-

DAX Elliott Wave Analysis: More Upside

Read MoreShort term DAX Elliott Wave view suggests the decline to 12491.5 on 5/18 ended Intermediate wave (2). Up from there, the rally is unfolding as a double three Elliott Wave structure. Minute wave ((w)) ended at 12879.5 and Minute wave ((x)) pullback ended at 12616.44. Internal of Minute wave ((x)) is subdivided as an expanded flat Elliott Wave […]

-

Gold-to-Silver Ratio Near Turning

Read MoreIn the video below, we provide an update of the Elliott Wave view on Gold-to-Silver ratio and show how the ratio is close to turning which can soon result in Gold and Silver getting support and turn higher Gold-to-Silver Ratio Daily Chart Gold-to-Silver ratio is correcting cycle from 2/29/2016 peak (83.68) in 7 swing. While […]

-

YM (Dow Futures) Elliott Wave Analysis 6.16.2017

Read MoreShort term YM (Dow Futures) Elliott Wave view suggests the rally from 4/19 low is unfolding as a diagonal Elliott Wave structure where Minor wave 1 ended at 21010 (4/26), Minor wave 2 ended at 20474 (5/18), Minor wave 3 ended at 21270 (6/8), and Minor wave 4 ended at 21081 (6/8). Minor wave 5 is in progress and […]

