-

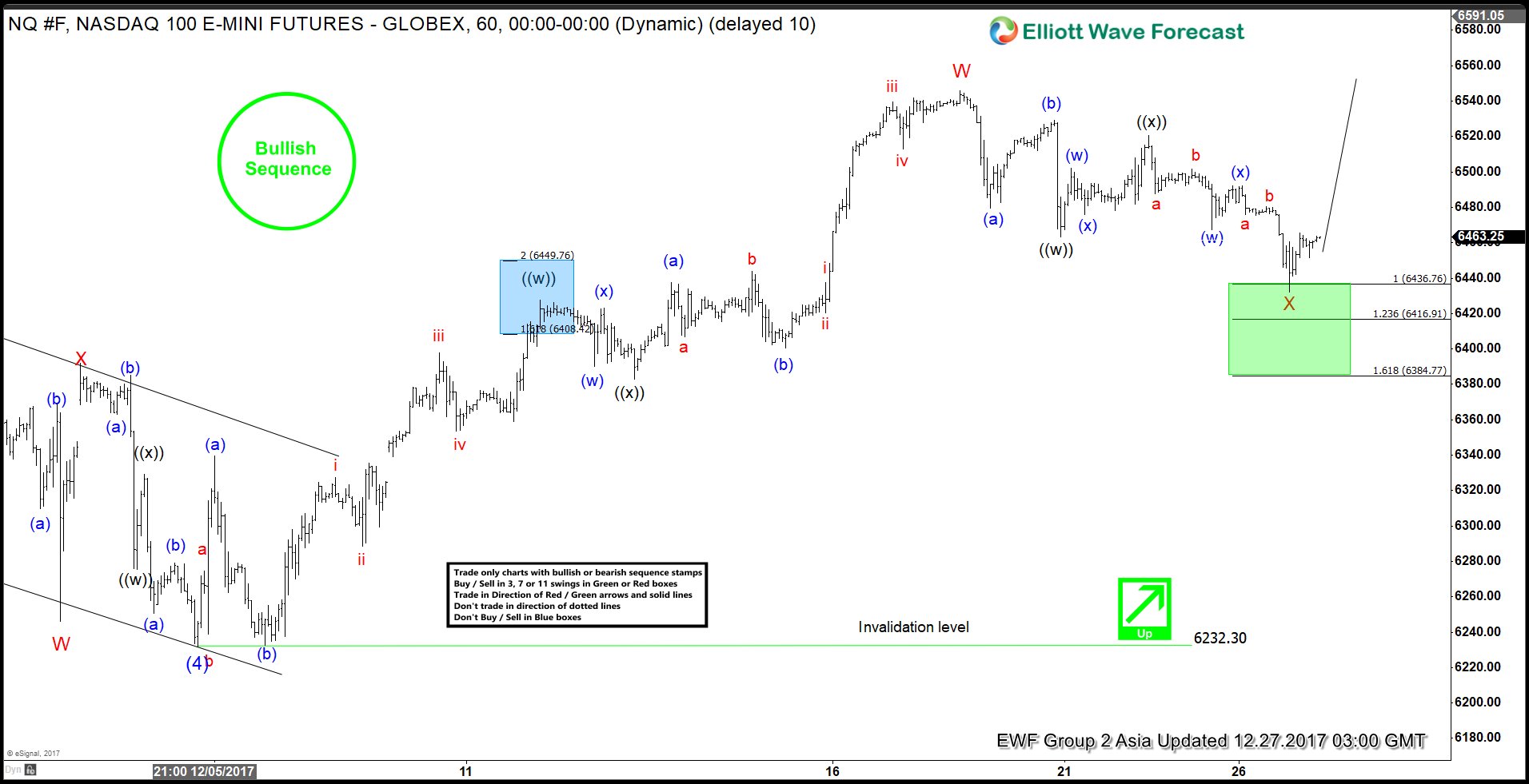

Nasdaq Elliott Wave Analysis: Upside Resumes

Read MoreNasdaq Short Term Elliott Wave view suggests that the decline to 6232.3 ended Intermediate wave (4). Up from there, Nasdaq has resumed the rally higher as a double three Elliott Wave structure. The first leg Intermediate wave W unfolded also as a double three Elliott Wave structure where Minute wave ((w)) ended at 6427.75, Minute wave ((x)) ended at […]

-

SPX Intra-Day Elliott Wave Analysis

Read MoreSPX Intra Day Elliott Wave view suggests that rally from 11.15 low at 2557.45 is unfolding as an Ending Diagonal where Minor wave 1 ended at 2665.19 and Minor wave 2 pullback ended as a zigzag correction at 2624.19 low. Minor wave 3 is in progress as a double correction with a target of 2731 – 2757. Up from 2624.19, Minutte wave (a) […]

