-

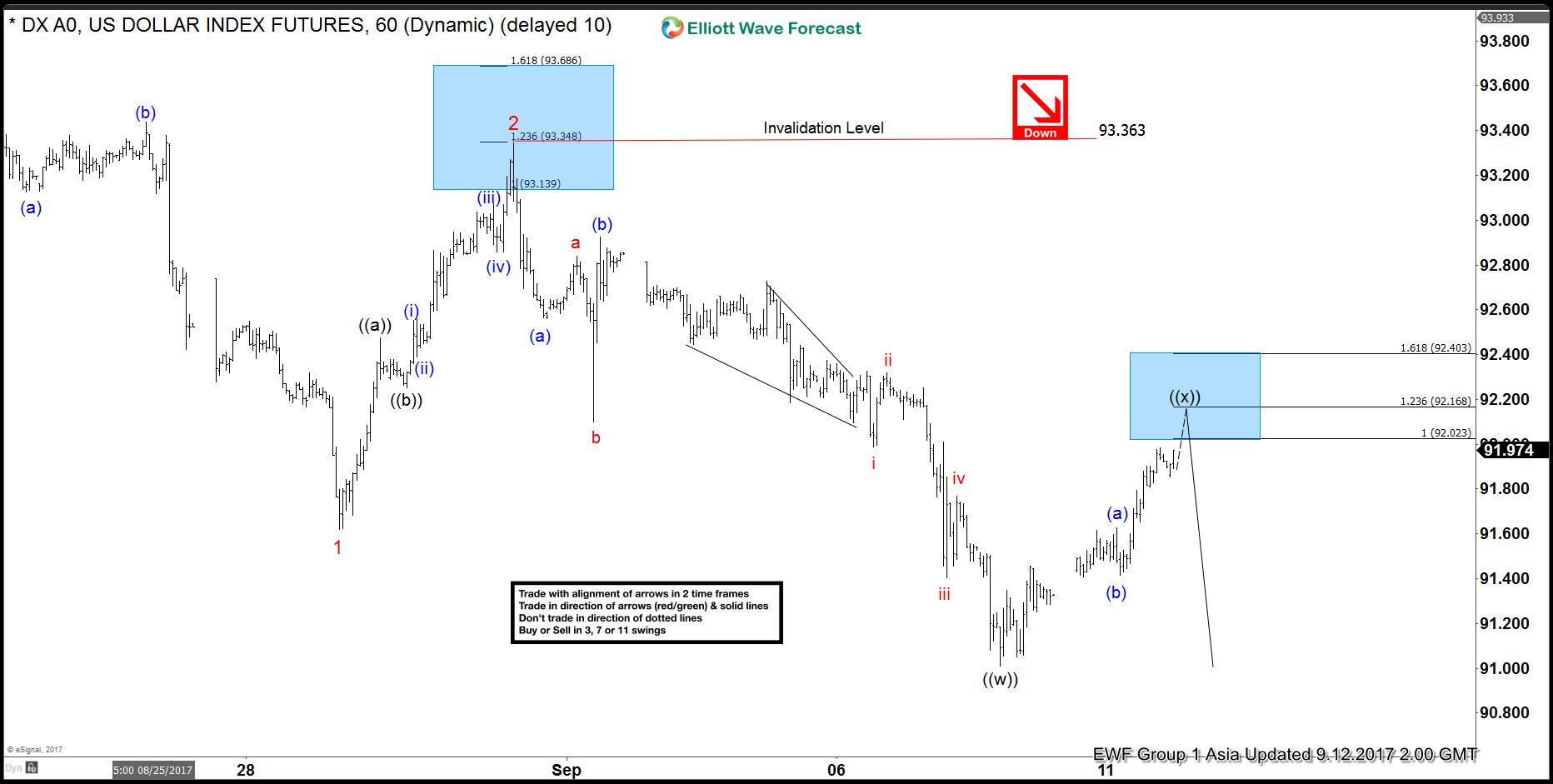

DXY Dollar Index Elliott Wave View: 9.12.2017

Read MoreDXY Dollar Index Short Term Elliott Wave view suggests that the decline from 8/16 peak is unfolding as an Ending Diagonal Elliott Wave structure. Down from 8/16 high, Minor wave 1 ended at 91.62 and Minor wave 2 ended at 93.347. Minor wave 3 is unfolding as a double three Elliottwave structure. Minute wave ((w)) of […]

