-

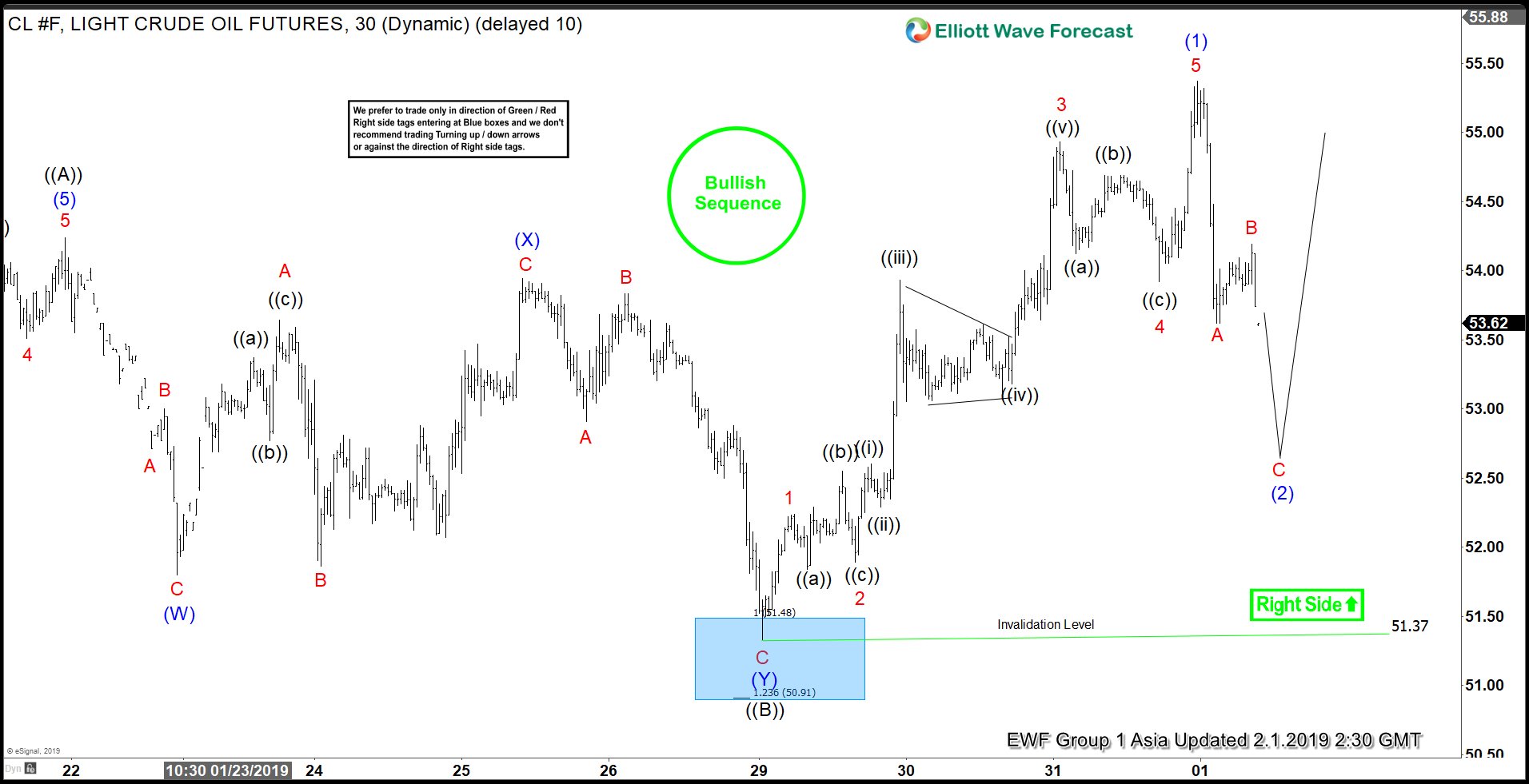

Elliott Wave Expects Limited Pullback in Oil

Read MoreElliott Wave expects Oil to see limited pullback and resume the rally higher. The article and video shows potential area for the pullback and alternate view

-

Elliott Wave View Expects Exxon Mobil To Rally

Read MoreThis article and video explains the short term Elliott Wave path of Exxon Mobil. The stock is expected to continue the rally higher as another 5 waves provided pivot on January 29, 2019 low stays intact.