-

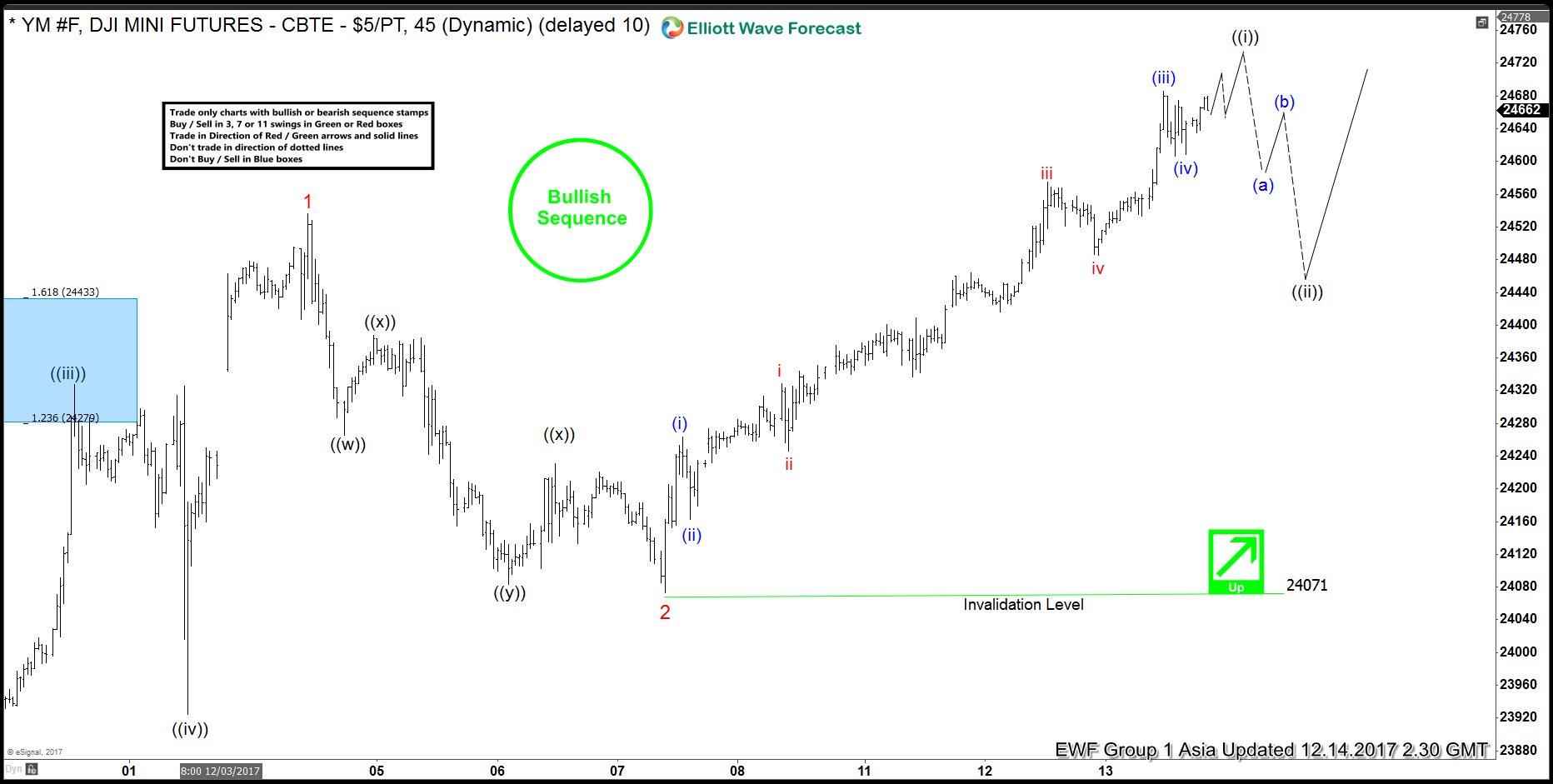

Dow Future Elliott Wave Analysis 12.15.2017

Read MoreDow Future Short Term Elliott Wave view suggests that rally to 24536 ended Minor wave 1 and Minor wave 2 ended at 24071 as a triple three Elliott Wave structure. The Index has since broken above Minor wave 1 at 24536 which suggests the next leg higher has started. Up from 24071, the rally is progressing as 5 […]

-

Dow Future Intra-Day Elliott Wave Analysis

Read MoreDow Future Short Term Elliott Wave view suggests that the decline to 23205 ended Intermediate wave (4). Intermediate wave (5) is in progress as an Ending Diagonal Elliott Wave structure where Minor wave 1 ended at 24536 and Minor wave 2 ended at 24073. The Index has broken above Minor wave 1 at 24536 which suggests the […]