-

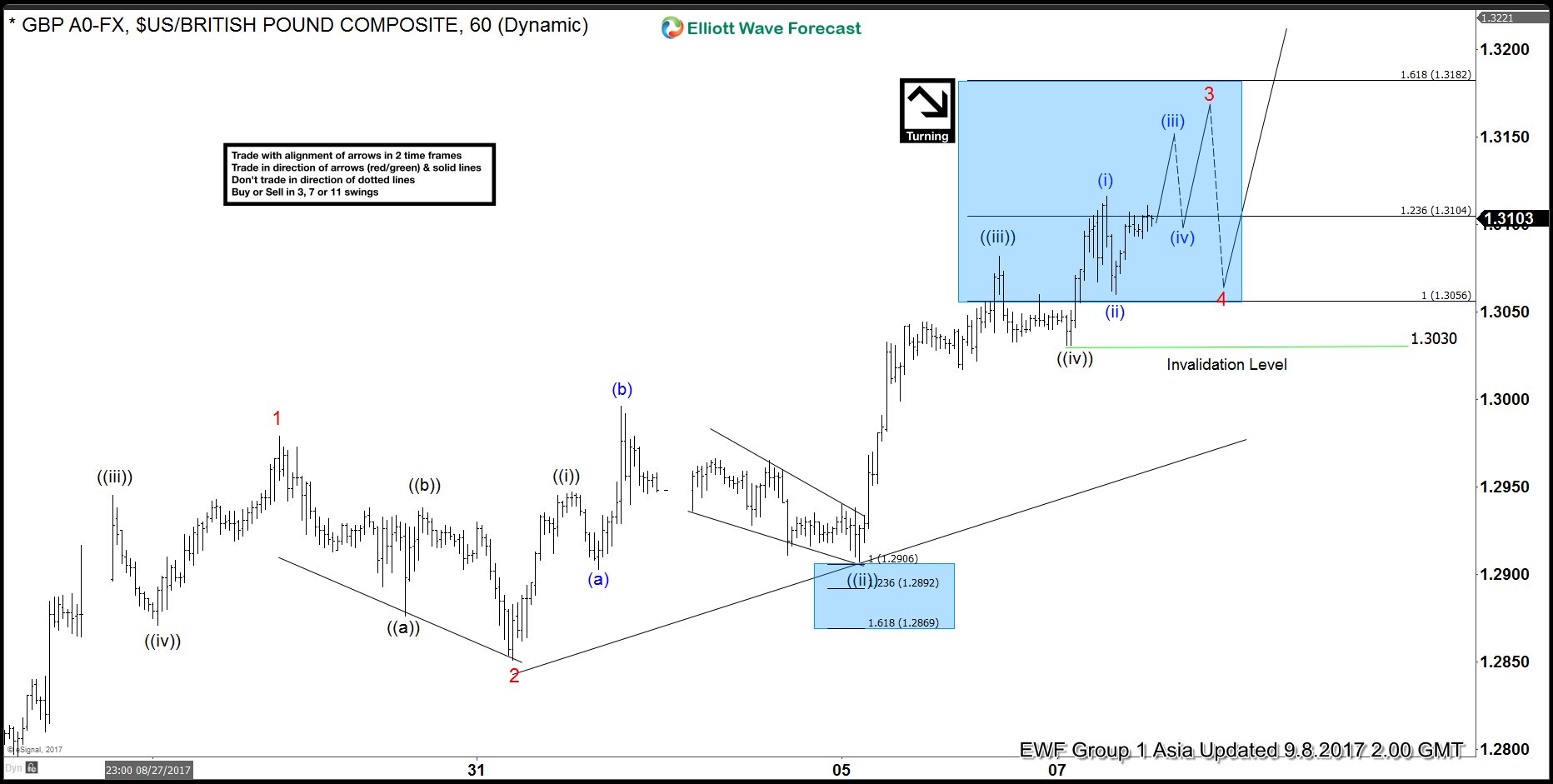

GBPUSD Elliott Wave View: More Upside

Read MoreGBPUSD Short Term Elliott Wave view suggests that the rally from 8/24 low is unfolding as an impulse Elliott Wave structure. Up from 8/24 low (1.2773), Minor wave 1 ended at 1.2979 and Minor wave 2 ended at 1.2851. Minor wave 3 is in progress and the subdivision is unfolding as an impulse Elliott Wave structure. Minute […]

