-

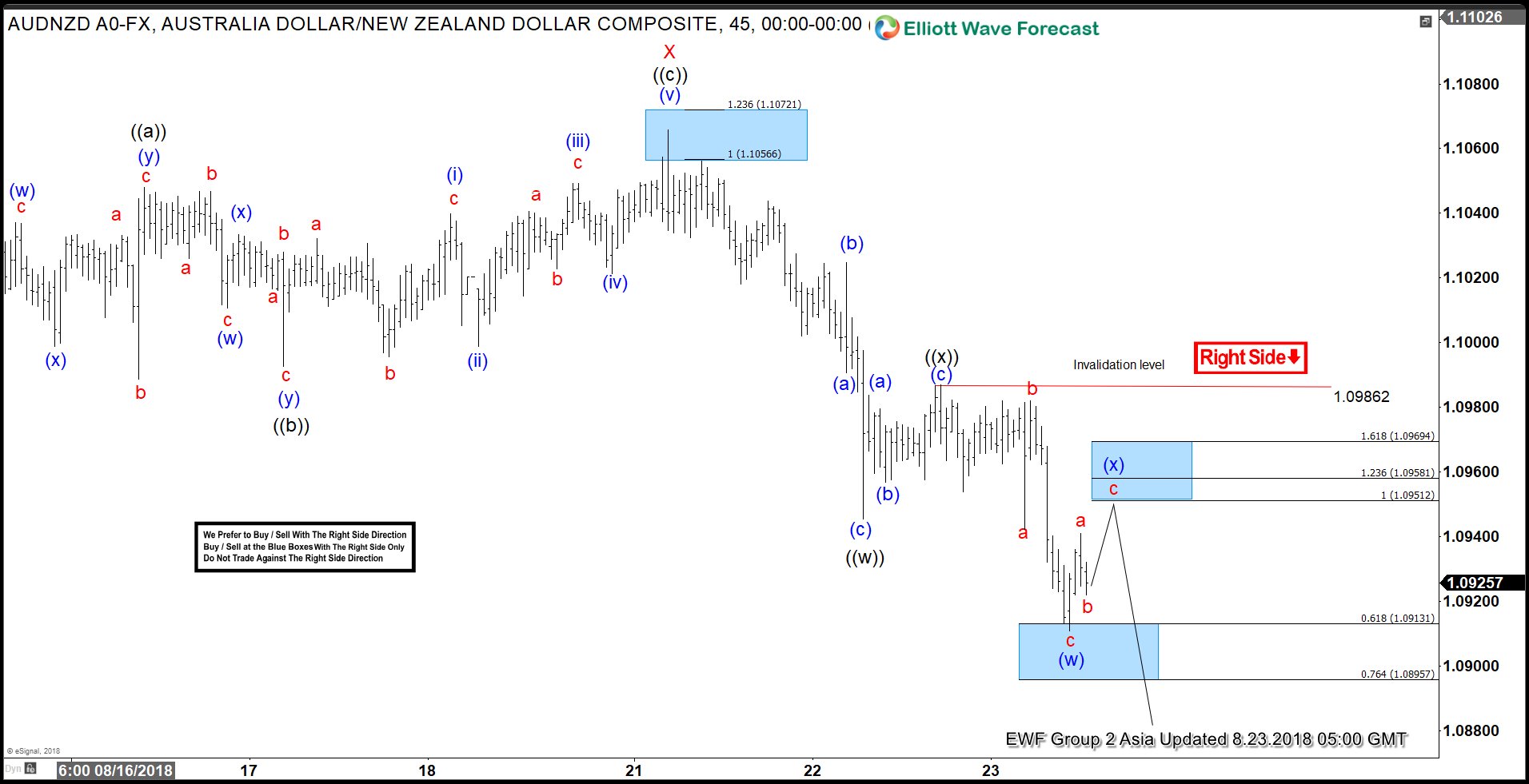

AUDNZD Elliott Wave View: Further Downside Expected

Read MoreAUDNZD Short-term Elliott Wave view suggests that the rally to 1.1066 ended Minor wave X. The internal subdivision of Minor wave X is unfolding as a zigzag Elliott Wave structure where Minute wave ((a)) ended at 1.1048, Minute wave ((b)) ended at 1.0992, and Minute wave ((c)) of X ended at 1.1066. A zigzag is […]

