-

USDPLN Elliottwave Analysis 6.24.2016

Read MoreThe pair spiked higher and now is showing a complete 7 swing sequence from 4/1 low. It has since pulled back again and still stay below the broken trend channel from June 2014 low. As far as pair stays below 1/27 peak at 4.158, pair can resume lower. For more trading ideas and education, feel free to […]

-

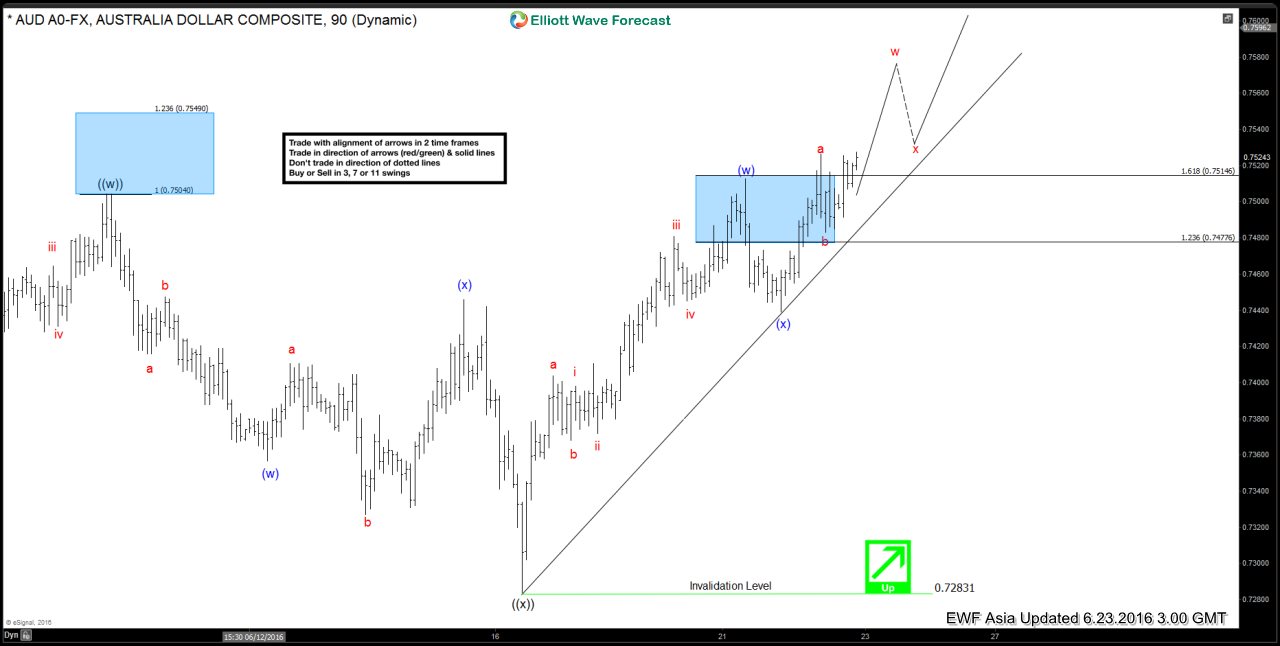

$AUDUSD Short-term Elliott Wave Analysis 6.23.2016

Read MoreShort term Elliottwave structure suggests rally to 0.7504 ended wave ((w)), and pullback to 0.7283 ended wave ((x)). From 0.7283 low, pair ended wave (w) higher at 0.7512, and we take the more aggressive view and call wave (x) pullback completed at 0.7439 as pair has since broken above 0.7512 again. While pair now stays above wave (x) […]

