) ended at 83.47. Wave (y) is in progress as a double three where wave “w” is proposed complete at 82.13 and wave “x” bounce is expected […]

-

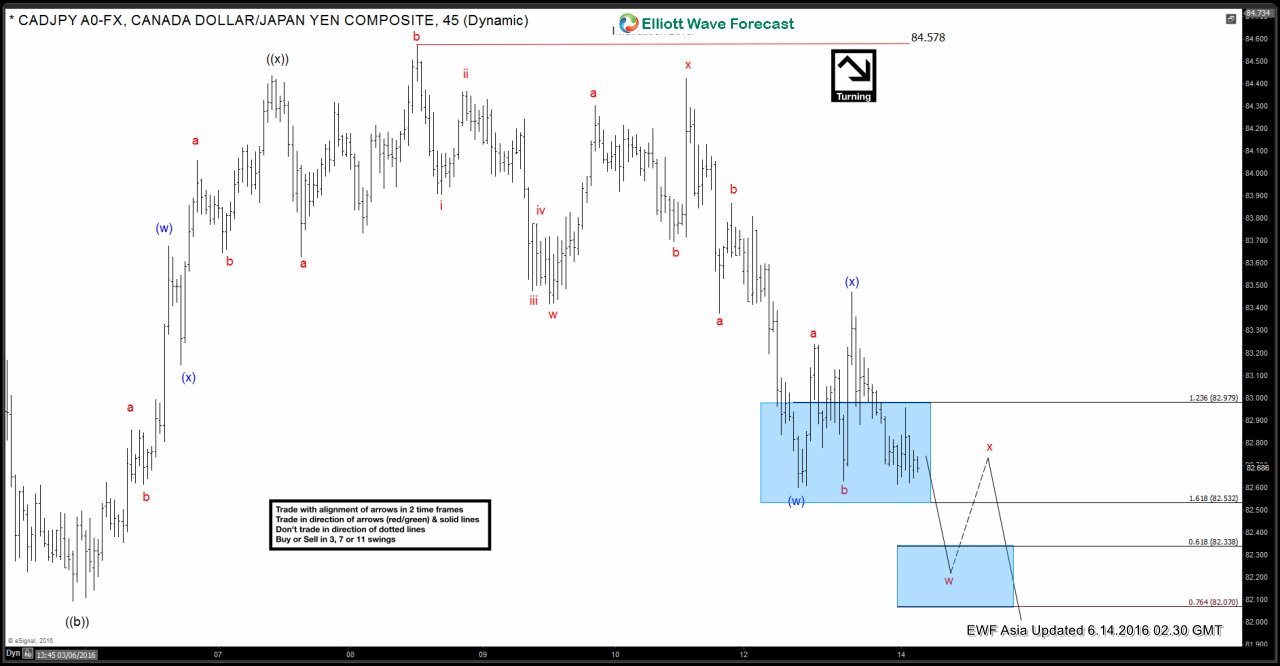

$CADJPY Short-term Elliott Wave Analysis 6.14.2016

Read MoreShort Term Elliottwave structure suggests that rally to 84.43 ended wave ((x)). Decline from there is unfolding as a double three where wave (w) ended at 82.6 and wave (x) ended at 83.47. Near term focus is on 82.07 – 82.33 area to complete wave “w”, then it should bounce in wave “x” to correct the […]

-

Dow Jones Real Estate $DJUSRE Elliottwave Analysis 6.11.2016

Read MoreIn this video, we will take a look at the Dow Jones U.S. Real Estate Index ($DJUSRE). This analysis is useful if you are a real estate investor and looking to buy houses in the U.S. $DJUSRE is following the same cycle and sequences of Dow Jones Index and other global Indices. The Index has […]

-

NZDCAD Short Term Elliottwave Analysis 6.10.2016

Read MoreWhile pair stays above wave ((b)) low at 0.884, it has scope to extend another towards 0.9154 – 0.9228 area to end at least cycle from 5/26 now and likely also from 4/28 low. Afterwards, pair should at least pullback in 3 waves. For more trading ideas and education, feel free to browse other technical articles at our Technical Blogs, check Chart of The […]

-

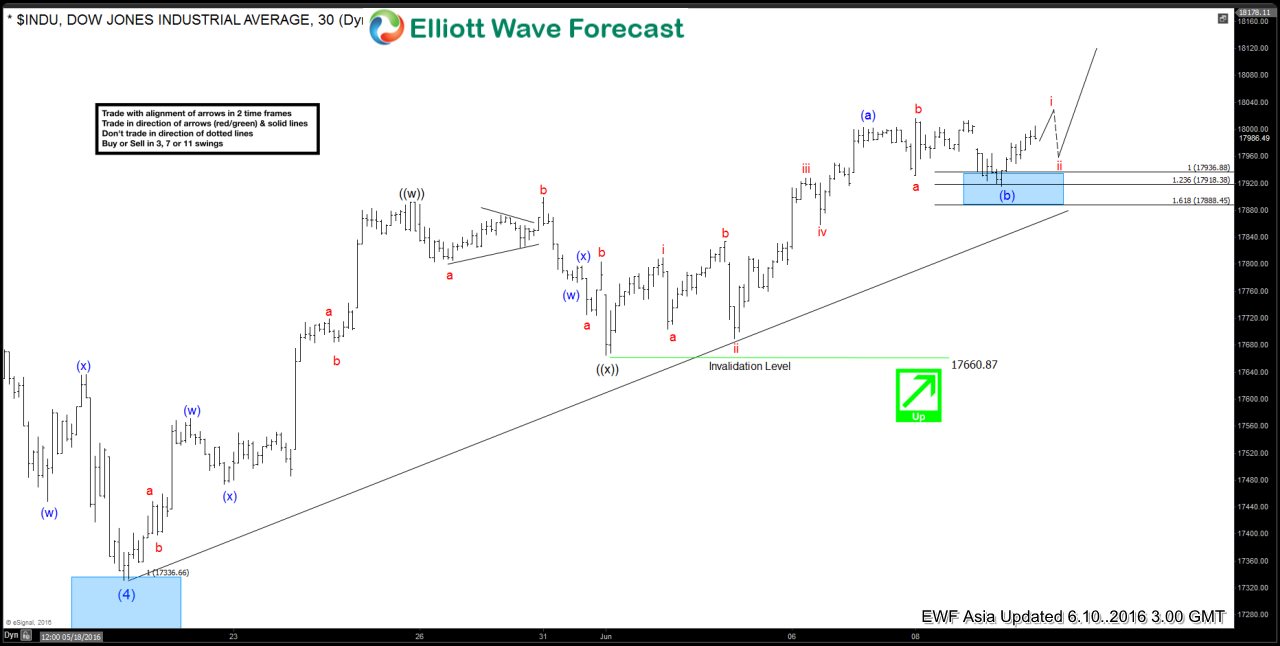

Dow Jones $DJIA Short-term Elliott Wave Analysis 6.10.2016

Read MoreShort Term Elliottwave structure suggests that dip to 17331.07 ended wave (4). Rally from there is unfolding as a double three where wave ((w)) ended at 17891.6 and wave ((x)) ended at 17660.87. Internal of wave ((y)) is unfolding as a zigzag where wave (a) ended at 18003 and wave (b) is proposed complete at 17915. A break […]