-

AT&T Elliott Wave View: Rallying as Impulse with Nest

Read MoreAT&T (ticker symbol T) Short-term Elliott Wave view suggests that the pullback to $31.76 ended Minor wave 2. The stock is rallying from there within Minor wave 3 as an impulse Elliott Wave structure with a nest. An impulse structure subdivides in 5 waves and we can see up from $31.76, the rally to $33.58 […]

-

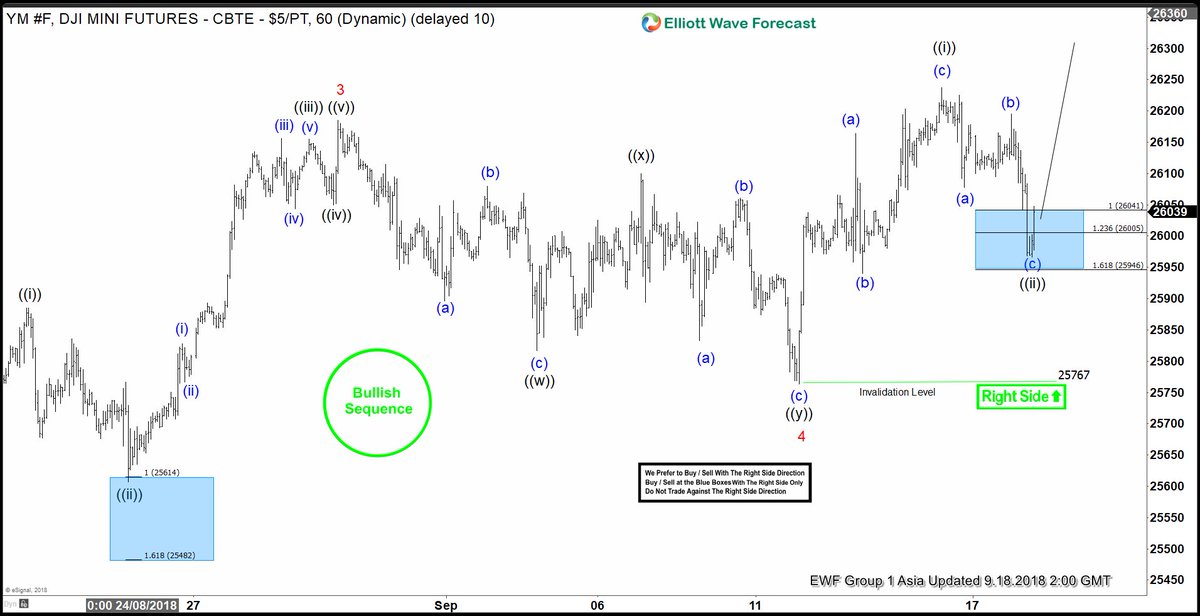

Dow Futures Elliott Wave View: Pullback Should Find Support

Read MoreShort-term Elliott Wave view on YM_F (Dow Futures) suggests that the pullback to 24956 low ended Minor wave 4. Up from there, Index is rallying within Minor wave 5 to end a 5 waves up from 4/2/2018 low. Minute wave ((i)) of 5 is currently in progress with internal subdivision as an impulse Elliott Wave structure. […]

