-

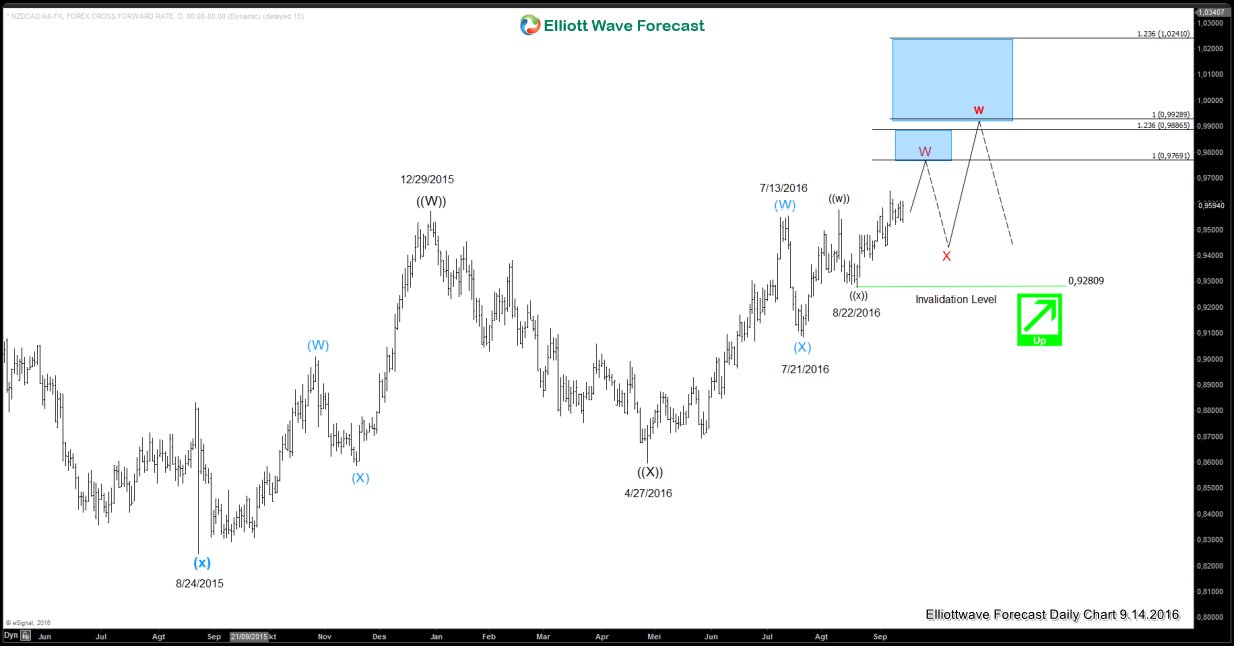

$NZDCAD may extend higher

Read More$NZDCAD Daily chart is showing that the instrument has broken above ((W)) peak on 12/29/2015 at 0.9573, suggesting that further upside is favored. From 8/24/2015 low, the instrument is showing a 7 swing sequence but the 7th swing has not reached the target at 1.005 – 1.0276 area. Furthermore, rally from 8/19/2016 low is showing what looks to be a […]

-

$USDJPY Short-term Elliott Wave Analysis 9.15.2016

Read MoreShort term Elliott wave count suggests that rally to 104.33 ended wave W. Decline from there is unfolding as a double three where wave ((w)) ended at 101.18 and wave ((x)) ended at 103.35. Short term, while bounces stay below 103.35, and more importantly below 104.33, expect more downside towards 100.94 – 101.4 area initially, followed by 99.47 […]

-

Wheat $ZW_F Short-term Elliott Wave Analysis 9.13.2016

Read MoreShort term Elliott wave count suggests that decline to 386.6 ended wave ((w)). Rally from there is unfolding as a double three where wave (w) ended at 406.6 and wave (x) pullback ended at 396.6. Short term, while pullbacks stay above 402.6, and more importantly above 396.6, expect more upside towards 416.5 – 421.3 area to complete wave ((x)) […]

