-

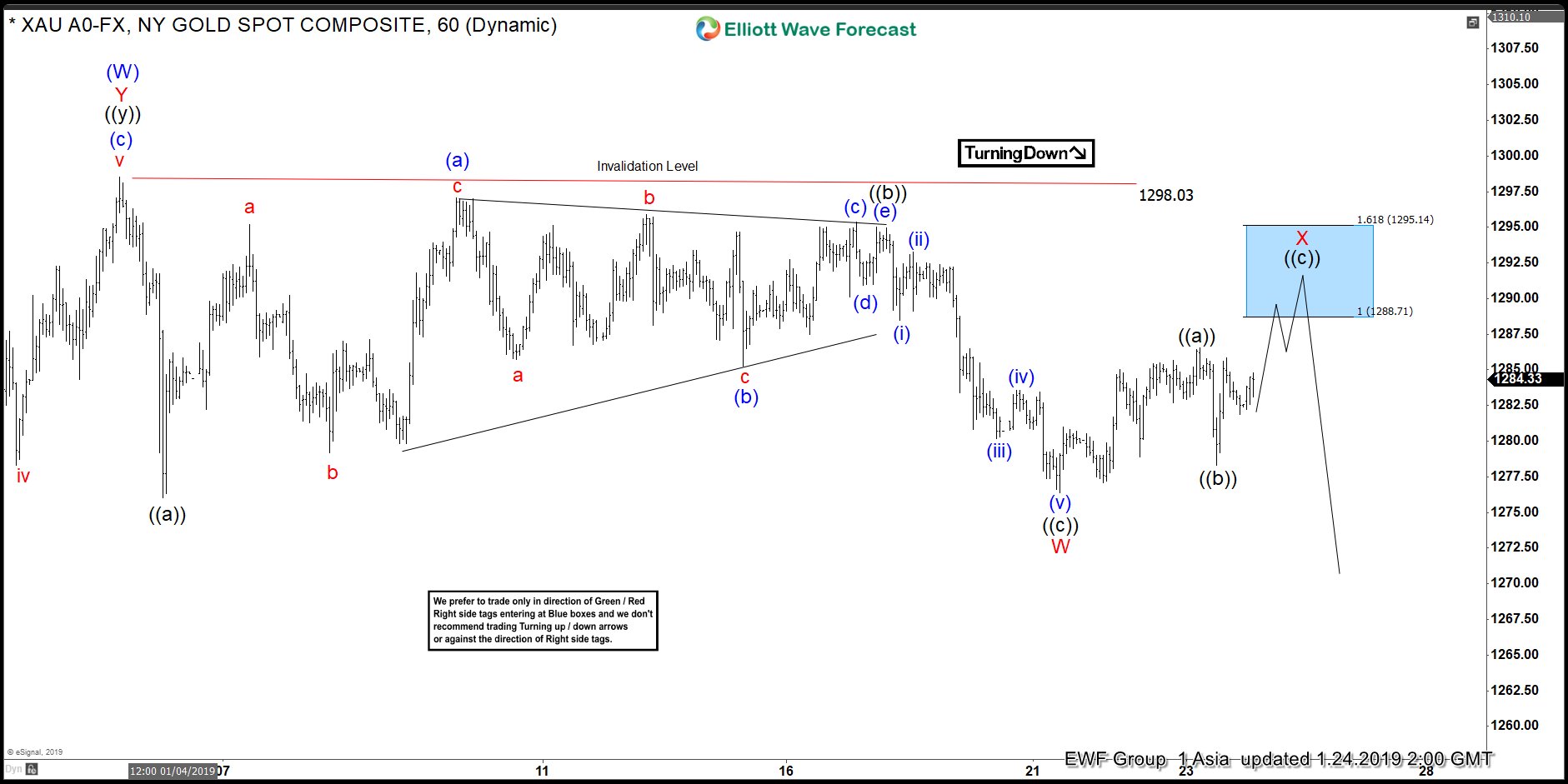

Elliott Wave View: Gold In Consolidation Before a Break Higher

Read MoreThis article and video explains the short term Elliott Wave path for Gold. The yellow metal can continue to consolidate while it fails to break pivot at Jan 4, 2019 high

