-

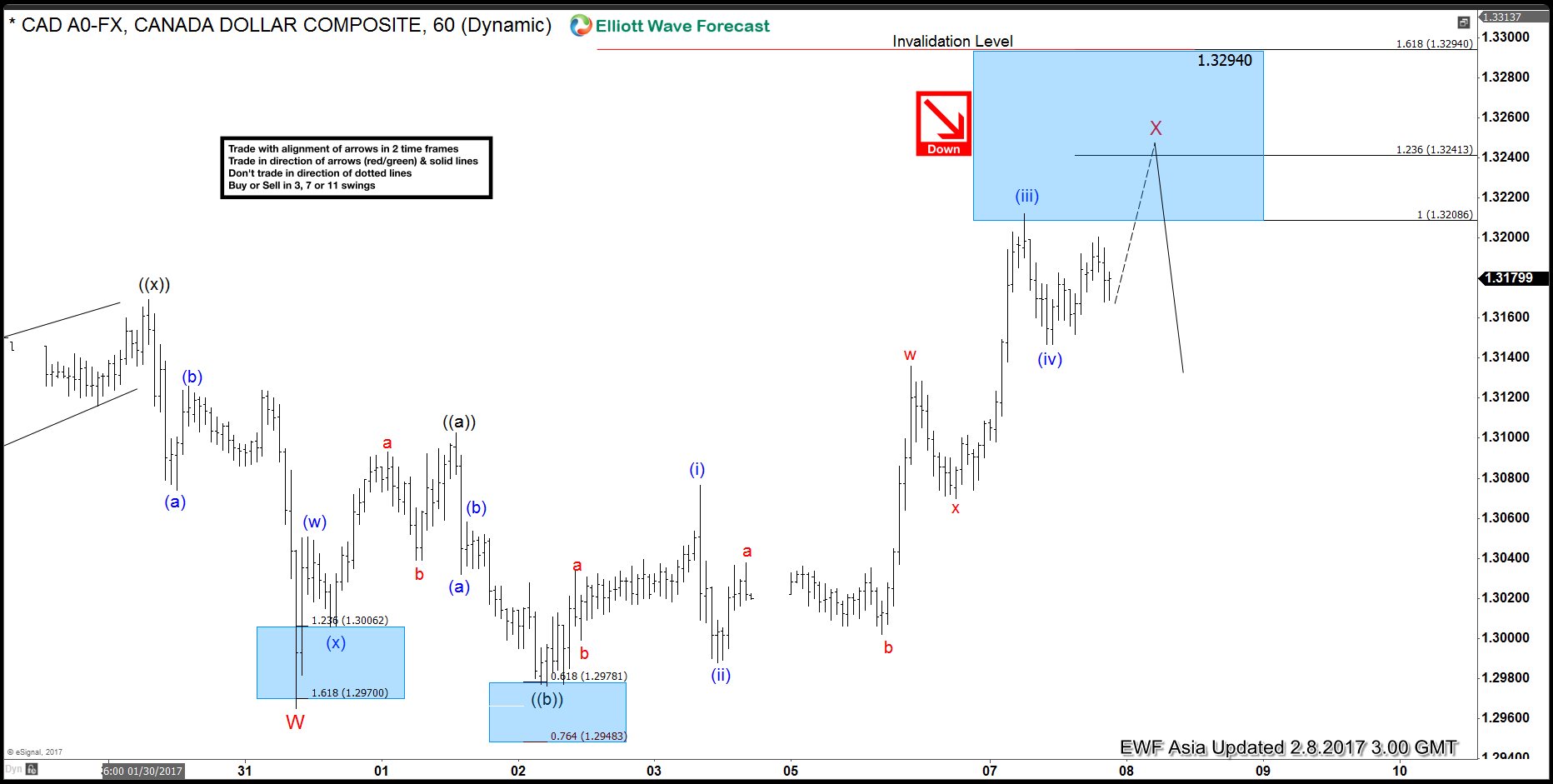

USDCAD: Expect turn lower soon

Read MorePreferred Elliott wave view in USDCAD suggests that the pair is showing a 5 swing bearish sequence from 12/28 high, favoring more downside. Short term, decline to 1.2965 ended Minor wave W and Minor wave X bounce is unfolding as a flat where Minute wave ((a)) ended at 1.3102, and Minute wave ((b)) ended at 1.2976. Minute […]