-

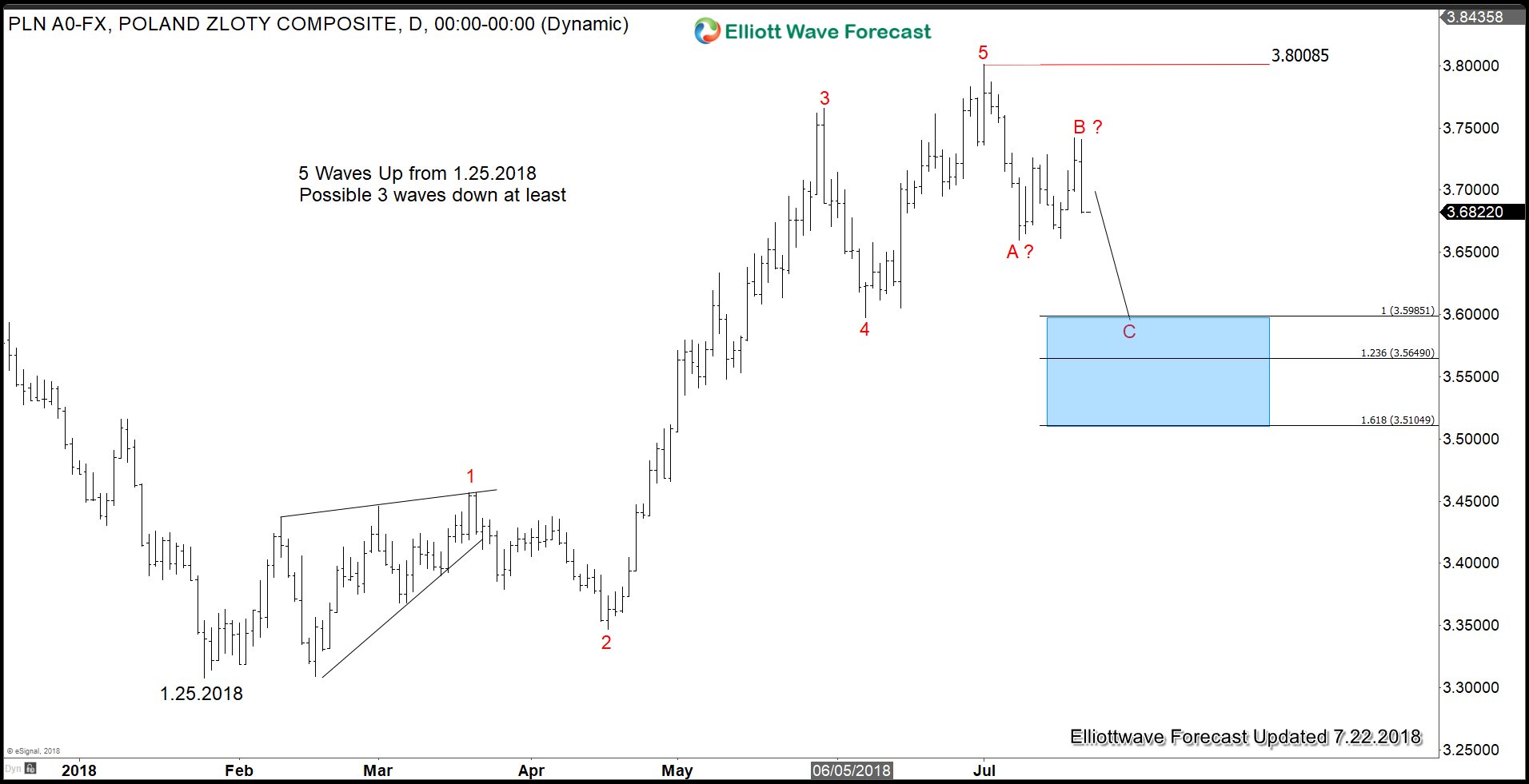

Trading Elliott Wave Charts with the Right Side Tag and Blue Boxes

Read MoreSimplifying Elliott Wave Analysis for Traders One of our goals at Elliottwave-Forecast is to figure out the best way to present Elliott Wave charts in such a way that non-technical traders can easily understand our view and know what they need to do. To this end, we implement the Right Side Tag and Blue Boxes […]