-

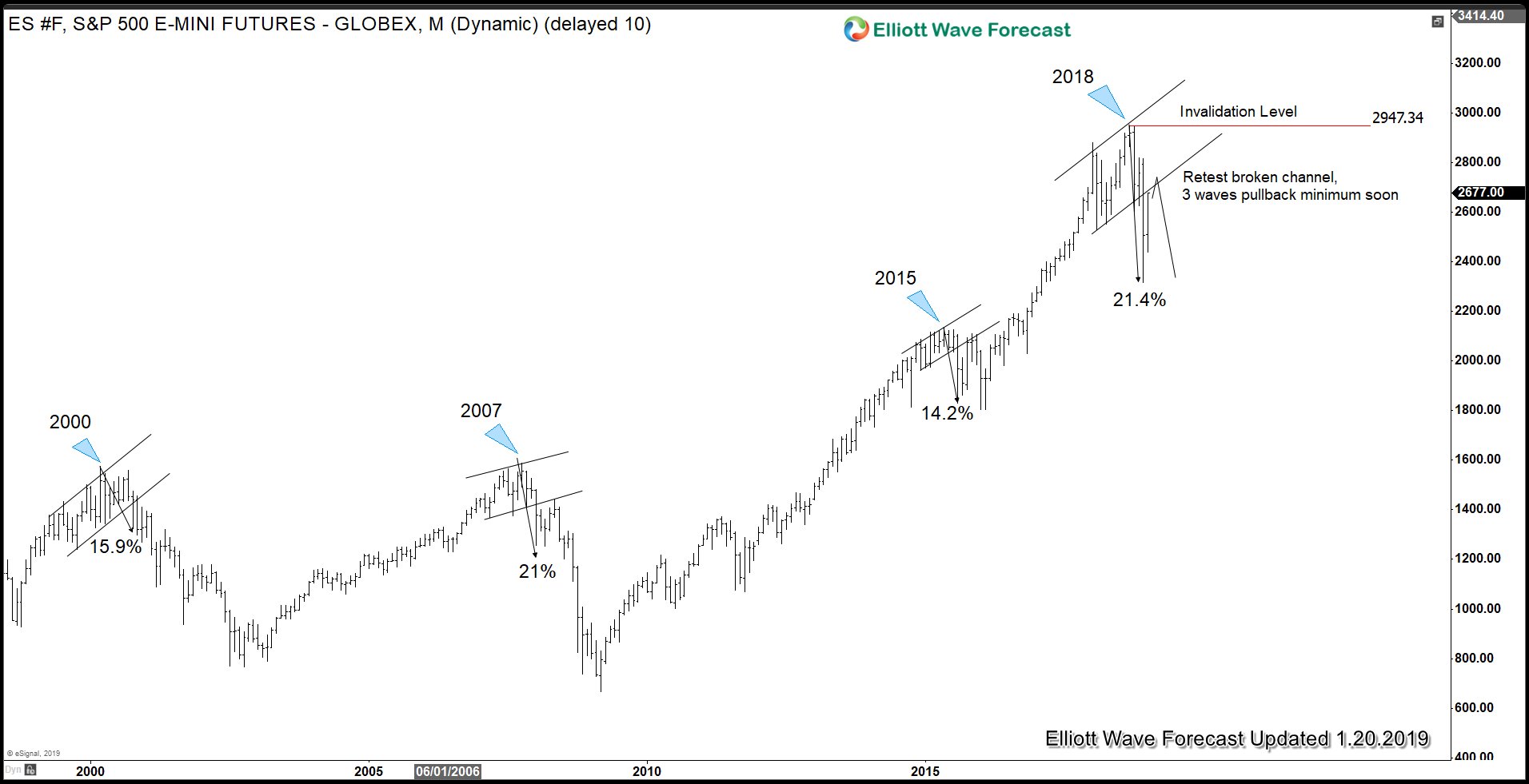

Is S&P 500 Ready to Make All-Time High?

Read MoreS&P 500 formed a significant high at 2947 on Sept 21, 2018 after a 342% rally in 10 years. During the entire rally from year 2009 low, there was no major correction in the Index, that is until last year. In less than 3 months, the Index has dropped 21.4% from the peak. The Index […]

-

Elliott Wave View: FTSE Can See Another Leg Higher

Read MoreShort term Elliott Wave view in FTSE suggests that the decline to 6534.59 ended wave ((A)). Wave ((B)) bounce is in progress as a zigzag Elliott Wave structure. Up from 6534.59, wave (A) ended at 7001.94. The internal of wave (A) unfolded as a 5 waves Impulse Elliott Wave structure. Wave 1 ended at 6752.54, […]

-

Elliott Wave View Suggests Oil to See More Upside

Read MoreThis article & video explain the short term Elliott Wave path for Oil (CL_F) & also provide the alternate path. The right side is higher as long as invalidation level holds. The alternate path suggests Oil is correcting larger degree from 12/24/2018 low ($42.36).