-

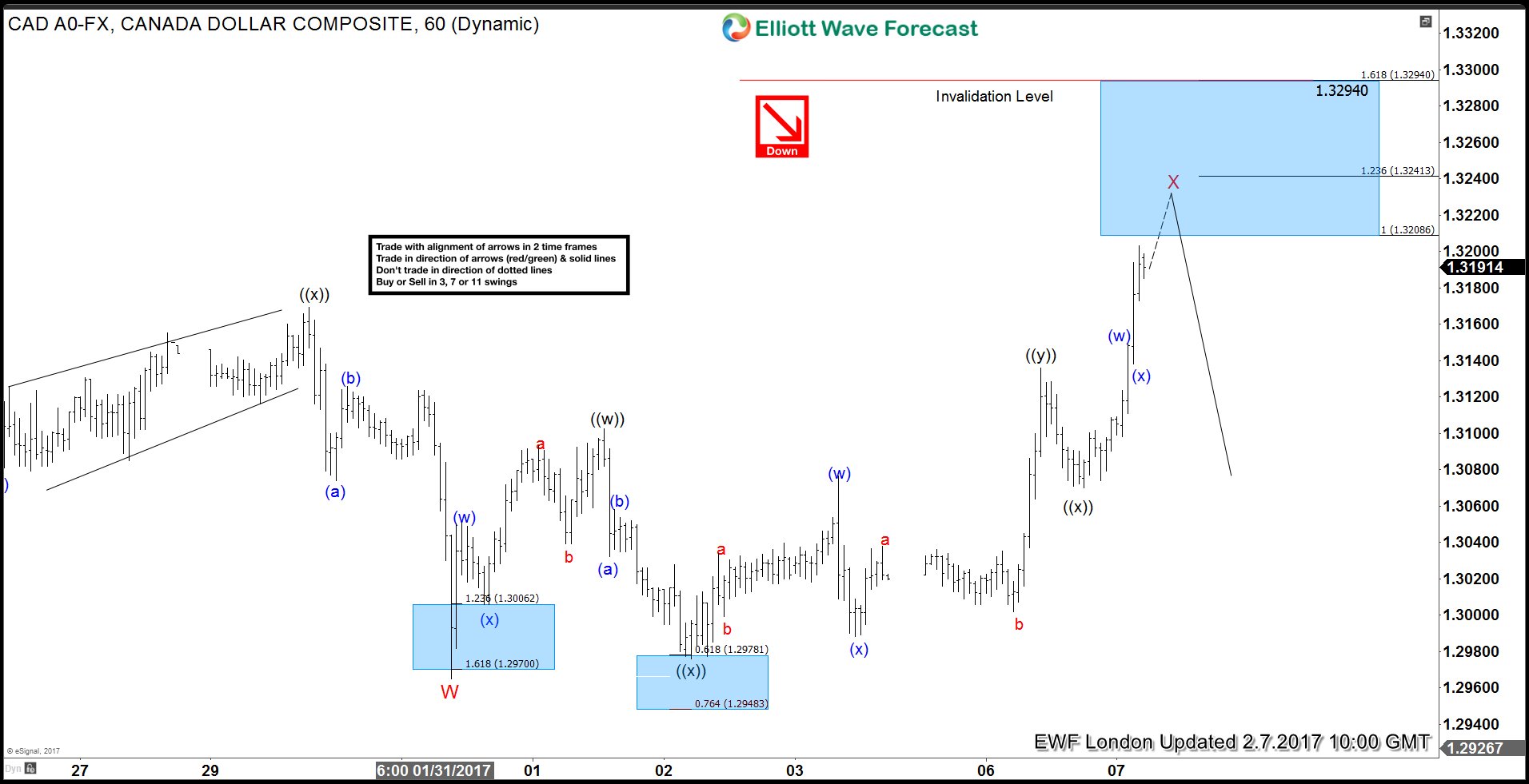

USDCAD: Bearish sequence favors more downside

Read MorePreferred Elliott wave view in USDCAD suggests that the pair is showing a 5 swing bearish sequence from 12/28 high, favoring more downside. Short term, decline to 1.2965 ended Minor wave W and Minor wave X bounce is unfolding as a triple three where Minute wave ((w)) ended at 1.3102, Minute wave ((x)) ended at 1.2976, Minute […]