-

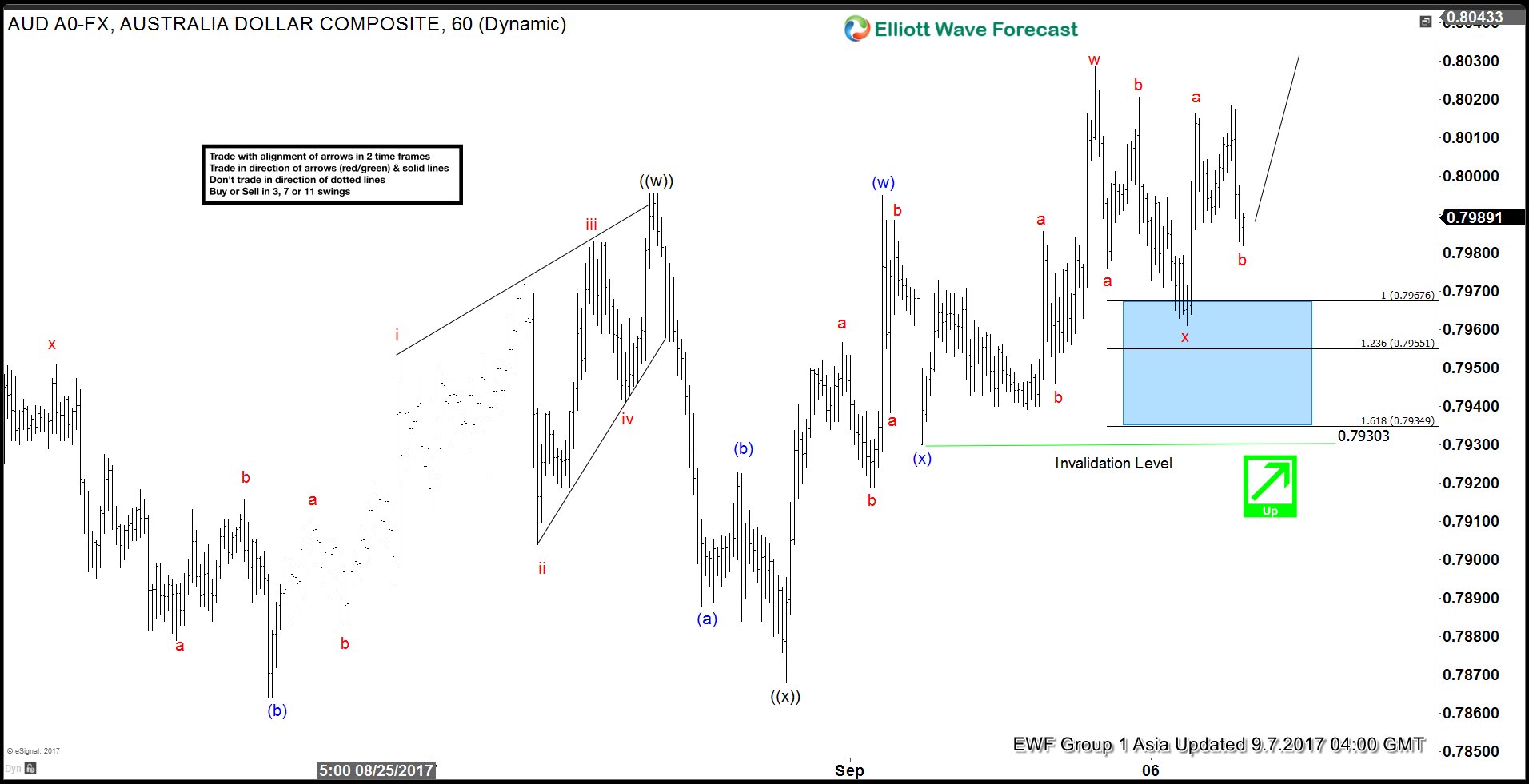

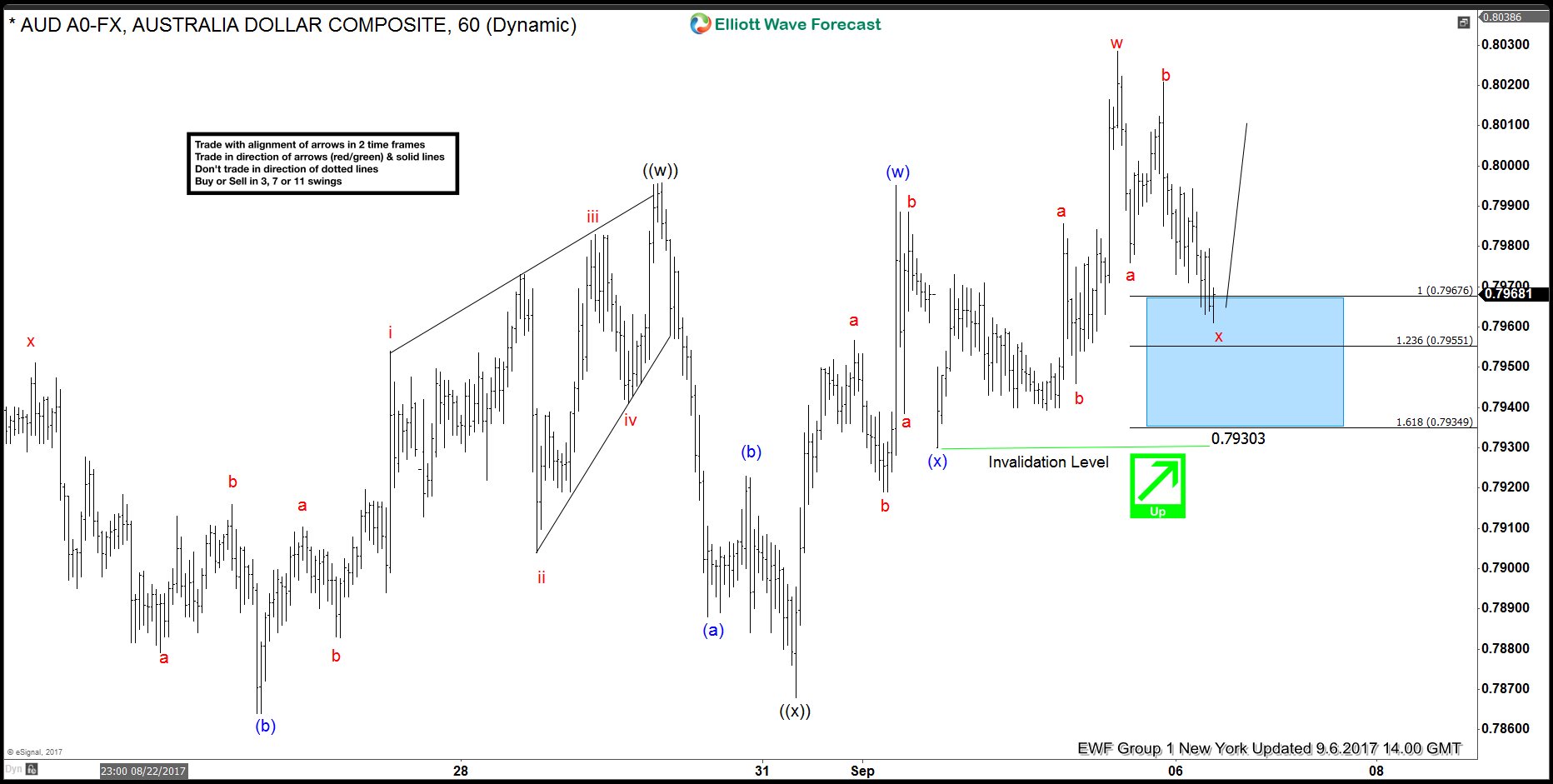

AUDUSD Elliott Wave View: Bullish above 0.787

Read MoreAUDUSD Short Term Elliott Wave view suggests that the rally from 8/15 low is unfolding as a double three Elliott Wave structure. Up from 8/15 low, Minute wave ((w)) ended at 0.79957 and Minute wave ((x)) ended at 0.7868. Minute wave ((y)) is in progress and the subdivision also unfolds as a double three. Minutte wave (w) of […]