-

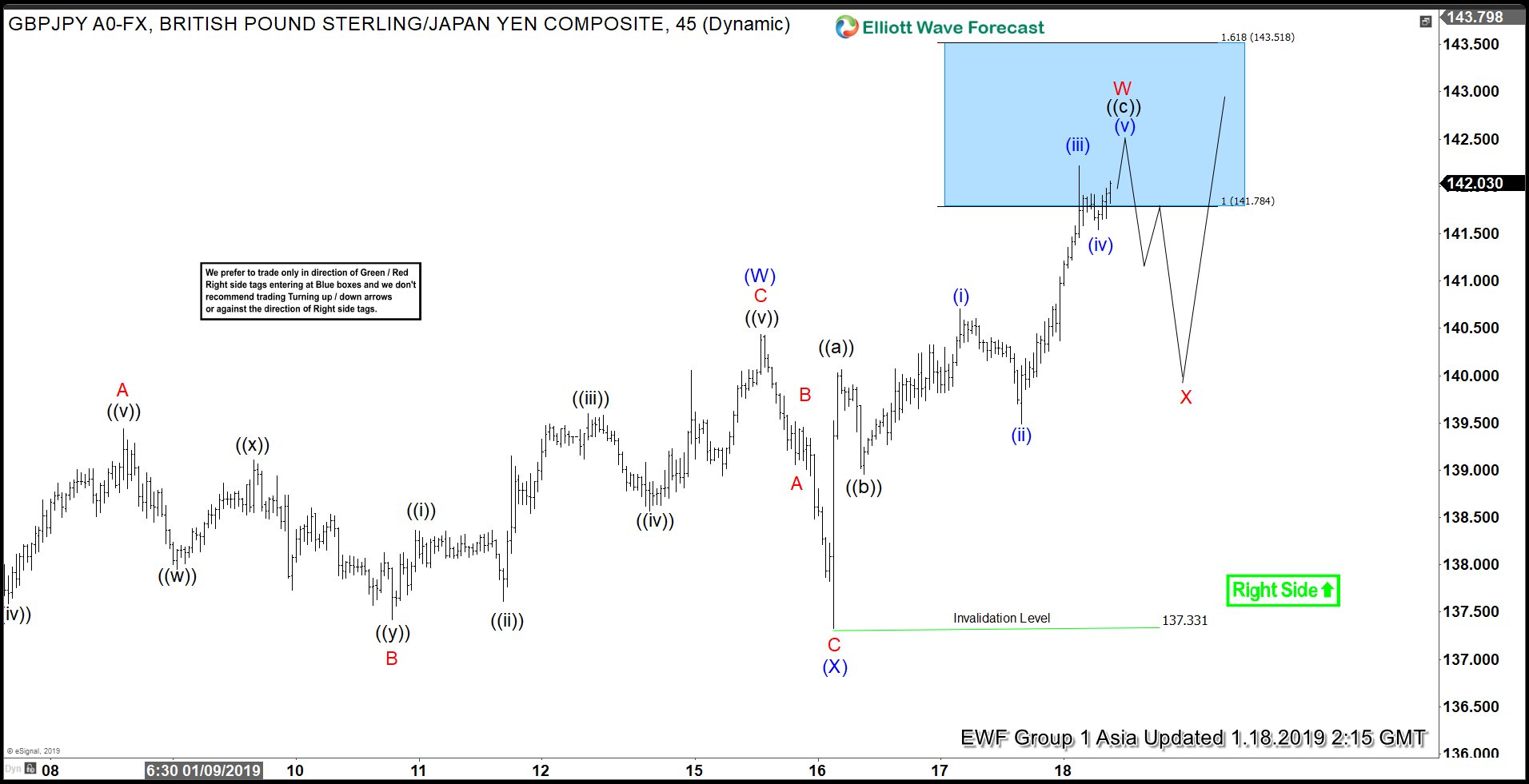

Elliott Wave view in GBPJPY favors upside bias

Read MoreThis article and video explains the short term technical path of GBPJPY using Elliott Wave. The pair has a short term bullish sequence from 1/3/2019 low, favoring further upside. We provide the invalidation level, alternative view and also target for the move higher.