-

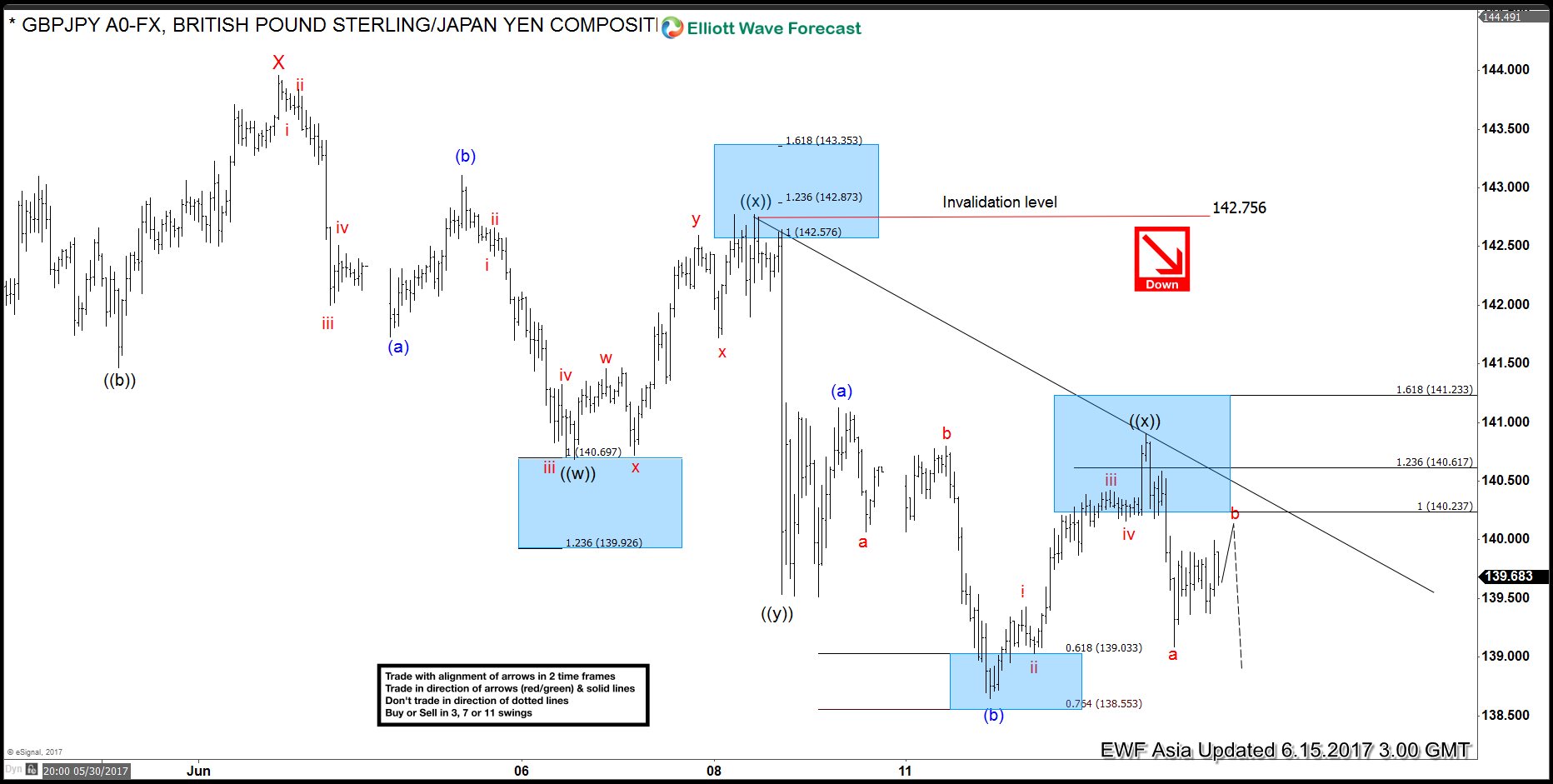

GBPJPY Elliott Wave Analysis: Resuming Lower

Read MoreShort term GBPJPY Elliott Wave view suggests the decline from 5/10 high shows a 5 swing sequence, thus favoring more downside. Decline from 5/10 high is unfolding as a double three Elliott Wave structure. Down from 5/10 peak (148.11), Minor wave W ended at 141.47 and Minor wave X ended at 143.96. Minor wave Y is currently in progress and has […]

-

GBPJPY Elliott Wave Analysis: Bearish Below 143.9

Read MoreShort term GBPJPY Elliott Wave view suggests the decline from 5/10 high shows a 5 swing sequence, thus favoring more downside. Decline from 5/10 high is unfolding as a double three Elliott Wave structure. Down from 5/10 peak (148.11), Minor wave W ended at 141.47 and Minor wave X ended at 143.96. Minor wave Y is currently in progress and has […]

-

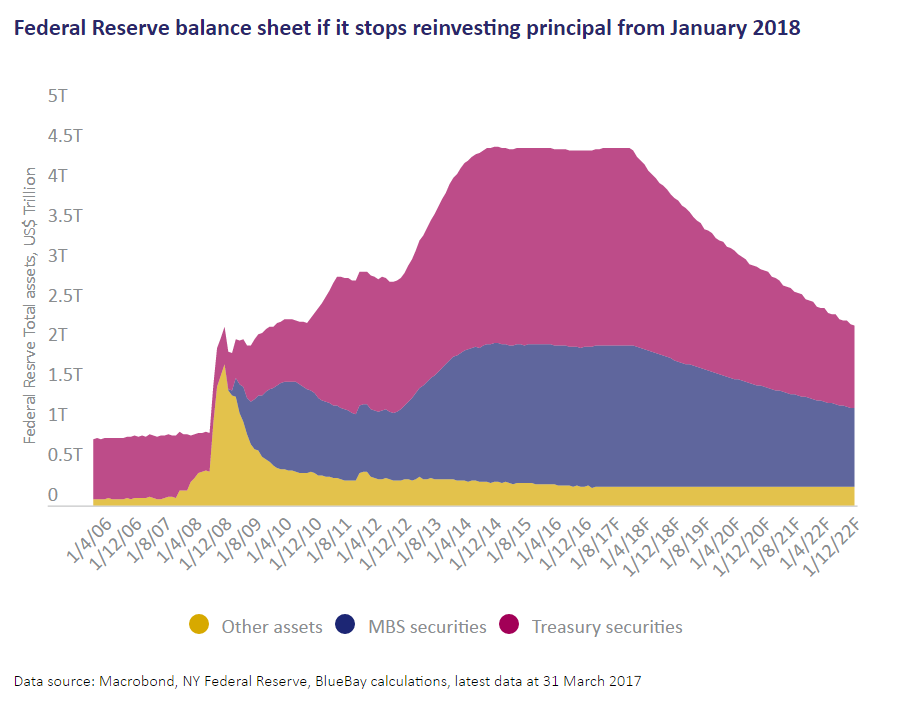

Preparing for Quantitative Tightening

Read MoreThe Fed will soon embark in an uncharted water of Quantitative Tightening (QT). In the aftermath of 2008 global credit crisis, the world central banks went into the biggest experiment in monetary policy called Quantitative Easing (QE). Central banks printed money and bought the government bonds as the primary way for monetary expansion. The combined […]