-

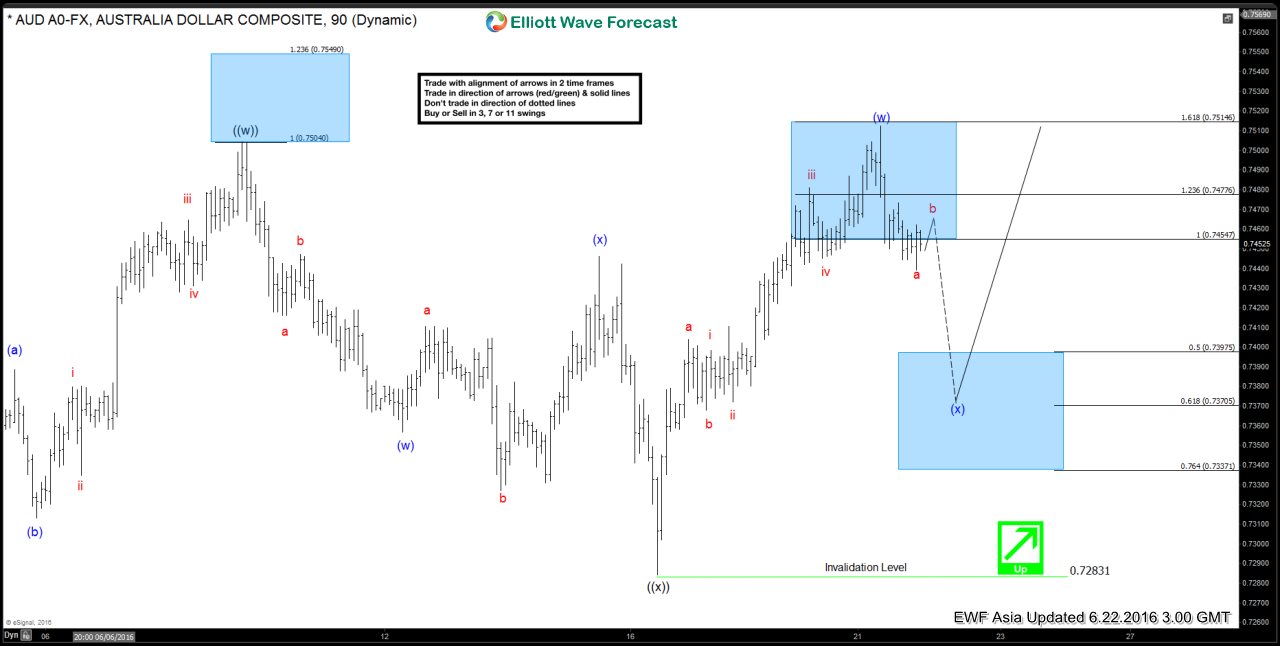

$AUDUSD Short-term Elliott Wave Analysis 6.22.2016

Read MoreShort term Elliottwave structure suggests rally to 0.7504 ended wave ((w)), and pullback to 0.7283 ended wave ((x)). As pair already breaks above 0.7504, it has resumed the next leg higher in wave ((y)). Internal of wave ((y)) is unfolding in a double three where wave (w) is proposed over at 0.7512, and wave (x) is currently in progress […]

-

$TNX Short-term Elliott Wave Analysis 6.21.2016

Read MoreShort term Elliottwave structure suggests that cycle from 3/16 peak, i.e. 2.00, has ended with wave W at 1.518. Rally from there is unfolding as a double three where wave (w) ended at 1.62 and wave (x) pullback ended at 1.604. Near term focus is on 1.706 – 1.73 area to complete wave (y) of ((w)) and end cycle […]