-

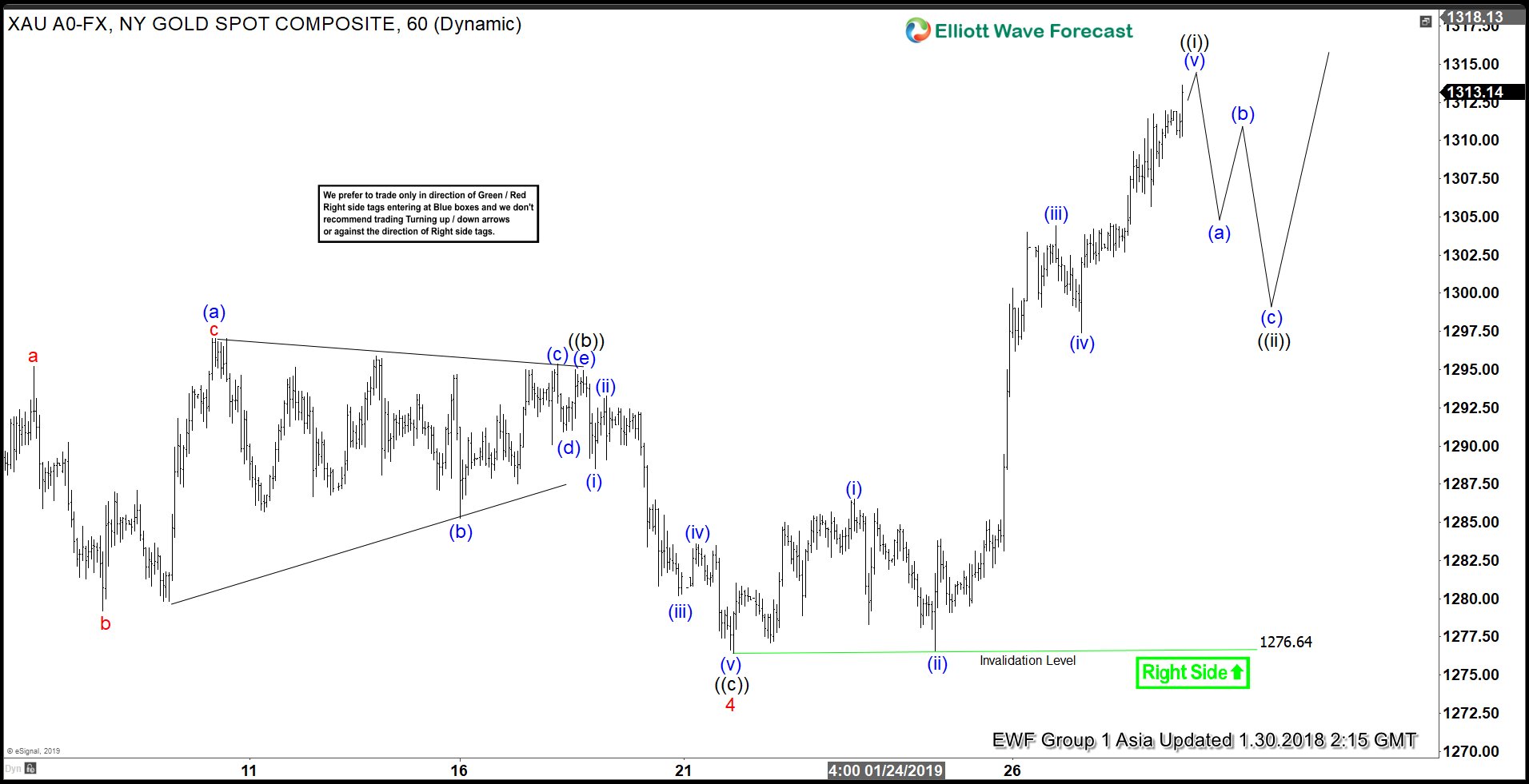

Elliott Wave View: Gold Should Continue Higher

Read MoreThis article and video explains the short term Elliott Wave structure for Gold. The yellow metal is rallying in an impulse, and it should find support in any pullback in 3, 7, 11 swing for more upside.

-

Elliott Wave View Expects Tesla Rally to Fail

Read MoreThis article and video explains the short term Elliott Wave path of Tesla. The rally in the stock is expected to fail and stock to extend lower

-

Break above $1300 in Gold Forms Elliott Wave Impulse

Read MoreThis article explains why the break above $1300 in Gold is important and suggests potential Impulsive move in the metal and next expected target

-

Elliott Wave View: Alibaba Ending 5 Waves Move

Read MoreThis article and video explains the short term path of Alibaba. The stock is in the process of ending 5 waves from 12/24/2018 low & still can see another leg higher.