-

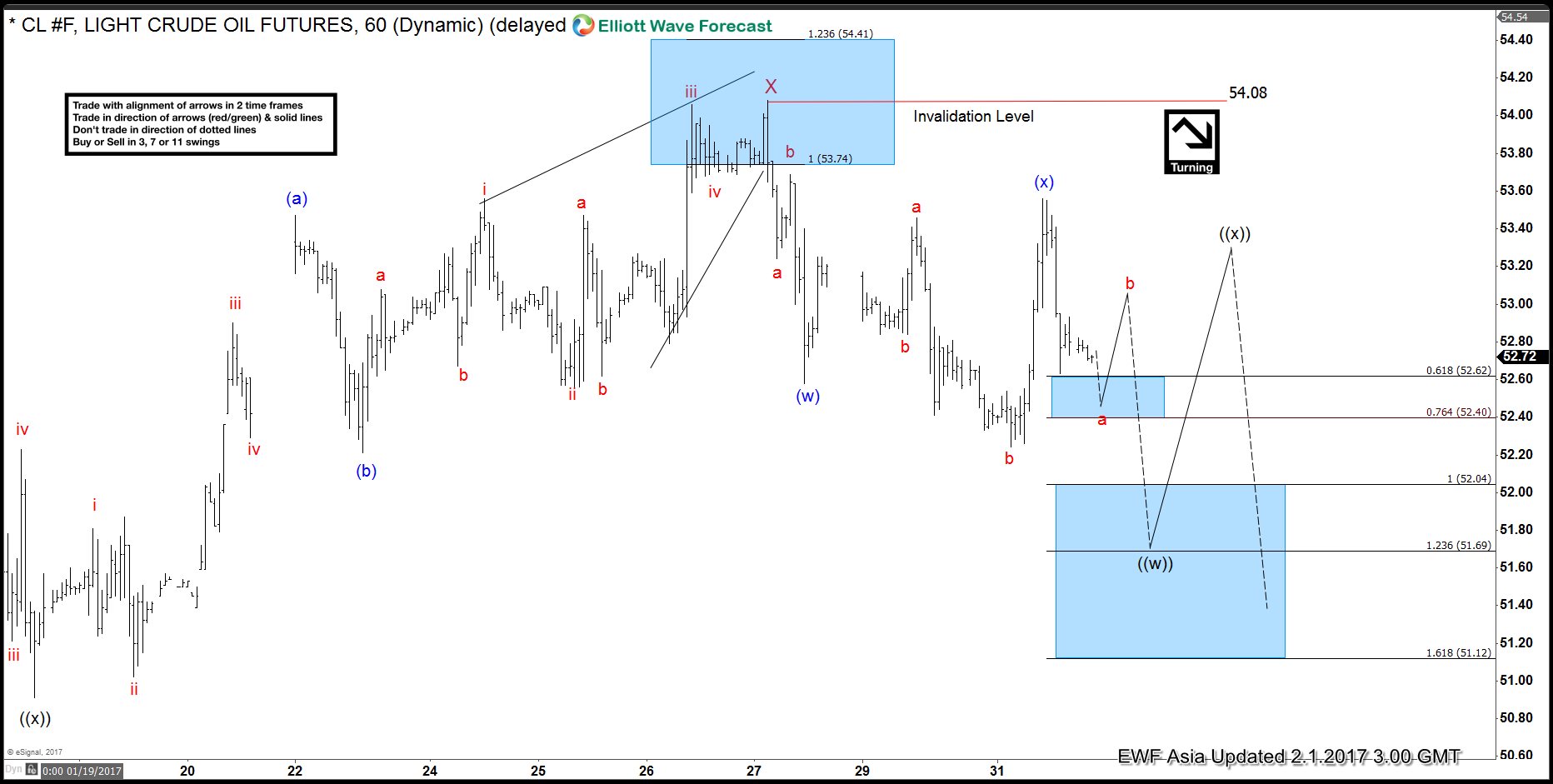

Crude Oil: Extension higher expected

Read MoreRevised view suggests that Crude Oil rally from 1/10 low (50.71) is unfolding as a diagonal where Minor wave 1 ended at 54.08 and Minor wave 2 is proposed complete at 52.22. Crude Oil has broken above 54.08, and thus showing a 5 swing sequence from 1/10 low and favoring more upside. Near term, while pullbacks […]

-

Elliott Wave Structures and Fibonacci Ratio Seminar

Read MoreIn the video seminar below, we discuss about various Elliott Wave structure and the Fibonacci ratio. The following excerpt comes from the opening of the video. You can skip to the video directly if you want to watch the seminar Excerpt of the Seminar Elliott Wave Structures are part of Elliott Wave Theory. It is […]

-

Crude Oil: The next leg higher has started

Read MoreRevised view suggests that Crude Oil rally from 1/10 low (50.71) is unfolding as a diagonal where Minor wave 1 ended at 54.08 and Minor wave 2 is proposed complete at 52.22. A break above 54.08 would add more conviction to the view that the next leg higher has started, until then a double correction in Minor […]

-

Oil CL_F: Correction Still in Progress – Elliott Wave Forecast

Read MoreRally to 55.24 completed Intermediate wave (W) and ended the cycle from 8/3/2016 low. From 55.24 high, oil turned lower to correct the cycle from 8/3 low as a double three structure where Minor wave W ended at 50.71 and Minor wave X ended at 54.08. Decline from 54.08 high is unfolding as a double […]