-

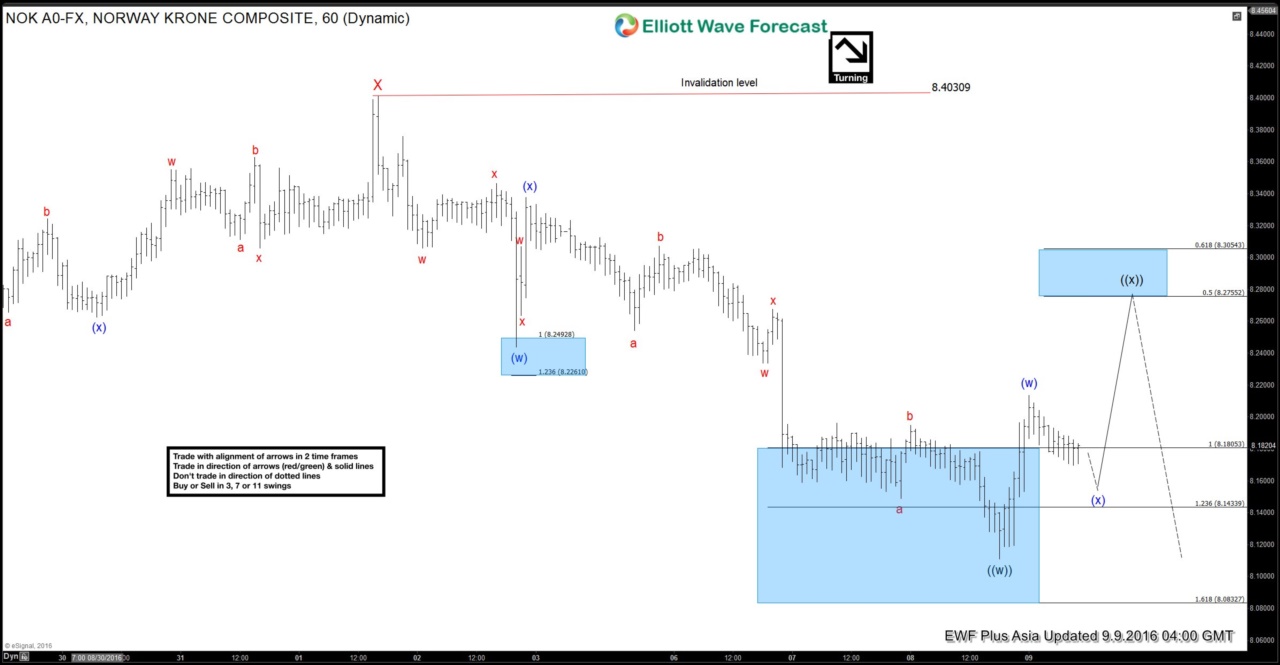

$USDNOK Short-term Elliott Wave Analysis 9.9.2016

Read MoreShort term Elliott wave count suggests that rally to to 8.403 ended wave X. Decline from there is unfolding as a double three where wave ((w)) ended at 8.11 and wave ((x)) bounce is in progress towards 8.275 – 8.305 area to correct the decline from 9/1 peak (8.403). As far as 9/1 pivot at 8.403 stays intact […]

-

$EURJPY Live Trading Room Setup from 9/6

Read MoreWe issued a scalping short order for $EURJPY at market on Sep 6 Live Trading Room. We took profit on Sep 7 for a +95 pips profit. Each day in Live Trading Room, members attending the session will receive a similar trading journal like the one below The short clip below from our Live Trading Room on September 6 provides the setup for $EURJPY short trade. We have […]

-

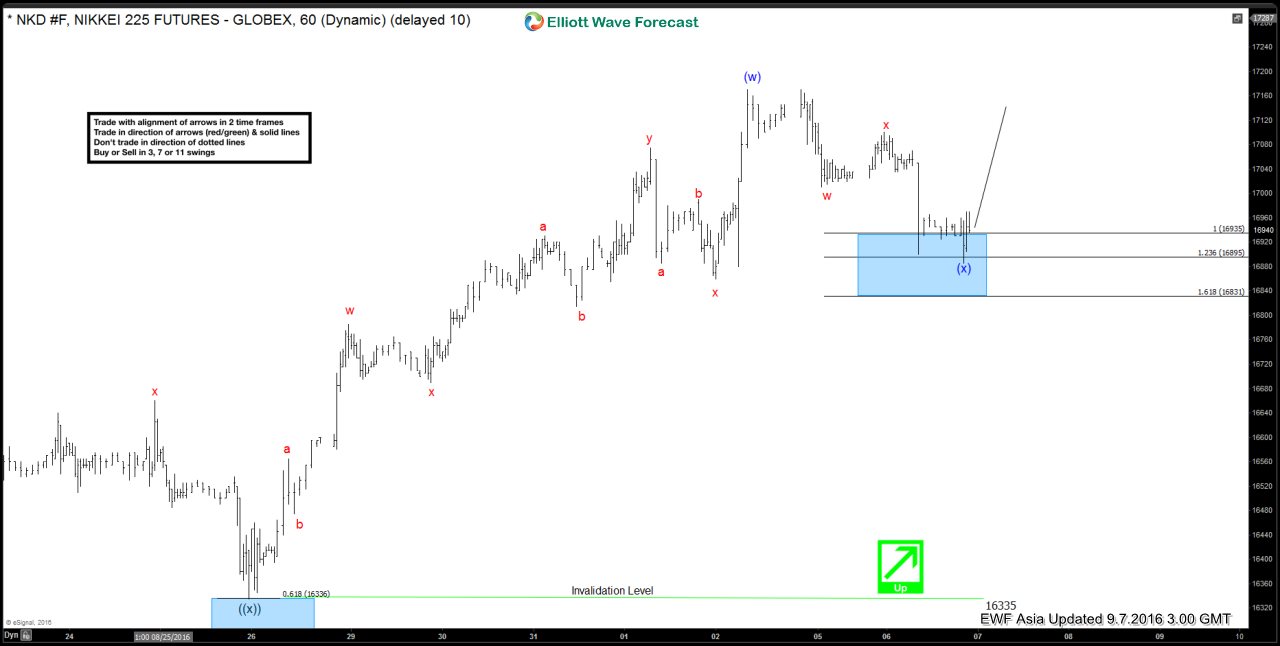

Nikkei $NKD_F Short-term Elliott Wave Analysis 9.7.2016

Read MoreShort term Elliott wave count suggests that decline to 16335 ended wave ((x)). Rally from there is unfolding as a double three where wave (w) ended at 17170 and wave (x) pullback is proposed complete at 16885. While Index remains above 16885, and more importantly as far as wave ((x)) pivot at 16335 stays intact, expect more upside in […]