-

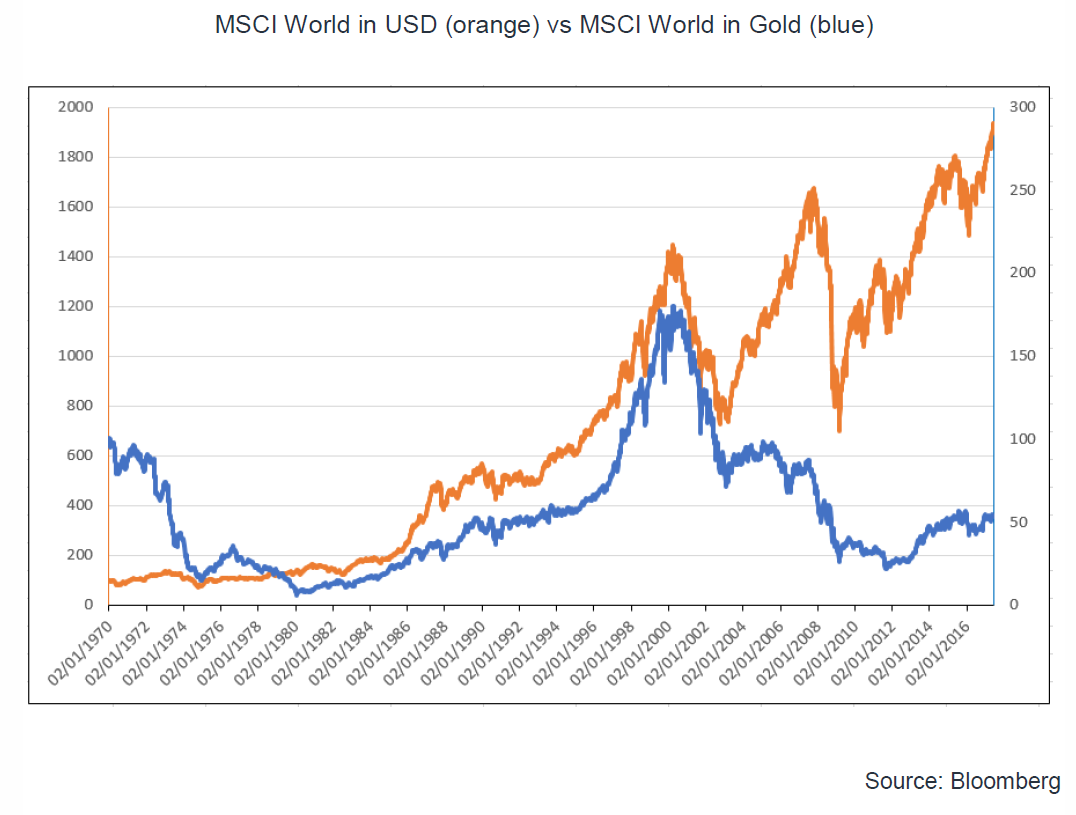

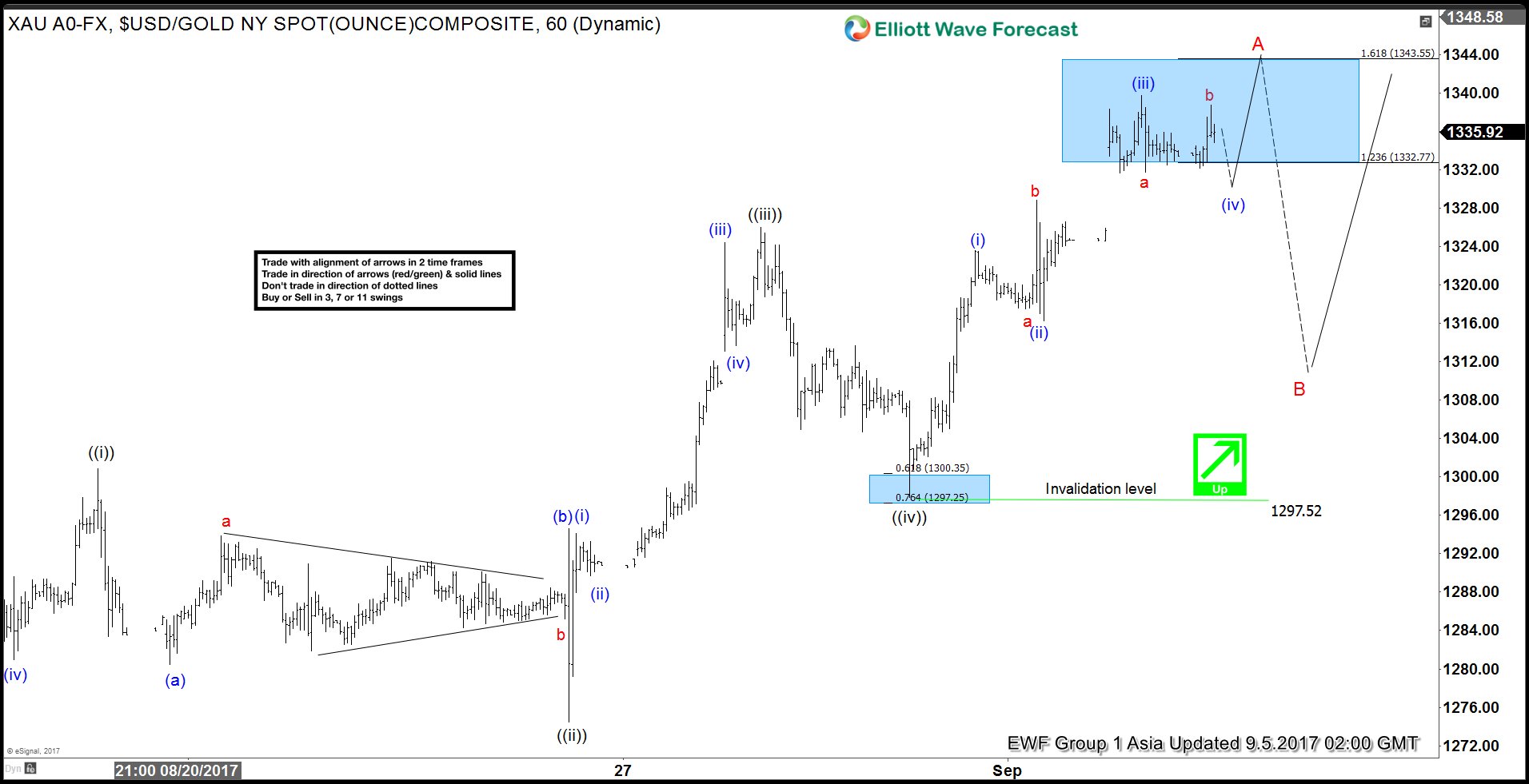

Gold Soars Above $1300 as Concerns Mount

Read MoreGold has tested $1300 level 3 times since April and it finally broke above the level on Monday and rose to the highest level this year. The trigger of the break seems to be the North Korea firing a ballistic missile over Japan, which boosts the safe haven demand. The yellow metal then extended the […]

-

AUDUSD Elliott Wave View: More Upside

Read MoreAUDUSD Short Term Elliott Wave view suggests that the rally from 8/15 low is unfolding as a double three Elliott Wave structure. Up from 8/15 low, Minute wave ((w)) ended at 0.79957 and Minute wave ((x)) ended at 0.7868. Minute wave ((y)) is in progress and the subdivision also unfolds as a double three. Minutte wave (w) of […]

-

Gold Elliott Wave View: 5 Waves Up

Read MoreShort Term Gold Elliott Wave suggests that the rally from 8/15 low is unfolding as a zigzag. The first leg Minor wave A is subdivided as an impulse. Minute wave ((i)) of A ended at 1300.83, Minute wave ((ii)) of A ended at 1274.45, Minute wave ((iii)) of A ended at 1326, and Minute wave ((iv)) […]