-

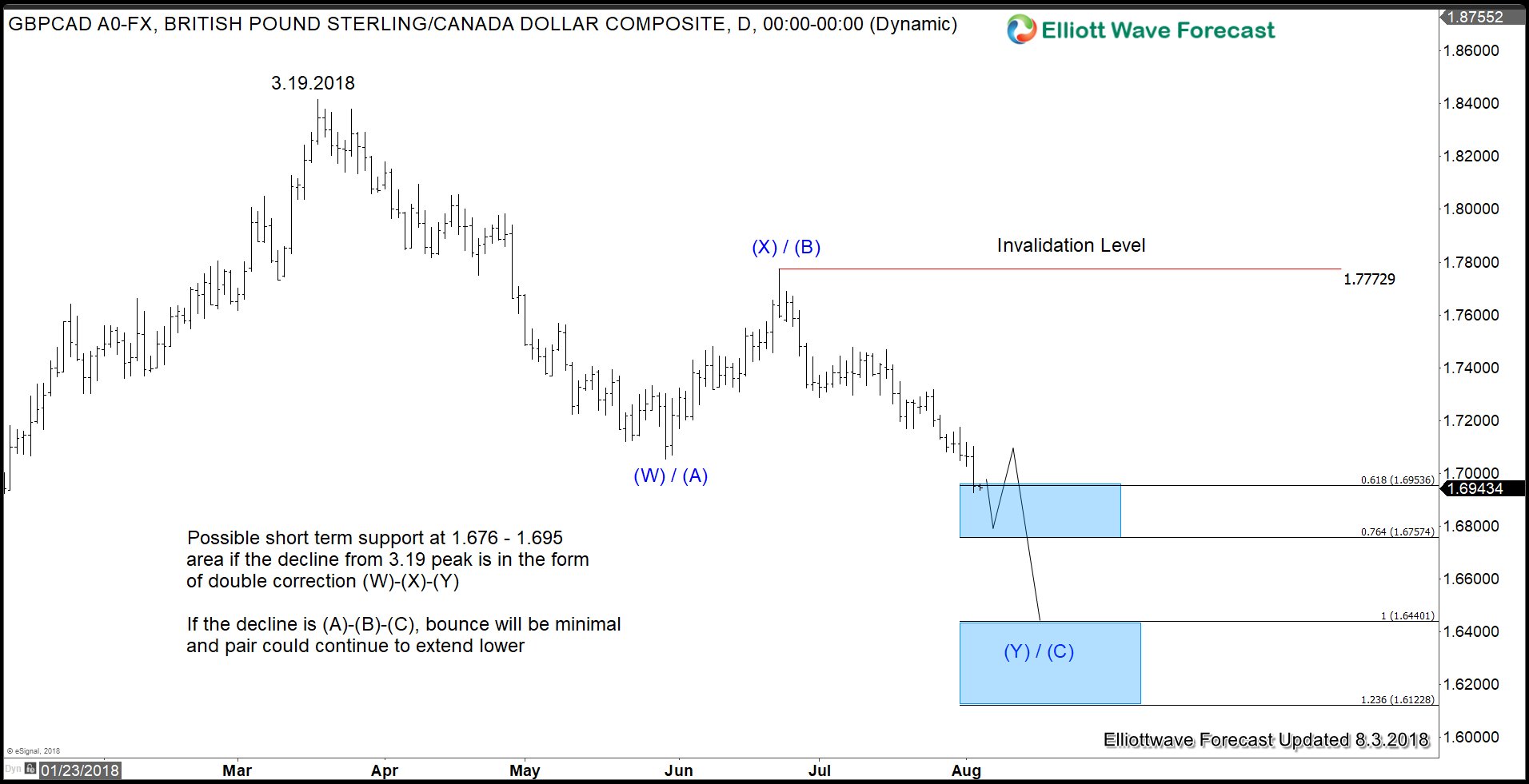

Poundsterling Remains Weak Despite BOE Rate Hike

Read MorePoundsterling Slumped after Rate Hike Decision The Bank of England raised benchmark interest rate to 0.75% with unanimous 9-0 vote. Poundsterling initially rallied but subsequent press briefing reversed those early gains. Despite the uncertainty in Brexit talks, BOE policy makers went ahead with the rate hike due to mounting price pressure. Governor Mark Carney suggested […]

-

Will Trump’s Remark Cap the US Dollar Strength?

Read MoreIn an interview with CNBC last Thursday, President Trump indicated that he is not thrilled about interest rate hikes. He went on to say that he did not agree with the Fed’s decision to keep raising the rate. Trump argued that the higher rate puts the U.S. at a disadvantage compared to the European Union […]