-

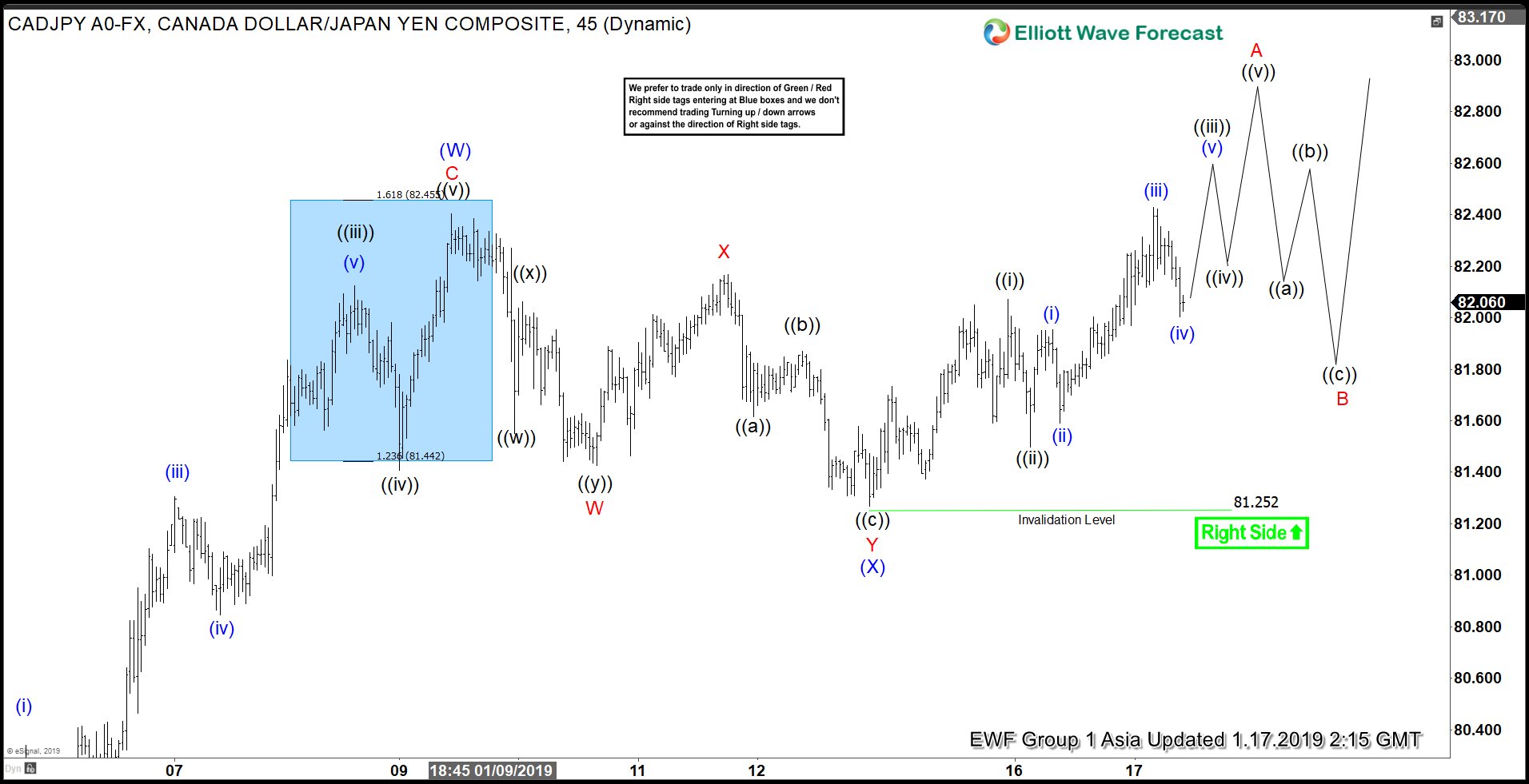

Elliott Wave View: CADJPY Starts Next Bullish Leg

Read MoreThe article and video explains the near term path for CADJPY using Elliott Wave Theory. It explain why the pair should remain supported & gives the next potential target as well as the invalidation level and alternate view.