-

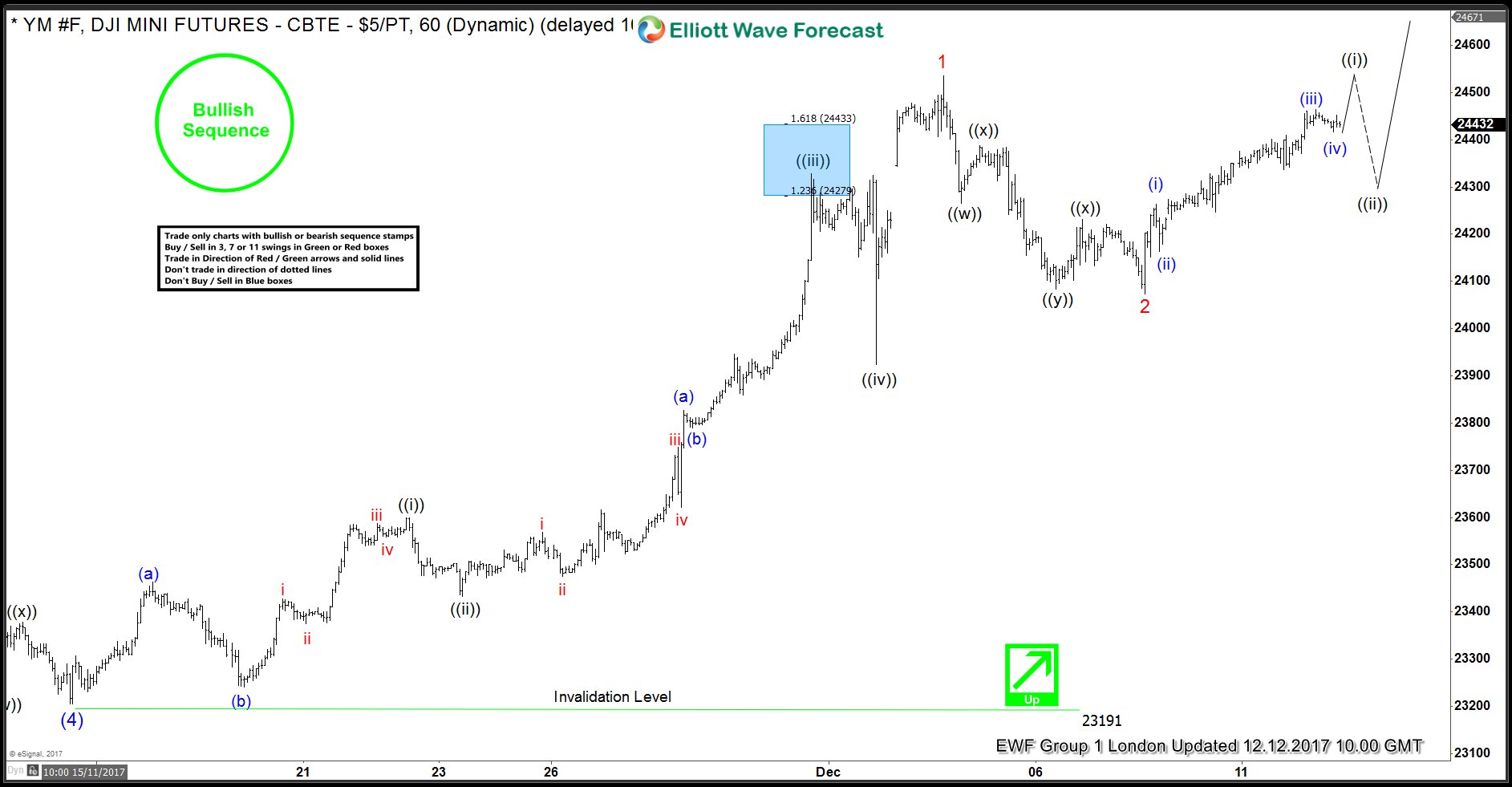

Dow Future Short Term Elliott Wave Analysis

Read MoreDow Future Short Term Elliott Wave view suggests that Intermediate wave (4) ended with the decline to 23205. Up from there, Intermediate wave (5) is unfolding as an Ending Diagonal Elliott Wave structure where Minor wave 1 ended at 24536 and Minor wave 2 ended at 24073. The Index has been able to break above Minor wave […]

-

Dow Future Elliott Wave Analysis 12.12.2017

Read MoreDow Future Short Term Elliott Wave view suggests that the decline to 23205 ended Intermediate wave (4). Intermediate wave (5) is in progress as an Ending Diagonal Elliott Wave structure where Minor wave 1 ended at 24536 and Minor wave 2 ended at 24073. The Index still needs to break above Minor wave (1) at 24536 to […]