-

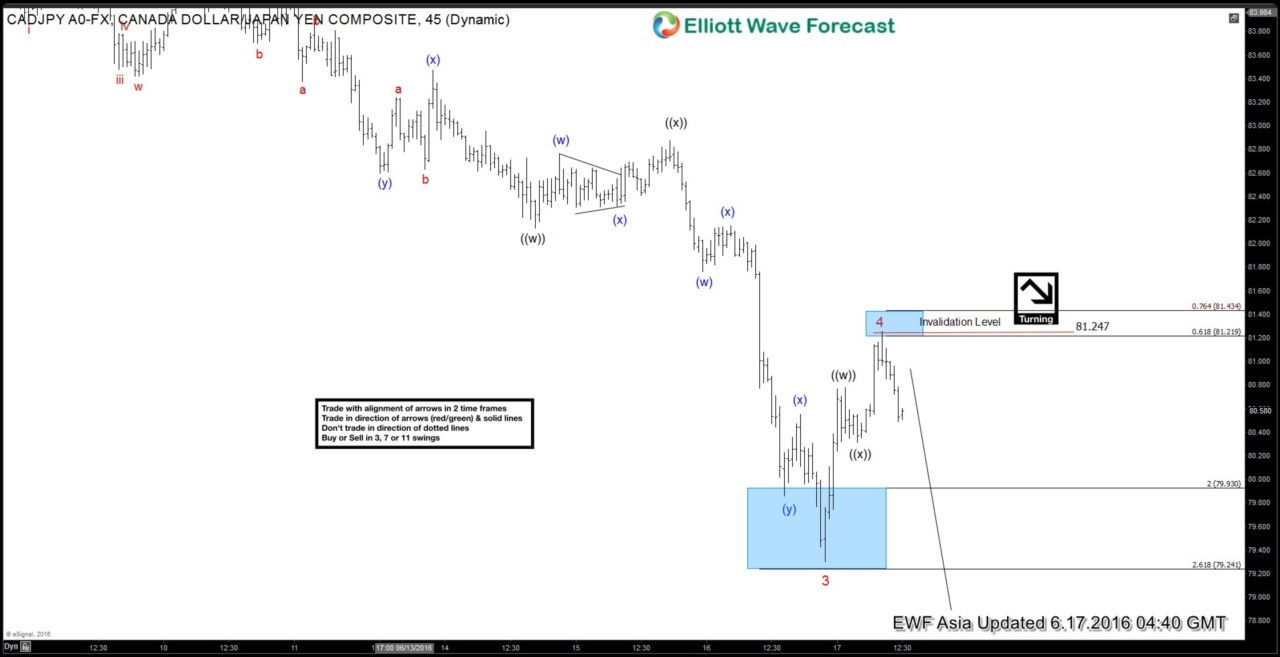

$CADJPY Short-term Elliott Wave Analysis 6.17.2016

Read MoreShort term Elliottwave structure suggests cycle from 5/12 peak (85.48) is unfolding as a flat where wave A ended at 82.88 and wave B ended at 85.51. Wave C is in progress as 5 waves where wave 1 of C ended at 82.65, wave 2 of C ended at 84.57, wave 3 of C ended at 79.3 and wave 4 of C […]

-

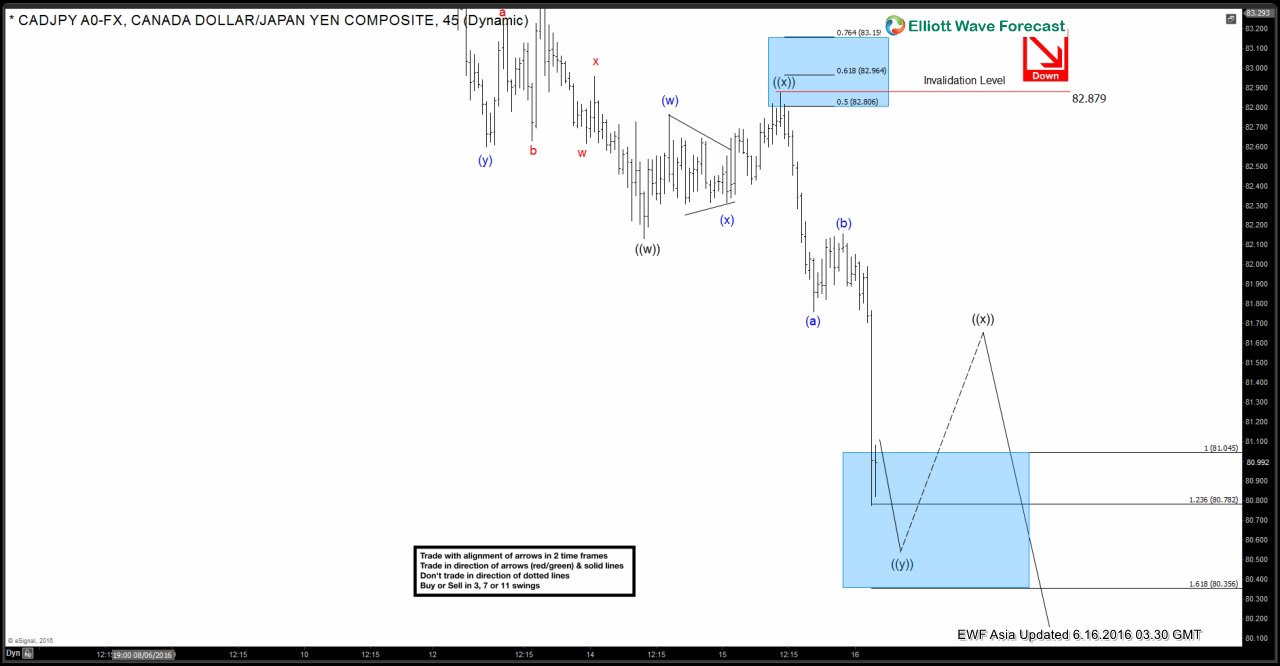

$CADJPY Short-term Elliott Wave Analysis 6.16.2016

Read MoreShort term Elliottwave structure suggests cycle from 6/8 peak (85.57) is unfolding as a triple three where wave ((w)) ended at 82.59 and wave ((x)) ended at 83.47. Wave ((y)) is in progress as a zigzag where wave (a) ended at 82.13 and wave (b) ended at 82.87. Wave (c) of ((y)) decline from there is currently in progress […]